bodnarchuk

Introduction

Saint Helier, Jersey-based Caledonia Mining Corp. Plc (NYSE:CMCL) released its first-quarter results in 2023 on May 15, 2023.

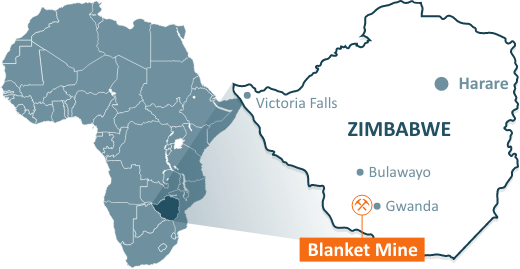

Caledonia’s primary asset is Blanket Mine, a gold mine in Zimbabwe. The company has 64% ownership.

Caledonia is a Zimbabwean focused exploration, development and mining corporation. Caledonia owns a 64% stake in the gold-producing Blanket Mine (“Blanket”), and 100% stakes in the Bilboes oxide mine, the Bilboes sulphide project, and the Motapa and Maligreen gold mining claims, all situated in Zimbabwe.

CMCL Map Assets Presentation (CMCL Presentation)

This article updates my preceding article, published on January 15, 2023.

Note: The last available presentation was released on March 28, 2023.

On January 6, 2022, the company completed the purchase of Bilboes for a total consideration of 5,123,044 shares, representing approximately 28.5% of Caledonia’s fully diluted equity.

A 1% NSR Bilboes has a NI43-101 compliant P&P Reserve of 1.79Moz @ 2.34 g/t, an M&I Resource of 2.56Moz @ 2.26 g/t, and an additional Inferred mineral resource of 577Koz @ 1.89 g/t. Bilboes is one of Africa’s most significant gold development open-pit projects, with a gold production estimated at 12.5K-17K Oz in 2023 (pending a change of outlook).

1 – 1Q23 Gold production Results Snapshot

1.1 – Gold production and commentary

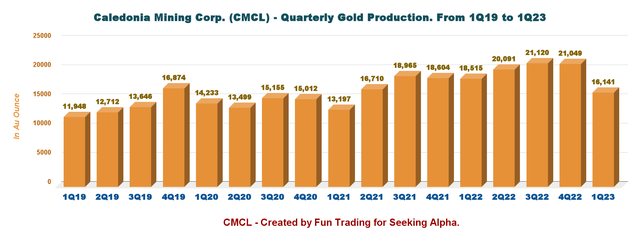

The company announced 1Q23 gold production of 16,141 Au ounces, down 12.8% compared to 18,515 Au ounces in 2022. It was a disappointing gold production. Production this quarter decreased significantly, mainly due to lower grade and lower than budget tonnes milled. Several individually minor mechanical breakdowns and logistical issues have been resolved, and the company said that 5,194 ounces of gold were produced in April.

CMCL Quarterly Gold Production History (Fun Trading)

One hundred five ounces were produced at the Bilboes oxide mine, where production was adversely affected by several minor mechanical breakdowns and logistical issues. Output from the restart of the Bilboes oxide mine has been slower than expected and was adversely affected by irregular grades, mechanical breakdowns, and poor availability of spare parts and alternative equipment.

Therefore, CMCL withdrew the Guidance, including the production and associated costs at the Bilboes oxide mine.

Gold production guidance for Blanket in 2023 is maintained but excludes the production outlook for Bilboes. Production expected is still between 75K and 80K Au ounces of gold, with AISC excluding Bilboes oxides scheduled to be in the range of $935 to $1,035 per ounce. (The initial guidance, including Bilboes oxides, was expected to be 87.5K – 97K Au Oz in 2023.)

Furthermore, the 12.2 MWac solar plant was fully commissioned on February 2, 2023. The plant, which cost approximately $14.2 million, was funded and is 100% owned by Caledonia. The plant provides power to Blanket Mine at a price per kilowatt/hour cost, which reflects Blanket’s historic blended cost per unit.

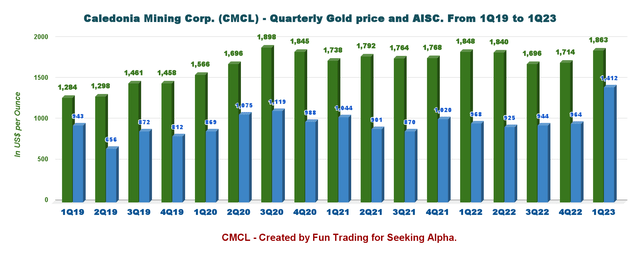

1.2 – Historical gold price realized and AISC

CMCL Quarterly Gold Price and AISC History (Fun Trading)

The cost of oxide mining at Bilboes contributed $293 per ounce to the overall increase in the on-mine cost per ounce. Gold production from the oxides commenced in the last week of the Quarter and 105 ounces were produced in the Quarter.(press release)

