Key Takeaways

- Genius Group inventory rose 11% after the agency expanded its Bitcoin Treasury to $30 million.

- The corporate reported a 1,649% BTC yield since its preliminary acquisition in November.

Share this text

Genius Group Restricted (GNS) inventory rose 11% to roughly $0.72 in early US buying and selling Monday after the AI-driven training firm mentioned it had expanded its Bitcoin holdings to $30 million, in response to Yahoo Finance.

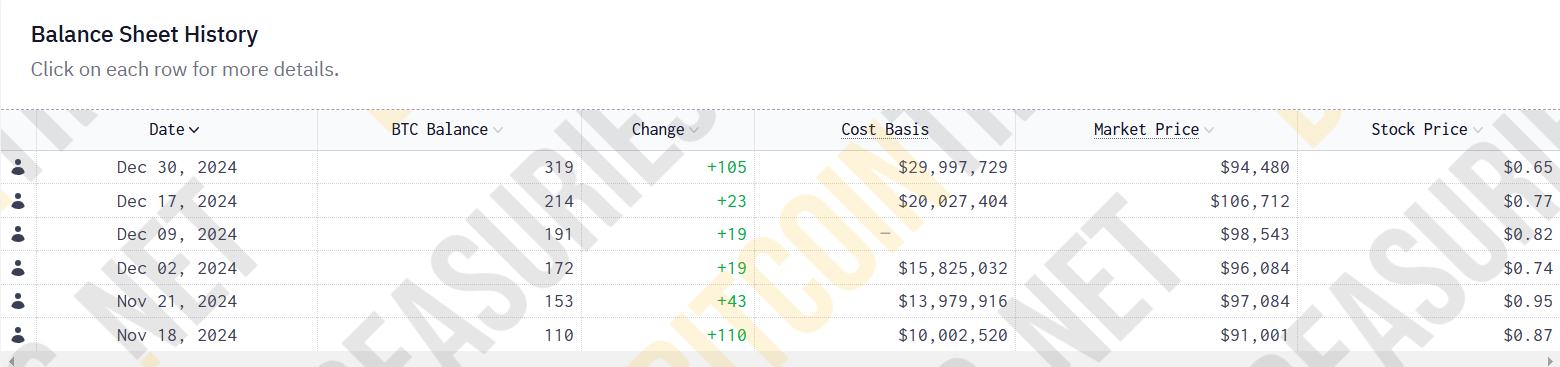

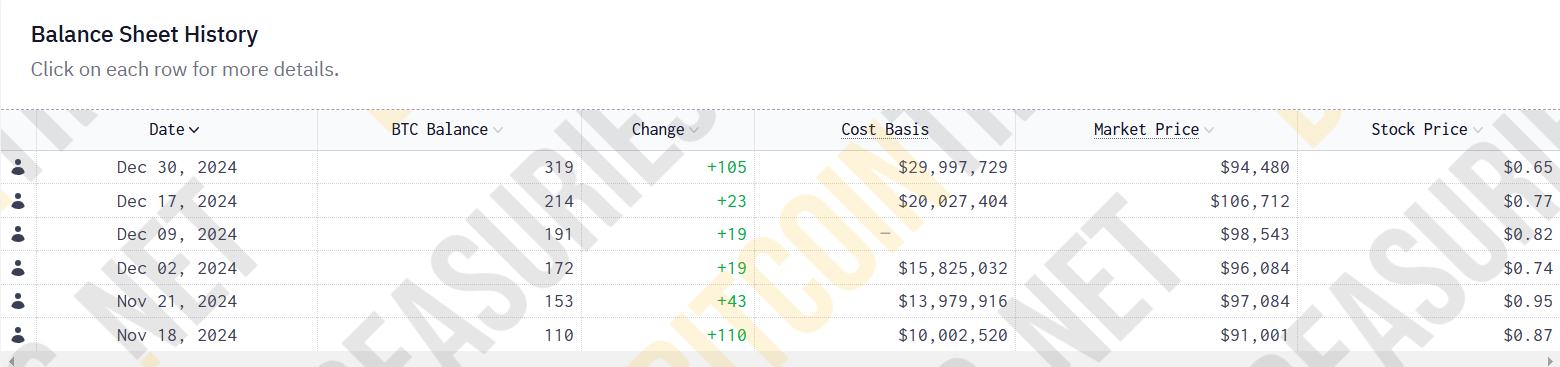

The corporate elevated its Bitcoin Treasury by $10 million, bringing its complete holdings to 319.4 Bitcoin, in response to a Monday assertion.

The growth comes as Genius Group reported a 177% enhance in web asset worth to over $54 million within the first half of 2024, surpassing its market capitalization of greater than $40 million.

The corporate additionally launched BTC Yield as a brand new efficiency metric, reaching a 1,649% yield since its preliminary Bitcoin acquisition in November.

Genius Group first revealed plans to carry 90% or extra of its reserves in Bitcoin in November, with an preliminary goal of $120 million. The corporate has since made common purchases, beginning with a $10 million funding on November 18.

“Now we have been shopping for Bitcoin constantly and are happy to be forward of our inside schedule to achieve our preliminary goal of 1,000 Bitcoin in our Treasury,” mentioned Genius Group CEO Roger Hamilton.

The Bitcoin purchases have been funded by a mix of reserves, ATM proceeds, and a $10 million Bitcoin mortgage from Arch Lending.

As of December 29, 2024, the Bitcoin Treasury was valued at $30.4 million primarily based on Bitcoin’s value of $95,060, whereas the corporate’s market cap was $40.6 million, leading to a BTC/Value ratio of 75%.

“While we’re happy to be reaching a excessive BTC yield, we imagine our Bitcoin efficiency will not be but mirrored in our share value. That is indicated by Genius Group having a excessive BTC / Value ratio of 75%, which we imagine is considerably increased than our business friends,” mentioned Genius Group CFO Gaurav Dama.

Share this text