MikhailMishchenko/iStock by way of Getty Pictures

Introduction

The Adecco Group (OTCPK:AHEXF) (OTCPK:AHEXY) is without doubt one of the finest recognized HR and recruiting companies on this planet and this asset-light mannequin has traditionally resulted in robust money flows. Adecco has been utilizing these money flows to diversify and the current acquisition of AKKA Applied sciences is without doubt one of the methods Adecco is branching out. In my earlier article which was printed in September, I used to be specializing in the corporate’s free money move which was fairly robust, however the inventory has solely gotten cheaper since.

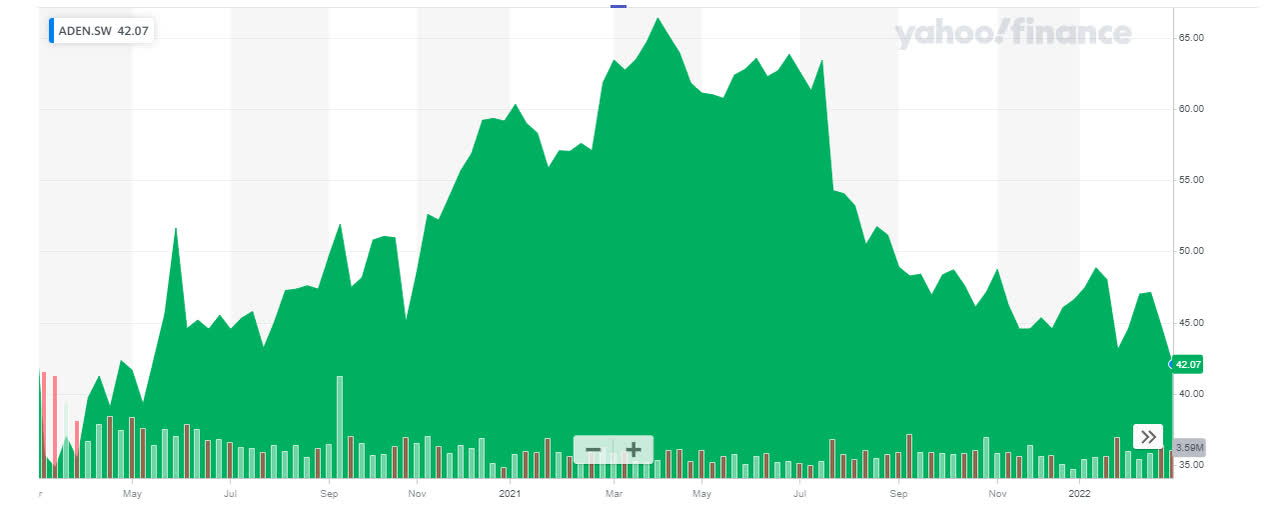

Yahoo Finance

Adecco’s major itemizing is in Switzerland the place the group is buying and selling with ADEN as its ticker image. The common each day quantity of in extra of 600,000 shares confirms its Swiss itemizing clearly provides probably the most liquid buying and selling possibility. Utilizing a share value of roughly 42 CHF and the present share rely of roughly 168M shares (this already contains the shares issued within the current capital increase to assist fund the brand new acquisition in addition to the just about 2M shares issued as a part of the consideration) the market capitalization is roughly 6.9B CHF (which is about 1.1B CHF decrease than once I final mentioned this firm). Though the shares are buying and selling in Swiss Francs [CHF], Adecco reviews its monetary ends in EUR.

