Gold has been used as a retailer of worth for 1000’s of years, serving as a common medium of alternate and a hedge in opposition to financial uncertainty. Not like paper foreign money or shares, gold has intrinsic price that doesn’t rely on the efficiency of an organization or authorities. In accordance with the U.S. Division of the Treasury, gold performs a big position in sustaining financial stability, making it a precious hedge for traders. For novices, gold presents a technique to protect wealth throughout inflationary intervals, financial downturns, and market turbulence.

Gold additionally acts as a diversification instrument in an funding portfolio. When different asset lessons decline in worth, gold usually maintains and even will increase its price. This inverse correlation might help stabilize total portfolio efficiency, lowering the affect of market volatility. Whereas gold costs can expertise short-term fluctuations, historical past reveals that gold persistently holds its worth over many years.

The Completely different Methods You Can Spend money on Gold

There’s a couple of manner so as to add gold to your portfolio. Every choice comes with distinctive benefits and potential drawbacks, so understanding them will assist you choose the strategy that aligns along with your monetary targets.

Bodily Gold – Cash, Bullion, and Bars

Proudly owning bodily gold means you maintain tangible property within the type of cash, bullion, or bars. This methodology gives a way of safety as a result of you’ve gotten direct management over your funding. Nevertheless, it additionally comes with duties, similar to arranging safe storage. Buyers usually select financial institution security deposit bins, insured vaults, or high-quality dwelling safes. Bodily gold additionally requires cautious consideration to authenticity, which is why shopping for from respected sellers is essential.

Gold ETFs and Mutual Funds

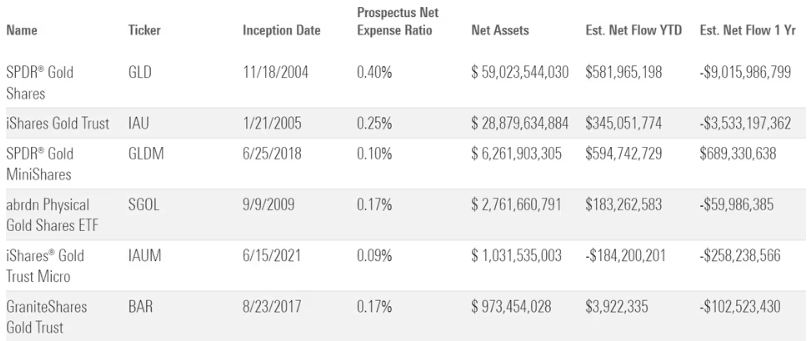

Gold ETFs and mutual funds enable traders to realize publicity to gold with out bodily storing it. ETFs are traded on inventory exchanges, making them simple to purchase and promote. Mutual funds may be actively managed, which could attraction to traders looking for skilled oversight. These automobiles typically have decrease transaction prices and are extra liquid than bodily gold, making them interesting to novices.

Gold Mining Shares

Gold mining shares provide oblique publicity to gold costs by investing in firms that mine and course of gold. These shares can ship increased returns if gold costs rise considerably, however additionally they carry dangers tied to the mining business, together with operational prices, regulatory challenges, and geopolitical instability. Mining shares may be extra unstable than bodily gold or ETFs.

Digital Gold and Gold-Backed Tokens

Digital gold and gold-backed tokens are rising funding automobiles that mix know-how with tangible worth. These merchandise signify possession of particular portions of gold saved in safe vaults. Buyers should buy and promote them on-line, usually in smaller increments than conventional gold purchases. Whereas handy, these choices require due diligence to make sure the supplier is reliable and clear.

Present Promotion: get your Free Gold IRA Information Right this moment!

Investing in Gold Jewellery

Gold jewellery may be each a trend accent and a type of gold funding. The gold content material and craftsmanship affect its worth, and a few items can respect over time. Whereas jewellery usually has a better normal value resulting from design and labor, it may well nonetheless function a conveyable and precious asset that holds intrinsic price.

Understanding Gold Futures and Choices

Gold futures contracts and gold choices enable traders to agree on a selected value of gold for a future date. These monetary devices are usually utilized by subtle traders to invest on value actions or hedge in opposition to market circumstances. Buying and selling futures and choices entails better volatility and threat, so a transparent funding horizon and a robust understanding of the gold market are important.

The Function of Gold Bullion in a Portfolio

Gold bullion, together with bars and cash, represents funding grade gold that many traders view as a dependable different asset. Bullion may be purchased or bought by main retailers and respected sellers. Its worth is intently tied to gold spot costs, and proudly owning gold bullion gives bodily possession of a tangible and precious asset that may defend buying energy in unsure instances.

Exploring Gold-Backed Belongings and ETFs

Gold-backed property, together with gold-backed ETFs and gold-backed securities, give traders publicity to precise gold with out direct possession. These automobiles are sometimes thought-about a precious asset class for these trying to diversify within the inventory market whereas lowering the necessity for bodily storage. Many traders select them as an funding choice as a result of they supply entry to gold holdings in a liquid, tradable type.

Some funds make investments solely in gold, whereas others embrace different treasured metals to broaden diversification. The World Gold Council notes that gold maintains a novel position as each a secure haven and a development asset in unsure instances, making gold alternate traded funds a strategic alternative for each novices and skilled traders.

