AIER’s On a regular basis Worth Index (EPI) rose to 295.8 in June 2025, a rise of 0.51 p.c. June was the primary month since February, wherein the EPI rose extra on a proportion foundation than our same-month CPI proxy, ending a streak of three months when EPI will increase had been decrease.

Of the 24 elements making up the EPI, fifteen rose in value, seven declined, and two had been unchanged from the earlier month. The most important value will increase had been seen in housing fuels and utilities, charges for classes and instruction, and housekeeping provides. Probably the most pronounced declines occurred in intracity transportation, nonprescription medicine, and leisure studying supplies.

The sharp improve within the AIER On a regular basis Worth Index in June 2025, its largest since February and the seventh largest since January 2024, most likely displays rising prices in tariff-sensitive shopper items. 9 of its 24 constituent classes are extremely uncovered to tariffs on imports from Mexico and China, together with housekeeping provides, tobacco merchandise, private care merchandise, pet merchandise, alcoholic drinks at house, nonprescription medicine, audio media, leisure studying supplies, and meals at house. A further three classes — meals away from house, prescribed drugs, and motor gas — are reasonably uncovered to tariff-driven value pressures.

AIER On a regular basis Worth Index vs. US Client Worth Index (NSA, 1987 = 100)

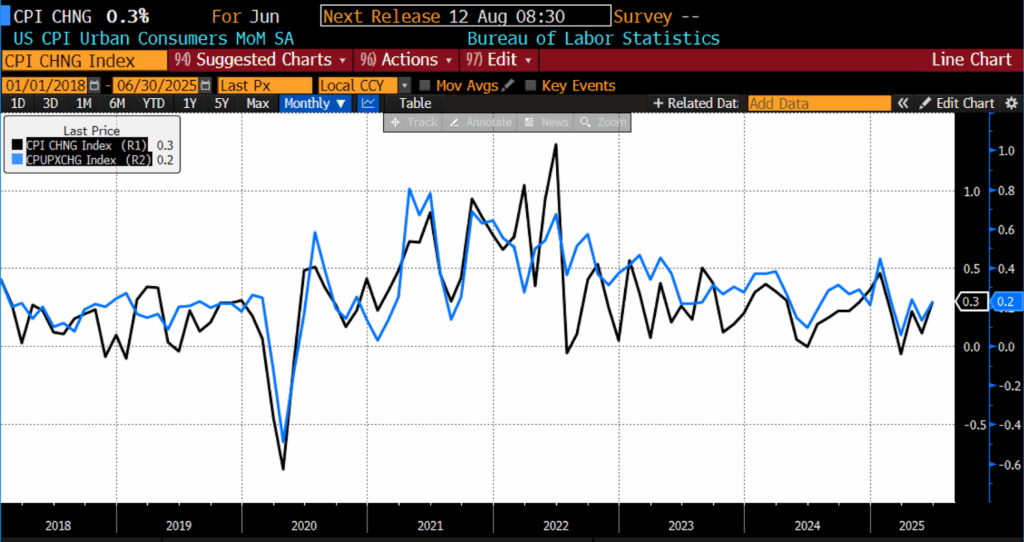

On July 15, 2025, the US Bureau of Labor Statistics (BLS) launched its June 2025 Client Worth Index (CPI) knowledge. On a month-to-month foundation, the headline CPI rose 0.3 p.c, which was in step with forecasts. Core CPI rose 0.2 p.c versus an anticipated 0.3 p.c.

The rise within the month-to-month headline quantity was largely pushed by shelter prices, which superior 0.2 p.c. Inside shelter, house owners’ equal hire rose 0.3 p.c, hire elevated 0.2 p.c, and lodging away from house declined 2.9 p.c. Core CPI, which excludes meals and vitality, rose 0.2 p.c in June following a 0.1 p.c acquire in Might.

Meals costs continued their regular climb, rising 0.3 p.c in June. Meals at house additionally elevated 0.3 p.c, although positive factors had been uneven throughout classes: nonalcoholic drinks jumped 1.4 p.c (with espresso up 2.2 p.c), vegetables and fruit rose 0.9 p.c (citrus fruits up 2.3 p.c), and “different meals at house” edged up 0.2 p.c. Elsewhere, cereals and bakery merchandise declined 0.2 p.c as meats, poultry, fish, and eggs fell 0.1 p.c (a big portion of which was because of a 7.4 p.c drop in egg costs). Dairy merchandise slid 0.3 p.c. Meals away from house rose 0.4 p.c, led by an 0.5 p.c improve in full-service meals and a 0.2 p.c rise in limited-service meals.

The vitality index elevated 0.9 p.c following a 1.0 p.c decline in Might, with gasoline costs up 1.0 p.c, electrical energy rising 1.0 p.c, and pure gasoline rising 0.5 p.c.

In core, family furnishings rose by 1.0 p.c, as did medical care (up 0.5 p.c), recreation (up 0.4 p.c), attire (up 0.4 p.c), and private care (up 0.3 p.c). The medical care improve was supported by positive factors in hospital providers and prescribed drugs (every up 0.4 p.c) and doctor providers (up 0.2 p.c). Offsetting a few of these positive factors had been declines in used vehicles and vans (down 0.7 p.c), new autos (down 0.3 p.c), and airline fares (down 0.1 p.c).

