Kevin Dietsch

In a recent report, I discussed the quarterly results of Aerojet Rocketdyne (NYSE:AJRD) and marked shares of Aerojet Rocketdyne a buy due to their strategic positioning for weapon system capability and national security as well as space exploration. Reuters reported that L3Harris Technologies (LHX) is close to announcing the acquisition of Aerojet Rocketdyne and an announcement could follow as early as Monday. In this report, I will be focusing on what this acquisition means for Aerojet Rocketdyne share prices and why this acquisition has higher chances of receiving regulatory approval than the combination with Lockheed Martin that was called off earlier this year.

Aerojet Rocketdyne: A Market Outperformer

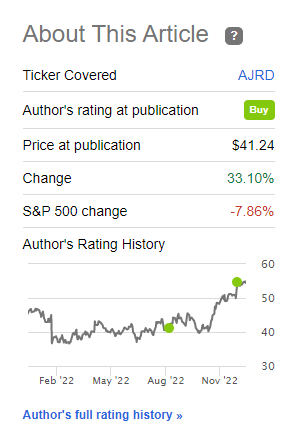

Seeking Alpha

While I have been following Aerojet Rocketdyne for some time, it wasn’t until August this year that I wrote my first report covering the manufacturer of defense and space rocket thrusters. Back then, shares of Aerojet Rocketdyne had tumbled following a wide Q2 2022 earnings miss. However, back then I noted that the miss was largely caused by negative adjustments on the Standard Missile program for which Aerojet Rocketdyne increased capacity to facilitate increased customer demand into 2024 and 2025 which obviously is a good thing but pushed the Standard Missile program into a loss position for the quantities that were under contract. Excluding this adjustment, margins would actually have expanded.

I also noted the following:

The situation with Russia positions Aerojet Rocketdyne extremely well with its involvement in space and defense, more particularly hypersonics.

So, I believe that the selloff was not justified given the nature of the Standard Missile adjustment, which was in anticipation to facilitate future demand, and the company’s involvement in space and defense and particularly hypersonics was very promising for its prospects. Until November 30th, the stock had already gained 20% so the buy rating was a justified one.

On that day, the news broke that General Electric (GE), L3Harris Technologies, Textron (TXT) and Veritas Capital were exploring opportunities to acquire the company and I marked shares of Aerojet Rocketdyne a buy based on concurrent uptick in space and defense demand. The space part is driven by lunar exploration while the defense part is driven by the situation in Ukraine resulting in increased rocket use and defense budgets while development of new weapon system capability also plays a significant role:

Is Aerojet Rocketdyne Stock A Buy?

The short answer is “Yes”. We see significant opportunities in space and in defense, with new weapon capability and capacity expansion opportunities. These elements make Aerojet Rocketdyne attractive as an acquisition target, and therefore, should also be of interest to investors. Even more so, even as a stand-alone business, the company offers significant opportunities for growth, making it attractive to buy shares. Wall Street has a buy rating on Aerojet Rocketdyne stock, but its consensus target is 4 to 5 percent below current trading levels. That is caused by the fact that we haven’t seen any adjustments to ratings since April this year. So, items like the positives on capacity expansion, opportunities and positioning as an acquisition target as well as strength as a stand-alone company are not sufficiently reflected in the current price targets.

I also noted that Aerojet Rocketdyne had hit its EBITDAP margin of 14%, so future growth should primarily come from higher production volumes and further efficiency initiatives. So, this seemed like a good moment to consider the company an acquisition target.

Better Deal, Limited Upside For Aerojet Rocketdyne Stock

It is said that Aerojet Rocketdyne will be acquired for $4.7 billion or $58 per share. Compared to the previous closing price this provides a 5.7% premium. That is not huge, but still represents 40% premium measured from the point I marked shares a buy and 42% measured from the point I wrote the article. So, a significant premium as measured from those points and it should also be kept in mind that shares of Aerojet Rocketdyne started appreciating in October partially due to the stock markets recovering somewhat and early signs that Aerojet Rocketdyne could be a very interesting acquisition target. So, the market already positioned for an acquisition and that drove prices up in October and even further by the end of November and December.

