MF3d

Introduction

Recently I have written several articles about lithium producers (LAC (LAC), ALB (ALB), SGML (SGML), LICY (LICY), VULNF (OTCPK:VULNF)). Almost all of them are excellent investments in my view. But one thing stood out to me, and that is also the main risk. The demand for lithium is highly related to the demand for electric cars and energy storage solutions. Since every lithium producer wants to ramp up their production as fast as possible, an alternative to lithium would be the death blow for the so far excellent margins. The worst-case scenario for any lithium miner would be a world where batteries no longer need lithium. Given the current cost of lithium, it’s no wonder this is exactly what is being researched. A few days ago, I read something that made me sit up and take notice, and every shareholder of lithium miners should know. What exactly this is about is the subject of this, I think, important article.

Lithium introduction

But before I talk about this alternative, a little basic knowledge about lithium itself. Those who already know a lot can skip the following paragraphs.

Benefits of lithium

Lithium is a lightweight, silvery-white metal that is highly reactive and has an incredibly high electrochemical potential. This makes it ideal for batteries, as it can store large amounts of energy in a relatively small space. They are used in everything from cell phones to electric cars and are the go-to choice for most manufacturers. Additionally, lithium-ion batteries have relatively fast charging times and a low self-discharge rate. This means they can be recharged quickly and retain most of their charge when unused. This is important for applications that require frequent rechargings, such as electric cars and smartphones.

In addition to being used in batteries, lithium has a variety of other uses. It is used in producing glass and ceramics, as a lubricant, and as an additive in steel production. Some medications also use lithium compounds to treat bipolar disorder and depression. It is also used in aerospace and aviation as a heat-resistant lubricant for high-temperature applications. Finally, lithium is used in air treatment systems to reduce the atmosphere’s carbon dioxide and water vapor levels.

Drawbacks of Lithium

Lithium is a highly reactive metal, and its electrochemical properties make it prone to overheating and fires. It also has the potential to leak, which can be dangerous and contaminate the environment if not handled properly. In addition, lithium batteries are expensive and require specialized care. They must be stored at the right temperature and humidity. Finally, lithium batteries are not as long-lasting as other options on the market — typically only lasting for a few years before needing to be replaced.

Outlook and how much Lithium is used for batteries?

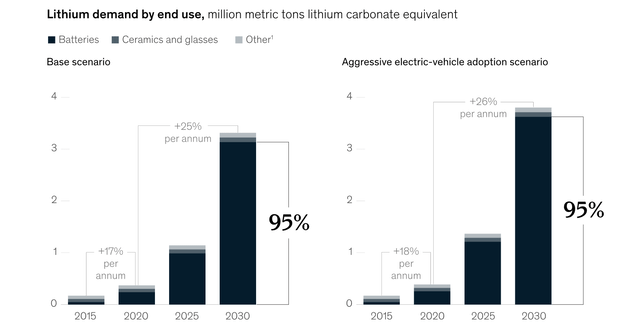

In 2021, the global demand for lithium carbonate (LCE) was about 500k metric tons. In an analysis, McKinsey assumes that this demand will multiply by 2030. About 95% of this demand is expected to be used for batteries, not only in electric cars but also for energy storage, electric bicycles, and other means of transportation.

Not long ago, in 2015, less than 30 percent of lithium demand was for batteries; the bulk of demand was split between ceramics and glasses (35 percent) and greases, metallurgical powders, polymers, and other industrial uses (35-plus percent). By 2030, batteries are expected to account for 95 percent of lithium demand, and total needs will grow annually by 25 to 26 percent to reach 3.3 million to 3.8 million metric tons LCE.

McKinsey

McKinsey

This means that by 2030 there will be an additional demand for LCE of 2.8M to 3.3M tons. By comparison, the world’s current largest producer Albemarle (ALB) produced 120k tons of LCE in 2021. This means that in 2030, the world will need an additional 25 times the amount currently produced by the largest producer. However, lithium mines, whether hard rock mining or evaporation ponds have years of lead time. The IEA warns that the world may face a potential shortage of lithium as early as 2025.

