pixdeluxe/E+ via Getty Images

Investing in stocks at or near the bottom is always hard. The easiest way to invest is to find companies with strong fundamentals and impressive earnings, but long-term value is sometimes easier to find in companies that are struggling.

Inflation and slowing growth have hit many companies very hard. Prices started to rise significantly in early 2021, and rising costs have had a significant impact on many businesses throughout the economy. A business hit harder than most by inflationary pressures has been the meat distribution business. Few industries have been hit as hard as this industry.

One company that has faced a particularly difficult operating environment since costs began to rise significantly nearly two years ago is Tyson Foods (NYSE:TSN).

Tyson Food’s core business is selling meat with the well-known brands such as Jimmy Dean, Hillshire Farm, Wright, and Ball Park.

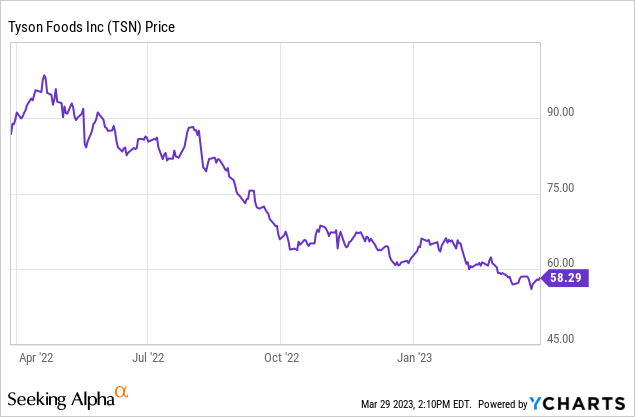

This company’s stock has fallen significantly since March of 2022.

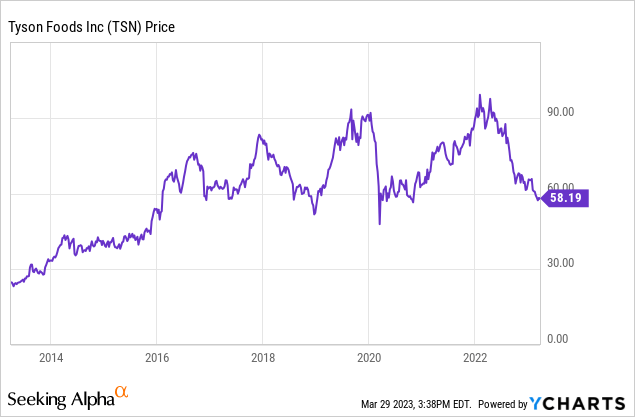

Still, Tyson Foods performed very well over the last decade prior to last year.

Tyson Foods struggled significantly over the last year, the company had one of the worst quarters on record in the first quarter of this year. The company recently reported adjusted earnings per share of $.85, down 70% from last year at the same time. The company also stated that adjusted operating income was $453 million, down 68% year-over-year. Tyson’s GAAP operating margin was 3.5%, down from 19.1% last year.

Management also issue concerning guidance, projecting adjusted operating margins of 0-2% in the pork segment, 2-4% in the chicken segment, and 2-4% in the beef segment. The beef business is the most important division for Tyson Foods. The frozen food segment was the only division that performed well for the company through last year, and management is forecasting margins of 8-10% in this part of the business throughout 2023. Still, the company did report last quarter that sales volumes remained solid, up 2.5% from 2021, and management also stated that the company’s balance sheet remains very strong, with liquidity of $2.9 billion.

Today, Tyson Foods is a buy. The company’s market share continues to remain impressive, and the cost issues that hurt earnings should subside over time. Current cattle and beef prices are likely unsustainable, and demand for Tyson Foods’ core products should remain strong. The first quarter of this year looks like a bottom for the company’s earnings and profitability levels, this stock also looks cheap using several valuation metrics.

Tyson Foods was hit hard by lower demand and falling prices for the many of the core products the company sells in 2022 and early this year. Beef prices were down 8.5% year-over-year, and sales volume for pork fell 7.4% year-over-year. Chicken prices rose 7.1% year-over-year, but even in this segment the company lowered guidance, with management forecasting operating margins to drop to 2-4% from 6-8% last year. Tyson Foods international food sales were also hurt by forex issues and increased competition, this division is nearly 15% of the company’s overall revenue.

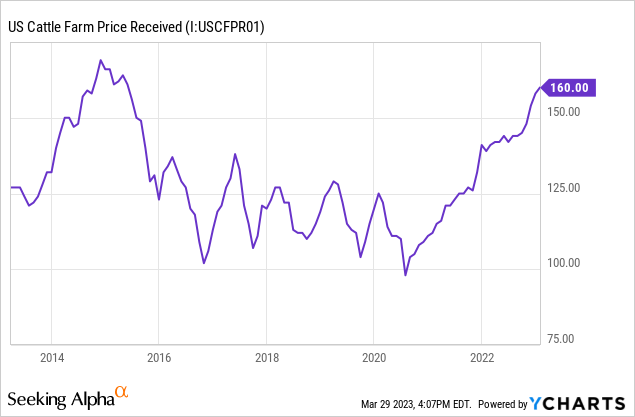

Even though The USDA today is projecting that beef production will drop by nearly 5% in 2023 and Cattle inventory numbers are the lowest they’ve been since 2015, and the impacts of recent weather issues are likely to subside over time. Cattle futures are trading at the highest levels since 2014 at $164,and this has hurt Tyson Foods margins because of the company’s exposure to protein costs. The beef business surpassed Tyson Foods chicken division several years ago, and is the company’s most important core segment.

Cattle prices crashed in 2014, which was the last time these prices reached the current levels we are seeing. While the impact of recent droughts is likely to impact the beef ranching industry again for some of this year, current prices levels have not been sustainable historically, and a significant market correction will likely come.

Tyson Foods should also be better positioned moving forward to deal with rising costs after management’s $2.5 billion dollar capital expenditure plan this year, which is focused on streamlining production and moving more to automation to relieve stresses from labor shortages. The market pork and beef market are also likely to be more favorable for Tyson Foods in the long-term as well, for several reasons. The company has $2.9 billion in liquidity, and this cost-reduction plan should hurt margins in the short-term, but streamlining and making production more efficient should obviously still provide significant benefits in the long-term.

This is why TSN stock looks cheap using several metrics. Tyson Foods has a very strong balance sheet, the company has still been aggressively buying back shares, even over the last year. Management repurchased 4.9 million shares for $313 million in 2022. Tyson Foods currently trades at 13.6x likely forward GAAP earnings, 8.09x projected forward EBITDA, and .37x forecasted forward sales. The industry average is 19.9x forward GAAP earnings, 12.08x forward EBITDA, and 1.12x forward sales. Tyson Foods five-year average is also .58x likely forward sales.

It is almost impossible for investors to time the market, but there are signs that Tyson Foods first quarter was likely a near-term bottom in the company’s earnings and profitability levels. This company also maintains a very strong balance sheet, management is likely to keep buying back shares and continuing to look at acquisition targets. The company acquired Williams Sausage in just February of this year. While buying companies with strong earnings is always more comfortable, long-term investors willing to be patient should find value in Tyson Foods.