Torsten Asmus

(This article was co-produced with Hoya Capital Real Estate

Introduction

With a large portfolio to invest and then manage, having Core ETFs for a significant percentage greatly eases the work involved. This strategy allows more time for analyzing more narrowly focused funds, based on factors like market-cap, growth/value or sectors. A recent article of mine reviewed two ETFs I use as my Core US Equity funds: VTI Vs. SPTM For Total US Equity Exposure. This article compares two U.S. Bond ETFs I am considering if I add a Core US Fixed Income to that part of my portfolio. Those ETFs are:

- iShares Core U.S. Aggregate Bond ETF (NYSEARCA:AGG)

- Vanguard Total Bond Market ETF (NASDAQ:BND)

iShares Core U.S. Aggregate Bond ETF review

Seeking Alpha describes this ETF as:

The fund invests in U.S. dollars denominated, fixed rate investment grade treasury bonds, government-related bonds, corporate bonds, mortgage-backed pass-through securities, commercial mortgage-backed securities and asset backed securities that have a remaining maturity of at least one year. It seeks to track the performance of the Bloomberg U.S. Aggregate Bond Index. AGG started in 2003.

Source: seekingalpha.com AGG

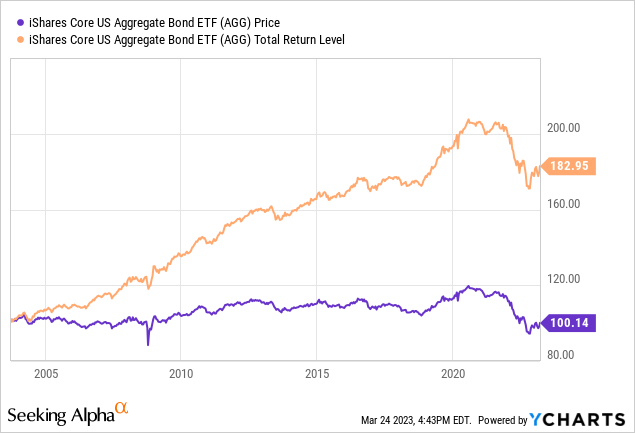

AGG has $87.5b in AUM and only has 3bps in fees. Investors currently receive a TTM yield of 2.5%.

Index review

I could not find a good review on the Bloomberg for their index, but did find some details elsewhere.

The Bloomberg Barclays US Aggregate Bond Index (ticker: LBUSTRUU), formerly known as the Lehman Aggregate Bond Index and the Barclays US Aggregate Index, was created in 1986 with backdated history going back to 1976. The index has been maintained by Bloomberg L.P. since August 24th 2016. The index is a predominant index benchmark for US bond investors, and is a benchmark index for many US index funds.

Overview

The Index is a composite of four major sub-indices: US Government Index; US Credit Index; US Mortgage Backed Securities Index (1986); and (beginning in 1992) US Asset Backed Securities Index. The index holds investment quality bonds. The ratings are based on S&P, Moody, and Fitch bond ratings. The index does not include high yield bonds, municipal bonds, inflation-indexed bonds, or foreign currency bonds.

Source: bogleheads.org Index

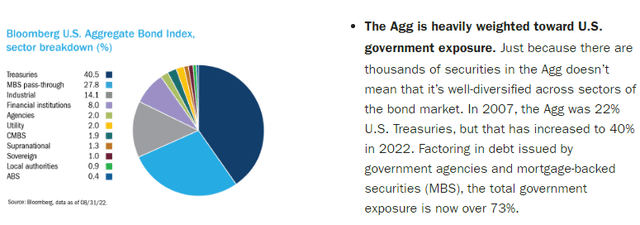

The next chart shows the sectors in the index, with weights.

columbiathreadneedleus.com AGG Index

Knowing what the index can hold is critical if the ETF invests based on it, so despite its name, “Aggregate” is dominated by government debt. While that weighting probably matches what the total US Fixed Income market comprises, investors wanting corporate or High-Yield debt, will need to add other funds if the AGG ETF is a “core” holding.

