Andrew Burton

After Alibaba Group Holding Limited (NYSE:BABA) revealed its mixed Q2 earnings results last week, it’s safe to say that the company is more than likely going to continue to underperform due to Beijing’s inability to quickly solve the structural issues that China’s economy is facing. The devaluation of the yuan, along with the decrease in consumer confidence caused by the zero-Covid policy and a decline in exports, have already hampered Alibaba’s core business performance. Even though the markets recently have reacted positively to the news of a possible easing of a lockdown policy along with a meeting of Xi Jinping with Joe Biden on the fields of the G20 summit in Bali, those events are unlikely to benefit Alibaba in the near term.

Despite all the chatter, millions of Chinese continue to be under strict movement restrictions to this day, while the improvement of the Sino-American relationships is nowhere near in sight as the risks of a possible trade war between two of the biggest economies in the world grow. Add to this the fact that the Chinese economic miracle appears to be over; the declining population along with a mature economy are unlikely to reproduce aggressive double-digit returns, which fueled China’s rise along with Alibaba’s growth in recent decades, in the foreseeable future.

As a result, even though it appears that Alibaba might trade at a bargain, the weaker-than-expected economic forecasts are more than likely to negatively affect the company’s growth prospects going forward. This makes it hard to justify a long position even at the current market price.

China’s Economic Miracle No More

A few weeks before Alibaba reported its Q2 earnings results, I wrote several articles on China’s latest National Congress of the CCP. In them, I’ve explained why its outcome would have negative effects on the company going forward due to the abandonment of market reforms along with a call for the redistribution of wealth, which is unlikely to fix the structural issues that the Chinese economy is facing.

When the Q2 results came in last week, it became obvious that the recent policies that are being implemented by Beijing would make it even harder for Alibaba to deliver the same exceptional results that it managed to deliver during the pre-Covid times in the foreseeable future. While in Q2 Alibaba generated ¥207.2 billion in revenues, up 3% Y/Y, the revenues of its core commerce business, which accounts for the absolute majority of the overall sales, nevertheless decreased by 1% Y/Y to ¥135.4 billion.

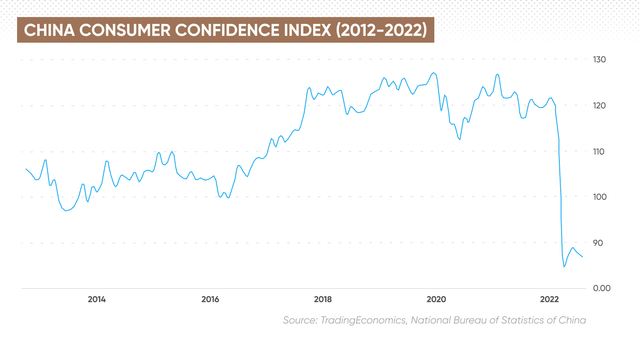

Such a decline was mostly expected, as currently China’s consumer confidence index is at historically low levels, even lower than it was during the peak of the Covid-19 pandemic in 2020. This is a result of the constant implementation of movement restrictions along with the increase of structural risks within the Chinese economy, which hampers economic activity.

China Consumer Confidence Index (TradingEconomics, National Bureau of Statistics of China)

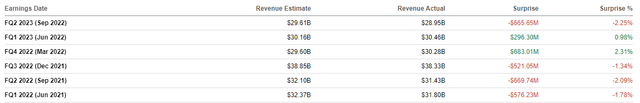

What’s also important to note is that due to Beijing’s decision to devalue its currency in recent quarters, Alibaba’s business stopped growing in dollar terms. Even though the company stated that its total revenues in the recent quarter have increased by 3% Y/Y, the increase was only in the Chinese renminbi. If we look at the latest quarterly report, which shows that Alibaba generated $29.1 billion in total revenues, and compare it with the report for the same period from a year ago, which shows $31.2 billion in total revenues, we would see that the overall sales in dollar terms were actually down ~6.7%. This shows that a devaluation of China’s currency is a major concern, since it hurts Alibaba in dollar terms and makes it harder to beat street estimates, which are also priced in USD.

Alibaba’s Revenue Results vs. Expectations (Seeking Alpha)

On top of all of that, weak consumer confidence and a devalued currency are not the only worries that haunt Alibaba. While recently there were talks about easing the zero-Covid policy, no major steps have been taken so far, as millions of Chinese people continue to be in lockdown in various places of the mainland to this day, while new Covid cases in Beijing are currently rising.

This makes the efforts of the Chinese government to stimulate the weakened economy via different fiscal and monetary programs even more difficult. This could force Beijing to devalue its currency even more, as the exports fail to increase amidst a global slowdown, while the annual GDP growth rate is expected to be at the lowest levels in decades, causing a potential further decline of Alibaba’s revenues in dollar terms.

What’s worse is that as China enters a growth crisis, which could last for a while, there’s no guarantee that it would be able to successfully exit it and return to record growth levels, as was the case in decades before the pandemic, due to the demographic issues that the country is facing.

