cworthy/E+ by way of Getty Photographs

Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) is an American leisure cruise big that had a really attention-grabbing couple of years within the cruise enterprise. Journey and leisure shares have been hammered for the higher half of the final two years because of ongoing pandemic-related points. Seemingly endemic throughout the business, cruise shares have drawn the quick finish of the stick. With lockdowns and journey restrictions in place, being actually closed down and with no means to generate money, cruise shares have been preventing an uphill battle for a very long time.

Nonetheless, with pandemic instances and deaths shedding their momentum over the course of the previous a number of months, many international locations have been rolling again restrictions amid optimism that the top of Omicron has introduced the world one step nearer to the top of your entire pandemic. With this, many expect the long-awaited restoration of cruise shares and a brighter future for the leisure giants. Nevertheless, is that this really the case? We are going to share our views on the matter and attempt to reply why we consider Norwegian Cruise Line remains to be removed from a restoration significant to its shareholders.

A brand new starting for Norwegian?

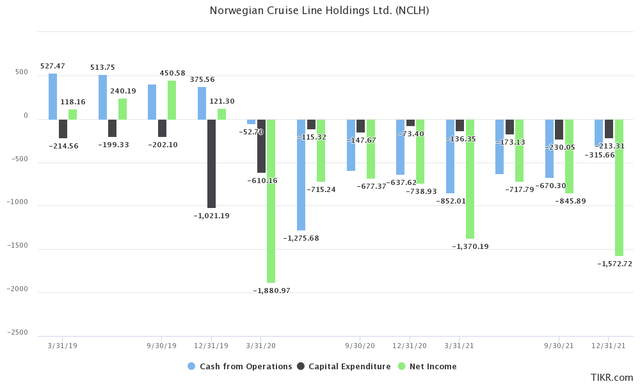

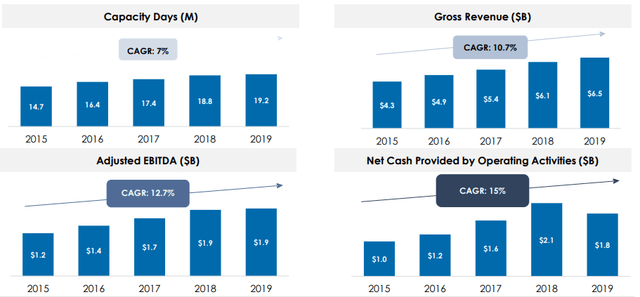

Norwegian Cruise Line’s complete cruise fleet consisting of 28 ships has been docked for the higher a part of the final two years. Throughout this time, with no cash-generating means, the corporate had no significant technique to fund expenditures apart from to resort to debt and fairness financing. Within the final yr alone, the corporate burned by way of $2.6 billion of money.

On the brighter aspect, administration was profitable in stabilizing its funds by bringing the expenditures considerably underneath management whereas placing an finish to the rise of debt. With part of the cruise fleet lastly crusing, the corporate has began producing some much-needed money circulate, which has introduced some additional reduction to the funds. Moreover, administration was in a position to construct up a comparatively sturdy money place of $2.70 billion, given the circumstances.

NCLH Pandemic Operations (TIKR Terminal)

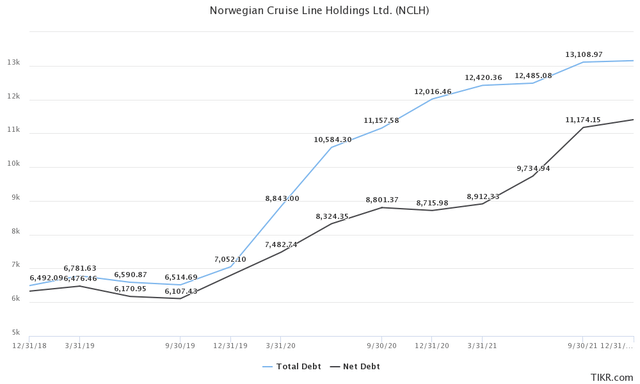

As per the most recent quarterly submitting, the corporate had $13.10 billion in debt and $11.17 billion in web debt. That may be a vital enhance from its pre-pandemic debt ranges again in early 2019, when the corporate had little greater than $6 billion in debt. In different phrases, the corporate needed to elevate $6.6 billion of debt with the intention to keep afloat. Which means that Norwegian was compelled to double its debt on account of the closed-down operations through the pandemic.

To position issues into perspective, the corporate went from a present ratio of 0.20x and a fast ratio of 0.09x on the finish of 2019 to a present ratio of 0.89x and a fast ratio of 0.78x on the finish of 2021. They went from having a manageable pre-pandemic Whole Debt/EBITDA ratio of three.72x and a Web Debt/EBITDA ratio of three.59x to at present’s unfavorable 7.41x Whole Debt/EBITDA ratio and unfavorable 6.42 Web Debt/EBITDA ratio.

