Poulssen

Last time, we deep-dived into Aegon (NYSE:AEG) and we positively view its decision to merge its operations with ASR. According to our internal estimates, this deal will help to achieve the company’s strategic transformation plan and will further unlock shareholders’ value. In detail, regarding the acquisition multiple, the estimated 2023 Price Earning multiple was almost 9x, carrying a significant premium versus Aegon’s historical average (last five years, the average P/E was 6.7x). Here at the Lab, we performed a comps analysis versus the NN Group, and despite a lower capital appreciation opportunity on a twelve-month basis, we still rated Aegon with a buy based on: 1) its solid solvency ratio, 2) its ongoing portfolio reshaping, 3) a solid FCF generation which leads to a debt reduction, 4) no exposure to Ukraine and Russia and 5) still supported by point 2) its re-focused activities on the US with the Wilton RE’s reinsurance transaction.

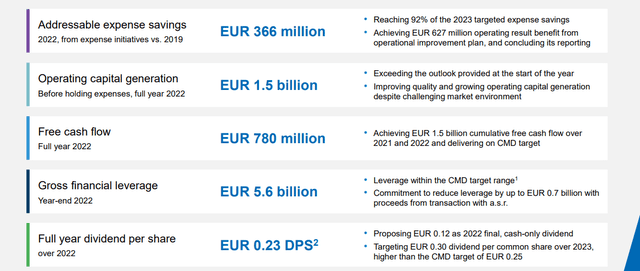

Starting with the positive news, Aegon shareholders approved the ASR deal and is on track to be closed in the 2023 second half. Reporting the CEO’s words Q4 “closes out a year in which we accelerated our transformation and the execution of our strategy”. Looking at the company’s key financial ratio, we positively report the following:

- Aegon’s cash holding increased to €1.6 billion from €1.4 billion;

- Point 1) was supported by an FCF increase to €780 million compared to the €729 achieved in 2021. In the last two years, the company delivered €1.5 billion in FCF, in line with our previous internal estimates;

- Aegon’s Solvency ratios are well above the regulator requirements in all the regions. In particular, the US, Netherlands, and the UK reached 428%, 210%, and 169% respectively;

- The company’s operating result signed a 4% increase versus its previous year-end quarter;

- As already reported, Aegon will further reduce its financial debt by up to €700 million using ASR sales proceeds.

Aegon financials in a Snap (Aegon Q4 and FY results presentation)

Conclusion and Valuation

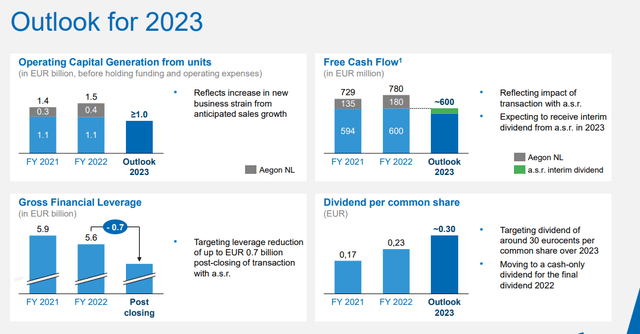

On the remuneration policy, Aegon proposes to confirm a dividend of €0.23 per share for the 2022 results. Also, the company is targeting a DPS of €0.30 for the 2023 period (which is well above management expectations from the 2020 CMD targets). In addition, Aegon also announced a €200 million share repurchase to be executed in 2023, and despite an uncertain macro outlook, they positively confirmed its yearly guidance. In detail, the company estimates at least “€1.0 billion operating capital generation” and “around €600 million of free cash flow“. If we are checking Aegon’s initiation of coverage, our FCF estimates until 2023 were over €2 billion. Aegon already delivered €1.5 billion in FCF and if we sum up management 2023 FCF estimates, we exactly got the number.

Mare Evidence Lab’s previous publication

Therefore, we decide to confirm our overweight valuation with a target price of 5.7 and 6.1 per share in Euro and US Dollars respectively. Aegon is fairly priced on an FCF yield and P/E estimates; however, with the ASR transaction, the company will receive €2.5 billion in cash, which is almost the 25% of its current market capitalization, and will have a 29.9% of combined equity entity. As already mentioned, NN is more discounted and offers a capital appreciation opportunity.

Aegon 2023 guidance

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

:max_bytes(150000):strip_icc()/Health-GettyImages-2148115727-320342eaa3ce4fb6bda09bf3994791ea.jpg)