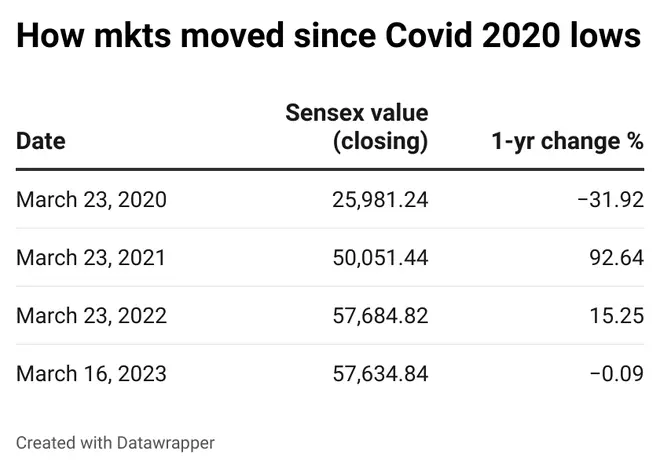

Fears of calamitous damage ahead of the world’s largest coronavirus lockdown had brought the Indian stock markets to its knees after the worst single-day rout in history on March 23, 2020. The Sensex had closed at 25,981.24 that day as selling frenzy gripped D-Street amid shuttered shops, empty train tracks, closed airports and idled factories in an already sputtering economy. That was three years ago.

Over the course of 740 trading sessions since then, the Sensex not just recovered the losses, but hit new highs as Indian equity markets added Rs 130 lakh crore to investors’ wealth kitty. That’s a frenetic pace of ₹17,500 crore each day m-cap added or ₹50 crore per minute. If you went by Warren Buffett’s adage of being greedy when others are fearful, there is a 97 per cent chance (438 of 451 stocks of BSE 500) that your stock buys have given your handsome returns till date, with the best ones growing 10-to 50-fold!. Stocks belonging to Industrials, Metal, Power, Infrastructure and Auto — the same set that were hit the hardest during the Covid-19 crash — have led the phoenix-like rise.

Decoding crash to cash

In the run-up to March 23 of 2020, markets had crashed 35 per cent in just about a month. Since the initial reaction to the 20-nanometre virus from equity market was purely based on panic., the bulls quickly turned the tables on bears when the tide turned.

During March 23, 2020 – March 23, 2021 period, the Sensex nearly doubled (up 92 per cent), with almost all the stocks of BSE 500 making spirited gains and adding over ₹95-lakh crore investor wealth. During March 23, 2021 to March 23, 2022, the 30-share bluechip benchmark consolidated gains (up 15 per cent) as another ₹40-lakh crore was added to investors’ kitty.

The momentum lost lustre thereafter, as in the next year i.e. March 23, 2022 to March 16, 2023 (latest prices), investor wealth was stagnant, with the number of gainers and losers locked at 50:50 amid rising global interest rates.

Winning stocks, sectors

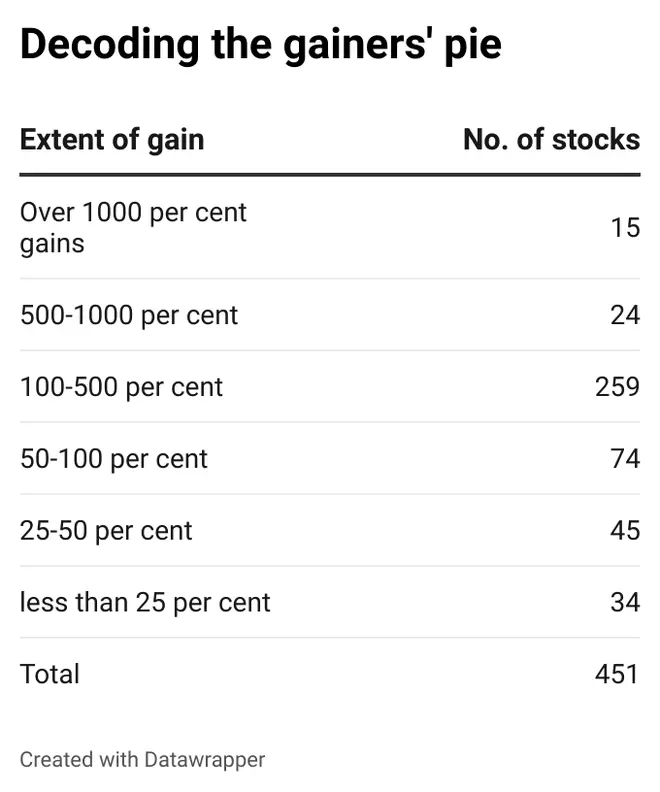

Overall for the three years, as many as 15 stocks gave over 1000 per cent returns, 24 clocked between 500 and 1,000 per cent gains and more than 250 stocks returned between 100 and 500 per cent.

