FatCamera/E+ via Getty Images

Co-produced with Treading Softly.

When I go out and about, I love to watch how the world works. I like to take in all the available information and remain observant. Young children imagine that the food makes it to the shelves of their local store from some magical or ethereal location. They don’t understand how food goes from farm to store.

Likewise, we see branded gas stations, but rarely consider how gasoline makes it from ground to the pump.

Nothing makes me happier than being paid for both the exciting and mundane parts of life. I would invest in rain clouds if it meant I would get paid anytime it rains! As long as they had positive cashflow and steady dividend coverage!

So, when I visit the grocery store or fill my car’s tank with gasoline, I would like nothing more than for it to pay me back for my efforts.

Today, I want to cover two opportunities to make that happen for you.

Let’s dive in!

Pick #1: BGS Bond – 10% YTM

Inflation has hit the grocery store aisles exceptionally hard. Consumers are struggling with the rising prices, but few realize that the costs of getting those same items to the shelves have also become more expensive.

When we last covered B&G Foods, Inc. (BGS), we explained why we side-stepped the common shares and their attractive yield in favor of moving higher into the capital stack.

We outlined two significant risks – inflation costs and the likelihood of a common dividend cut. As we expected, BGS cut their common dividend heavily in November of 2022 to adjust their capital spending to more easily service debt. An unsustainable dividend proved to be unsustainable.

Their 4th quarter earnings, however, provided multiple glimmers of hope for a better future from our perspective.

The first significant positive was that their inflation-related price adjustments are starting to reach their bottom line and help restore BGS’s much-needed margins.

Q4 2022 generated $0.40 in adjusted diluted earnings per share vs. $0.39 in Q4 of 2021. This is a positive development from BGS’s price adjustments.

We do not hold the common shares, but we elected to climb higher into the capital stack and buy the BGS bond maturing in 2025 – the first debt demanded to be handled by management.

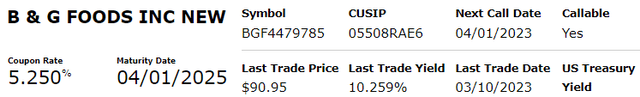

Finra – Morningstar

Currently, the pricing of this bond is identical for the most part to our last update on BGS, but the YTM is higher now because we’re closer to that date. The bond’s CUSIP is 05508RAE6.

Management is focused primarily on growing the core business of BGS and selling off lower margins, less in-focus assets. With this focus, BGS sold off “Back to Nature” snack brand. This transaction forced a $50 million prepayment on their floating rate term loan which matures in 2026.

BGS has an interest coverage ratio of 2.4x with their Adjusted EBITDA for the 2022 fiscal year. We are electing to use Adjusted EBITDA for this evaluation vs. EBITDA due to a large adjustment from a non-cashflow impairment applied due to the sale of “Back to Nature.”

This ratio should continue to improve as their debt is reduced overall but also negatively impacted by rising rates.

We continue to find the bond an attractive way to get income from everyday grocery purchases while sidestepping the drama of the common shares. BGS is continuing to evaluate additional divestitures to reduce its debt. Our bond holdings are callable at any time if BGS decides to tackle them in advance and the bond presents an attractive income for now and a long-term upside in 2025 at the latest.

Pick #2: CAPL – Yield 9.8%

CrossAmerica Partners LP (CAPL) is the smallest of the “big 3” fuel distributors and one we’ve been closely watching for a while now.

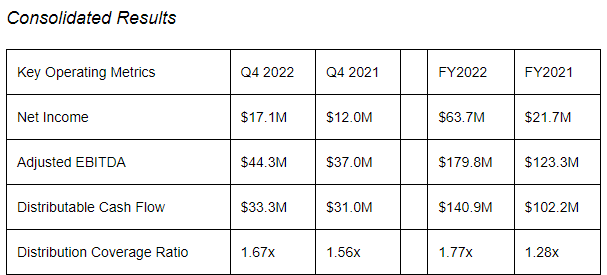

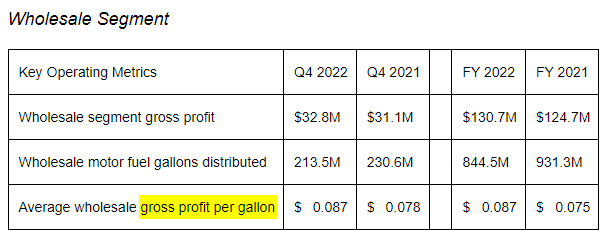

When we look at CAPL, we find its large and generous yield of 9.7% attractive, so we’re not looking for growth but sustainability. Thankfully, this has been CAPL’s major focus throughout 2022 as well. We can see that CAPL outperforms 2021 on every key metric, both quarterly and annually: Source.