Promoting Gold and Working With Sellers

When it comes time to promote gold, understanding the gold market and your choices is important. Working with respected gold sellers ensures that you just obtain a good market worth on your gold product, whether or not it’s gold bars, gold jewellery, or different bodily gold property. Buyers who maintain gold usually evaluate presents from a number of sellers to safe the most effective value for a certain quantity of gold.

Some might select to promote gold to fund different property or rebalance their portfolio. A monetary advisor might help you identify one of the best ways to promote based mostly on present market circumstances, rates of interest, and your long-term funding horizon. Whether or not you’re promoting for the primary time or managing giant quantities of gold holdings, having a transparent technique can maximize returns and defend your wealth.

Methods to Get Began With Gold Investing

Getting began with gold investing entails greater than merely making a purchase order. It requires a transparent understanding of your goals, finances, and most well-liked funding methodology.

Decide Your Funding Objectives

Your targets will dictate the kind of gold funding that most closely fits your wants. Some traders use gold as a hedge in opposition to inflation, others as a retailer of worth for wealth preservation, and nonetheless others as a part of a diversified development technique.

Resolve on Allocation Share

Many monetary planners advocate allocating 5% to 10% of a portfolio to gold. The precise allocation relies on your threat tolerance, time horizon, and different property in your portfolio. Conservative traders might want a smaller proportion, whereas these looking for better safety from volatility would possibly go for extra.

Purchase From a Trusted Supply

Working with a good vendor or monetary establishment is important. Search for sellers who present authentication certificates, clear pricing, and a robust fame within the business. Regulatory our bodies and business associations also can assist confirm legitimacy.

Present Promotion: $15,000 in Free Silver on Certified Purchases

Perceive Pricing and Premiums

The spot value is the bottom market value for gold, however patrons often pay extra resulting from vendor premiums, which cowl minting, distribution, and vendor revenue. Evaluating costs from a number of sources will assist make sure you get the most effective deal doable.

Errors to Keep away from When Investing in Gold

Buyers usually make avoidable errors that may affect returns. One widespread pitfall is overpaying for gold resulting from extreme premiums or buying from unreliable sources. One other is neglecting storage safety, which may put property in danger. Liquidity must also be a consideration, as sure gold varieties are tougher to promote rapidly. Lastly, investing solely in gold with out balancing it with different asset lessons can cut back long-term development potential.

Highlight on Hamilton Gold Group

Hamilton Gold Group is a well known identify within the treasured metals business, specializing in serving to traders buy and retailer gold securely. They provide providers similar to bodily gold purchases, gold IRA rollovers, and insured storage choices. For novices, their client-focused strategy, clear pricing, and academic assets could make the method of shopping for gold simple and stress-free. Working with a trusted supplier like Hamilton Gold Group can provide new traders confidence as they start their journey into gold investing.

Present Promotion: Unconditional Purchase Again Assure

Ideas for Lengthy-Time period Success in Gold Investing

Success with gold investing comes from persistence, self-discipline, and a diversified strategy. Monitor market developments and modify your allocation as wanted. Preserve storage safe and insured. Mix gold with a mixture of shares, bonds, and different property to scale back threat whereas sustaining development potential. Reviewing your portfolio commonly ensures your gold investments stay aligned along with your monetary targets.

Conclusion

Gold stays some of the enduring and trusted types of funding on this planet. For novices, it presents stability, portfolio diversification, and safety in opposition to inflation and market instability. By understanding the other ways to speculate, taking steps to keep away from widespread errors, and dealing with respected sources, you’ll be able to construct a gold funding technique that aligns along with your long-term monetary targets. Whether or not you select bodily gold, ETFs, mining shares, or digital choices, a disciplined and knowledgeable strategy will make it easier to profit from your funding.

Inquisitive about how Gold and Silver investing evaluate? Take a look at our new information: Methods to put money into Gold and Silver!

FAQs

Most monetary consultants counsel between 5% and 10% of your portfolio, relying in your targets and threat tolerance.

Gold usually maintains or beneficial properties worth throughout recessions, making it a typical safe-haven asset.

Bodily gold presents tangible possession, whereas ETFs present comfort and liquidity. Your alternative relies on private preferences and storage capabilities.

Take into account safe dwelling safes, financial institution security deposit bins, or insured third-party vaults.

Sure, sure self-directed IRAs enable bodily gold investments in the event that they meet IRS laws.

High U.S. Brokers of 2025

★ ★ ★ ★ ★

Options:

✅ U.S. shares, ETFs, choices, and cryptos

✅ Now 23 million customers

✅ Money mgt account and bank card

Signal-up Bonus:

Free inventory as much as $200 with new account, plus as much as $1,500 extra in free inventory from referrals

Study extra

★ ★ ★ ★ ★

Options:

✅ Free Stage 2 Nasdaq quotes

✅ Entry to U.S. and Hong Kong markets

✅ Academic instruments

Signal-up Bonus:

Deposit $100, get $20 in NVDA inventory; Deposit $2,000, get $50 in NVDA inventory; Deposit $10,000, get $300 in NVDA inventory; Deposit $50,000, get $1,000 in NVDA inventory

Study extra

★ ★ ★ ★ ☆

Options:

✅ Entry 150+ world inventory exchanges

✅ IBKR Lite & Professional tiers for all

✅ SmartRouting™ and deep analytics

Signal-up Bonus:

Refer a Good friend and Get $200

Study extra