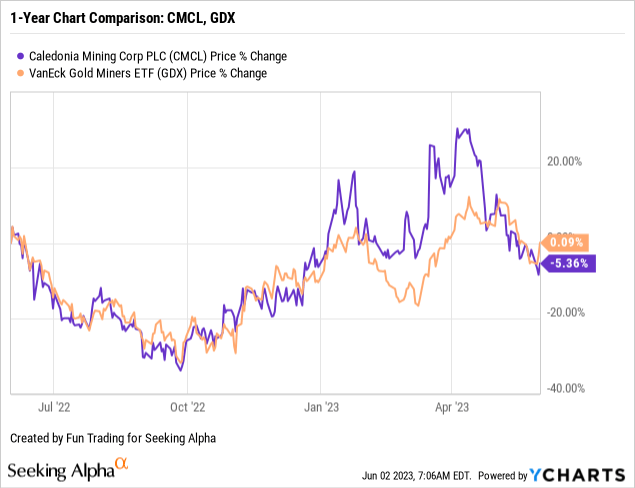

2 – Stock performance

The stock performance has been quite exceptional on a one-year basis until April 2023, as shown below. However, the stock dropped quickly due to the FED uncertainty, and now CMCL is down 6% YoY.

3 – Investment Thesis

The company is a good option for a long-term investment. However, the problems encountered with Bilboes and weak production at the Blanket Mine highlight the weakness of the business model. On the positive side, the company has a good balance sheet with little debt and pays dividends with a yield of 4.34%.

Until recently, the company’s unique producing asset was the Blanket mine in Zimbabwe, but it is trying to diversify and expand with the Bilboes project. This process is not going smoothly, unfortunately.

Thus, the business model is improving but is still risky from a long-term investment perspective because all assets are in Zimbabwe, and the Bilboes production is still uncertain.

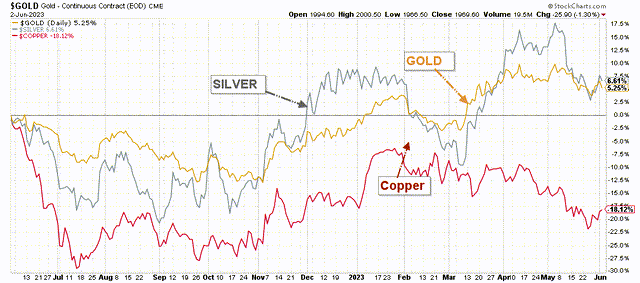

The outlook for gold is bullish in 2023, with the FED expected to slow down gradually, its hiking pace this year, with inflation starting to decrease. The gold price is now well over $1,900 per ounce, up nearly 5.25% YoY.

CMCL 1-Year Gold, Silver, Copper (Fun Trading StockCharts)

Thus, I recommend accumulating CMCL on weakness for the long-term and trading short-term LIFO with a minimum of 60% of your long position to alleviate any potential risks and take advantage of the gold volatility, which is very high at the moment.

Caledonia Mining – Balance Sheet history through 1Q23 – The Raw Numbers

| CMCL | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Total Revenues $ million | 35.07 | 36.99 | 35.84 | 34.18 | 29.44 |

| Quarterly Earnings (excl. non-controlling %) $ million | 5.94 | 11.38 | 8.61 | -8.03 | -5.03 |

| EBITDA $ million | 14.52 | 18.87 | 16.90 | -2.49 | 2.26 |

| EPS (diluted) $ per share | 0.45 | 0.88 | 0.65 | -0.63 | -0.30 |

| Operating Cash Flow $ million | 10.16 | 16.72 | 8.92 | 6.82 | -0.88 |

| CapEx in $ million | 9.96 | 13.42 | 11.15 | 9.56 | 4.74 |

| Free Cash flow | 0.20 | 3.29 | -2.23 | -2.74 | -5.61 |

| Total Cash in $ million | 15.29 | 10.86 | 8.26 | 6.74 | 17.06 |

| Total LT Debt in $ million | 0.86 | 0.00 | 2.09 | 12.34 | 22.46 |

| Dividend $/ share | 0.14 | 0.14 | 0.14 | 0.14 | 0.14 |

| Shares Outstanding (diluted) in million | 13.20 | 12.93 | 13.25 | 12.06 | 16.77 |

| Gold Production | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

| Quarterly Production K Oz | 18,515 | 20,091 | 21,120 | 21,049 | 16,141 |

| Gold Price in $ | 1,848 | 1,840 | 1,696 | 1,714 | 1,863 |

| AISC in $ | 968 | 925 | 944 | 964 | 1,412 |

Data Source: Company press release.