In the past, one of the main arguments of Alibaba bulls was the idea that, thanks to being the most populated country in the world, China offers infinite opportunities for growth to its businesses. However, the latest data shows that that’s not the case.

There are already reports about a negative growth of population in a number of provinces, while the data from the Shanghai Academy of Social Sciences shows that in 2022 China will experience its first population decline in decades due to the constant decrease in the fertility rate. At the same time, it expects that by the end of the current century, China’s population will decrease to 587 million from 1.41 billion last year, which would represent the biggest demographic decline that mankind has ever witnessed. Add to this the fact that China is also becoming one of the fastest-aging countries in the world and it becomes obvious that it’s very unlikely that it will be able to aggressively grow its economy as before during the period of the economic miracle that began a few decades ago and which is about to end. Without a doubt, such development is also going to negatively affect Alibaba’s ability to grow and create additional shareholder value in the future.

Not Much Optimism Going Forward

Historically, the third quarter, which for Alibaba begins in October and ends in late December, has always been the most successful for the company in terms of the ability to generate record revenues thanks to the holiday season. While this is likely to be the case this year as well, there’s a high probability that we’ll nevertheless see a Y/Y decline in sales. The street already expects Alibaba’s revenues in Q3 to be down nearly 10% Y/Y in dollar terms, while the EPS is expected to be down 18% in dollar terms as well.

Considering that during the Singles Day event, which took place a couple of weeks ago, the disruptions caused by the resurgence of Covid-19 affected 15% of Alibaba’s delivery areas, there’s a high chance that the street could be correct in its forecasts. Add to this the fact that Alibaba decided not to reveal its sales during this period for the first time, and it becomes safe to assume that we’re more than likely to see the company disappoint its shareholders once again in the upcoming Q3 earnings report, which will be available next year.

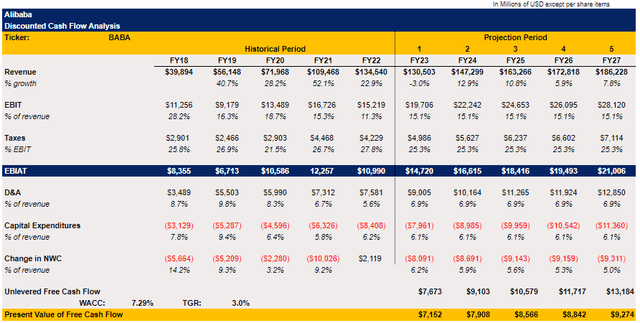

With that in mind, it makes sense to update my discounted cash flow (“DCF”) model, which back in September showed Alibaba’s fair value to be $128.71 per share. This should figure out whether there’s any upside left given the latest developments. This time, I made only two changes to the model. First of all, I changed the top-line performance forecast, which is mostly in line with the street expectations, due to the release of the new earnings report that caused me to revisit the revenue outlook. Secondly, the share count data, in the end, was updated as well, since, due to the buybacks, the total number of shares outstanding has slightly decreased.

Alibaba’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

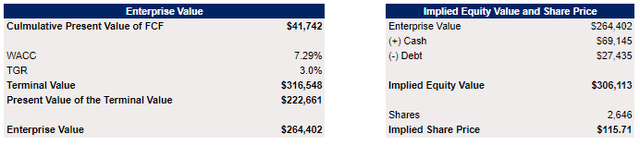

The updated model shows that Alibaba’s current fair value is $264.4 billion, while its implied share price is $115.71 per share, which still represents an upside from the current market price, but the upside itself is lower than it was back in September.

Alibaba’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

However, several things need to be mentioned here. First of all, even though Alibaba is undervalued solely based on the fundamentals, we shouldn’t forget that for several quarters in a row the stock has traded below its fair value and nothing prevented its price from further depreciation. Therefore, the fact that at first it appears that Alibaba is undervalued shouldn’t be the deciding factor on whether to invest in the company.

At the same time, there’s always a possibility that if Beijing starts to aggressively devalue its currency or the company’s sales decline is greater than expected, then the top-line growth assumptions would need to be revised as well, which would lead to an even lower fair value of Alibaba. Lastly, a single bump of 0.50 bps to 1 bps for WACC alone would decrease the fair value of Alibaba by several dollars per share. As a result, the actual upside, in reality, could be significantly less depending on various factors, which makes Alibaba’s stock not as attractive as it could be seen at first sight.

The Bottom Line

Even after losing nearly half of its value in the last 12 months and trading cheaply based on the current fundamentals, it’s still hard to justify a long position in Alibaba. The catalysts that were there even a decade ago are no longer present now to help Alibaba improve its overall performance going forward. At the same time, the amount of economic, political, and geopolitical issues that are outside of the company’s control continue to increase, which hampers its business and ability to create additional shareholder value along the way. Considering this, I continue to believe that it’s better to avoid Alibaba and Chinese stocks altogether, as most of them are also exposed to the issues described above.