Acquired Debt (TIKR Terminal)

The corporate’s EBITDA/Curiosity Expense ratio earlier than the pandemic outbreak was 7.40x, which means generated EBITDA may cowl the curiosity cost by greater than seven instances. As of late are lengthy gone, since Norwegian Cruise Traces generated a unfavorable EBITDA of $489 million final quarter. The identical ratio at present stands at a unfavorable 2.72x, as the corporate has to pay an costly $178 million in curiosity funds.

This won’t be as honest contemplating the corporate has not been doing enterprise. If the cruise leisure business would return to regular in late 2022 and 2023, it’s not unreasonable to anticipate related numbers to reappear, so we may evaluate the final optimistic EBITDA quarter to at present’s quarterly curiosity expense. We’d arrive at an EBITDA/Curiosity Expense ratio of two.08x.

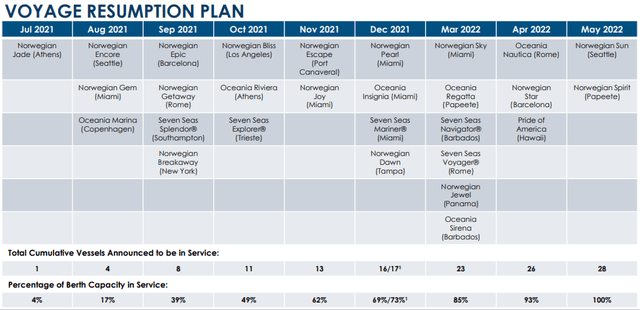

Fleet Sail Schedule (NCLH 2021 Annual Report)

The general cumulative booked place for the primary half of 2022 is beneath the terribly sturdy ranges of 2019 whereas the second half is according to the comparable 2019 interval and with all durations at increased costs. – ~70% of the cumulative booked place for full yr 2022 is money bookings vs. FCCs – ~60% of the cumulative booked place for full yr 2022 are loyal repeat cruisers to our manufacturers

NCHL – 2021 Annual Presentation

All of this serves to level out the truth that the corporate is in dire want of getting its cruise fleet out and crusing once more, and would in any other case be confronted with extreme dangers by way of servicing its money owed and staying afloat. Fortunately, higher days appear to be forward for Norwegian Cruise Line, because it was introduced that by Might of 2022, their complete fleet is meant to be out and crusing if no main disruptions happen. Which means that we may see fourth-quarter outcomes someplace according to what the corporate would have been producing previous to the pandemic, presumably signaling a brand new starting for Norwegian.

Pre-Pandemic Financials (Annual Report)

As soon as once more, this complete state of affairs was largely out of anybody’s arms and, basically, what has occurred to an in any other case good enterprise is an actual tragedy. This may be witnessed by trying again on the stellar monetary outcomes the corporate had been producing all through the years. Nevertheless, administration and shareholders alike must take care of the results, and people penalties have, in truth, been horrible.

The price of fairness financing

As defined earlier, the corporate was burning by way of massive sums of money and it wanted to discover a technique to pay the payments. Apart from taking up massive quantities of debt that we’ve got already touched upon earlier, administration has additionally resorted to elevating capital by issuing new shares of the corporate.

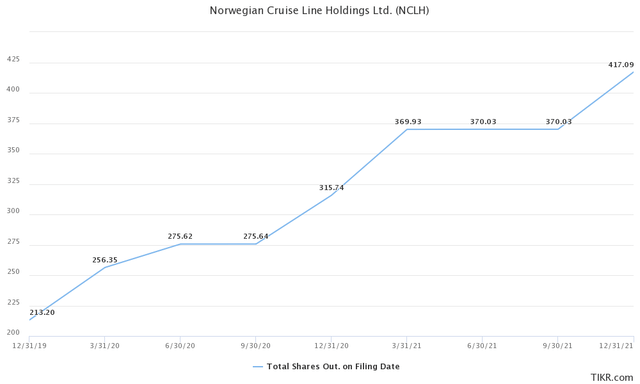

The reasonably unhappy actuality is that the corporate was displaying shrewd use of capital by executing well-coordinated share buyback applications within the pre-pandemic 2014-2019 interval. Throughout that point, the corporate lowered the variety of shares excellent to 212.7 million shares, all the best way down from 227 million earlier than the applications have been executed. Administration ended up shopping for again virtually 7% of the shares throughout these years.

On the finish of This autumn in 2019, the corporate had 213.20 million shares excellent. That quantity has elevated to greater than 419.09 million shares through the firm’s pursuit of capital within the pandemic. Whole shares excellent have elevated by virtually 206 million. With some back-of-the-paper math, if we assume that the typical share value was round $20, we are able to conclude that the corporate raised greater than $4.1 billion by way of fairness financing.

