gorodenkoff/iStock via Getty Images

Even after a steep crash from all-time highs, Datadog (NASDAQ:DDOG) still trades at premium valuations. DDOG traded at extreme valuations at the peak and has still maintained a premium relative to tech peers. That premium, at least in part, looks justified due to the company’s resilient growth rates amidst a tough macro backdrop, as well as the company’s strong free cash flow generation. The company also maintains a net cash balance sheet and with the company’s business tied to the growth of data, there appears to be greater visibility into the long-term viability of the business. Investors looking for a financially less risky way to invest amidst the tech crash may find DDOG attractive, though they may have to pay up for the name.

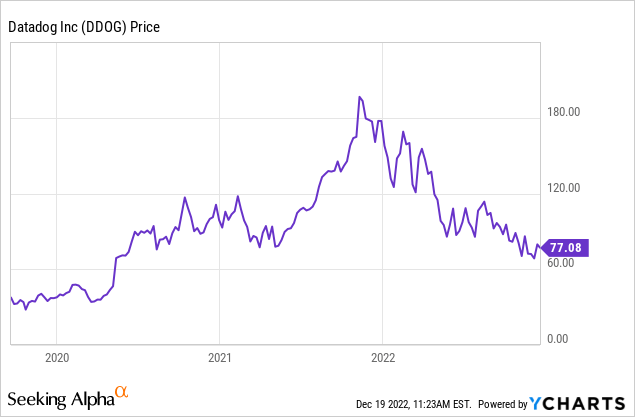

DDOG Stock Price

DDOG peaked close to $200 per share in late 2021 before it all came crashing down. The stock recently traded just below $80 per share. Even after the fall, DDOG still does not look obviously cheap.

I last covered DDOG in September where I discussed how the company’s strong growth profile, high cash flow generation, and net cash balance sheet offset the stock’s high valuation. The stock has dipped around 10% since then, helping somewhat to address valuation concerns.

DDOG Stock Key Metrics

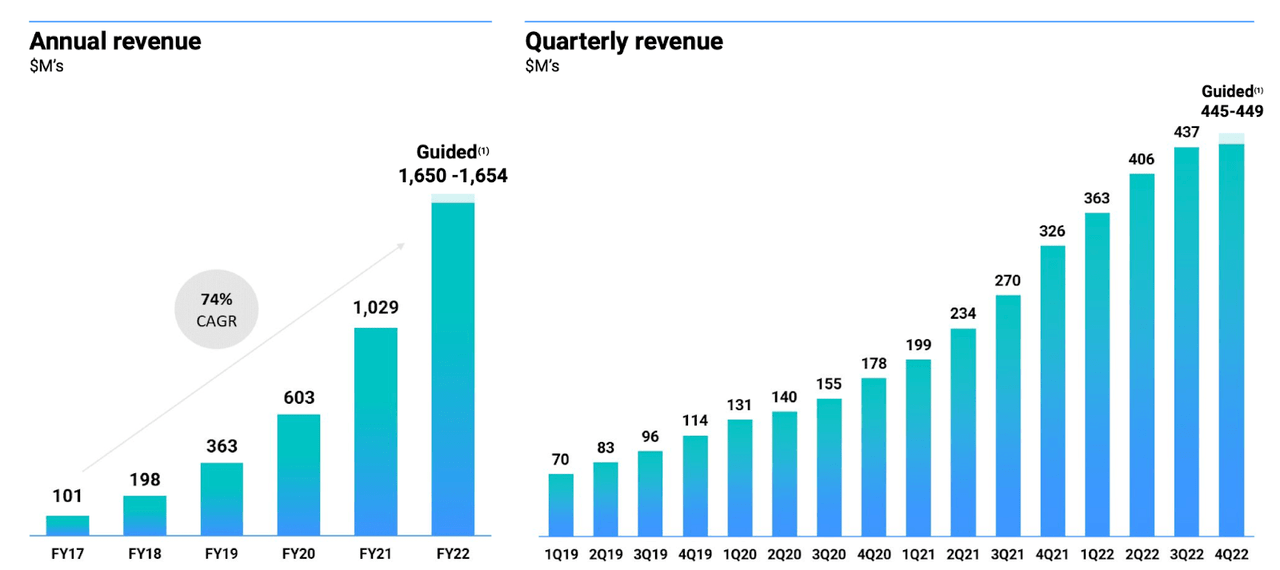

DDOG continued to deliver rapid growth in the latest quarter, with revenue growing 61.4% to $437 million. DDOG had previously guided to just $414 million in revenue.

