gorodenkoff/iStock via Getty Images

I first wrote on Adobe (NASDAQ:ADBE) in 2020. I’ve owned the company for quite a while, and I’ve never been disappointed in the company’s direction.

Seeking Alpha

Since I wrote on the company three years ago, the company’s share price got caught up in Software Mania 2021, and has declined through the last year resulting in a relatively flat return. This has given some time for Adobe to continue to grow (what the company does best), and the investment case is even stronger today than it was then.

I realized when sitting down to write this article that I spend a lot of time sifting through the stock market for the next great compounder. Compounders generate tons of cash, invest it at high ROIC’s, and return it to shareholders. The best easily lap the market, and many fly under the radar in boring industries with strong, entrenched moats and pricing power. Adobe doesn’t hit the last mark there as far as boring industries, but the company’s leadership in its space is exemplary.

With the amount of time I spend researching and looking for these next compounders, the question I often ask myself is, why not just buy more Adobe?

The company is a gold-standard in its industry group. Its software is ubiquitous among creators. Photoshop and its add-on offerings is taught in schools, where students graduate and preferentially purchase the product to create at their companies. It’s a flywheel effect, and one that is nearly impossible to disrupt. Disruption is the name of the game in software, but Adobe continues to innovate and make incremental improvements to maintain its perch on top.

Acrobat invented the PDF file format, and won the war for a portable document format (PDF) three decades ago. The product faces competition, but remains the industry leader, and Adobe hasn’t rested on its laurels here either. With the transition to the cloud, Acrobat cross-functionality between all devices, signature capabilities, and combining payments with signed documents are but a few of the company’s add-on capabilities over time.

The strength and pricing power of these products has enabled Adobe to generate significant profitability and cash flows.

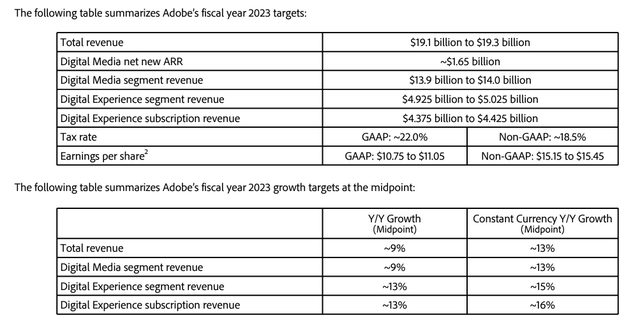

Company 8-K

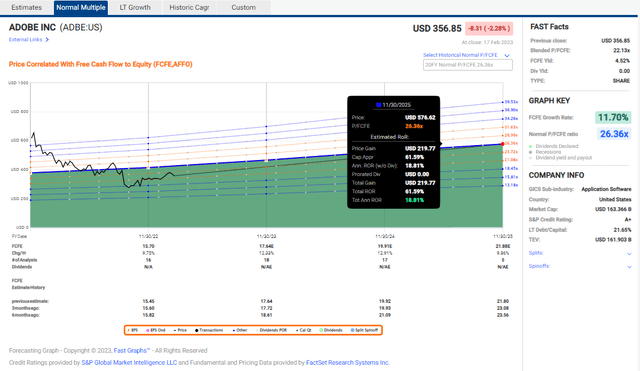

Looking at targets for 2023, management is projecting mid-teen’s revenue growth across the company’s operating segments. Earnings is expected to grow to $15.30 per share non-GAAP at the midpoint from $13.71 in 2022, for 12% growth. At $15.30 per share, the company is trading for around 23X forward earnings.

The strongest revenue growth is projected in Digital Experience, an area likely to provide the strongest growth trajectory for Adobe from here. The company’s greatest strength and moat comes from Digital Media, which contains the likes of Photoshop and Acrobat, but Adobe has consistently acquired over the years to branch out.