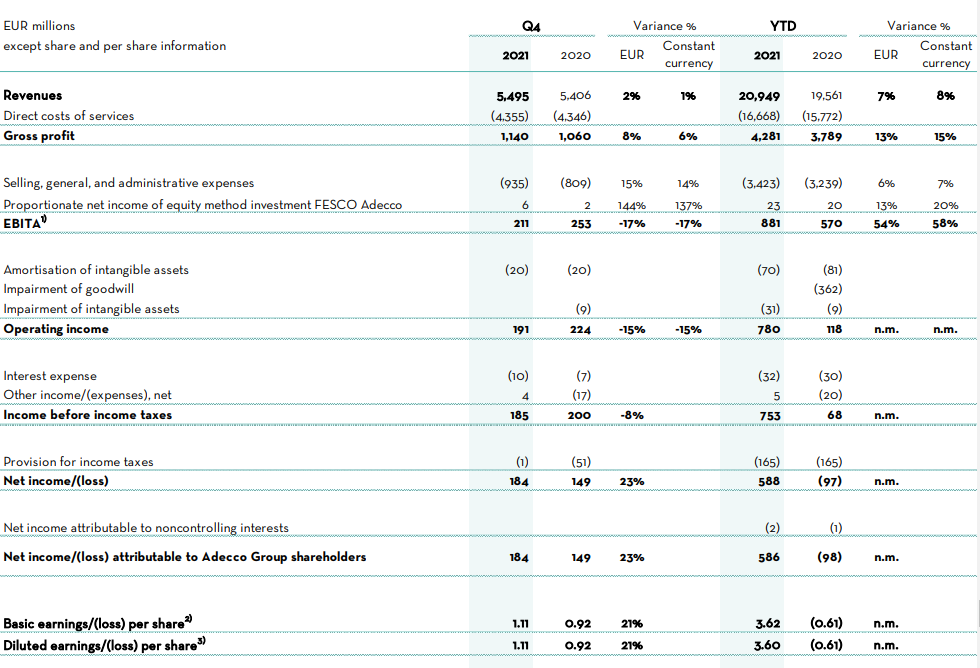

The 2021 outcomes had been very satisfying leading to a 6% yield

I feel we could be fairly proud of Adecco’s outcomes though there was some margin stress within the ultimate quarter of the yr. Though the gross revenue elevated by about 8% in This fall, the EBITA decreased by roughly 17% resulting from a 15% improve in SG&A bills. That was barely disappointing and the one purpose why the underside line confirmed a internet revenue and EPS greater than in This fall 2020 was due to the very low tax invoice. As such, the 1.11 EUR EPS in This fall is not precisely a “normalized” end result because it included the popularity of deferred tax belongings.

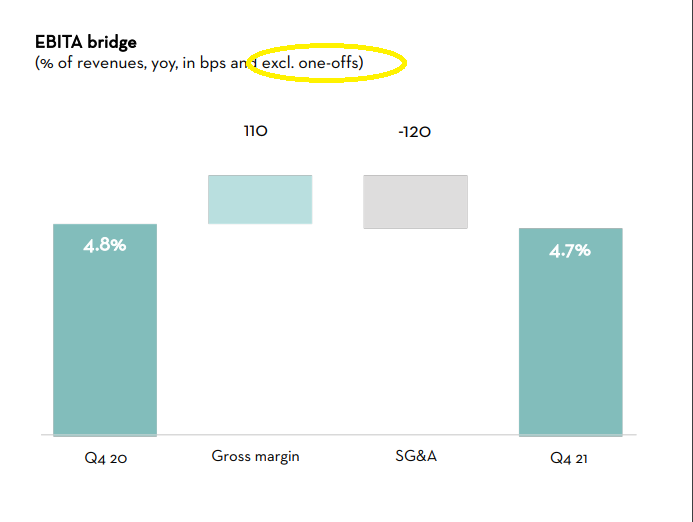

Adecco Investor Relations

On a full-year foundation, the corporate noticed its gross revenue improve by 13% and its EBITA jumped by 54% to three.42B EUR. We should not be too alarmed but by the SG&A bills as there must be some non-recurring bills associated to the acquisition of AKKA Applied sciences. This seems to be confirmed within the company presentation the place the EBITA margin excluding one-offs was confirmed at 4.7%. Given the income of just about 5.5B EUR in This fall, the EBITA excluding the non-recurring parts would have been virtually 260M EUR. This certainly confirms the EBITA end result was underneath stress from some non-recurring parts though there for positive had been “regular” value will increase as nicely and it is going to be fascinating to see how the corporate will deal with this in 2022.