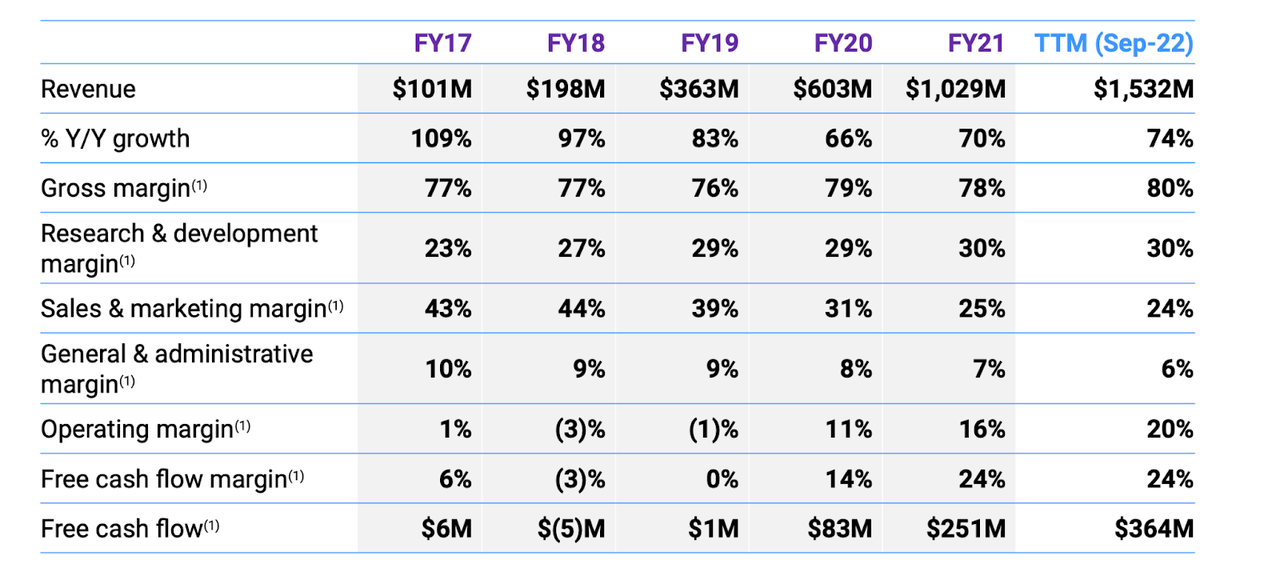

2022 Q3 Presentation

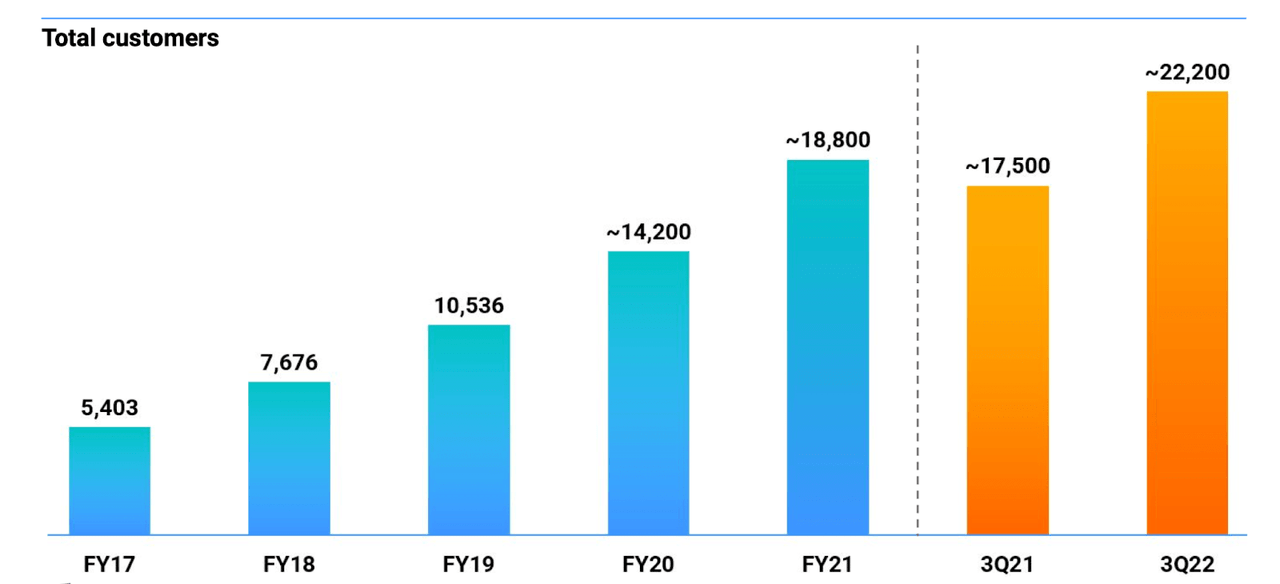

DDOG continued to increase its long-term growth profile as it added new customers.

2022 Q3 Presentation

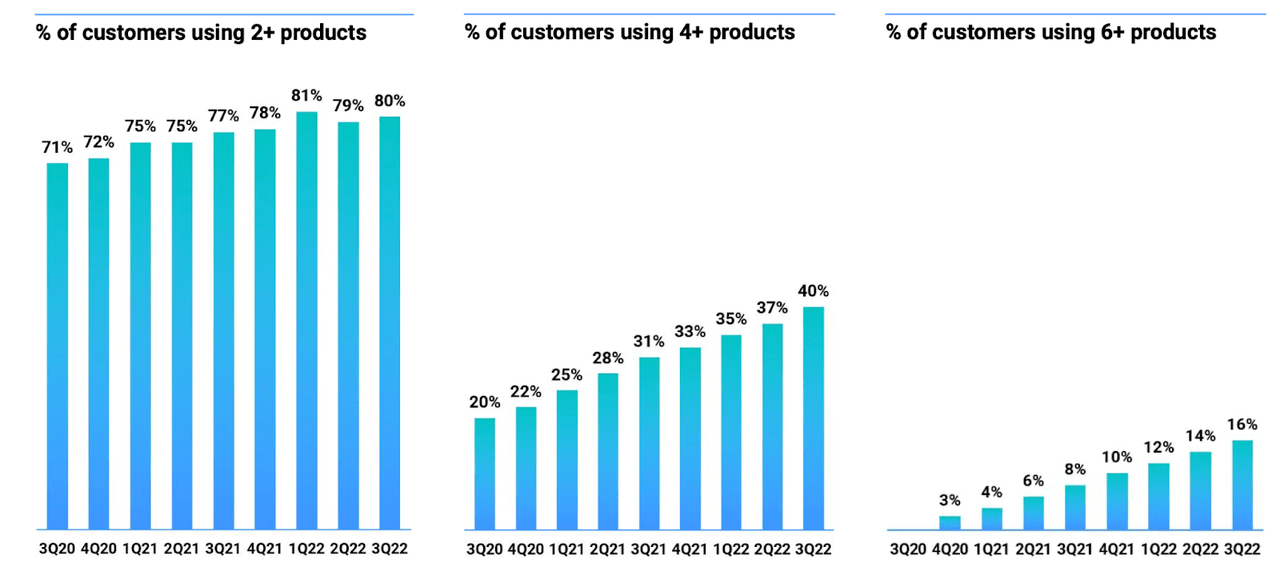

In the near term, I expect much of the growth to come from existing customers, as DDOG has historically done a good job cross-selling new product. In fact, DDOG generated over 130% net dollar retention in the quarter.

2022 Q3 Presentation

On the conference call, management noted that they did feel some effect from the macro environment as customer usage growth remained at levels “similar to Q2.” I doubt many investors will complain about these results and may even be thinking that the results could have been even better absent the tough market environment.

Those are already strong results but this is a name in which one does not have to sacrifice on profitability for growth. DDOG generated $67.1 million in free cash flow in the quarter and has generated a 24% FCF margin over the trailing twelve months, continuing a track record of increasing FCF margins.