The experience cloud contains Adobe’s offerings in marketing, commerce, and analytics. The company recently reported the segment’s first $1B quarter, and some major new customers brought on. Some use cases discussed on the earnings call:

Adobe is differentiated in our ability to power the entire customer experience, from ideation to content creation to personalized delivery to monetization. Chipotle is a great example. They are using Creative Cloud to design content for web and mobile channels and Experience Cloud to highlight new product offerings based on consumer preferences and support a faster, easier and more customized online ordering process. In government, the State of Illinois is using Experience Cloud and Document Cloud to provide simpler and more equitable access to state services for over 12 million residents.

It’s especially inspiring to witness the positive social impact of Adobe technology. The National Center for Missing and Exploited Children has long used Photoshop to create age-progressed photos and uses Experience Cloud to facilitate the recovery of missing children…

[S]everal of our enterprise customers are starting to deploy their own product-led growth using our analytics technology, a banking customer, for example, one of our best customers. They have their online mortgage application, and they want to track who is able to use it successfully, who’s able to complete applications completely online, and they’re using our analytics technology to do that and see what works and what they need to do to fix it. So, we’re starting to see like exactly, as you said, our technology being both used inside Adobe to drive our own PLG as well as customers doing it.

The experience cloud powering cross-functionality for B2B customers is the best-case scenario for cloud software companies like Adobe. The company’s history provides significant credibility among creative professionals, and it’s a natural progression from a product like Photoshop to marketing offerings.

However, there is risk here. Adobe’s core products are the source of its moat, and outside competition faces a nearly impossible task in unseating them. In the experience cloud, Adobe faces real competition, which could impact profitability. Additionally, the company has acquired its way in over the years vice organically creating new offerings. It will be important to monitor relevant operating metrics going forward to ensure Adobe continues to build traction.

Another interesting growth vector for the company lies in Adobe Express. Express is a stripped down, web-based compilation of Adobe’s creative offerings at a lower price point and with a free tier. Management is hoping to build a larger funnel for its products by offering limited functionality for specific tasks, which will indoctrinate customers and eventually convert them to paying subscribers. This could easily cannibalize from the company’s software subscriber base, but the product has been live for a year and there appears to be limited negative impact. Some color from the earnings call:

Our primary focus has been and continues to be right now around usage, repeat usage and utilization. We are seeing, though, while that’s our primary focus, we are seeing a lot of really interesting data coming in suggesting that we — that the upgrade has are — while still early and not our primary focus are working. For example, in many higher ed institutions where we’ve started to deploy Adobe Express, we’re starting to see not just the increase in terms of usage of Express, but we’re also starting to see increase in demand for Adobe Creative Cloud flagship applications. And again, part of this is we know and we believe that everyone should be creative and creativity is the new productivity. But as people start to leverage and benefit from that creativity, they naturally want more power and precision as well. So that they do go well hand in hand.

Lastly, the upcoming Figma acquisition is among the largest the company has ever completed. The purchase price is half-stock, half-cash at $20B, a substantial investment against the company’s ~$160B market cap. Figma has built a web-platform for design collaboration, which Adobe will utilize and empower with its creative tools. The founder will stay on and report to Adobe’s Digital Media head. The acquisition is pending regulatory approvals, and the company hasn’t updated its projections yet to include any revenues from Figma. From the press release:

“Figma has built a phenomenal product design platform on the web,” said David Wadhwani, president of Adobe’s Digital Media business. “We look forward to partnering with their incredible team and vibrant community to accelerate our joint mission to reimagine the future of creativity and productivity.”

“With Adobe’s amazing innovation and expertise, especially in 3D, video, vector, imaging and fonts, we can further reimagine end-to-end product design in the browser, while building new tools and spaces to empower customers to design products faster and more easily,” said Dylan Field, co-founder and CEO, Figma.

