AleksandarNakic/E+ via Getty Images

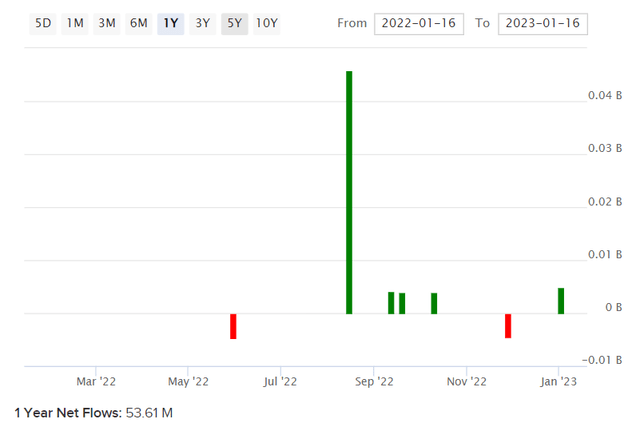

iShares MSCI Denmark Capped ETF (BATS:EDEN) is an exchange-traded fund that provides investors with exposure to Danish equities. The fund had $219.5 million in net assets under management as of January 13, 2023, with an expense ratio of 0.53%. That makes the fund relatively unpopular, although net assets have at least firmly climbed over the past year or so (see below).

ETFDB.com

The fund seeks to track the performance of its chosen benchmark index, the MSCI Denmark IMI 25/50 Index. This is a capped version of the primary MSCI Denmark index; a cursory glance tells us that Novo Nordisk A/S (NVO) would represent roughly 53% of the portfolio as of December 30, 2022, if it were not for capping the largest holding to 25%. Instead, NVO stock represents 24.23% of the fund (as of January 13, 2023). Evidently NVO has continued to budge up against this limiting factor.

Novo Nordisk is a Danish multinational pharmaceutical company. The company manufactures and markets a range of pharmaceutical products, specifically diabetes care medications and devices (among other products, including hemostasis management and hormone therapies). The large holding is not inherently “bad”, but it presents a risk to the portfolio in some sense. Having said that, “health care” as a sector is fairly defensive, and it is unlikely that NVO presents any idiosyncratic risks beyond its mere mathematical significance to EDEN’s portfolio.

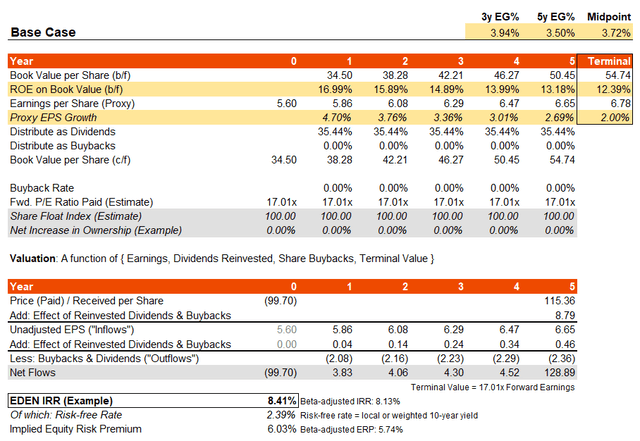

Referencing Morningstar’s data in respect of EDEN’s portfolio as of January 13, 2023: the fund’s forward price/earnings ratio was approximately 17.01x, with a price/book ratio of 2.89x. iShares themselves reported, as of the same date, a trailing price/earnings ratio of 17.81x. So, the difference suggests a fairly modest forward one-year earnings growth rate of 4.70%. However, Morningstar also report a three- to five-year earnings growth rate of 11.38% on average, which is a fairly tall order, implying accelerating earnings growth.

It is interesting that it was only December 2021 that Denmark had a negative-yielding 10-year bond yield. However, more recently this has risen to 2.39% (as of the time of writing), hence the local risk-free rate has risen considerably. More fortunately, per Professor Damodaran’s work, Denmark does not deserve an additional country risk premium, since it is considered a developed market with no especial risk (pertaining to equity investing). Therefore, we can fall back on mature market equity risk premiums, which tend to fall in the range of circa 4.2-5.5% at most (sometimes less, such as in healthy bull markets).

If the 10-year yield offers some kind of indication as to mature earnings growth rates, one could potentially take a “pessimistic” view of the next five years or so, with a three- to five-year earnings growth rate of 3.50-3.94% (as in my case), which would take our terminal year six to earnings growth of about 2%. Assuming a similar dividend distribution rate of about 35% as on a trailing basis, and no share buybacks for the moment, I find an IRR potential of circa 8.41%. This would reflect an underlying equity risk premium of 6.03%, or 5.74% on a beta-adjusted basis.

Author’s Calculations

The return on equity falls from about 17% to 12.4% in my calculations here, which is possibly pessimistic too. In spite of that possibly negative view, the IRR is healthy. The headline IRR may not be “high” in absolute terms, but given low local risk-free rates, there is a healthy beta-adjusted ERP here. That would suggest under-valuation. Factoring in the effect of buybacks would enhance the possible IRR in theory, and this is helped by the shares being apparently undervalued too.

What about the forward earnings multiple? Currently it is 17.01x, but could this fall by the terminal year? Well, assume that the 10-year holds at 2%, which is not difficult to imagine, as it would suggest very low real interest rates in the long run (assuming developed-world central banks continue to set 2% as their inflation targets). With an ERP of 4.2%, that would suggest a long-term cost of equity of circa 6.2% altogether. Subtracting long-term earnings growth of at least 2%, takes you to a forward earnings multiple of 23.81x. Therefore, if anything, you could see earnings multiple expansion here too.

Bear in mind EDEN’s portfolio is concentrated, with just under 50 holdings in total. Nevertheless, it would seem like a safe and defensive European equity portfolio with a natural USD-diversifier (the fund’s underlying holdings are domestically denominated in Danish krone). The Danish krone is also probably undervalued, giving a surging current account. Giving the fund the benefit of the doubt of earnings multiple expansion to 20x by year 5 gives you an IRR of 11.45%, with a very large beta-adjusted ERP of about 8.63%. My calculations are after considering the expense ratio of 0.53%, too.

In short, while EDEN is an unpopular fund, it is undervalued, and probably deserves more attention. It is rare that you find a portfolio that is both cheap in fixed FX terms and even cheap in FX-adjusted terms.