[ad_1]

gorodenkoff/iStock by way of Getty Photos

Thesis

AbCellera Biologics (NASDAQ:ABCL) is an undervalued and worthwhile small-cap drug discovery inventory, that buyers ought to have of their portfolio for a few years to return. There are lots of causes an investor ought to believe in long-term good points in terms of proudly owning AbCellera inventory. On this article we’ll undergo why I consider this inventory can have outsized good points, together with what dangers the inventory could have. After that lets study AbCellera’s valuation in opposition to the competitors, and what metrics to concentrate to shifting ahead.

Once I put money into know-how firms, I search for founder led CEO firms, the place workers need to work at. These firms even have excessive gross margins, income progress, platform enterprise fashions, sturdy steadiness sheets, and in my perspective make the world a greater place to dwell in. AbCellera checks virtually all of those containers and I’ll elaborate on these factors afterward.

Founder-Led CEO Firm

AbCellera as talked about earlier is a founder led CEO firm and it was based in 2012 as a spin-off from the College of British Columbia. The PhD and CEO Carl Hansen and his workforce pioneered a know-how platform that integrates microfluidics, next-generation DNA sequencing, machine studying, and synthetic intelligence to uncover molecules which are naturally produced by the immune system. These molecules which are naturally produced by the immune system are often called antibodies, and they are often changed into efficient therapeutics for quite a few ailments.

So why does it matter that this firm has a founder led CEO?

Previously few many years Founder led CEO firms have considerably outperformed for shareholders than these that aren’t founder led. Founders deal with their firms as in the event that they had been their very own youngsters and the success the founder needs for the corporate aligns a lot with shareholder expectations. In my view Founder CEO will be visionaries and are driving in the direction of outcomes for the long-term and their worker retention is less complicated as workers need to be part of that long run imaginative and prescient.

AbCellera Staff Get pleasure from Working There and Would Refer a Buddy

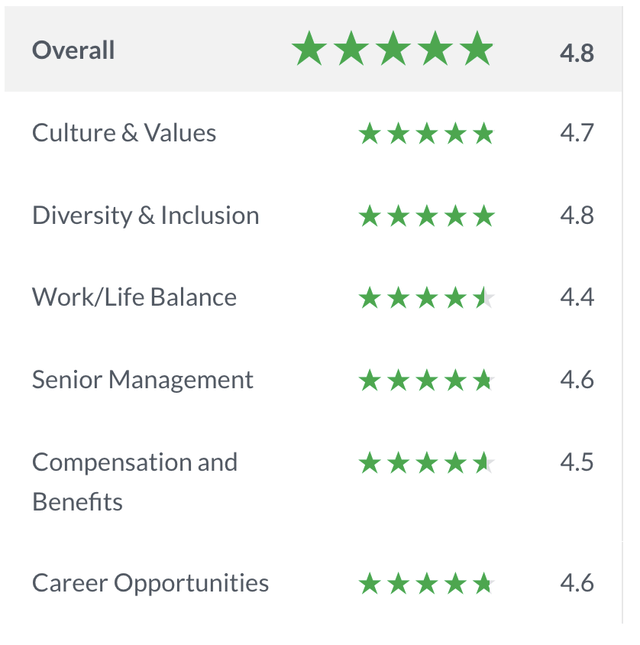

This firm seems to have an amazing firm tradition and workers price their expertise working there general 4.8 out of 5 stars. Over 92% of the workers interviewed by Glass Door would advocate working at AbCellera to a pal. See the person scores beneath, which lead me to the touch upon the nice firm tradition.

Glass Door Scores for AbCellera Biologics

Insider Possession is Excessive and CEO Continues to Purchase Particular person Shares

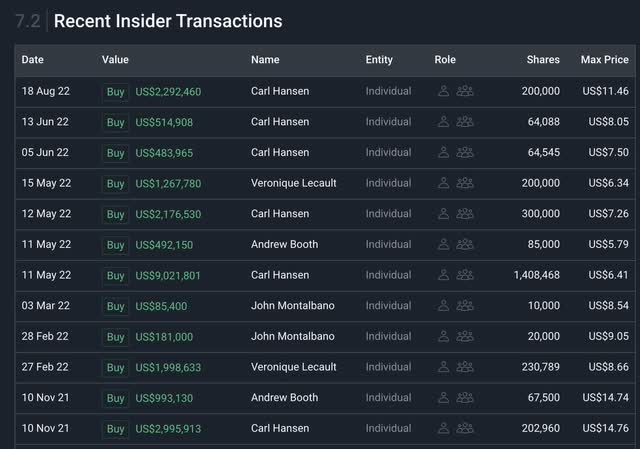

When an organization has excessive insider possession of shares this will point out worker and management confidence within the inventory and the corporate’s future progress prospects. This additionally drives alignment with workers and shareholders as a result of there’s a widespread purpose for firm success. CEO Carl Hansen has been making a number of inventory purchases since Could 2022, totaling over $14.3M. This brings his possession to 19.6% and the whole insider possession of shares to 27.4%! Management and different workers are shopping for shares with conviction on the businesses’ future potential.