2022 Q3 Presentation

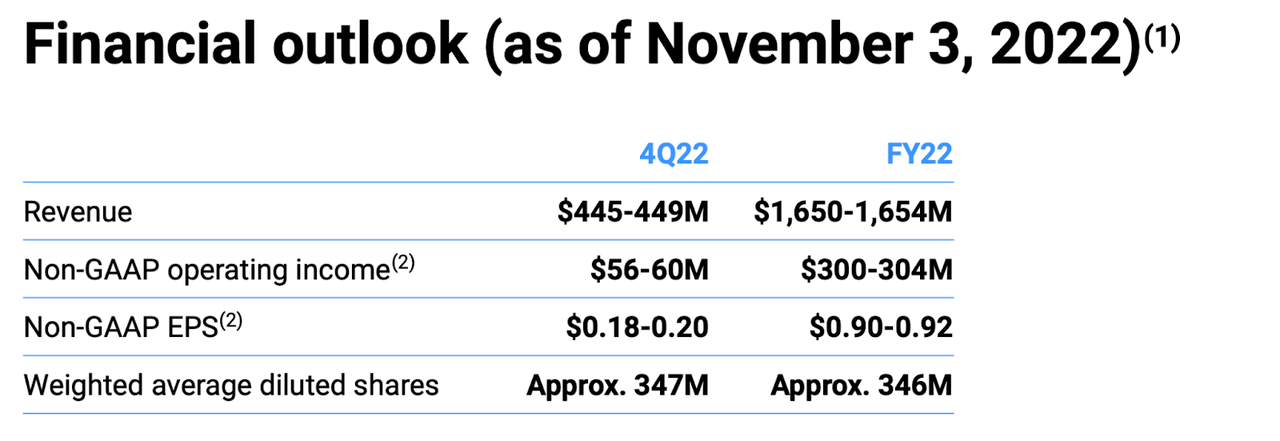

Looking ahead, DDOG guided for $1.654 billion in full year revenues – the prior outlook called for $1.63 billion in revenue. Excluding the third quarter beat, that raise reflected just a $1 million bump, but nonetheless it is still impressive that DDOG continues to beat and raise guidance even in the face of a tough macro environment.

2022 Q3 Presentation

DDOG ended the quarter with $1.8 billion cash versus $738 million in convertible notes, reflecting a strong balance sheet position.

Is DDOG Stock A Buy, Sell, Or Hold?