Figma has a total addressable market of $16.5 billion by 2025. The company is expected to add approximately $200 million in net new ARR this year, surpassing $400 million in total ARR exiting 2022, with best-in-class net dollar retention of greater than 150 percent. With gross margins of approximately 90 percent and positive operating cash flows, Figma has built an efficient, high-growth business.

With an acquisition this large, the fear will always be integration risk. I have no doubt Adobe will find a use for the Figma product in its lineup, but the potential is there the company overpaid and may not drive meaningful improvement to the bottom-line from the purchase. I’m not in love with large acquisitions like this one, but Adobe has proven over the past decade to be capable of integrating acquisitions in building out its ecosystem.

The value proposition is not always apparent. I anticipate seeing more perspective as the regulatory approvals roll in on management’s plans for product load-out with Figma added in.

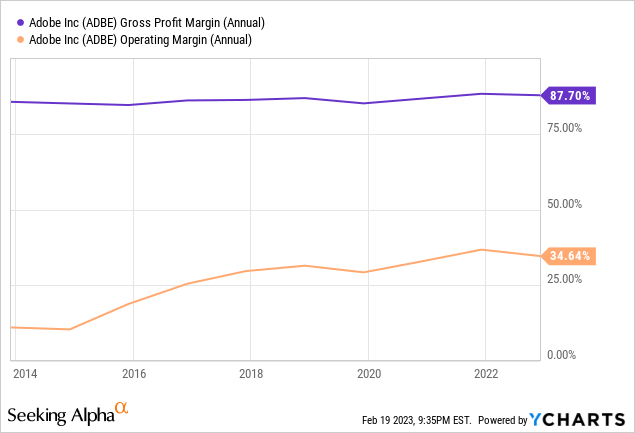

Looking at the company’s margin profile, gross margin is a healthy 87%, which gives the company plenty of room for operating. Operating margins have trended up over time, but I would expect a dip from the upcoming acquisition while the company works on integration.

As far as expenses, Adobe is among the lowest in the industry in its G&A line item. G&A expenses grew 12.4% yoy, under revenue growth, and only account for 7.4% of revenues.

R&D expenses represent 18% of revenues, and grew 17.6% yoy, slightly outpacing revenue growth. Adobe has launched improvements to its product offerings over time, and continues to utilize those improvements to drive revenue and earnings growth. Adobe’s R&D expenses are much lower than most cloud companies.

S&M expenses represented 30% of revenues in 2022, and grew in-line with revenues at 15%. Again, the company’s S&M expenses as a percent of revenues are among the lowest in the industry (Shopify (NYSE:SHOP) is actually slightly lower), which shows the company is running a lean operation as it continues to grow.

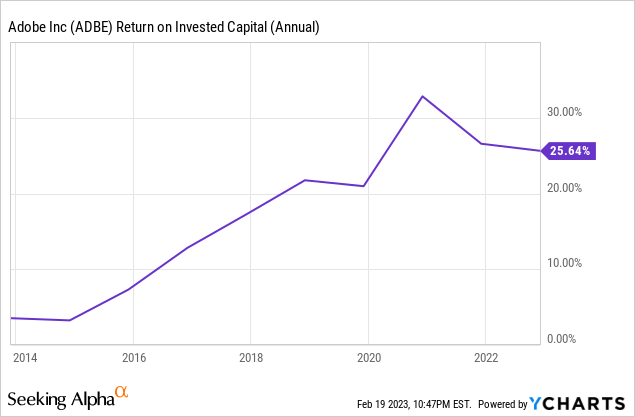

Returns on invested capital have scaled up well, and show a company creating shareholder value as they spend. Adobe has completed several acquisitions over the past decade, and ROIC has continued to improve. No concerns here. This is among the most important metrics to see for a solid compounder.