Costs of lithium

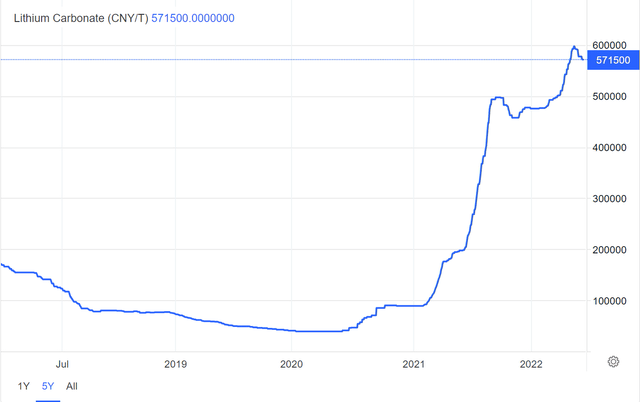

Whether this demand can be met in the end is not yet certain. A part of it will also come from recycling, but how much exactly can only be roughly estimated. Recycling will start to take off from the year 2030 as more and more electric car batteries reach their end of life (one of the companies in this area is Li-Cycle (LICY), here you can find my article). Already now, it seems that lithium production can only barely keep up with demand. The consequence of this we see in the lithium prices. This is a 5-year chart of LCE in Chinese Yuan. Converted, the price for one ton is currently $82k.

tradingeconomics.com

$82k per ton means $82 per kilogram, and in an EV battery, there are about 16kg LCE, which equals $1312. However, there are different numbers on how much LCE is in a battery, and my calculation is based on the current spot price, so it is much cheaper for battery manufacturers. But even if we end up at $800, that’s still significant because that’s just the cost of the lithium, not including all the other materials and manufacturing.

Another risk, especially for Western countries, is that lithium production is spread over only a few countries, mainly Australia and Chile, and the largest battery manufacturers come from China, South Korea, and Japan.

“China owns basically 70-80% of the entire supply chain for electric vehicles and lithium-ion batteries,” Lake Resources’ Stuart Crow told the Financial Times. The IEA puts China’s share of global lithium chemical production at 60%, and says it accounts for 80% of lithium hydroxide output. “Five major companies are responsible for three-quarters of global production capacity,” it says.

Australia had the highest production in 2021, according to the US Geological Survey, but Chile has the world’s biggest lithium reserves. The South American country is part of the so-called “Lithium Triangle”, along with Argentina and Bolivia. Just under 60% of Earth’s lithium resources are found in these three countries, according to the 2021 US Geological Survey’s Mineral Commodity Summary.

weforum.org

Lithium conclusion

In summary, there is enough lithium in the ground, but the demand is growing so fast that it is not sure if the production can keep up. And the higher the price rises, the greater the need for alternatives. In addition, from a geopolitical point of view, it would also make sense not to rely only on lithium for battery production but to have alternatives, at the very least, in reserve.

Alternative battery solutions

I have read several reports about alternative battery research, and these are some examples. Aluminum-ion battery, Sodium-ion battery, Iron Salt Battery, Hemp – boron carbide battery, Glass Battery. Batteries that use magnesium instead of lithium or at least some of the lithium is replaced by silicon.

But in theoretical research, it is often the case that some things never get beyond the research stage because they do not make economic sense, new problems arise in mass production, or they have other issues. That’s why I paid less attention to it as long as it was in research, but from my point of view, it’s worth taking a closer look only when something is actually being applied. And that is what seems to happen now.

Sodium-ion Batteries

The Chinese battery specialist CATL has announced a new cell chemistry requiring no cobalt, nickel, or lithium. At the end of July 2021, the world’s largest battery manufacturer CATL (Contemporary Amperex Technology), surprised the public with an announcement about its new sodium battery. In this battery, sodium ions move back and forth between the cathode and the anode. The energy density of 160 Wh/kg is significantly lower than that of current batteries, which can hold about 270 Wh/kg. However, the density is expected to increase to 200 Wh/kg in the next generation. There are other advantages as well. CATL’s sodium cell has excellent cold resistance (90 percent capacity at minus 20 degrees) and outstanding fast-charging capability (0 to 80 percent in 15 minutes). It is scheduled to be launched in 2023.

