Investment Thesis

The Mosaic Company (NYSE:MOS) is one of the most stable companies in the sector of fertilizer producers due to its high share of the global fertilizer market and unique positioning in the rapidly growing Brazilian market. However, the current market situation leaves much to be desired. Prices for phosphorous and potash fertilizers continue to decline, which will also put pressure on sales prices and the company’s already low margin. We believe that it is too early to invest in the company’s shares. Rating for The Mosaic Company is HOLD.

Macroeconomic picture

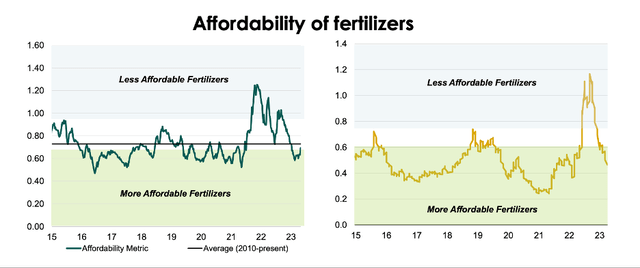

According to MOS, the decline of prices for the basic types of fertilizers stimulates purchases. The nutrient affordability index for North and South American farmers has descended into the ”more affordable” area for the first time since 2021.

ronstik Mosaic

As fertilizer prices stabilize and fertilizer inventories in Brazil and India are set to run low, the company expects demand for phosphate and potash fertilizers to bounce back as soon as 2023.

Mosaic Mosaic

Outlook

Phosphate fertilizers

The phosphate segment ended 1Q 2023 with a revenue of $1382 mln (-11% y/y), in line with our forecast for $1401 mln.

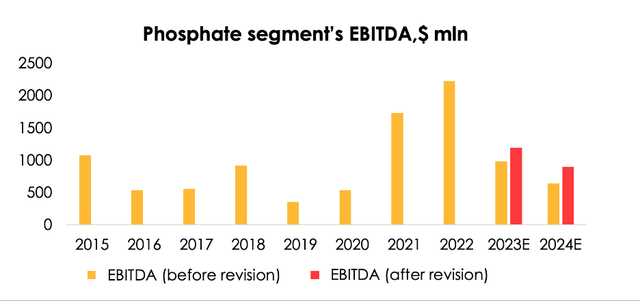

The segment’s EBITDA totaled $382 mln (-40% y/y), compared with our forecast of $272 mln. The discrepancy was driven by the following:

- Ammonia prices fell faster than we had expected following the decline of natural gas prices. We had expected that ammonia costs per ton of end product would be $627, while in fact they were $605;

- A faster decline of prices for sulfur. We had expected that sulfur costs per ton of end product would be $332 per ton, while in fact they were $236 per ton as new capacities went into operation in China and demand weakened in anticipation of global recession.

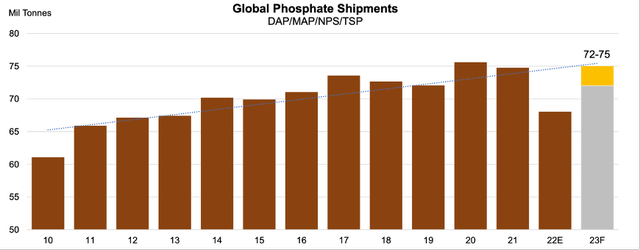

We have maintained our expectations for capacity utilization over the forecast period at 80% because demand from farmers is steadily recovering as their inventories run lower. We still believe that phosphate fertilizer sales will reach ~7.8 mln tons (+18% y/y) in 2023.

But we have lowered the outlook for the average realized price of phosphate fertilizers over the forecast period from $709 a ton to $654 a ton due to a reduced forecast for DAP/MAP prices until 2024 as China could potentially lift the restrictions for fertilizer exports while the rhetoric regarding Russian fertilizers is softening and global prices for natural gas are declining. Due to a greater supply of sulfur on the market, we have lowered expectations for the cost of sulfur per ton of fertilizer output (part of the costs) from $305 a ton to $217 a ton for 2023, and from $289 a ton to $205 a ton for 2024 .

Due to the combination of these factors, we have raised expectations for the segment’s EBITDA from $982 mln (-56% y/y) to $1195 mln (-46% y/y) for 2023, and from $642 mln (-46% y/y) to $896 mln (-25% y/y) for 2024.

Invest Heroes

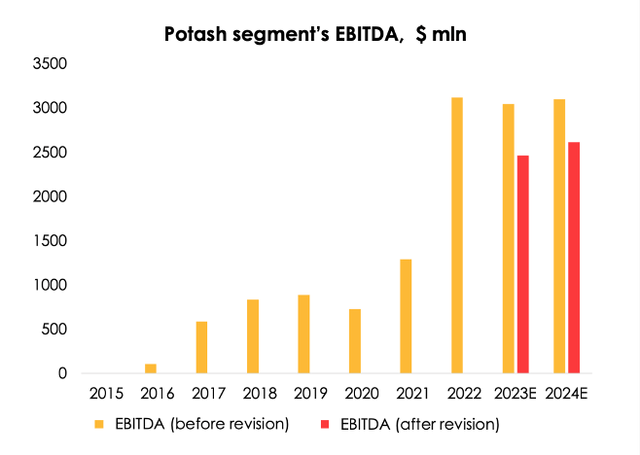

Potash fertilizers

Revenue of the potash fertilizers segment totaled $907 mln (-14% y/y) in 1Q 2023, down 17% from our forecast of $1094 mln. The difference is attributable to:

- lower-than-expected selling prices ($475 a ton versus our estimate of $599 a ton).

