bjdlzx

Just a couple of days ago I published an article on American Tower Corporation (AMT), highlighting the significant tailwinds that are expected for cell towers. These tailwinds, of course, will primarily be driven by increased data usage (a growing number of connected devices, as well as data consumption per device). Additionally, a roll out of new technology like 5G will add further to already pretty enticing growth prospects. Today I want to talk about a major competitor of AMT – Crown Castle (NYSE:CCI). The goal of this article is to highlight the differences and decide which one, if any, is a better investment.

Before diving into the specifics, let’s touch on the number one difference that in itself is enough for many investors to make up their minds, and that of course is the dividend yield. CCI pays a much higher yield of 5.6%, while AMT’s stands at just 3.4%. That’s a large difference, considering these are very similar companies. And while it might seem like a material difference on the surface, I’d argue that it shouldn’t really matter to the investment decision, because what we care about are total returns and the return on investment that each of these firms can generate. That’s why this article will focus on total return and will not favor CCI just because it has a higher dividend yield.

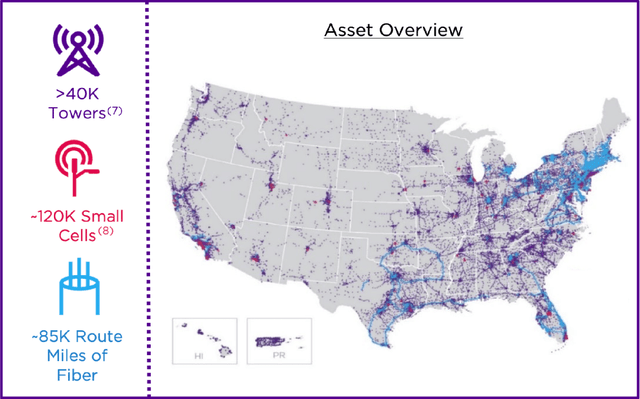

Going beyond the obvious, the main differentiator between the two companies is their geographical exposure. AMT is a global player with operations on all 6 continents, while CCI is only located in the US. This means a couple of things. First off, it’s good, because the US has a much better legal and regulatory framework which better protects landlord’s rights. This means that CCI is much less likely to struggle with disobeying tenants who refuse to pay rent (something not uncommon in emerging markets such as India). On the other hand, the emerging markets exposure is what gives AMT superior growth prospects (recall my article on AMT) so because of this CCI is likely to grow less over time.

CCI

Moving on, the two companies are also not entirely the same in terms of their assets. Sure, cell towers account for the majority of the portfolio, but it’s the secondary assets that differentiate them. CCI’s focus is on fiber optic cables that connect their cell towers, while AMT slightly shifted its focus with its recent acquisition of a number of datacenters. While I don’t have a strict preference for one type of asset over the other, we have to keep in mind that datacenters tend to be priced at higher multiples, hence one should expect AMT’s valuation to be a little higher.

The third and final difference has to do with their balance sheet. Don’t get me wrong, both companies have extremely strong balance sheets, but there are two key things to consider here – interest rates and hedging. CCI is being considerably more cautious as they have hedged 88% of their debt against interest rate risk, compared to only 77% for AMT. That can make a difference, especially in the current high rate environment. Beyond hedging, AMT is a clear winner in terms of the overall interest rate they pay (2.8% vs 3.6%), largely thanks to their EUR exposure.

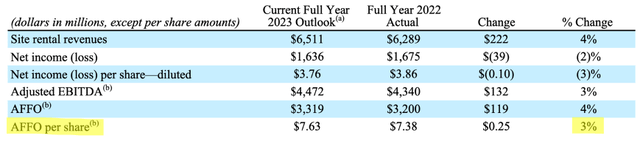

Now that we have an idea of where CCI stands relative to competition, I want to focus on some recent issues they’ve been facing that are affecting their guidance for 2023. This is of course the drop in revenue related to the consolidation of Sprint and T-Mobile (TMUS), as well as an ongoing increase of their interest expense. Combined these are expected to drive AFFO growth of 3% this year, which isn’t bad considering the complexity of the situation we’re in. By year-end AFFO per share should reach $7.38 per share.

CCI

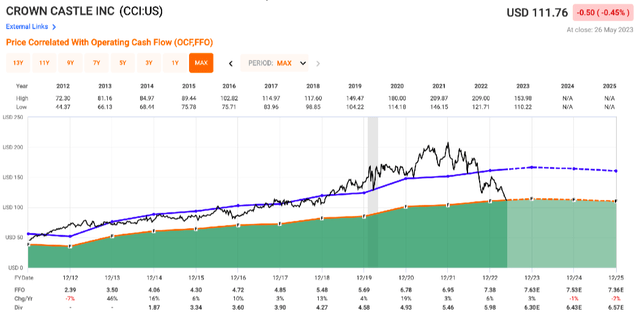

The chart below says more than a thousand words. CCI has plummeted and so has its P/FFO multiple which now only stands at 15x. With the expectation that FFO will remain flat on the 2023 level for the next three years and assuming that the stock will return to the 22x average multiple, investors could earn almost 20% on an annualized basis. That’s impressive given the tailwinds this industry is expected to experience and given the safety of their dividend and balance sheet. This is why I rate CCI as a BUY here.

FastGraphs