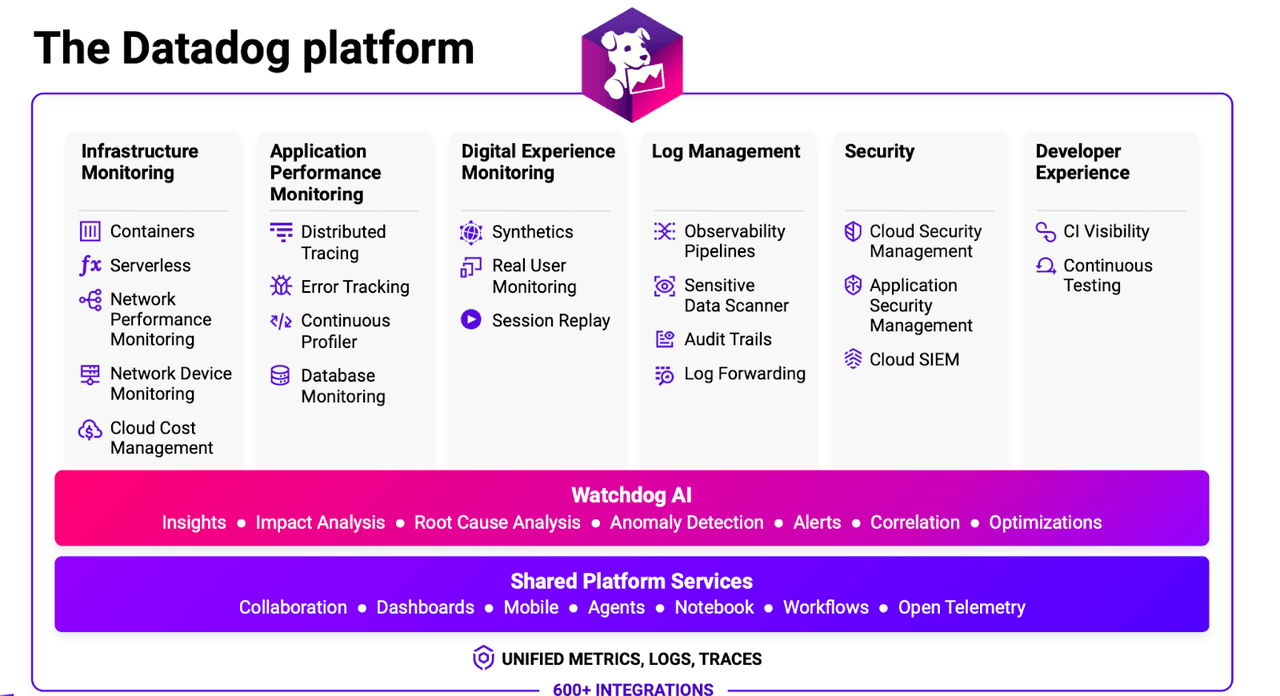

DDOG offers a complete data observability platform, helping its customers take advantage of the growth of data.

2022 Q3 Presentation

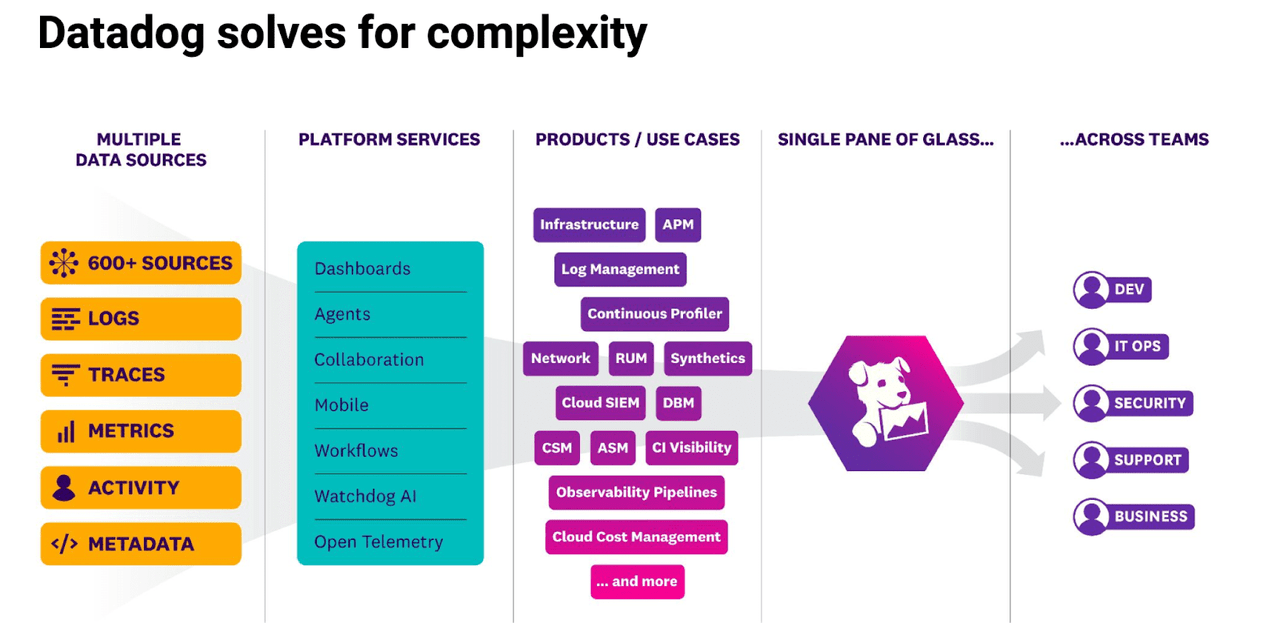

DDOG enables its customers to monitor data performance from various data sources, across various use cases and across teams.