AGG holdings review

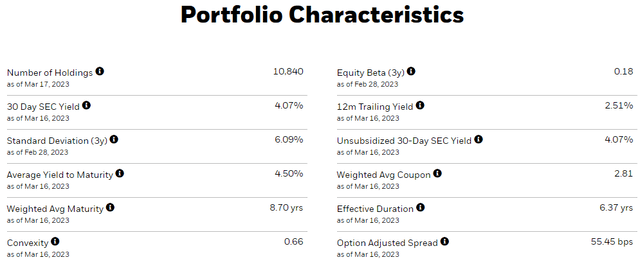

iShares provides the following data points for the ETF’s portfolio.

ishares.com AGG factors

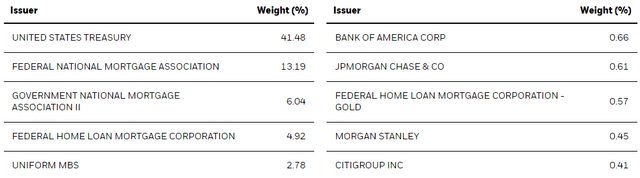

With bond ETFs, a list of which issuers have the largest exposure is very informative and important. iShares provides that.

ishares.com AGG issuers

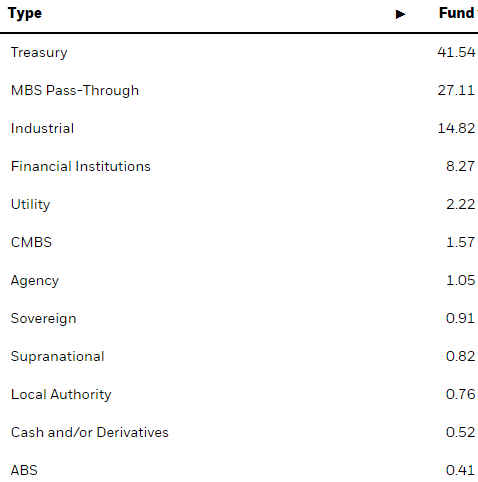

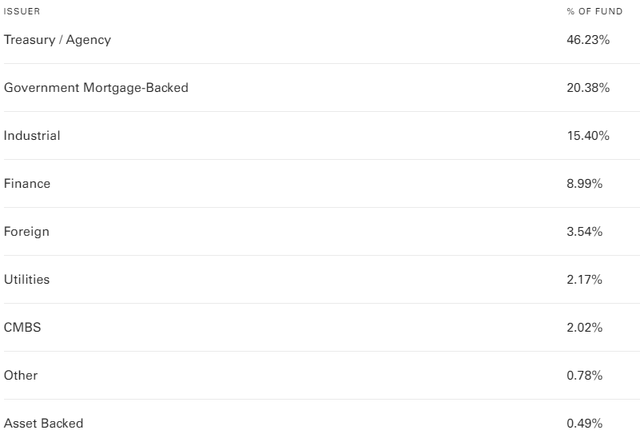

The current sector allocations are:

ishares.com AGG sectors

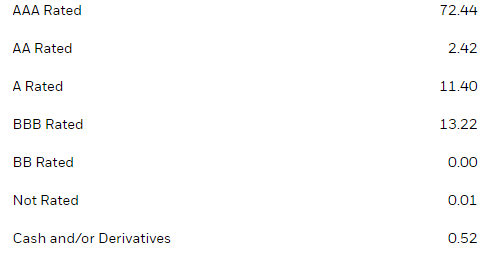

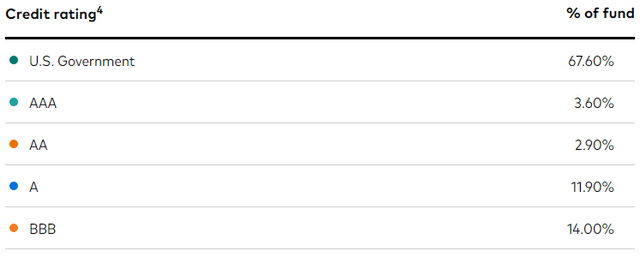

At this time, the three non-government sectors (IND, FIN, UTL) comprise just over 25% of the assets. With government debt being 75%, no surprise how the credit rating allocation looks.

