sasirin pamai/iStock via Getty Images

After a slight delay caused by a very busy results season, here at last is the second edition of my Top 40 list of UK dividend stocks.

You can see the full list at the bottom of this post, but first, let’s get the big caveat out of the way:

This is a mechanical list that ranks FTSE 350 stocks by a combination of their market capitalisation (bigger is better) and forecast dividend yield (higher is better). It says nothing about my like or dislike of any particular stock, or whether you should or shouldn’t invest in them. It is simply an easy way to answer the question, “which dividend stock should I look at next?”

Much has changed since the last update in September, with banks now hogging many of the top spots.

High-yield banks and another banking crisis

Bank shares have gone down in the last couple of weeks and their dividend yields have gone up, because (as I’m sure you already know) several banks have recently failed:

Banks now make up four of the top 12 dividend stocks and life insurers another three, so financial stocks make up more than half of the top dozen UK dividend stocks.

To some extent, this isn’t a surprise, because UK financial stocks have been out of favour for years, but the level of negativity towards these companies is now extreme.

Number one on my top 40 list is HSBC (HSBC, OTCPK:HBCYF), with a market cap of £111 billion and a massive forecast yield of 8.7% (according to SharePad).

NatWest (NWG, OTCPK:RBSPF) is number nine, with a forecast yield of 6.6% and Barclays (BCS) is number ten with a 6.4% forecast yield. Lloyds (LYG, OTCPK:LLDTF) rounds out the top dozen dividend stocks with a forecast yield of 6%.

Those are all very attractive yields and although I haven’t looked at those companies in detail, if you’re comfortable investing in banks, then they could well be worth a look.

As I’ve already mentioned, life insurers are also very much out of favour. Whether that’s the LDI crisis or something else, I don’t know, but their yields are very enticing.

Legal & General (OTCPK:LGGNY, OTCPK:LGGNF) is the highest-ranking life insurer with a somewhat unbelievable 9% forecast dividend yield. L&G has been in the UK Dividend Stocks Portfolio since 2017 so I know the company quite well, and my opinion is that L&G’s dividend should be sustainable (although of course, dividends are never guaranteed).

The other two life insurers are Aviva (OTCPK:AIVAF, OTCPK:AVVIY) and Phoenix (OTCPK:PNXGF), with respective forecast yields of 8.2% and 9.4%. Those yields are so high that the market must be expecting dividend cuts at the very least, but if those cuts don’t materialise, these stocks could be very attractively priced.

Everyone hates tobacco stocks, for obvious reasons

Tobacco stocks operate in a structurally declining market and they have long been socially stigmatised, so the fact that they are out of favour in a world that is increasingly interested in “socially useful” investments is no surprise.

That’s why both of the UK’s big tobacco stocks, British American Tobacco (BTI, OTCPK:BTAFF) and Imperial Brands (OTCQX:IMBBY, OTCQX:IMBBF), are comfortably within the top ten dividend stocks.

British American Tobacco has a forecast yield of 8.3%, which is good because it’s one of the larger holdings in my portfolio.

In terms of ethics, my opinion is that as long as people know the risks then they should be allowed to smoke, ride a motorbike or go bungee jumping, so if smoking is legal then I have no moral qualms about investing in tobacco stocks.

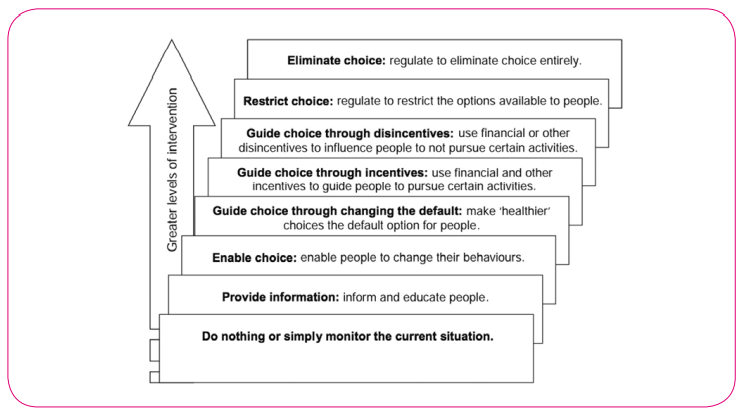

If anything, I am more concerned about the government’s increasing use of nudge economics, where the government manipulates the behaviour of citizens in ways the government thinks will improve our lives.