2022 Q3 Presentation

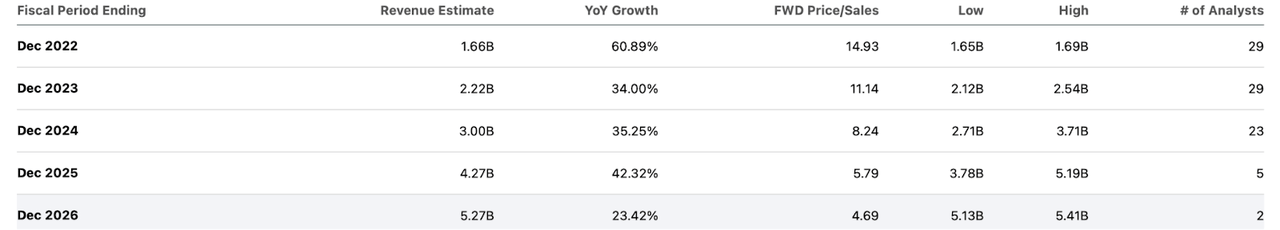

DDOG is similar to tech peer Snowflake (SNOW) in that it represents a direct investment on the growth of data. That attractive secular growth story has also made it similar to SNOW in that it has sustained a rich valuation, with the stock trading at 15x this year’s sales.

Seeking Alpha

Assuming 30% growth exiting 2024, 30% long term net margins and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see DDOG trading at 13.5x sales in 2024, representing a stock price of $126 per share. That reflects 28% compounded annual returns over the next two years. That would be more than enough to beat the broader market, but it reflects rather aggressive assumptions regarding multiple expansion, and some readers may point out that cheaper tech peers may be offering comparable returns even without similar multiple expansion assumptions. Yet DDOG’s premium valuation is not justified only by the story – the company has also shown strong execution in sustaining rapid growth rates, maintains a net cash balance sheet, and is flowing cash.

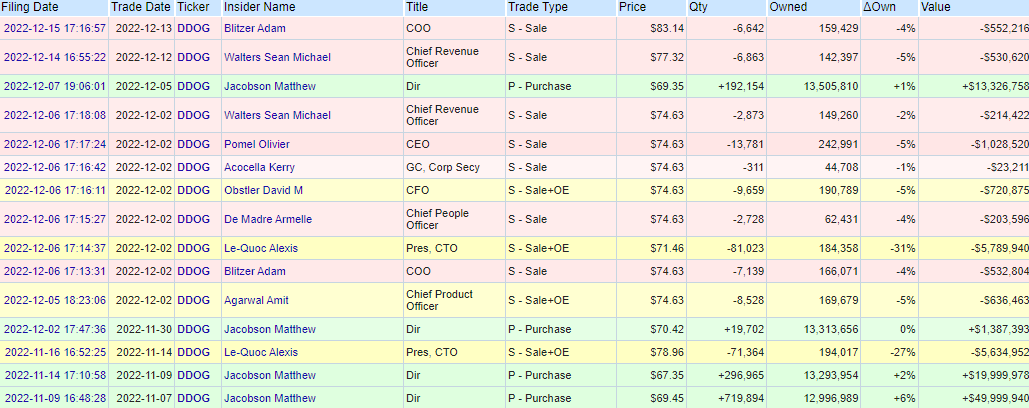

I should note that one director, Matthew Jacobson, has been buying the stock in big amounts recently.

Openinsider.com

Insider buying can often be construed as a bullish signal, but in this case, readers should temper expectations. While the large purchase sizes are a positive factor, the fact that only one insider is buying (not only that, but other insiders are selling) dampens my enthusiasm.

What are the key risks here? Valuation stands first and foremost. Sentiment can be fickle – there is the possibility that if DDOG misses guidance, or even just fails to beat and raise enough to satisfy Wall Street, then the stock may experience significant multiple compression. I estimate that DDOG can fall at least 30% and still trade at some premium to peers on a growth adjusted basis. Another risk is that of competition. Data observability is a competitive market with strong competitors like Dynatrace (DT). It is possible that competition eventually leads to growth rates compressing meaningfully. The current macro environment may also lead to downside surprises. While enterprise tech has shown great resilience over the past few quarters, it is possible that customers eventually pull back on spending, even with regards to data. That would throw a wrench into the growth of data thesis and, as discussed above, likely lead to significant multiple compression. As discussed with subscribers to Best of Breed Growth Stocks, I view a portfolio of undervalued tech stocks as being an ideal strategy to take advantage of the tech stock crash. DDOG can fit in with such a basket as a higher quality play, though I note that I find the cheaper tech peers to offer greater return upside from here.

.png?rect=0%2C25%2C666%2C350&w=1200&auto=format%2Ccompress&ogImage=true)