Adecco Investor Relations

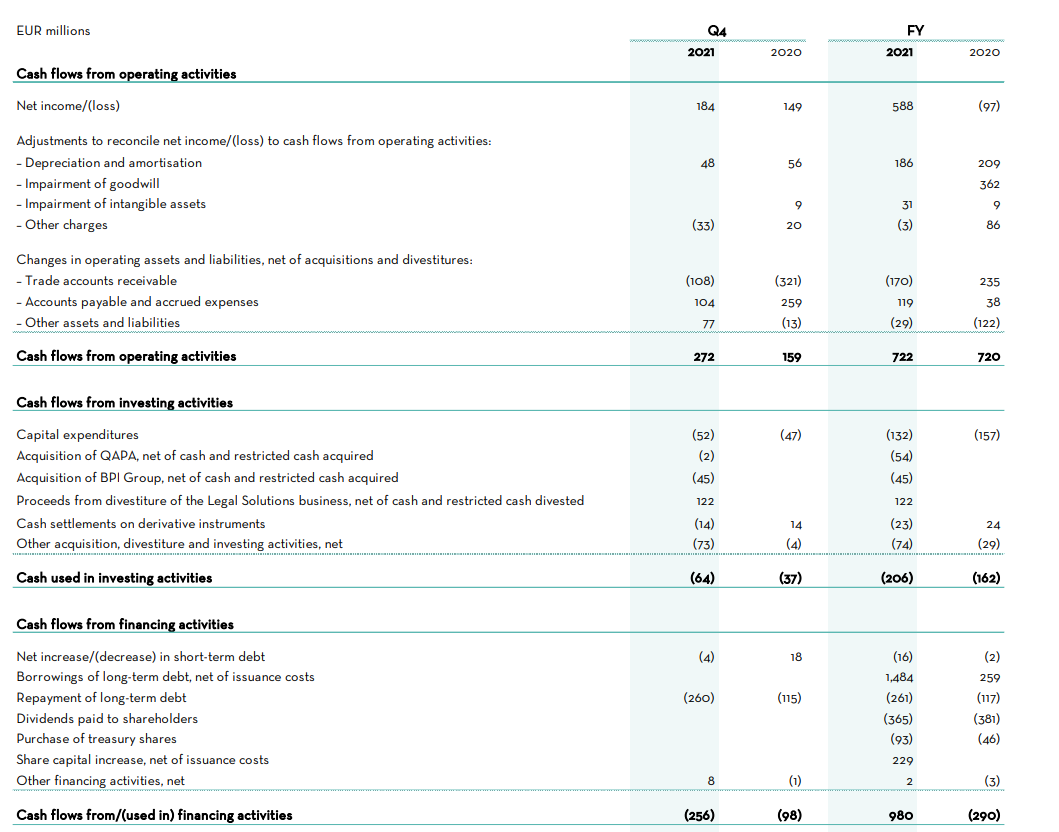

Within the unique article, my principal focus was on Adecco’s free money move efficiency. As operating an HR and recruiting agency is capital-light, I anticipate the corporate to publish sturdy money move outcomes.

In FY 2021, the full reported working money move was 722M EUR however this included an 80M EUR funding within the working capital place (primarily associated to accounts receivable). With a complete capex of simply 132M EUR, the free money move end result was 670M EUR. Divided over 168M shares this represents 3.99 EUR per share or 4.08 CHF per share utilizing the present EUR/CHF change charge of 1.023.

Adecco Investor Relations

Adecco has determined to declare a dividend of two.50 CHF per share. This dividend can be break up into two equal tranches of 1.25 CHF per share of which one tranche can be a “regular” dividend (topic to the 35% Swiss Dividend Withholding tax charge), the second tranche can be paid out of free reserves and will not be taxable in Switzerland).

The free money move will assist fund the AKKA acquisition

Adecco has clearly been underperforming its peer (principal competitor Randstad as an example is buying and selling roughly on the identical degree it was buying and selling at a yr in the past whereas Adecco’s share value is now roughly 30% decrease than the place it was buying and selling at in early March 2021.