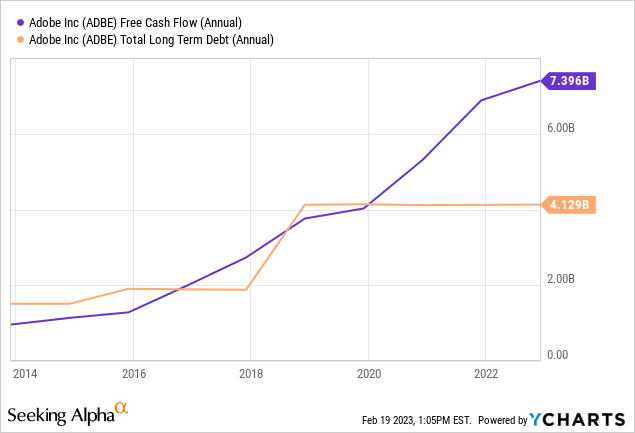

As far as cash generation, Adobe is operating at a 42% FCF margin, leading the way in cloud software. Free cash flow continues to scale, year after year, and Adobe currently holds $6B on its balance sheet against around $4B in debt.

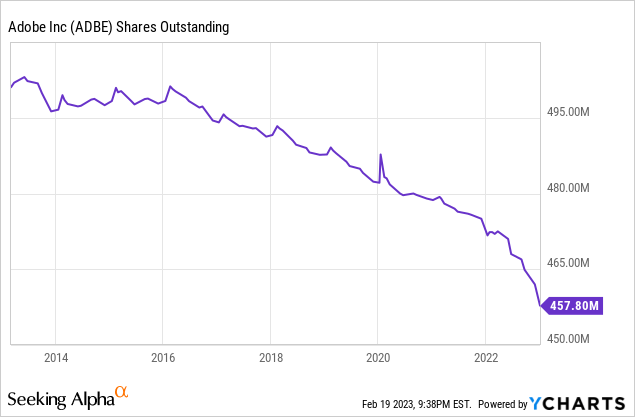

Management is using that cash to cannibalize the float. The company has $6.55B remaining on a prior share repurchase authorization, and recently added another $1.75B share buyback plan. In the most recent quarter, the company repurchased 15.7M of its own shares. Although Adobe doesn’t pay a dividend, we are looking at consistent capital allocation to make the individual shareholder a greater percent owner over time.

This is the dream of every investor when they buy a cloud software stock. This is the end state. Adobe is sitting on a highly cash-generative business with a wide moat protecting the core products. The company has now moved from printing shares like its 1999 to actually returning wads of cash to shareholders.