ishares.com AGG ratings

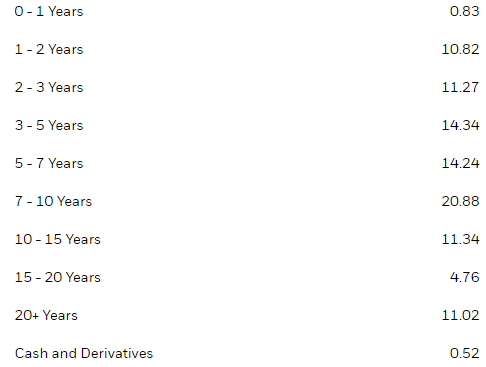

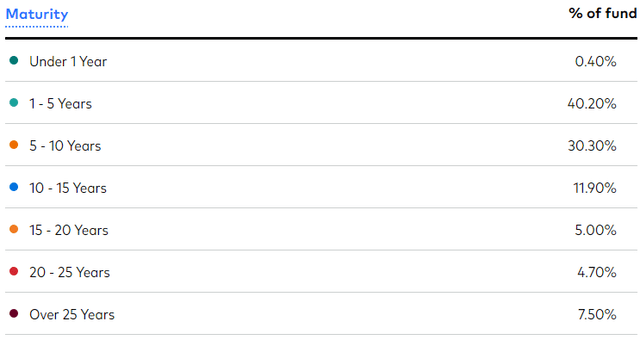

Another way to view this is that most of the corporates owned are in the lower ratings that are still considered investment-grade bonds. The maturity profile is:

ishares.com AGG maturities

This comes to a 8.7-year WAM, with a shorter duration of 6.37 years. Duration is important when rates are moving up like today. AGG’s duration equates to a possible 6.4% price decline if rates go up another 100bps. Before 2025, about 11% of the portfolio will mature and needs to be replaced. This might increase the WAC.

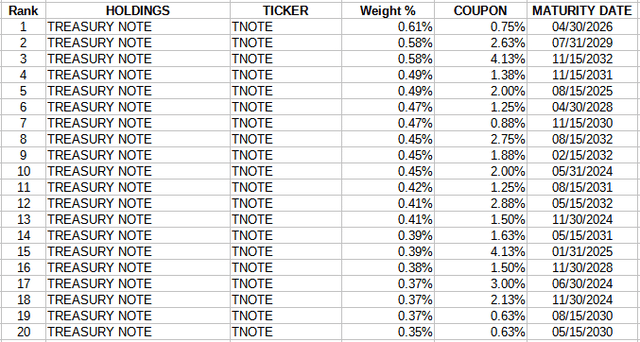

Top 20 holdings

ishares.com; compiled by Author

Currently the cash position is earning almost 200bps more than the WAC of the portfolio. Its YTM is also higher than the portfolio’s. The last 8000 positions account for about 13% of the total weight.

AGG distribution review

seekingalpha.com AGG DVDs

While payouts have generally followed the direction of interest rates, with a lag, it is interesting to see that the last payment was down slightly from January but still above the last one in 2022. Based on the past pattern, not something I would be concerned about, yet.

Vanguard Total Bond Market ETF review

Seeking Alpha describes this ETF as:

The fund invests in the fixed income markets of the United States. It invests in investment-grade debt securities including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities with maturities of more than 1 year that are rated BBB- or above by S&P. The fund seeks to replicate the performance of the Bloomberg U.S. Aggregate Float Adjusted Index. BND started in 1986.

Source: seekingalpha.com BND

BND has $89.4b in AUM and also comes with a 3bps fee. The TTM yield here is 2.6%.

Index review

This index was even harder to find details about. I found one unsourced description: “The Bloomberg US Aggregate Bond Float Adjusted Index is a broad-based benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The Float-Adjusted version excludes US agency debentures held in the Federal Reserve SOMA account.” The bolded sentence explains the major difference between the index used by BND and the one used by AGG.

