AIER’s Everyday Price fell 0.4 percent in September following a 1.3 percent drop in August and 0.6 percent decline in July. Those were the first back-to-back-to-back declines since the period from February through April 2020. From a year ago, the Everyday Price Index is up 10.0 percent. Once again, motor fuel prices more than accounted for the overall drop in September, offsetting increases in other key categories.

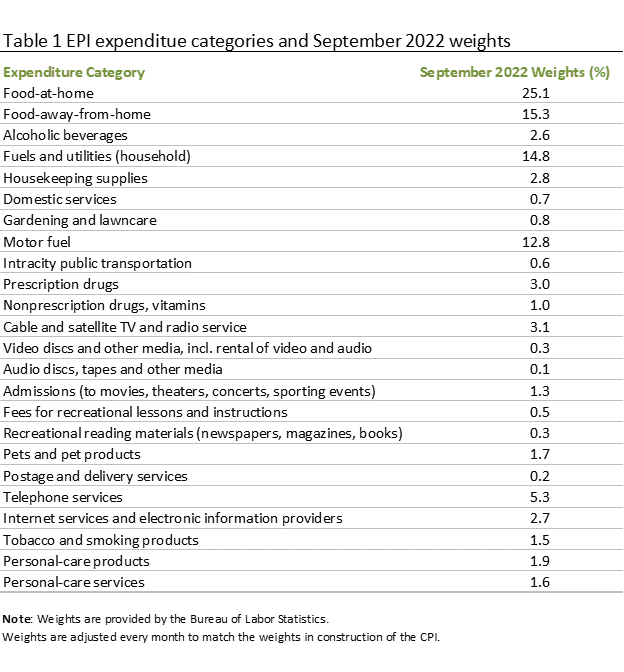

Motor fuel prices, which are often a significant driver of the monthly changes in the Everyday Price index because of the large weighting in the index and the volatility of the underlying commodity, sank 5.6 percent for the month, reducing the overall gain by 80 basis points (on a not-seasonally adjusted basis). Eight other components showed price declines in September, including a 1.3 percent drop in admissions prices, a 1.3 percent decline in recreational reading materials, a 0.4 percent fall in cable and satellite services, and a 0.4 percent decrease in nonprescription drugs. Still, their contributions to the overall index were quite small.

Price increases were led by fees for lessons (2.8 percent), food away from home (0.9 percent), and pets and pet products (0.9 percent). The three largest positive contributors in September were food at home (up 0.6 percent and contributing 15 basis points), food away from home (up 0.9 percent for the month and adding 14 basis points), household fuels and utilities (up 0.6 percent and contributing 9 basis points), and housekeeping supplies (up 0.6 percent and adding 2 basis points). A total of 13 categories had price increases versus nine showing declines.

The Everyday Price Index, including apparel, a broader measure that includes clothing and shoes, fell 0.2 percent in September, the third consecutive decline. Over the past year, the Everyday Price Index, including apparel, is up 9.7 percent, the lowest since February.

Apparel prices rose 2.2 percent on a not-seasonally-adjusted basis in September. Apparel prices tend to be volatile on a month-to-month basis. From a year ago, apparel prices are up 5.5 percent.

The Consumer Price Index, which includes everyday purchases and infrequently purchased, big-ticket items and contractually fixed items, rose 0.2 percent on a not-seasonally-adjusted basis in September. Within the CPI, energy posted a 2.6 percent drop on a not-seasonally-adjusted basis while food had an 0.7 percent increase. Over the past year, the Consumer Price Index is up 8.2 percent.

The Consumer Price Index, excluding food and energy, rose 0.4 percent for the month (not seasonally adjusted) while the 12-month change came in at 6.6 percent, the highest since 1982. The 12-month change in the core CPI was just 1.3 percent in February 2021 and 2.3 percent in January 2020, before the pandemic.

After seasonal adjustment, the CPI rose 0.4 percent in September while the core increased 0.6 percent for the month. Within the core, core goods prices were unchanged in September and up 6.6 percent from a year ago. Significant increases for the month were seen in new vehicles (0.8 percent), motor vehicle parts and equipment (0.8 percent), and household furnishings (0.6 percent), while used cars and trucks posted a 1.1 percent drop, and tech commodities fell 0.6 percent.

Core services prices were up 0.8 percent for the month and 6.7 percent from a year ago. Among core services, gainers include health insurance (up 2.1 percent and 28.2 percent from a year ago), motor vehicle repair (1.9 percent and 11.1 percent from a year ago), motor vehicle insurance (up 1.6 percent for the month and 10.3 percent from a year ago), medical care (up 1.0 percent for the month and 6.5 percent from a year ago), rent of shelter (which accounts for 32.1 percent of the CPI, rose 0.8 percent for the month and 6.7 percent from a year ago).

Price pressures for many goods and services in the economy remain elevated. Sustained elevated price increases are likely distorting economic activity by influencing consumer and business decisions. Furthermore, price pressures have resulted in an aggressive Fed tightening cycle, raising the risk of a policy mistake. The fallout surrounding the Russian invasion of Ukraine continues to disrupt global supply chains, compounding shortages of supplies and materials in the U.S. Labor shortages and turnover further challenge output expansion. All of these are sustaining a high level of uncertainty for the economic outlook. Caution is warranted.