This implies that people are incapable of making their own decisions about smoking, drinking sugary drinks, and living their lives in general and that we need a wise and benevolent government to help us make these decisions. This infantilises society (the language used to describe these nudges ranges from “smacks” to “hugs”) and is not a good path to go down, but I’ll leave that rant for another day.

Source: Changing Behaviours – To Nudge or to Shove? (PDF)

As for tobacco stocks, British American Tobacco has done an amazing job of scaling up its post-cigarette brands Vuse and Glo, and they are on schedule to break even in 2024. And with momentum building in its post-nicotine ventures, including vaccine production and cannabis-derived products, the future could be bright for this company (although I expect a change of name at some point).

The UK is one of the most attractive dividend-focused stock markets on the planet

The FTSE All-Share has been out of favour with investors for more than a decade, thanks to the financial crisis, the Eurozone crisis, Brexit, Covid, and the long-running UK housing bubble, where houses have become an important pension investment rather than stocks.

This has left the FTSE All-Share with embarrassingly terrible capital gains over the last 20 years, but the good news is that for dividend investors, this is a golden age.

If you bought every one of the 40 stocks on this list and weighted them evenly, the resulting portfolio’s forecast yield would be astonishingly high at 6.8%. Of course, there’s more to dividend investing than simply looking at dividend yields, but to have such a high average yield across a collection of mostly multi-billion-pound companies is very unusual.

To some extent, we have the current economic malaise and now a banking crisis to thank for this, as the FTSE All-Share fell 7% last week as banks were going bust left, right, and centre. But it is at times like these that investors must remember these immortal words:

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold. When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons” – Warren Buffett

You can find the complete top 40 list of UK dividend stocks below.

| No. | Name (Links to Review) | EPIC | Index | Sector | Share Price | Forecast Yield (%) |

|---|---|---|---|---|---|---|

| 1 | HSBC Holdings plc (HSBC) | HSBA | FTSE 100 | Banks | £5.42 | 8.7 |

| 2 | Glencore plc (OTCPK:GLCNF) | GLEN | FTSE 100 | Industrial Metals and Mining | £4.33 | 11.0 |

| 3 | British American Tobacco p.l.c. (BTI) | BATS | FTSE 100 | Tobacco | £29.49 | 8.3 |

| 4 | Vodafone Group PLC (VOD) | VOD | FTSE 100 | Telecommunications Service Providers | £0.90 | 8.7 |

| 5 | Rio Tinto PLC (RIO) | RIO | FTSE 100 | Industrial Metals and Mining | £52.50 | 7.1 |

| 6 | Legal & General Group Plc (OTCPK:LGGNY) | LGEN | FTSE 100 | Life Insurance | £2.27 | 9.0 |

| 7 | Imperial Brands PLC (OTCQX:IMBBY) | IMB | FTSE 100 | Tobacco | £18.85 | 7.8 |

| 8 | Aviva PLC (OTCPK:AIVAF) | AV. | FTSE 100 | Life Insurance | £4.02 | 8.2 |

| 9 | NatWest Group PLC (NWG) | NWG | FTSE 100 | Banks | £2.58 | 6.6 |

| 10 | Barclays PLC (BCS) | BARC | FTSE 100 | Banks | £1.40 | 6.4 |

| 11 | Phoenix Group Holdings (OTCPK:PNXGF) | PHNX | FTSE 100 | Life Insurance | £5.59 | 9.4 |

| 12 | Lloyds Banking Group PLC (LYG) | LLOY | FTSE 100 | Banks | £0.46 | 6.0 |

| 13 | Anglo American PLC (OTCQX:AAUKF) | AAL | FTSE 100 | Industrial Metals and Mining | £25.04 | 5.7 |

| 14 | National Grid PLC (NGG) | NG. | FTSE 100 | Gas, Water and Multi-utilities | £10.39 | 5.3 |

| 15 | M&G PLC (OTCPK:MGPUF) | MNG | FTSE 100 | Investment Banking and Brokerage Services | £1.78 | 11.2 |