Analysis: Revenues, Free Cash Flow, Net Debt, and Gold Production

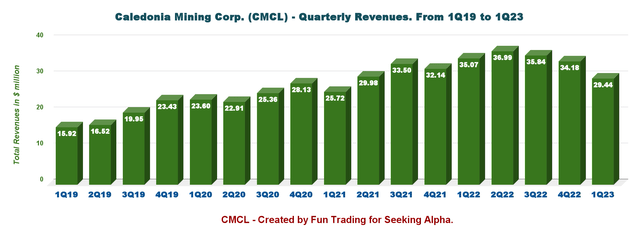

1 – Quarterly revenues history

CMCL Quarterly Revenue History (Fun Trading)

Revenues were $29.44 million in the first quarter of 2023. Net loss, excluding non-controlling interests, was $5.03 million or $0.30 per diluted share compared to an income of $5.94 million or $0.45 last year. However, the gross profit was $5.85 million in 1Q23, a notable decrease from $16.892 million in 1Q22.

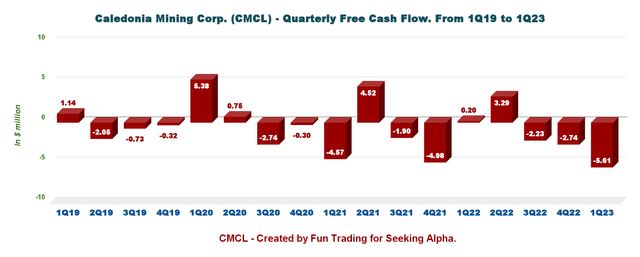

2 – The Quarterly Free cash flow history

CMCL Quarterly Free Cash Flow History (Fun Trading StockCharts)

Note: The generic free cash flow is the Cash from operations minus CapEx.

Trailing 12-month free cash flow is estimated at a loss of $7.29 million, with a loss of $5.61 million in 1Q23.

The company is paying a quarterly dividend of $0.14 per share or a dividend yield of 4.34%.

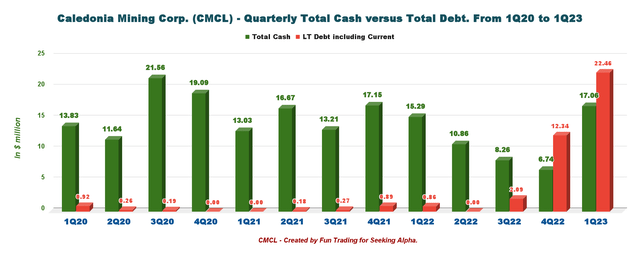

3 – Balance sheet history

CMCL Quarterly Cash versus Debt History (Fun Trading)

The company has long-term debt of $22.46 million, including current. The cash position was $17.06 million at the end of March 2022. The increase in debt is due to the completion of the solar power plant.

The company did an equity raise this quarter, which is not something shareholders like to read. In the press release, it is said:

The Company conducted equity raises by way of placings in the Quarter and shortly after the end of the Quarter which targeted institutional investors in the UK, Europe, South Africa and Zimbabwe. The equity raises were over-subscribed; depositary interests in respect of 781,749 shares were issued to investors in the UK, Europe and South Africa on March 30, 2023 and Zimbabwe depositary receipts in respect of 425,765 shares were issued on April 14, 2023. The placings raised $16.6 million before expenses.

Technical Analysis and Commentary

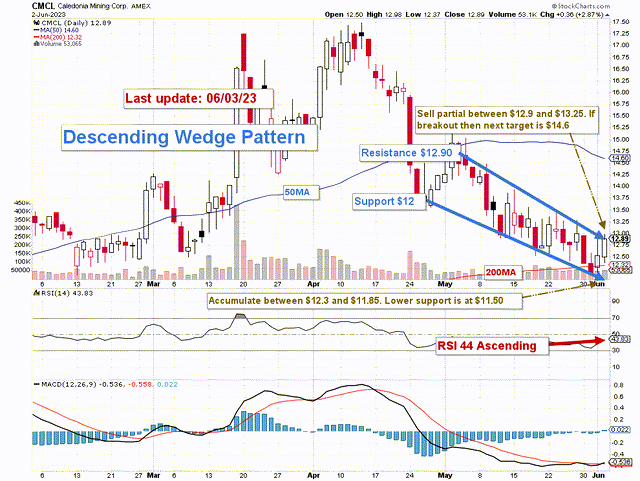

CMCL TA Chart Short-Term (Fun Trading StockCharts)

Note: The chart is adjusted for the dividend.

CMCL forms a descending wedge pattern with resistance at $12.90 and support at $12. The RSI is now 44, indicating potentially strong support at $12.

The gold market is increasingly bullish after a recent retracement from 2,050 per ounce. Gold is now $1,980 per ounce and looks solid after the FED indicated a potential pause in June.

A falling wedge pattern is seen as a bullish signal as it reflects that a sliding price is starting to lose momentum, and that buyers are starting to move in to slow down the fall.

I recommend using about 50% of your position for trading the current volatility. The trading strategy is to sell LIFO between $12.9 and $13.25 with potential higher resistance at $14.6. Conversely, I suggest accumulating CMCL between $11.85 and $12.3, with possible lower support at $11.50.

Watch the gold price like a hawk.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.