NasdaqGS: ABCL Current Insider Transactions by Firms or People

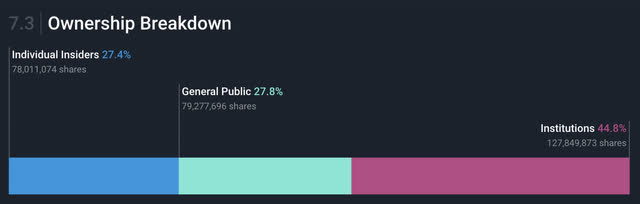

AbCellera Has a Sturdy Institutional Backing and Share of Shareholders

The insider possession is robust for this small cap firm however even stronger with establishments holding almost 45% of shares. Establishments embrace the likes of BlackRock Inc., Baillie Gifford & Co, Allianz Asset Administration AG, and Capital Analysis & Administration Firm. Institutional funding companies not often put money into small cap shares as a result of potential volatility of shares and threat they might acquire. If you see such a robust variety of establishments invested in a small cap inventory like AbCellera, this may be an indicator the inventory has big upside and is well worth the threat to carry for them.

Monetary Knowledge Offered by Customary & Poor’s Capital IQ

Flawless Steadiness Sheet with A number of Income Streams

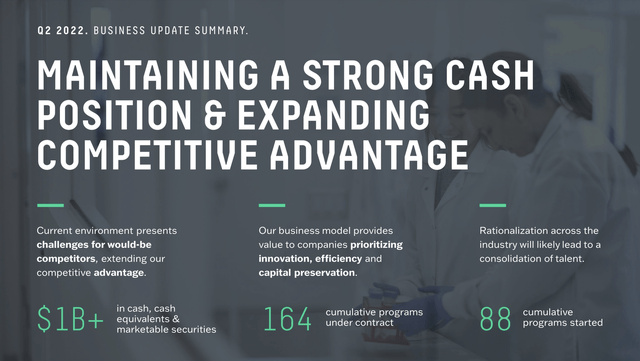

AbCellera Biologics has over $1 billion in money and money equivalents with no debt! This firm is a know-how firm that focuses from the antibody goal part all through to the Investigational New Drug Software part, and to ship quicker extra strong outcomes. AbCellera makes cash a number of methods by analysis charges, licensing, milestone funds, non-obligatory funding shares, and the biggest quantity by royalties from profitable medication to market. The patented know-how software program and processes that they use are extraordinarily environment friendly in working bills, permitting an extended runway earlier than needing any capital. These efficiencies have helped AbCellera preserve almost 74% of gross margins and 39.5% internet revenue margins.

Already AbCellera has continued to construct a various and enormous portfolio of various companions to work with and a number of kinds of healthcare sicknesses to deal with. This quick quantity of buy-in that AbCellera has gained from well-known drug firms, enterprise capitalists, and establishments present the corporate quite a lot of long-term flexibility.

Screenshot from Q2 Earnings Presentation

AbCellera Is Making the World a Higher Place and Amassing Royalties for It

AbCellera spent two years focusing their know-how round potential pandemic responses after which was in a position to companion with Eli Lilly (LLY) for creating the primary antibody Bamlanivimab approved by the FDA for COVID-19 in 2020. AbCellera than labored with them to create bebtelovimab, probably the most potent antibody remedy that’s efficient for COVID-19 for all variants nonetheless to this date. These two antibody medication have saved lives and have handled over 2.5M sufferers.

In June, AbCellera continued to obtain royalties for an additional 150,000 dose order from Eli Lilly to the U.S. Authorities for continued remedy to COVID-19. Throughout the winter, the corporate might see further orders procured by Eli-Lilly which might proceed to supply extra internet income so as to add to their basis of money and belongings for the long run.

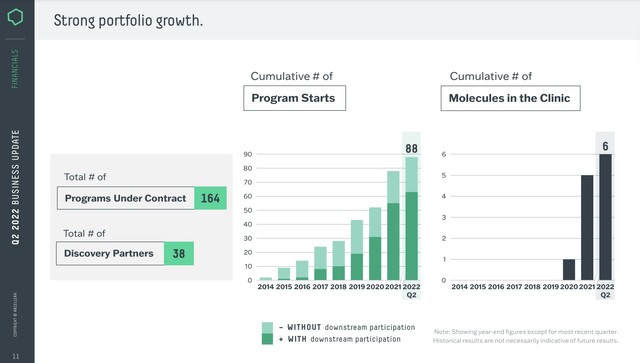

Continued Development in Companions and Applications Below Contract

This firm has one other 4 molecules in scientific phases with companions NovaRock Biotherapeutics, Invetx, inc., and different undisclosed companion. The patented applied sciences and processes that AbCellera has are enhancing the chances for antibody drug discovery and are driving extra discovery partnerships. The rising variety of partnerships and applications below contract are the 2 metrics I might advocate listening to for measuring the success of AbCellera within the brief time period. Within the picture beneath, you’ll be able to see the regular ramp up in each metrics, which result in the upper likelihood of extra antibody medication being found and brought to market.