| 16 | BP PLC (BP) | BP. | FTSE 100 | Oil, Gas and Coal | £4.80 | 4.5 |

| 17 | SSE PLC (OTCPK:SSEZF) | SSE | FTSE 100 | Electricity | £16.98 | 5.6 |

| 18 | Shell PLC (SHEL) | SHEL | FTSE 100 | Oil, Gas and Coal | £22.14 | 4.3 |

| 19 | Taylor Wimpey PLC (OTCPK:TWODF) | TW. | FTSE 100 | Household Goods and Home Construction | £1.14 | 8.4 |

| 20 | Barratt Developments PLC (OTCPK:BTDPF) | BDEV | FTSE 100 | Household Goods and Home Construction | £4.33 | 7.8 |

| 21 | Admiral Group PLC (OTCPK:AMIGF) | ADM | FTSE 100 | Non-life Insurance | £19.15 | 6.5 |

| 22 | abrdn PLC (OTCPK:SLFPF) | ABDN | FTSE 100 | Investment Banking and Brokerage Services | £1.99 | 7.3 |

| 23 | GSK PLC (GSK) | GSK | FTSE 100 | Pharmaceuticals, Biotechnology and Marijuana Producers | £14.01 | 4.0 |

| 24 | Unilever PLC (UL) | ULVR | FTSE 100 | Personal Care, Drug and Grocery Stores | £40.48 | 3.8 |

| 25 | Vistry Group PLC (OTCPK:BVHMF, OTCPK:BVHMY) | VTY | FTSE 250 | Household Goods and Home Construction | £7.31 | 9.0 |

| 26 | Schroders PLC (OTCPK:SHNWF) | SDR | FTSE 100 | Investment Banking and Brokerage Services | £4.41 | 4.9 |

| 27 | Tesco PLC (OTCPK:TSCDF) | TSCO | FTSE 100 | Personal Care, Drug and Grocery Stores | £2.47 | 4.3 |

| 28 | DS Smith PLC (OTCPK:DITHF, OTCPK:DSSMY) | SMDS | FTSE 100 | General Industrials | £3.03 | 6.2 |

| 29 | WPP Group PLC (WPP) | WPP | FTSE 100 | Media | £9.16 | 4.5 |

| 30 | Sainsbury (J) PLC (OTCQX:JSNSF) | SBRY | FTSE 100 | Personal Care, Drug and Grocery Stores | £2.49 | 5.3 |

| 31 | St James’s Place PLC (OTCPK:STJPF) | STJ | FTSE 100 | Investment Banking and Brokerage Services | £11.41 | 4.9 |

| 32 | Intermediate Capital Group PLC (OTCPK:ICGUF) | ICP | FTSE 250 | Investment Banking and Brokerage Services | £11.57 | 7.0 |

| 33 | Smurfit Kappa Group PLC (OTCPK:SMFTF) | SKG | FTSE 100 | General Industrials | £28.27 | 4.7 |

| 34 | Direct Line Insurance Group PLC (OTCPK:DIISF) | DLG | FTSE 250 | Non-life Insurance | £1.52 | 8.4 |

| 35 | Investec PLC (OTCPK:IVTJF, OTCPK:ITCFY, OTCPK:IVTJY) | INVP | FTSE 250 | Banks | £4.40 | 6.8 |

| 36 | Persimmon PLC (OTCPK:PSMMF) | PSN | FTSE 100 | Household Goods and Home Construction | £12.11 | 6.0 |

| 37 | Mondi PLC (OTCPK:MONDF) | MNDI | FTSE 100 | General Industrials | £12.66 | 4.7 |

| 38 | Harbour Energy PLC (OTCPK:PMOIF, OTCPK:HBRIY, OTCPK:PMOID) | HBR | FTSE 250 | Oil, Gas and Coal | £2.48 | 8.1 |

| 39 | OSB Group PLC | OSB | FTSE 250 | Finance and Credit Services | £4.90 | 7.9 |

| 40 | IG Group Holdings PLC (OTCPK:IGGHY, OTCPK:IGGRF) | IGG | FTSE 250 | Investment Banking and Brokerage Services | £6.74 | 6.8 |

I’ll publish the next top 40 review at some point during the summer and my next blog post will be a round-up of the recent 2022 results season.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.