The best-performing stocks list is led by Lloyds Metals (up 5400 per cent), CG Power (5100 per cent), Tata Tele. Mah. (2850 per cent), KPIT Technologies (1910 per cent), Tejas Networks (1630 per cent), Adani Enterprises (1390 per cent), Poonawalla Finance (1370 per cent), Tanla Platforms (1368 per cent), Jindal Stainless (1280 per cent) and Borosil Renewables (1250 per cent). Barring Adani Enterprises, the rest are from the long mid and small-cap tail.

Reflecting the enthusiasm, BSE Smallcap index has moved up 3 times and BSE Midcap index 2.5 times since March 23, 2020. In comparison, large-cap dominated Sensex is up 2.2 times.

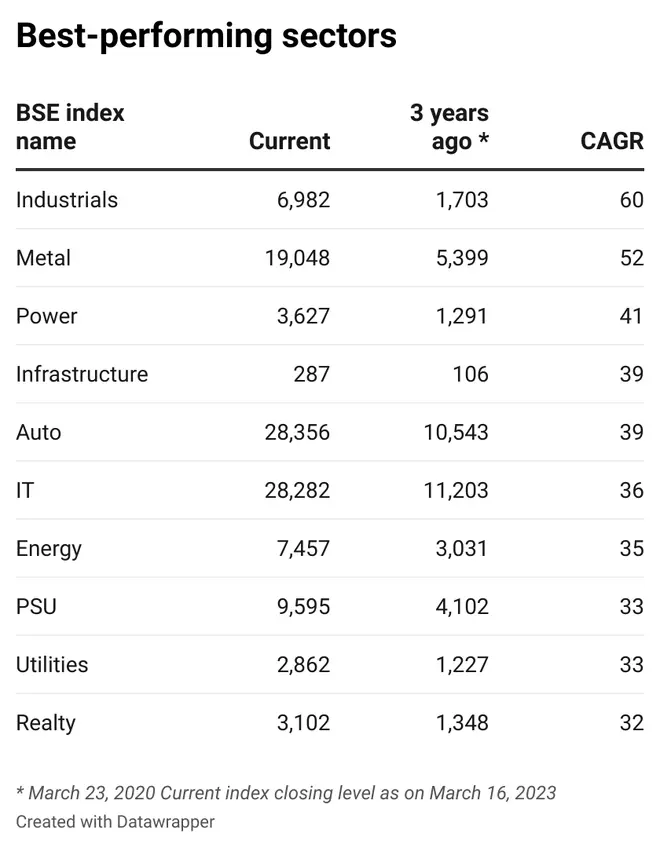

In terms of sectoral performance, BSE Industrials is the best-performing index quadrupling in these three years helped by gains in HAL, BEL, L&T and Siemens. BSE Metal is a close second having grown 3.5 times , aided by performance of JSW Steel, Hindalco and Tata Steel.

Next in the pecking order come Power, Infrastructure, Auto, IT, Energy, PSU, Utilities, Realty and Banking (Bankex) sectoral baskets.

Group hierarchy shuffle

The rally in Indian stocks from March 2020 lows has meant some fundamental changes in corporate group hierarchy by m-cap. Tatas (₹20.4-lakh crore), Mukesh Ambani (₹15.2-lakh crore) and HDFC (₹14.6-lakh crore) are the toppers and have clocked about 80-140 per cent total m-cap rise in these three years. Adani group (₹8.7-lakh crore), which had for sometime become No 2, is now back at 4th after the Hindenburg report caused volatility in stock prices. Still, Adani has moved up four places from 8th slot in March 2020 — thanks to over 400 per cent jump in group m-cap.

Notably, L&T group (nearly ₹5-lakh crore) has now become 7th, up three places, courtesy 245 per cent m-cap appreciation; while Kotak Mahindra group is now 10th even after growing m-cap by a decent 57 per cent. Overall, these 10 corporate groups now hold ₹91-lakh crore m-cap — a rise of 146 per cent compared with ₹36-lakh crore in March 2020.

At a broader level, State-owned companies have seen their m-cap rise by a massive ₹15.8-lakh crore (up 138 per cent) to ₹27.3-lakh crore, which beats any individual corporate group. PSU stocks have seen sharp re-rating in many sectors. A close second are MNCs with m-cap addition seen at ₹12.5-lakh crore (up 88 per cent) to ₹26.8-lakh crore.