Q2 FY23 AbCellera Biologics Earnings Presentation

Dangers To Be Conscious Of

The drug discovery enterprise takes a very long time to take a drug to market and buyers have to take care of endurance all through this course of. AbCellera was in a position to get their two COVID-19 antibody medication FDA authorized rapidly as a result of nature of the sources they’d & the severity of the pandemic. The drug discovery course of and getting the drug to market takes 10-15 years on common with a 90% failure price, and prices $1-2 billion {dollars}. AbCellera exists to unravel these challenges, velocity up the invention course of, enhance success charges, and assist create medication for probably the most tough ailments.

That is an space of healthcare that’s naturally dangerous with low success charges, excessive capital bills, and lengthy timelines. Moreover the character of the trade AbCellera operates in, are there another dangers for this firm? The corporate might see decelerating revenues if the 2 Eli Lilly COVID-19 antibody medication cease getting ordered by the federal government. Whereas revenues might decline within the close to future if this occurs, the general working bills are very low in comparison with their $1B fortress of money. Final quarter the corporate solely spent $34.7M in working bills, as this demonstrates enterprise effectivity, it additionally showcases an extended runway AbCellera has earlier than its subsequent profitable anti-body drug must be found to assist enterprise operations.

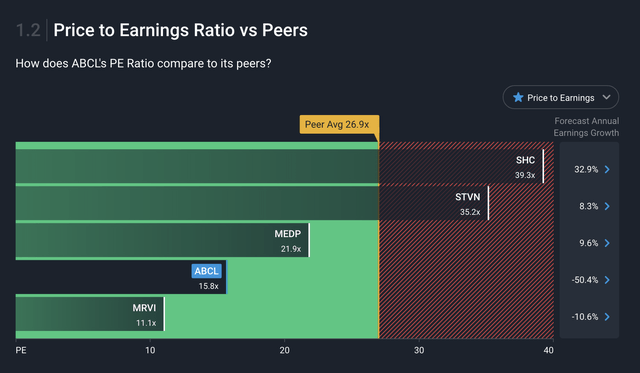

AbCellera is Undervalued Amongst Its Friends

We’re at the moment investing in a inventory market that could be very risky and is penalizing firms who are usually not worthwhile or overvalued. Abcellera Biologics is neither of these items and really undervalued amongst different peer U.S. Life Science firms (see beneath).

P/E Comparability to Peer Firms (Merely Wall St.)

Abcellera generated over $500M in income within the final trailing twelve months whereas having a market cap of $3B, giving the inventory a price-to-sales ratio of 6.

This firm is basically undervalued in comparison with its friends in its trade but additionally its 15.8 P/E ratio is way decrease than the S&P 500 which is at the moment buying and selling at a P/E ratio of twenty-two.8.

My Conclusion and What to Search for Later this 12 months

AbCellera like all firm has threat with investing in it, significantly within the short-term, however as a long-term funding I consider the danger is mitigated closely. I consider this threat is mitigated by the clear and robust steadiness sheet the corporate holds, the low OPEX enterprise mannequin it operates below, the expansion in partnerships, and the patented and confirmed know-how that this firm has to find molecule combos for future antibody medication.

I additionally like this funding as a safer play for the life sciences and healthcare sector that gives buyers diversification of their portfolio, with massive upside in the long run. I consider that is simply one of many many explanation why this firm has such massive funding from its workers and establishments, together with their continued progress in partnerships and contract applications.

I’m on the lookout for AbCellera to proceed constructing momentum on extra drug contracts, companions, which ought to outcome to progress in analysis charges within the close to time period. Simply on this previous quarter AbCellera signed two new partnerships with two enterprise capitalist companies resulting in a possible 14 new applications to begin. Due to the expansion in partnerships beforehand the corporate skilled 240% progress in income for analysis charges this previous Q2 FY23′. These revenues can proceed to gas and assist expansive spending in analysis and improvement, which is what you need to see in a know-how firm constructing a aggressive moat of their trade.

As at all times, I prefer to greenback value common to decrease my cost-basis and maintain my positions on common for at the very least 5 to 10 years. It seems establishments, enterprise capitalists, and insiders on the firm are additionally doubling down on this funding too. AbCellera Biologics is one which I stay up for holding for a very long time and would require endurance earlier than the true exponential returns might doubtlessly be seen.

[ad_2]

Source link