June 2025 US CPI headline and core month-over-month (2015 – current)

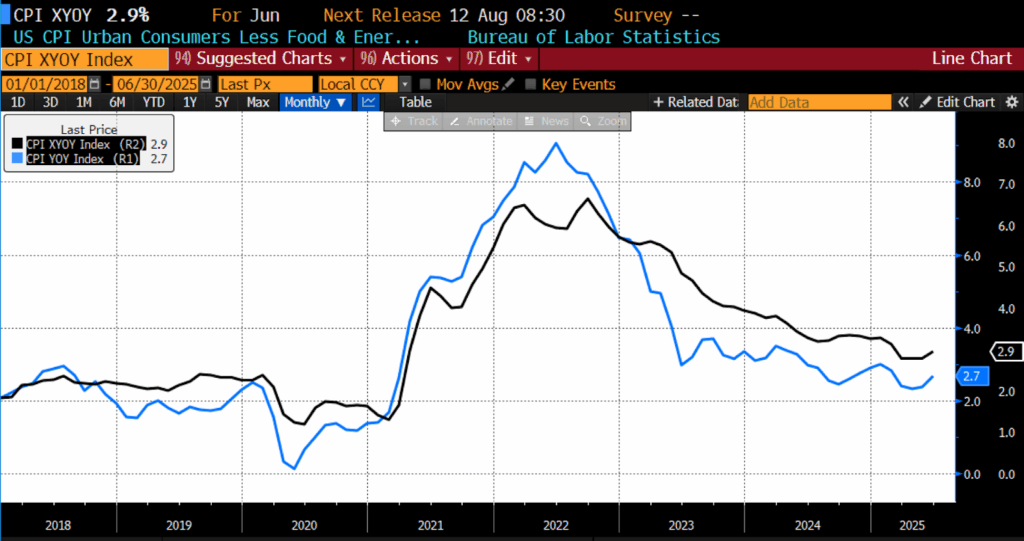

For the 12 months ending in June 2025, the headline Client Worth Index rose 2.7 p.c, increased than the forecast improve of two.6 p.c. The year-over-year improve in core CPI met expectations of a 2.9 p.c rise.

June 2025 US CPI headline and core year-over-year (2015 – current)

From June 2024 to June 2025, meals costs rose broadly. The meals at house index elevated 2.4 p.c and meals away from house by 3.8 p.c. Inside meals at house, meats, poultry, fish, and eggs surged 5.6 p.c, pushed largely by a 27.3 p.c soar in egg costs alone. Nonalcoholic drinks rose 4.4 p.c, whereas cereals and bakery merchandise and dairy every rose 0.9 p.c, vegetables and fruit 0.7 p.c, and different meals at house by 1.3 p.c. The index for full-service meals climbed 4.0 p.c as limited-service meals rose 3.5 p.c.

The vitality index declined 0.8 p.c over the yr, as gasoline costs dropped 8.3 p.c and gas oil fell 4.7 p.c, although electrical energy rose 5.8 p.c and pure gasoline leapt 14.2 p.c. Throughout the core inflation index, over the previous 12 months shelter costs elevated by 3.8 p.c. Notable positive factors had been additionally seen in motorcar insurance coverage (up 6.1 p.c), family furnishings and operations (up 3.3 p.c), medical care (up 2.8 p.c), and recreation (up 2.1 p.c).

Whereas headline inflation was pushed increased by gasoline and shelter, the uptick in core costs was largely prompted by tariff-sensitive items — home equipment, furnishings, toys, and attire — suggesting early indicators of import value pass-through. Declines in new and used automotive costs helped offset a few of these pressures. Companies inflation, notably exterior housing, remained agency, and medical care posted a notable acquire. Housing prices, a serious inflation driver in recent times, are cooling.

Some firms, like Walmart and Nike, have begun modest value will increase in response to tariffs, whereas others are delaying strikes till commerce negotiations play out. The inflation image is now formed by rising uncertainty surrounding President Trump’s sweeping tariffs, which embrace across-the-board 10 p.c import duties, 50 p.c levies on metal and aluminum, and threats of each a 50 p.c tariff on copper and 30 p.c on EU items beginning August 1. Although June value knowledge confirmed solely scattered proof of broad-based tariff inflation, underlying value power in core items — excluding vehicles — was the sharpest month-to-month improve since late 2021.

Fed Chair Jerome Powell has signaled warning, saying he needs to see how the financial system digests the tariffs earlier than adjusting charges, and policymakers seem divided: whereas inflation stays modest by post-pandemic requirements, the chance of sticky value will increase from extended commerce frictions is holding the Fed sidelined for now. Trump continues to demand price cuts, publicly criticizing Powell whereas asserting that inflation is already underneath management. But with actual common hourly earnings development decelerating to simply 1.0 p.c yearly and retail gross sales knowledge due later this week, the Fed is prone to maintain regular at its July assembly, with markets more and more seeking to September for a doable pivot. A lower could also be within the playing cards if each inflation cooperates and tariff escalation is prevented.