Shares Excellent (TIKR)

The impact of fairness financing is arguably much more damaging to the long-term prospects of the corporate than the rise in debt. Nonetheless, one may say that administration’s arms have been tied right here and that that they had no different actual options. Moreover, their competitors appears to have largely achieved the identical, as was the case with the likes of Carnival Cruise Traces (CCL) and Royal Caribbean (RCL).

Nevertheless, if we evaluate the quantity of dilution that has taken place in the remainder of the business, we are able to conclude that Norwegian’s administration relied on fairness finance essentially the most. Up till at present, administration has diluted the shareholders by 95%. In different phrases, we’ve got twice as many Norwegian Cruise Traces shares as in comparison with the pre-pandemic ranges. The primary focus of administration within the subsequent a number of years ought to be the battle to deleverage the stability sheet, which means that there’s most likely going to be a very long time till some type of a significant buy-back program might be executed once more.

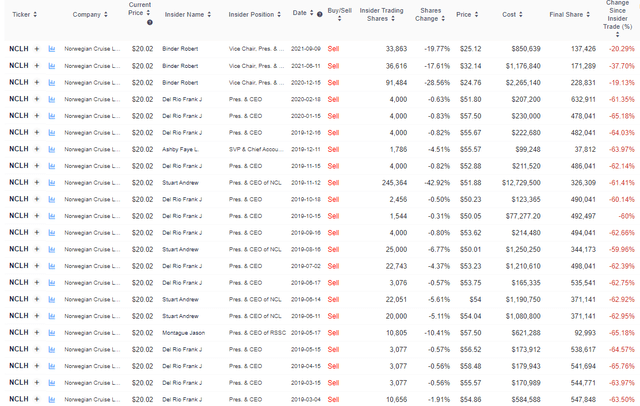

No vote of confidence by executives

A really attention-grabbing factor that we are able to witness when analyzing “post-pandemic” cruise shares is the insecurity by senior administration in future inventory efficiency. We’ve witnessed what I view as a really loud and noticeable lack of government insider purchases all through the sector, which is a message by itself.

All the line of Norwegian executives has achieved nothing however promote ever for the reason that pandemic hit. This comes throughout as considerably of a shock, contemplating that the inventory is priced at a big low cost of greater than 65% to pre-pandemic ranges.

Insider Trades (GuruFocus)

We are able to recall an attention-grabbing Peter Lynch quote at this level: “Insiders may promote their shares for any variety of causes, however they purchase them for just one: they suppose the worth will rise.” For my part, there is no such thing as a one with a greater perception and sharper outlook on the way forward for the enterprise apart from the executives and the remainder of the senior administration. The truth that nobody remains to be shopping for ought to be sending a robust message of no confidence in the way forward for the enterprise. Allow us to check out two instances of executives appearing otherwise.

Again in 2021 when shareholders reacted negatively to the WarnerMedia spin-off announcement, AT&T’s John Stankey determined to purchase again $1 million value of shares of the corporate in an enormous vote of confidence. In the same nature, after shares of Wells Fargo (WFC) fell greater than 40% in 2020, the brand new CEO Charles Scharf purchased virtually $5 million value of shares of the corporate. Shares of his firm later greater than doubled. If one believes {that a} turnaround is across the nook, there is no such thing as a higher technique to convey that to the shareholders apart from to get pores and skin within the recreation.

Some ultimate ideas and conclusions

The cruise operators have most likely gotten the worst deal of the pandemic out of all the journey and leisure companies. Unrelated to their precise monetary power and efficiency, they have been all thrown underneath the bus by being unable to function their cruise empire and burning money within the meantime. Firms have been consequently compelled to depend on debt and fairness financing, utterly wrecking their stability sheets within the course of and making them look reasonably borderline uninvestable.

Whereas it’s the reality that this case is priced right into a sure extent, I might argue {that a} 65% low cost from the pre-pandemic highs is just not sufficient to account for doubling each the debt and shares excellent of the enterprise. The debt has not solely gotten greater, but in addition dearer, and as such it can show more and more troublesome to be managed over the course of the subsequent a number of years, creating extra complications for administration and shareholders alike.

That is all underneath the presumption that the corporate will set up some type of pre-pandemic monetary success within the subsequent 3-5 quarters. On reflection, the shareholders that jumped off the decks as quickly because the pandemic hit do appear to have gotten the perfect or no less than the least painful deal. It could not be unreasonable to imagine that the inventory goes to recuperate barely because the macroeconomic headwinds clear and the primary good outcomes begin piling in; nevertheless, the actual query is what occurs subsequent? In the long run, I might argue that this can be a essentially flawed enterprise that has little to supply to potential traders.