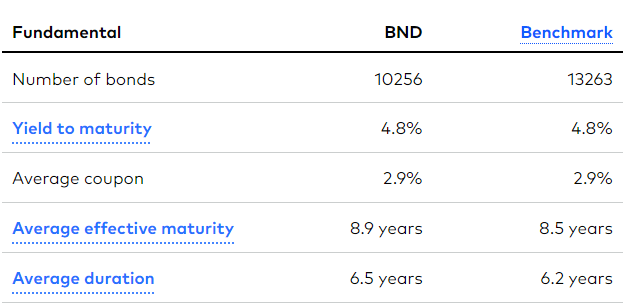

BND holdings review

Vanguard also provided basic data points on their ETF’s portfolio.

investor.vanguard.com BND factors

If WAM and duration are concerns, both ETFs show similar values, as do both the WAC and YTM values. This should be expected as holdings match up well; only the weights are reduced on some issues as compared to what AGG holds.

Vanguard classifies the holdings by issuer, not sector, but the two are basically the same.

advisors.vanguard.com BND issuers

Based on the weights between the two ETFs, I would surmise that the Fed Reserve SOMA holds a large amount of MBS assets as BND’s weight for those debt instruments is 7% lower than AGG’s.

investor.vanguard.com BND ratings

Even with some government debt excluded, the “A” and “BBB” ratings comprise only slightly more of this portfolio than AGG’s, pushing up BND’s weight in UST debt.

Here the maturity allocations look:

investor.vanguard.com BND maturities

This listing is not as detailed in the shorter time periods, but examining the whole portfolio data listing, it appears under 9% matures before 2025, versus about 11.5% in AGG’s portfolio.

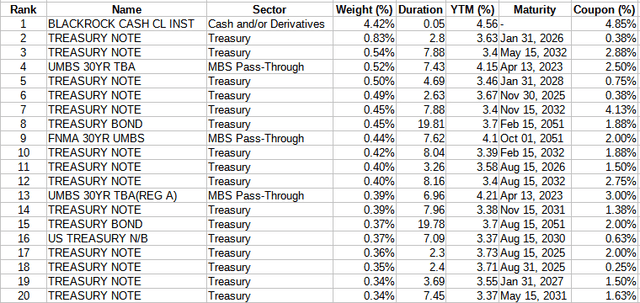

Top holdings

advisors.vanguard.com; compiled by Author

While the website indicates that BND holds just over 10,000 bonds, the holdings report lists over 17,000; 14,000 of which have a weight under 1bps and in total represent 33% of the portfolio.

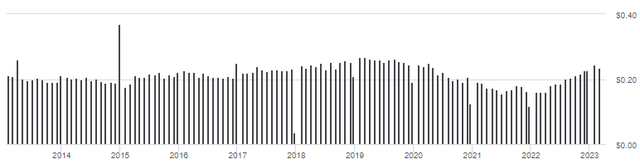

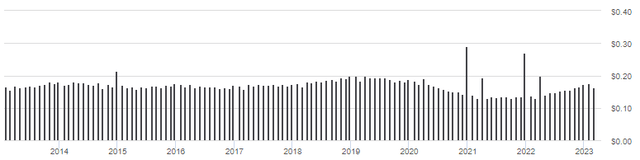

BND distribution review

seekingalpha.com BND DVDs

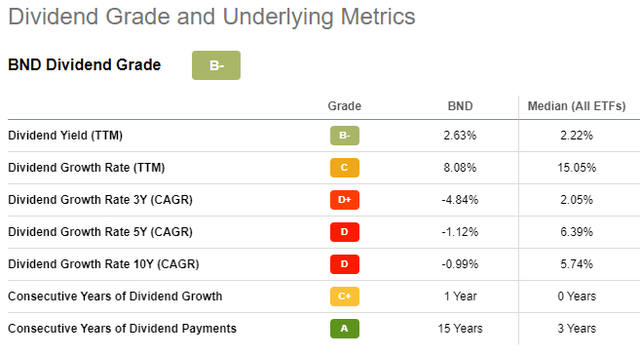

We see the same payout pattern here, including the small decrease in the last payment. This earned BND a “B-” grade for this factor.

