by confoundedinterest17

This will be the last time (Fed rate hikes) as the US economy is forecast to either go into a recession in 2023 or slow down to an anemic 1.20% Real GDP YoY. Even the Fed is forecasting 3.10% core inflation in 2023, still higher than their target rate of 2%.

One of the sectors that is suffering is commercial real estate.

Commercial mortgage bonds could get clobbered in the coming months, and investors are backing away from the securities.

Some $34 billion of the bonds come due in 2023, and refinancing property loans is difficult now. Property prices could fall 10% to 15% next year, according to JPMorgan Chase & Co. strategists. And some types of properties seem particularly vulnerable as, for example, city workers are slow to come back to their offices full time.

That may be why spreads on BBB commercial mortgage bonds have widened by about 2.7 percentage points this year through Thursday to around 6.6%, for the securities without government backing. They are now at their widest since January 2021. They’ve been getting hit particularly hard in the last few months, even as risk premiums on investment-grade and high-yield corporates have been shrinking on hopes the Federal Reserve will scale back its tightening campaign.

“For CMBS investors, there’s lots of uncertainty, especially around whether maturing loans are going to get refinanced or not, and if not, what the resolution will be,” said David Goodson, head of securitized credit at Voya Investment Management, in an interview. “Layering in risk from lower office utilization makes the assessment even tougher.”

The trouble that the bonds face won’t necessarily translate to a surge in defaults in the near term, which is part of why betting against them is so difficult. When property owners can’t refinance mortgages that have been bundled into bonds, noteholders have a difficult choice to make. They can seize the buildings and liquidate them, or they can extend the debt and accept repayment later. They usually go for the second option.

Extending maturities allows bondholders to kick the can down the road and potentially recover more later, said Stav Gaon, head of securitized products research at Academy Securities. The question is whether properties have permanently lost value as, for example, people reorder their lives after the pandemic, or whether declines may be more temporary because of higher rates.

“Foreclosing on a loan, rather than granting an extension, can be really messy — that’s a lesson that was learned during the great financial crisis,” said Gaon. “The lenders also recognize that today’s higher interest rates are a very sudden development that many high-quality borrowers need time to adjust to.”

Some investors that are still buying are focusing on higher-quality borrowers and properties, that are likelier to withstand any downturn in real estate prices without having to seek extensions on loans.

“We think trophy properties will fare better due to better access to the debt markets, lower potential property declines, and a continued tenant flight to quality,” said Zach Winters, senior credit analyst at USAA Investments.

He acknowledges that this strategy isn’t always popular now, even if it turns out to make sense.

“When we go out and bid on a bond tied to a trophy office building now, usually the number of buyers is significantly less than before,” Winters said.

After the Pandemic

The market for commercial mortgage bonds without government backing was about $670 billion as of the end of 2021, and although the securities soared in the second half of 2020 as the Fed opened the money spigots, they’re facing more difficulty now. With office occupancy still below 50% in many cities as more people work from home, corporate buildings may see their values drop. Retail space is similarly under pressure as consumers have grown used to buying more online. And while travel volume is rising, many hotels are struggling to reach 2019 levels for room charges.

A survey of institutional real estate market professionals in November found that firms expect office values to fall about 10% next year, and overall commercial property declines of 5%, according to the Pension Real Estate Association.

The $34 billion of bonds due next year includes mostly fixed-rate CMBS bonds sold without government backing. It’s a steep increase from the $24.4 billion of such bonds maturing this year, according to Academy Securities.

There’s another $103 billion of a type of CMBS known as single-asset single-borrower bonds maturing next year, according to Academy — although most of that debt pile has a built-in contractual ability to extend loans, meaning they’ll be able to seek extensions more easily.

Next year won’t be the first time that CMBS bondholders and servicers have faced tough choices about whether to allow en masse extensions to the underlying borrowers. After the 2008 financial crisis, commercial property values plummeted and many lenders chose to give owners of those properties more time to pay back their loans. As a result they ended up getting more money back than if they’d immediately foreclosed on the loans and liquidated the properties, said Jeff Berenbaum, head of CMBS and agency CMBS strategy at Citigroup.

In terms of watchlisted CMBS loans, currently most of the USA is in the green (good) except for San Francisco, New Orleans, Memphis and Chicago all have elevated commercial loans on the watchlist (loans being watched for going late and into default). Puerto Rico is also in the red (>25%) watchlisted commercial loans, so I expect AOC to be asking for a bailout.

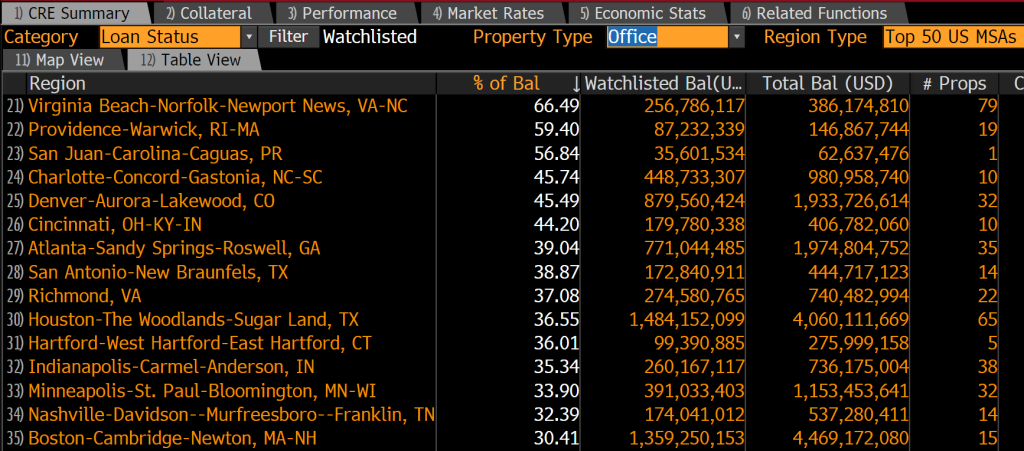

On the office property front, we can see red (>25% of commercial loans watchlisted) pretty much across the board.

The leading metro area in terms of watchlisted office property loans is … Virginia Beach-Norfolk-Newport News VA-NC at 66.49% (that is pretty bad). Providence RI is second and San Juan Puerto Rico is third followed by Charlotte NC in fourth place. The only Ohio city in top 15 is Cincinnati, home of Skyline Chili and Montgomery Inn.

While most are calling for more rate hikes in 2023, I predicted that December’s likely 50 basis point hike with be the last one for a while as the US economy grinds to a halt. Or it’s all over now for Fed rate hikes.

While The Fed predicts slow growth, markets are pointing to recession. The Fed is out of touch with reality. As is the US Secretarty of Treasury, “Too low for too long” Janet Yellen.