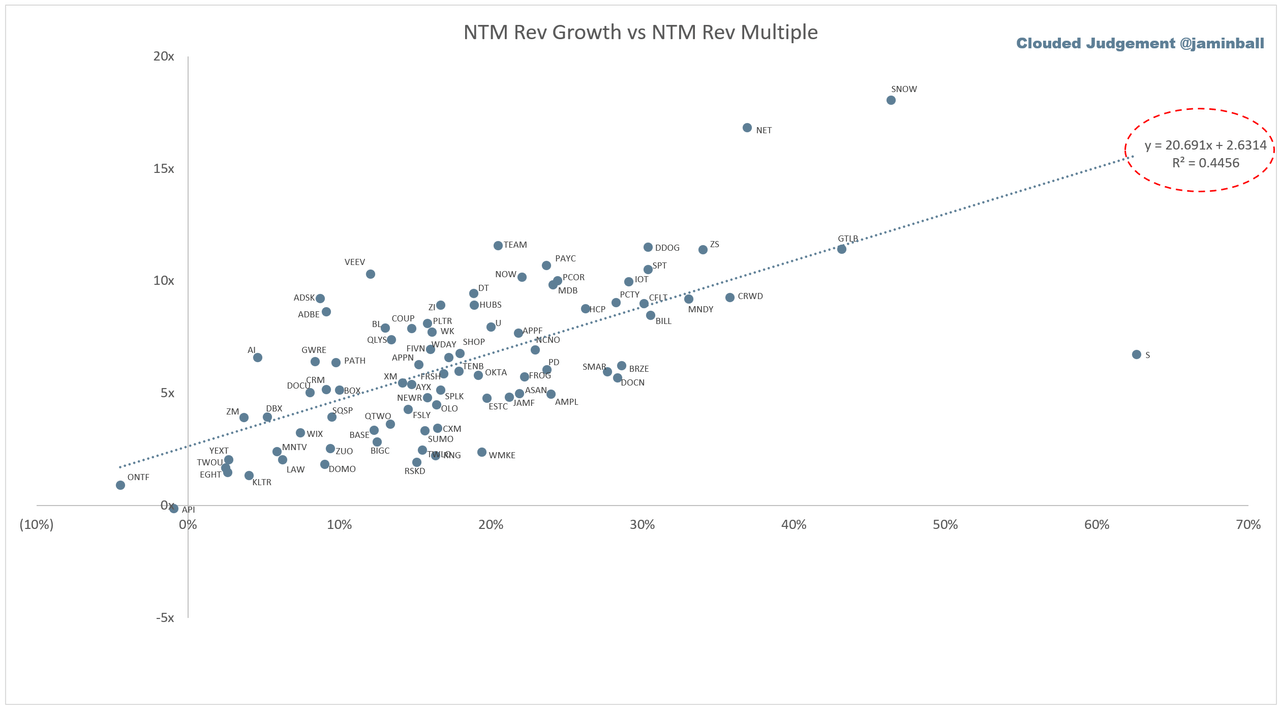

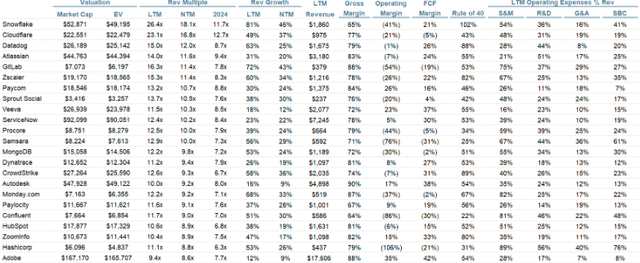

Clouded Judgement Substack

Looking across the cloud landscape, Adobe is expensive on a sales multiple for its growth. That’s not surprising at all. It’s one of the most profitable companies on that graph. The valuation is in-line with Autodesk (NYSE:ADSK), another favorite of mine.

For metrics, Adobe checks the box for Rule of 40 at 54%. Multiples are low compared to high-flyers like Cloudflare (NYSE:NET) and Snowflake (NYSE:SNOW), which are earlier in their growth stories. Stock-based compensation is among the lowest in the industry at 8% of revenues, which is likely stable and part of the company’s normal compensation packages.

This puts things in perspective somewhat. When you seek out a company growing revenues in the 20-50% range in cloud software, you’re going to look to pay SBC well into the teen’s-20% range, potentially double or even triple the sales multiple as Adobe, while profitability is in the distance with negative operating margins and potentially even negative FCF margins. What that gives you is a good product, with strong traction among customers, but no proof management is capable of reining in expenses to actually provide a profit when all is said and done. Companies like Adobe remove that risk, but you’re getting slower growth as part of the bargain.

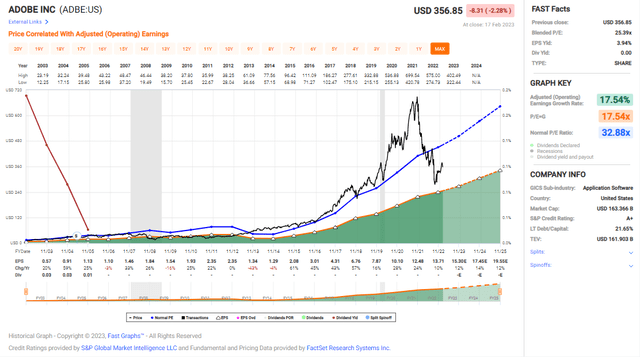

Clouded Judgement Substack FAST Graphs

Moving on to earnings, the run-up in 2021 is pretty remarkable. Notice the earnings inflection point following the transition to SaaS. Adobe has consistently compounded from there.

