Vitalij Sova

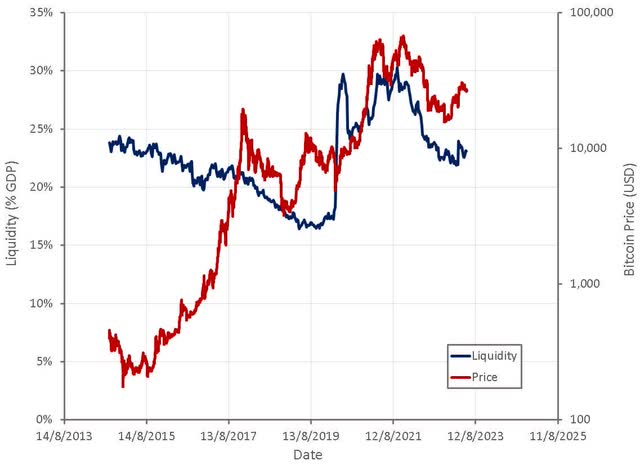

From a price perspective, Bitcoin (BTC-USD) has performed quite well in 2023, particularly in light of persistent inflation and tight monetary policy. With a halving approaching in the next 12 months, speculation will inevitably shift to the potential price impact, and investors may begin positioning themselves in anticipation of this. Investors should not underestimate the extent to which cryptocurrencies are a risk asset that behaves like a proxy for liquidity, though. Absent a financial crisis, liquidity is likely to continue declining, due to both fiscal and monetary policy. This is likely to put pressure on Bitcoin’s price, which may negate any potential price impact from the halving, particularly if sentiment becomes sufficiently negative.

I have previously described supply and demand approaches to estimating a fair price for Bitcoin, and while these approaches are flawed, an indicator of relative value is needed. As an asset that does not produce any cash flows, Bitcoin’s price is ultimately dependent on supply and demand. Metcalfe’s Law values Bitcoin based on the number of users, an indicator of demand. The stock-to-flow method values Bitcoin based on supply. Both of these approaches have widely recognized flaws, but are probably as good as any other approach, besides trying to gauge sentiment.

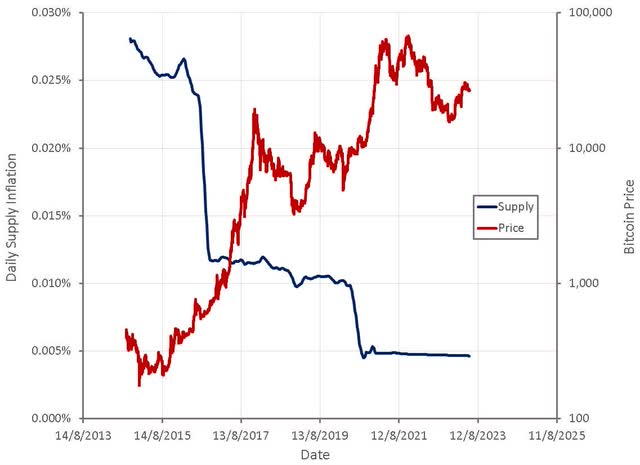

Bitcoin’s price has increased significantly in the months following previous supply halvings, which some have assumed implies a cause and effect relationship. This may be the case, but it is questionable whether a relatively small shift in the issuance of new Bitcoins could have such a large impact. Given the extent to which Bitcoin exhibits momentum, it is possible that a small shift in the balance of supply and demand could trigger a price rise that investors begin to chase, resulting in a bubble.

Figure 1: Bitcoin Supply Inflation (Created by author using data from Blockchain.com)