So, a 5.7% premium is not weak. The market just already started loading this premium into the stock price for some time now. It is not uncommon to see that happening and particularly for an acquisition of Aerojet Rocketdyne investors knew what to expect. Lockheed Martin was prepared to pay $56 per share representing a 33% premium before the combination was eventually called off due to regulatory hurdles. It seems that with $58 per share, investors could be getting a better deal than what Lockheed Martin offered.

Will Aerojet Rocketdyne Acquisition Be Blocked?

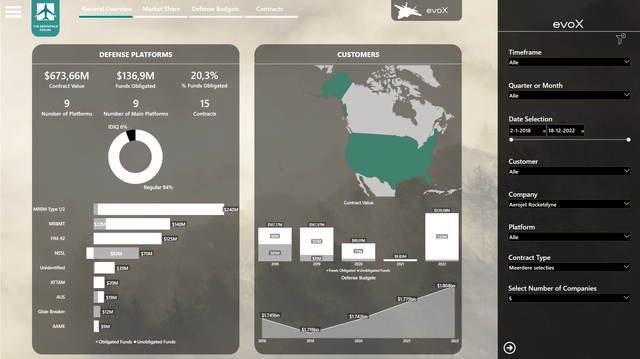

The Aerospace Forum

So, the big question is whether this acquisition could face regulatory hurdles. In theory, each acquisition can. However, an acquisition of Aerojet Rocketdyne by L3Harris Technologies is materially different than the one that Lockheed Martin had in mind when it made an offer for Aerojet Rocketdyne. For L3Harris Technologies, this will be a diversification of its business whereas for Lockheed Martin acquiring the rocket motor specialist was a vertical integration that could stonewall competition. An overview of the Defense contract awards from the evoX Defense Contracts and Budget Monitor shows that over the past 5 years Aerojet Rocketdyne received 15 contracts valued $674 million.

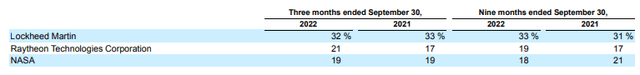

Aerojet Rocketdyne

The table above perfectly demonstrates why the acquisition of Aerojet Rocketdyne by Lockheed Martin Technologies was blocked. Seventy percent of all sales come from three parties. Lockheed Martin is by far the biggest with a third of the sales followed by Raytheon Technologies (RTX) and NASA, each with roughly 20%. So, an acquisition by Lockheed Martin would create the undesired situation in which Lockheed Martin would own a strategic supplier in which said supplier would also supply to the competition. In an ideal world, this is not a problem. However, we don’t live in an ideal world and having a competitor own the company that is your supplier could be problematic, especially in a supply-constrained environment as we have witnessed for some time now.

L3Harris does not have that issue. They have virtually no overlap or supply agreements with Aerojet Rocketdyne and as part of L3Harris, Aerojet Rocketdyne would maintain its neutral position as a strategic supplier.

Conclusion: Aerojet Rocketdyne To Be Acquired After All

After a failed takeover attempt from Lockheed Martin two years ago, it seems that Aerojet Rocketdyne will be acquired after all. Not by Lockheed Martin, but by L3Harris providing a neutral acquisition of the strategic supplier keeping the desired competition in the Defense landscape in place. For Aerojet Rocketdyne, this acquisition does make sense since it hit its long-term EBITDAP margins excluding adjustments and would be more reliant on cost optimization and capacity expansion going forward, which it can now do under the wings of L3Harris Technologies. We have no insights into any cost synergies, but for investors I do believe this eventually is a good deal.

Jefferies recently put a $62 price target on shares after the company did not receive any significant analyst coverage for some time. While a $58 per share acquisition price is below the price target Jefferies put, I think it is still a good deal. The $62 price target likely is based on a $5 billion acquisition price of Aerojet Rocketdyne which would imply a 50% premium compared to pre-acquisition rumour prices and while Aerojet Rocketdyne is a strategic supplier, I don’t think a 50% premium is justified based when viewing the entire landscape. So, $58 per share is a good deal and further upside only exists if this is the start of a bidding war.

Assuming that prices jump on Monday towards the $58 level, I am marking shares a Hold (from Buy) and this is only an interesting buy for those that want to park their cash to harvest the gap that will likely remain between the stock price and the acquisition price until the transaction is completed.