seekingalpha.com BND scorecard

Comparing ETFs

I found the following data points from various investment sites.

| Factor | AGG ETF | BND ETF |

| Effective Duration | 6.39 years | 6.52 years |

| Weighted Average Maturity | 8.73 years | 8.90 years |

| Weighted Average Coupon | 2.81% | 2.88% |

| Weighted Average Price | $91.59 | $90.20 |

| Yield-to-Maturity | 4.25% | 4.75% |

| Portfolio rating | AA | AA |

There is no material differences in the above factors between these ETFs.

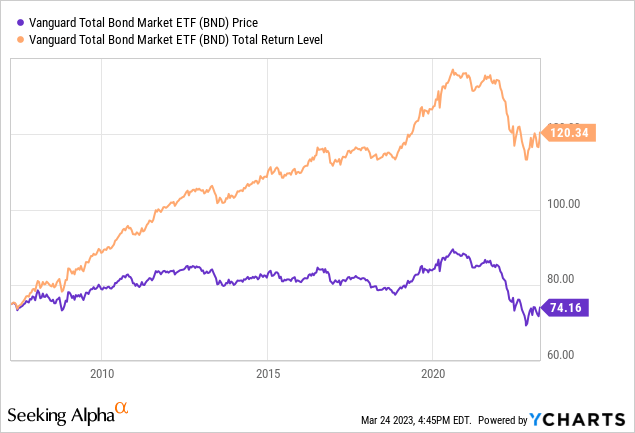

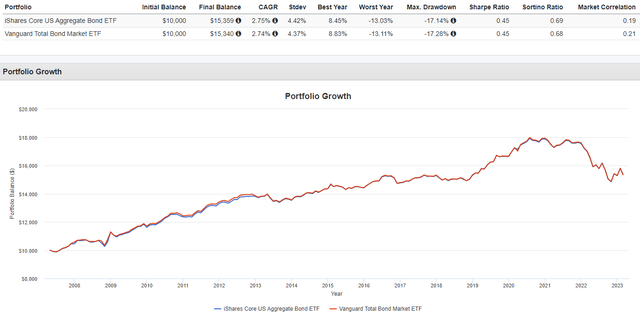

PortfolioVisualizer.com

You can barely see the Blue line that represents the BND ETF as the two ETFs are .98 correlated. Return and risk data points are almost identical too. As is often the case with ETFs that invest in a similar manner and have the same fee level, it comes down to which ETF manager the investor prefers: such is the case here. That closeness is also reflected in the Seeking Alpha Quant rankings, which places BND 13th and AGG 15th.

Portfolio strategy

This article had a focus of examining two ETFs that could be the Core fixed income holding for investors; how much to allocate to that asset class is a different discussion with numerous inputs required, like:

- Investors age

- portfolio size

- income needs

- risk tolerance

to name just a few. Using the Seeking Alpha Peers function, we can expand the list of possible ETFs to use as the Core US Fixed Income fund.

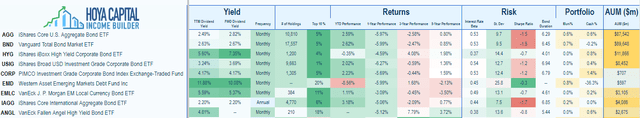

seekingalpha.com AGG Peers

Except for the PIMCO Active Bond Exchange (BOND) at 10-years, over the past 3,5, and 10-year periods, these ETFs provided investors with the similar returns. As with equities, there are then other fixed income classes to consider, such as:

- Developed international

- Emerging markets

- USD or foreign currency

- below IG, or “junk” bonds

Here are a few other bond ETFs that can be added to the Core ETF to adjust the allocation and add bonds not included in the above. Of course any of these could be consider a sub-core ETF.

Hoya Capital Income Builder