designer491/iStock by way of Getty Photographs

Funding Thesis

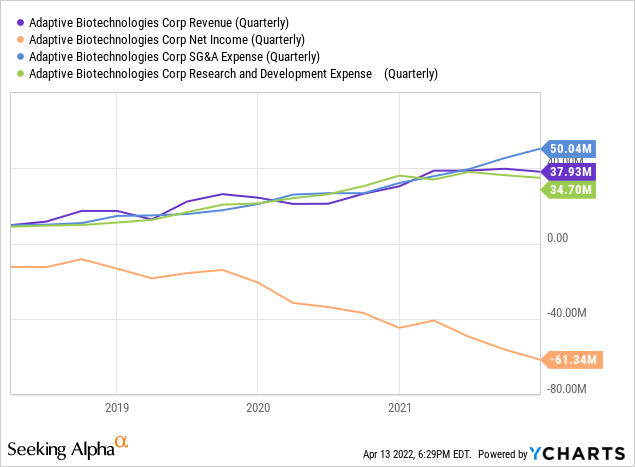

Adaptive Biotechnologies Corp. (NASDAQ:ADPT) inventory is down over 72% within the earlier 52-weeks and 58.5% YTD. Since its inception, the corporate has been a loss-maker. Nonetheless, the revenues have been rising at a wholesome tempo, beating 7 out of 8 quarterly income targets within the earlier 2 years, with 56.88% YoY development to $154.3 million in 2021 and ahead income development of 37.54%.

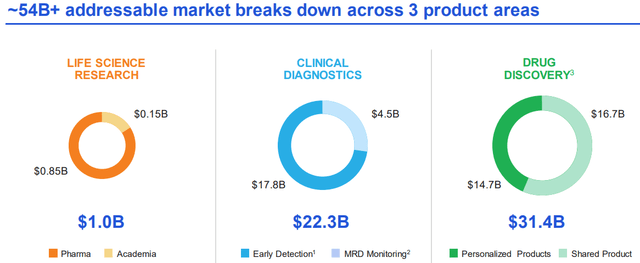

Adaptive biotech boasts a proprietary know-how that might grant it a robust aggressive edge amongst diagnostic shares and is seeking to handle an over $54 billion market between its merchandise. The corporate’s medical diagnostic product, clonoSEQ, is the primary FDA licensed take a look at to detect minimal ranges of remaining most cancers cells in sufferers with acute lymphoblastic leukemia (ALL), power lymphocytic leukemia (CLL), or a number of myeloma (MM). Whereas its immunoSEQ take a look at, a pure analysis software, at present assists over 175 biopharma companions, over 2,400 researchers, and over 650 medical trials.

The corporate’s distinctive tech benefit and in-place agreements fueling its development prospects make me bullish on ADPT inventory.

Firm Overview

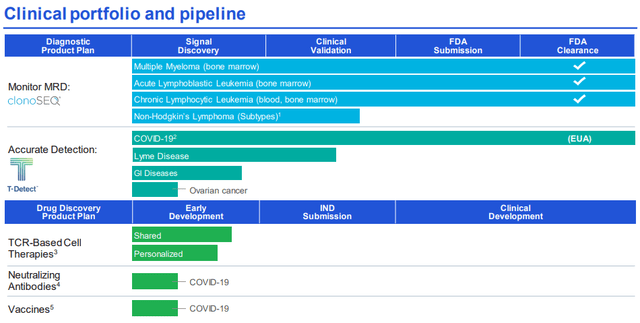

Adaptive Biotechnologies’ present portfolio consists of industrial services in medical diagnostics and life sciences analysis, with services beneath improvement in medical diagnostics and drug discovery.

Its immune medication platform applies its proprietary applied sciences to learn the various genetic code of a affected person’s immune system and goals to know exactly how the immune system detects and treats illness in that affected person.

The corporate’s dynamic medical immunomics database captures these insights, underpinned by computational biology and machine studying, and makes use of these insights to develop and commercialize medical services tailor-made to particular person sufferers.

It has three industrial services and a strong pipeline of medical services designed to diagnose, monitor, and allow the remedy of most cancers, autoimmune problems, and infectious illnesses.

- ADPT’s core immunosequencing product, immunoSEQ, serves because the foundational R&D pillar, leveraging on collaborated R&D initiatives to gas innovation whereas concurrently producing income from tutorial and biopharmaceutical prospects.