The segment’s EBITDA reached $474 mln (-27% y/y), compared with our estimate of $528 mln. The discrepancy of 10% was driven by a lower revenue in 1Q 2023 than we had expected.

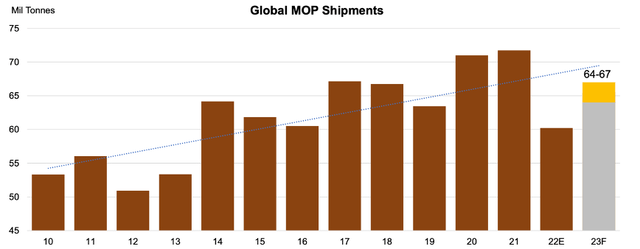

As with phosphate fertilizers, farmers are steadily depleting their inventories of potash fertilizers. The company expects that global demand for potash fertilizers will return to the level of 64-67 mln tons in 2023, following a 15% y/y drop to 60 mln tons in 2022.

We continue to see the company’s capacity utilization at ~83%, and sales volume at 9 mln tons (+11% y/y) in 2023, and maintain the forecast of 9.8 mln tons (+9% y/y) for 2024.

Despite the unchanged expectations for shipments, we have cut expectations for the segment’s EBITDA from $3046 mln (-2% y/y) to $2461 mln (-21% y/y) for 2023 and from $3097 mln (+26% y/y) to $2611 mln (+6% y/y) due to lowering the expectations for selling prices from $585 a ton to $463 a ton for the valuation period until 2024.

Invest Heroes

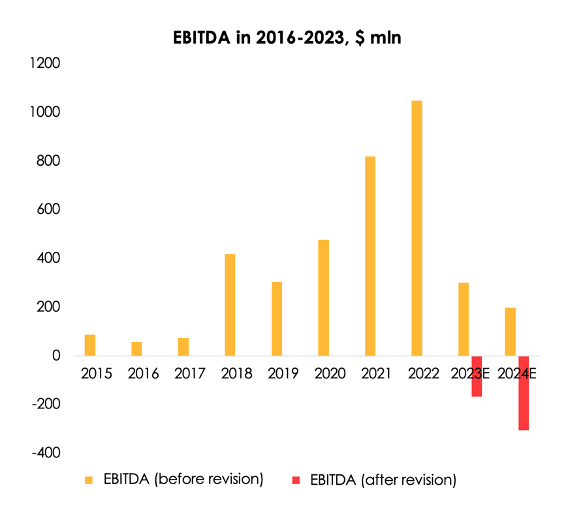

Fertilizer sales in Brazil

The segment of fertilizer sales in Brazil finished 1Q 2023 with a revenue of $1343 mln (-10% y/y), in line with our forecast of $1313 mln.

Sales volume rose by 14% y/y to 2080 thousand tons, compared with our estimate of 1720 thousand tons. The physical volume of sales is rebounding faster than we expected amid an ongoing correction of fertilizer prices, which makes them more affordable for farmers.

The segment’s EBITDA totaled $3 mln (-99% y/y), compared with our estimate of $44 mln. The discrepancy was driven by higher gross costs, which came to 100% of revenue, versus expectations of 95%, in light of higher prices for sulfur and ammonia on the Brazilian market.

We have lowered the forecast for the segment’s EBITDA from $299 mln (-71% y/y) to ($167) mln for 2023 and are setting it at ($305) mln for 2024 as selling prices are declining faster than production costs, which is in part offset by a higher volume of sales.

Invest Heroes

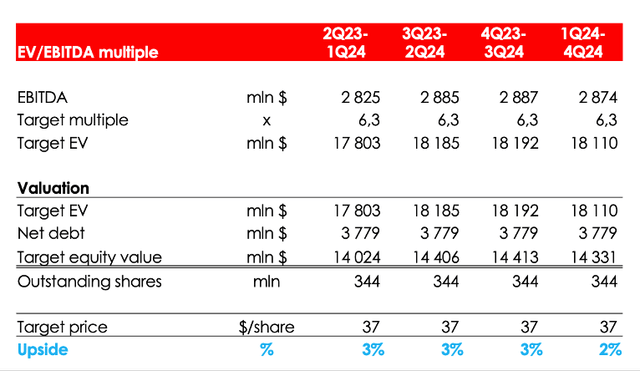

Valuation

The fair value price of the stock is $37. The target value of the shares was obtained by averaging estimates for 4 quarters ahead.

Invest Heroes

Conclusion

We believe that The Mosaic Company is not a perfect stock to gain extra alpha in a bearish market due to the condition of declining phosphate and potash prices. However, Mosaic has exposure to phosphate and potash markets that separates it from its closest peers. Also, The Mosaic Company is going to reap the gain of recovering market in Brazil and India. Rating for The Mosaic Company stock is HOLD.