I do assume the market is a bit upset with Adecco’s resolution to amass Akka Applied sciences in a proposal valuing the corporate at 2B EUR on an enterprise worth foundation. The overwhelming majority of the shares are being acquired for money (at 49 EUR per share) however a few of the largest shareholders of Akka will obtain a small consideration payable in Adecco shares.

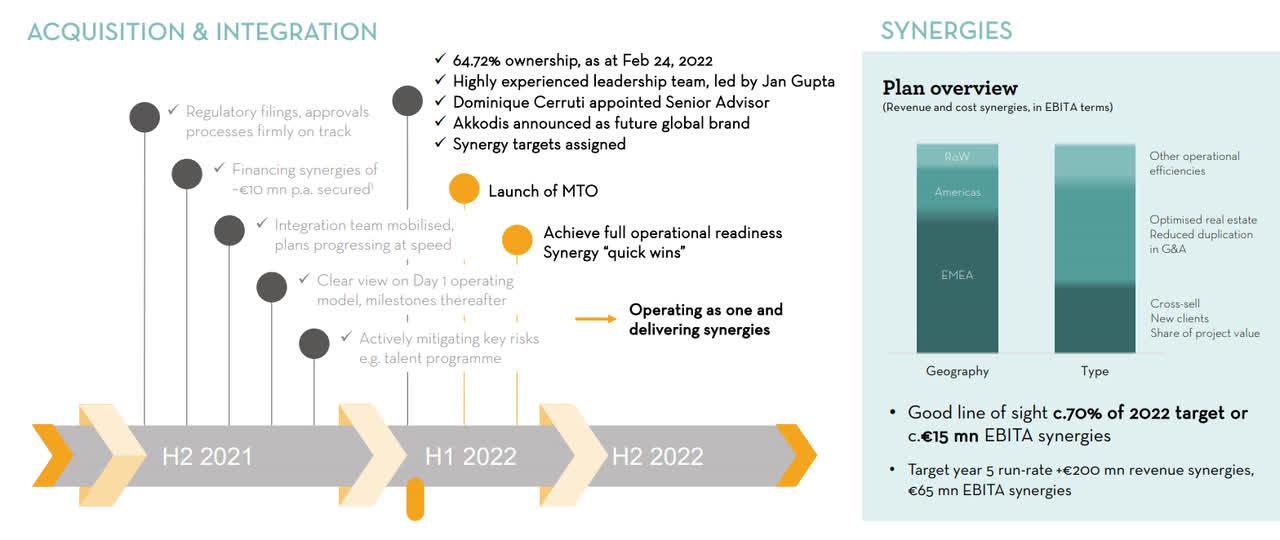

The preliminary step, buying a majority stake in AKKA, was accomplished final week as Adecco now owns just below 65% of the shares. This implies the obligatory takeover provide for the remaining securities (at 49.00 EUR in money) has now said, and Adecco expects this course of to be accomplished by the top of the present semester.

Whereas a 2B EUR price ticket seems to be fairly excessive remember AKKA is acquired at just below 11 occasions the anticipated EBITDA whereas Adecco anticipates to generate synergy advantages each on the income degree in addition to on the fee degree.

Adecco Investor Relations

For 2022, the EBITA synergies are anticipated to be 15M EUR whereas this could improve to 65M EUR inside the subsequent few years. After all these are simply ‘the plans’ and Adecco’s administration nonetheless has to ship on these plans.

Funding thesis

2021 was an excellent yr for Adecco and though I wasn’t fairly positive what to consider the corporate’s This fall end result resulting from a low tax invoice, the non-recurring bills would probably have mitigated the impression. Price inflation will certainly be one thing to maintain a watch out for, however Adecco is now virtually buying and selling at a free money move yield of 10%. That is primarily attributable to the acquisition of AKKA and I’ve the impression the Adecco administration must show to its shareholder base the acquisition certainly is wise.

I haven’t got an extended place in Adecco but however the present share value could be very inviting, each from a fundamentals standpoint in addition to from an earnings standpoint.