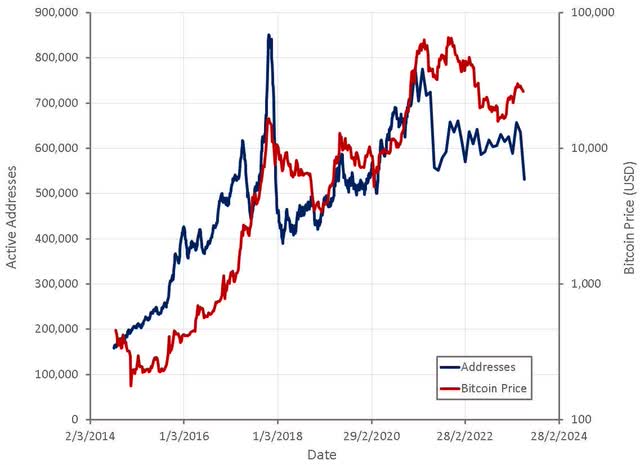

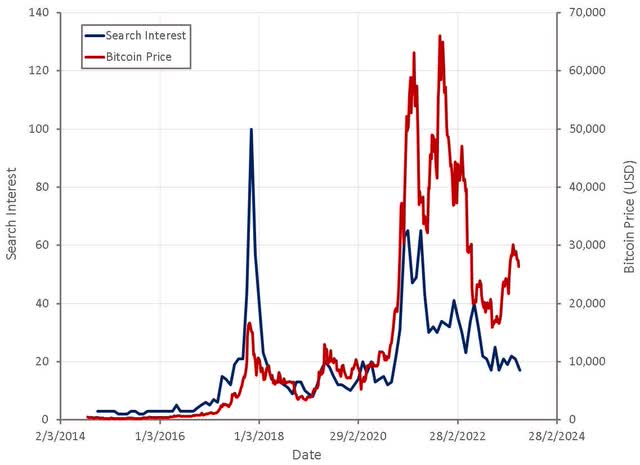

Demand is also likely an important driver of Bitcoin’s price, although difficult to measure. Bitcoin’s price has moved broadly in line with search interest and active addresses in the past. Both of these approaches suggest that adoption has stagnated in recent years and that Bitcoin is overvalued at the moment.

Demand also appears to be procyclical, with higher prices creating demand and lower prices destroying demand. The failure of demand to follow price in recent months suggests the current move-up is relatively weak.

Figure 2: Bitcoin Active Addresses (Created by author using data from Blockchain.com) Figure 3: “Bitcoin” Search Interest (Created by author using data from Google Trends and Blockchain.com)

Given the importance of liquidity, an approach that accounts for changes in liquidity could yield better results. Liquidity also calls into question the importance of Bitcoin’s halving. Absent loose monetary policy in 2020 and 2021, Bitcoin’s price may not have had a large price run.

This is difficult to assess though as changes in liquidity are unlikely to impact all assets equally, and any relationship is likely to be dynamic and highly dependent on investor sentiment. This can be seen in past data, where there have been periods of close correlation between Bitcoin and liquidity, and periods where they have been uncorrelated.

Figure 4: Bitcoin Price and US Liquidity (Created by author using data from Blockchain.com and The Federal Reserve)

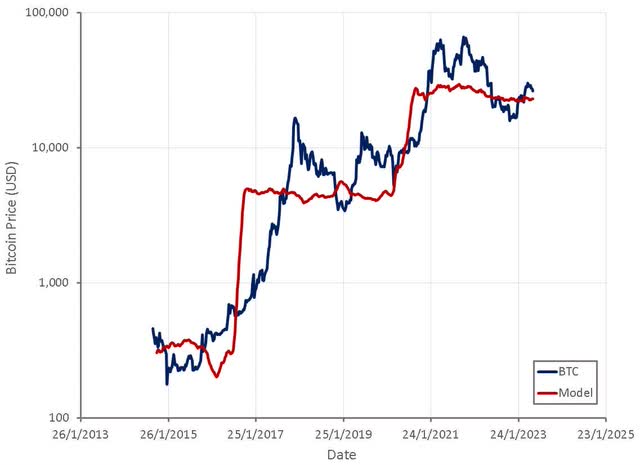

Modelling price based on supply inflation and liquidity results in supply inflation dominating price as liquidity does not exhibit a static relationship. This approach suggests that Bitcoin is currently overvalued, a situation that is likely to get worse as liquidity is withdrawn from the market in the coming months.

Figure 5: Bitcoin Price Model (Created by author using data from Blockchain.com and The Federal Reserve)

While the halving could provide Bitcoin with a tailwind over the next 1-2 years, from a demand and liquidity perspective Bitcoin appears overvalued. The path of liquidity is somewhat uncertain given the stress on the banking system, but it seems likely that liquidity will continue to decline as the government refills the TGA and the Fed continues QT. This is likely to put pressure on Bitcoin’s price, given that liquidity appears to be driving the market at the moment.