CAPL Earning Release

Their coverage for Q4 of 2022 improved compared to Q4 of 2021 by 0.11x, an impressive gain, and the total year coverage improved by 0.49x – which is even more impressive. As coverage increases, so should one’s confidence in the surety of their distribution.

Fuel distribution and convenience store operation suffers from seasonality. This means Q2 and Q3 are usually exceptionally strong, while Q1 and Q4 are weaker. This is due to “travel season,” where consumers are more likely to hit the road in the spring and summer months than they would in the colder months.

CAPL is more strongly exposed to this seasonality than their peers Sunoco LP (SUN) and Global Partners LP (GLP) because CAPL is strictly focused on fuel distribution, while SUN and GLP have gained exposure to more “traditional” midstream assets.

The key metric to watch and understand in 2023 for CAPL will be its cents per gallon profit margin:

CAPL Earning Release

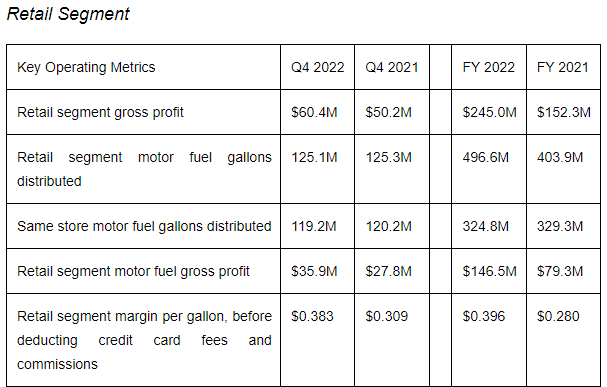

We are seeing highly elevated gross profit margins compared to prior years. This is due to all the economic and global uncertainty throughout 2022. GLP’s management team highlighted that their profit margins have moved back to historical trends, which were last seen in 2021; CAPL will not be immune to this trend. Likewise, in their retail segment, CAPL saw elevated profit margins as well:

CAPL Earning Release

This will reduce their bottom line profit in 2023 as their quarterly earnings are released and will reduce their distribution coverage ratio.

We do not foresee a distribution cut in 2023, but year-over-year comparisons will appear negative as comparing a “normal” year vs. a “record” year.

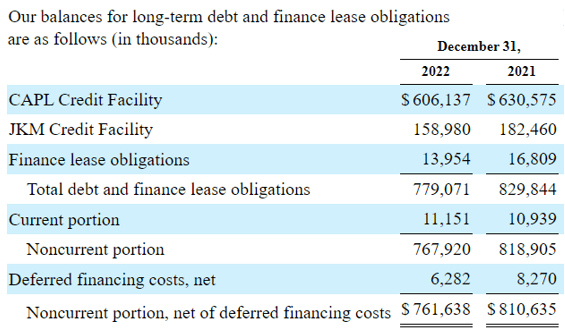

The other key metric to check up on CAPL is its debt ratio. Taking CAPL’s blended aggregate leverage ratio into consideration, when we last covered CAPL, their ratio was sitting at 4.85x, and they ended 2022 sitting at 3.9x. This is a continued positive trend. CAPL maintains a goal to have 4x or lower leverage ratio, so they are currently at the high side of their target. Source.

CAPL 10-K Q4 2022

The key to keeping this metric at acceptable targets is the continued reduction of their long-term debt. When we last covered CAPL in August 2022, their total debt stood at around $788 million; currently, it is down to $761 million. We’d like to see CAPL continue to reduce their debt as they see pressures on their profit margins as they normalize. Management has been very proactive in this area, and we are pleased with this focus.

With CAPL, we can enjoy a high yield and clear focus by management on reducing debt while improving coverage of the distribution they are paying out. I’ll happily collect my 9.8% and enjoy watching them progress on their goals.

We all need to drive to work, to the store, or to visit family. I’d like the pump to pay me back, and with CAPL, it does!

Note: CAPL issues a K-1 at tax time.

Conclusion

While I cannot invest in rainclouds, I can invest in CAPL and the 2025 bond offered by BGS to unlock income from everyday life essentials. I get paid by the gas pump, I get paid by my frozen veggies and cooking oil.

Both companies highlighted today are focused on reducing their overall debt or leverage profile to the benefit of specific classes of stakeholders. BGS is trying to manage their debt in a way that benefits their bondholders first and foremost. CAPL is focusing on reducing their debt ratios to maintain their target ratios which benefits their common unitholders.

I like when a management team works towards my benefit, all while paying me handsomely for being a stakeholder in their business. That way, my retirement is one which sees dividends raining into my account on a regular basis and washing away my expenses in a deluge of income.

Sounds great, doesn’t it?