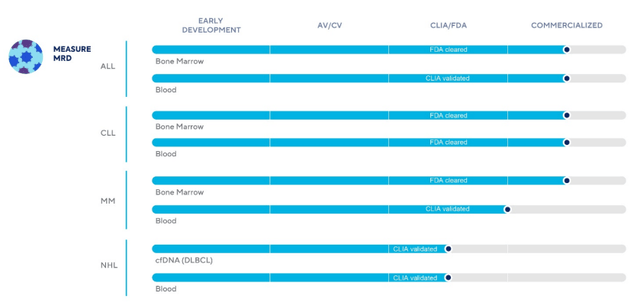

- Its first medical diagnostic product, clonoSEQ, is the primary FDA licensed take a look at for detecting and monitoring minimal residual illness (MRD) in sufferers with MM, ALL, and CLL and can be accessible as a CLIA-validated laboratory-developed take a look at (LDT) for sufferers with different lymphoid cancers.

Adaptive Biotechnologies

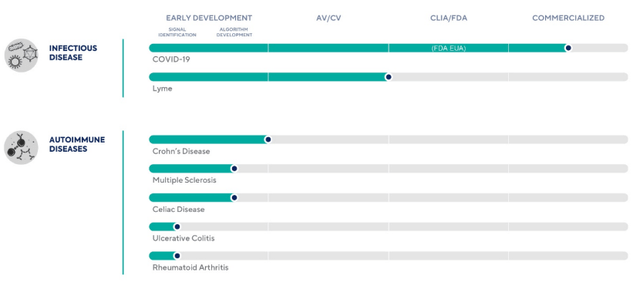

- The corporate can be making a map of the interplay between the immune system and illness (TCR-Antigen Map) in collaboration with Microsoft (MSFT), utilizing this map to develop analysis options for illnesses referred to as immunoSEQ T-MAP and a diagnostic product for a lot of illnesses from a single blood take a look at referred to as T-Detect. T-Detect COVID, the primary indication for the T-Detect product line, obtained Emergency Use Authorization (EUA) to verify the SARS-CoV-2 an infection in March 2021, with over 30,000 exams ordered.

Adaptive Biotechnologies

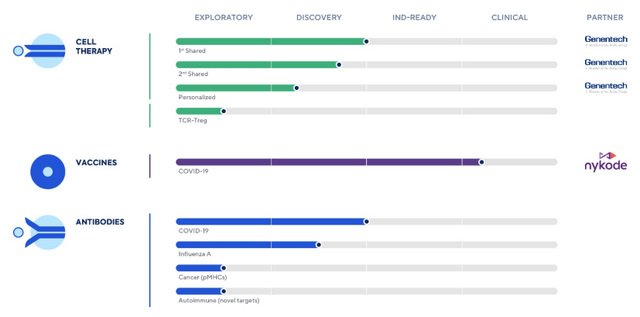

ADPT additionally prolonged its platform to tell vaccine design and improvement throughout a number of illness states by means of its licensing settlement with Vaccibody AS (OTCPK:VACBF), now referred to as Nykode Therapeutics AS.

Adaptive Biotechnologies

The corporate has sequenced a subset of pre and post-vaccination affected person samples from medical trials sponsored by a number of top-tier vaccine builders, together with Moderna (MRNA), Johnson & Johnson (JNJ), AstraZeneca (AZN), College of Oxford, and the Invoice and Melinda Gates Basis, amongst others.

With out going into an excessive amount of depth, it is secure to say that the corporate sports activities a top-of-the-class tech that may remodel the loss-maker into an trade chief with vigorous improvement and deployment of its medical portfolio and pipeline.

Adaptive Biotechnologies

Aggressive Benefit

The biotechnology and pharmaceutical industries, together with life sciences analysis, medical diagnostics, and drug discovery, are characterised by quickly advancing applied sciences, intense competitors, and a robust emphasis on mental property. Though the expansion within the international biotechnology trade has neared double-digits since 2020, the specter of entry into the market is weak resulting from excessive obstacles to entry.

Nonetheless, Adaptive faces substantial competitors from life sciences instruments, diagnostics, pharmaceutical and biotechnology firms, tutorial analysis establishments, governmental businesses, and private and non-private analysis establishments throughout numerous elements of its platform, merchandise, and providers.

Adaptive’s native competitor Juno Therapeutics has publicly acknowledged ADPT’s power and stated, “The know-how the parents at Adaptive have is an extremely essential window into understanding responses and non-responses (to medicine).”

ADPT is on the forefront of competitors with its 471 filed patents, most of that are already in impact, which have granted the corporate an edge, as said in its SEC filings:

Now we have developed a platform that’s able to studying and translating the huge genetic range of the adaptive immune system and its selective response to illness. Particularly, our platform sequences immune receptors and maps them to antigens for diagnostic purposes, pairs receptor chains and characterizes antigen-specific, paired receptors to establish optimum medical targets for therapeutic use. We’re the one firm that may carry out all of those functions-and we achieve this at an unprecedented scale to develop novel medical diagnostic and therapeutic merchandise.

Adaptive Biotechnologies

Additional, the corporate has signed a number of agreements with trade movers like Moderna, Amgen (AMGN), AstraZeneca, Microsoft, and many others., which testifies boldly to the corporate’s superior strides.