FAST Graphs

Zooming in to look at the company since that transition, and the earnings growth average shoots up to 28% per year. That puts the valuation in an even better spot, and shows a company growing profitability significantly while still trading at the same level it did in around 2019.

FAST Graphs

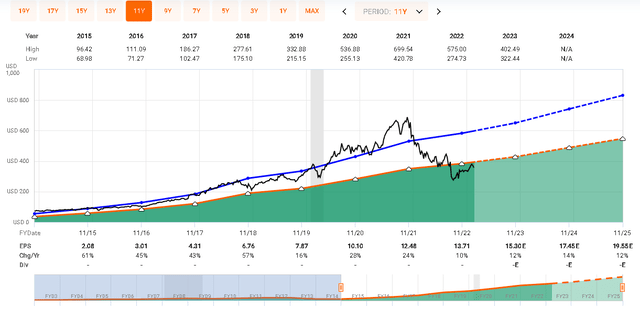

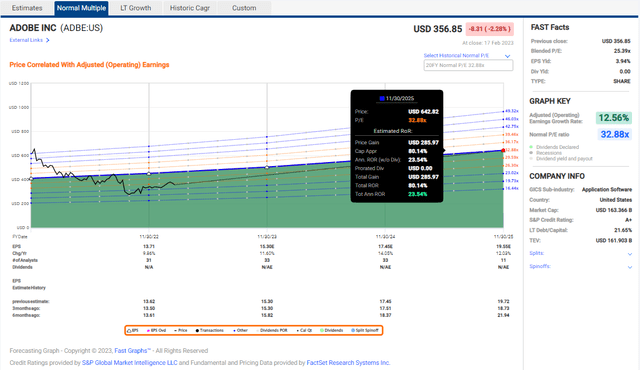

Based on the company’s long-term average valuation and analyst projections for free cash flow growth, an investment today could yield an 18% annualized total return.

FAST Graphs

Looking at the same projections, but this time with earnings, and you’d be looking at a 23.5% annualized total return.

FAST Graphs

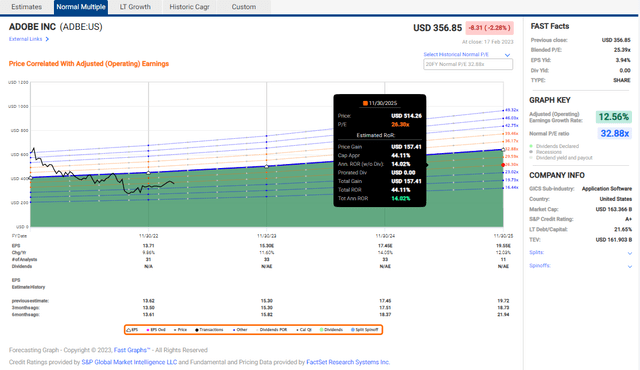

If Adobe stays at the same valuation against earnings, the projection would drop to 15% annualized total returns.

I think Adobe continues to beat the market. There are definitely some aspects that bear watching, and the upcoming Figma acquisition could be a thesis-changing shift for the company.

However, based on past success, and with the same CEO at the helm since 2007 who pulled Adobe through the SaaS transition, I’ll continue to trust in management. The company is highly profitable and continues to drive earnings and revenue growth. ROIC’s are solid, margins are among the best in the industry, and free cash flow is fantastic. As the company cannibalizes its own share float, it should flow through to EPS growing faster than revenues as Adobe maintains best-in-class expense ratios. Adobe is among the best compounders on the market, and is trading at a discount today as it has grown into its valuation while the share price is the same as 2019. Adobe is a strong buy.