These components considerably contribute towards enhancing the corporate’s repute and goodwill amongst its prospects and play out within the firm’s favor to garner a constructive market sentiment.

Monetary Efficiency

Adaptive has been rising persistently, with an virtually 57% YoY income development in 2021. Its Sequencing income of $78.9 million represented a 90% YoY development, and its Growth income of $75.4 million represented a 32% YoY development.

Regardless of the sturdy income development, its backside line has declined due to its excessive SG&A and R&D bills to enhance future efficiency. Equally, the corporate’s YoY CapEx development of over 228% and CapEx to gross sales ratio of over 40% additionally point out the place the corporate is directing its sources.

ADPT is investing in industrial initiatives to extend consciousness and utilization of its merchandise & providers within the clinic by increasing its income heart to focus on key buyer segments, together with tutorial facilities, built-in well being networks, and group clinicians, in a tiered method primarily based on affected person quantity. Resultantly, clonoSEQ is now getting used clinically in any respect 31 Nationwide Complete Most cancers Community (NCCN) establishments.

In 2022, ADPT is anticipating to considerably spend money on supporting its gross sales drive, together with offering enhanced promoting path, knowledge, and coaching and the method of ordering malignancies clonoSEQ testing and acquiring take a look at outcomes, aiming to proceed enhancing its customer-facing software program interface and consumer expertise. With the gross sales group virtually doubled, the corporate is anticipating the topline development momentum to extend additional by penetrating towards new name factors and including to current prospects.

Consequently, the corporate’s revenue assertion is predicted to enhance steadily however not change into worthwhile within the coming quarters. Its inventory value shall be primarily dictated by core tech improvement and deployment, swaying the market sentiment, and expenditure targeted on bettering income is deeply embedded in cultivating a constructive market sentiment.

Genentech Settlement

In December 2018, ADPT and Genentech signed an settlement to develop, manufacture, and commercialize novel neoantigen-directed T-cell therapies to deal with a broad vary of cancers. The corporate is accountable for screening and figuring out T-Cell Receptors (TCR) that may most successfully acknowledge and straight goal particular neoantigens. On the similar time, Genentech is accountable for medical, regulatory, and commercialization efforts.

In February 2019, the corporate obtained a $300 million upfront cost from Genentech. It might be eligible to obtain roughly $1.8 billion over time, together with funds of as much as $75 million upon the achievement of specified regulatory milestones, as much as $300 million upon the achievement of specified improvement milestones, and as much as $1.4 billion upon the achievement of specified industrial milestones.

Genentech can be certain to pay tiered royalties at a charge starting from the mid-single digits to the mid-teens on mixture international internet gross sales arising from the strategic collaboration, topic to sure reductions, with mixture minimal flooring.

The settlement accounts for a serious portion of the corporate’s sustainable income with 41.3%, 53.7%, and 40.2% of ADPT’s income in 2019, 2020, and 2021, respectively.

Dangers & Challenges

Early-stage biotechnology firms like Adaptive are usually not producing that a lot income however must pour loads of sources into R&D. The one locations the corporate can supply the money is by issuing public choices, diluting shareholders’ possession, or elevating debt, rising the corporate’s leverage. Though Adaptive’s liquidity place is stable, its money place must be carefully monitored.

Buyers typically spend money on the biotechnology sector with the identical expectations as different sectors. Nonetheless, the sector is closely regulated. A product created by a producing firm will be offered instantly, and income is earned. Nonetheless, even when a product has been produced and accepted within the biotechnology sector, it could nonetheless take some time to return to the market and be accepted by the market. Any points with the product’s malperformance will critically tank the corporate’s share value. So regardless of there being a number of merchandise within the pipeline, traders ought to keep knowledgeable about their progress.

Small-cap biotech shares are often risky due to small market capitalization, low quantity, liquidity, heavy rules, and a dependency of the inventory value on constructive information and sentiment, resulting in wild swings in inventory costs.

Conclusion

ADPT’s one-of-a-kind immune medication platform uniquely helps medical merchandise able to studying and translating the huge genetic range of the adaptive immune system and its selective response to illness.

With the tech benefit, rising revenues, and a robust stability sheet with over $570 million in liquid belongings, an 18.5% whole debt to fairness ratio, and a robust 9.14 Altman-Z rating, the corporate’s elementary power is stable and should not be a explanation for concern for potential traders.

Though the inventory is more likely to generate significant investor returns with a consensus analyst goal value of $32 (an upside of over 166%), quick to mid-term traders will expertise excessive volatility all through the holding interval, so traders ought to contemplate their danger appetites earlier than leaping into the inventory.

Buyers with a time horizon of no less than 5 years are more likely to profit from the corporate’s long-term monetary efficiency considerably.