Dr. Qisen Huang, deputy dean of the CATL Research Institute, said that sodium-ion battery manufacturing is perfectly compatible with the lithium-ion battery production equipment and processes, and the production lines can be rapidly switched to achieve a high-production capacity. As of now, CATL has started its industrial deployment of sodium-ion batteries, and plans to form a basic industrial chain by 2023.

catl.com

Advantages of sodium batteries

According to a scientific paper from 2019, the earth’s crust consists of 2.83% sodium while it consists of only 0.01% lithium. This means that sodium is available in huge quantities and, therefore, much cheaper to mine. Although the cost of EV batteries has fallen sharply since 2010, it was still $132/kWh in 2021. The Tesla Model Y has a 60 kWh battery, so the cost of the battery alone is almost $8000. Probably the actual price is less by now, but even half of $8000 would still be a lot. Current estimates suggest that sodium-based batteries will cost about $40/kWh in mass production, which would be a third of the current cost. If this is true, it would be a huge saving for manufacturers or consumers. If the energy density in these batteries is somewhat acceptable, an electric car manufacturer would have enormous cost advantages over its competitors.

The major advantage of Na-ion batteries is sustainability, which is important for a world striving to be free of carbon-based energy sources. We can foresee Na-ion batteries with hard-carbon anodes and cobalt-free cathodes as sustainable lower-cost alternatives to Li-ion batteries for applications such as short-range electric vehicles and large-scale energy storage (ESS) in a world that is increasingly being transformed to wind, solar, and hydroelectric power, which depend on battery energy storage for uninterrupted, around-the-clock, performance.

pubs.acs.org

One of the big problems with wind and solar is that the power generation fluctuates so much, and at peak times, there may be too much power being produced, and it cannot be stored. Given the abundance of sodium, this battery may be a solution for storing large amounts of energy. I’m not sure if sodium would really be a solution here since the amount of electricity to be stored is still enormous. But since these are batteries that are not moved back and forth, the weight doesn’t matter. Therefore, sodium batteries are preferable to lithium batteries here.

Disadvantages of sodium batteries

The most significant disadvantage of these batteries is the lower energy density per kilogram. Or, in other words, the higher total weight of the battery with the same energy. This means that for some subsectors, this battery will never be considered. The material costs are low for smartphones and other technical devices, and energy density is critical, so these devices rarely need to be recharged. The battery is also less attractive for high-priced electric cars, with more emphasis on top quality and long runtimes.

A BYD car with a sodium battery?

As far as I know, it has yet to be officially confirmed by BYD but has already been reported on many websites. Allegedly, the company plans to bring two very inexpensive models to market in 2023 that do not use lithium but sodium batteries.

BYD battery division FinDreams is said to be responsible for the development and mass production of the sodium-ion batteries, which are currently in the sample validation stage. According to the report, they could be used in the BYD Qin, Dolphin, and new Seagull models. The Qin and Dolphin range in price from $14,000 to $21,000. The Seagull will be priced between $11,000 and $14,000. EVs priced at less than $14,000 have accounted for over 36% of all battery-electric cars sold in China this year.

BYD and CATL are competitors because they are both battery manufacturers. But if CATL is more advanced in this area than BYD, they could very quickly become allies, especially since it is in line with the latest 5-year plan of the Chinese Communist Party to become the world leader in batteries. If it aligns with the central goal, the companies will cooperate.

It makes sense that low-cost electric cars use low-cost batteries even if the range suffers. In addition, self-driving cabs are already on the road in some areas of China. In this car-sharing system, cars have more intelligent ways to manage their range and drive themselves to recharge in time. The customer does not notice anything; the app simply sends another vehicle. Perhaps in a few years, it will be the case that for self-driving cars in cities, the range of the vehicles will no longer be as important as we assume today, and the race to more and more range will stop, at least for this type of vehicle.

Conclusion

Looking at all this, you can see why this is extremely important for any lithium investor. All lithium producers are working to increase their production quickly. But if a technological innovation comes along that makes lithium less important in the future, it would have catastrophic consequences for the lithium price and, thus, all lithium producer stocks. The lithium price will have to settle at a level in the future so that it remains attractive for electric car manufacturers to use lithium. When I look at the current margins of the lithium producers and the costs for electric car manufacturers, I think lithium has to be cheaper than it is right now. And in the long run, this is also in the interest of the lithium producers themselves because the more expensive lithium gets, the more attractive the alternatives. Because overall, lithium still seems to be the best metal for storing energy, but the cost can’t keep rising forever.

How it turns out in the end? Of course, we don’t know at this point. But I always thought that as soon as an alternative to lithium comes along, I want to take a closer look at it since I’m also investing in lithium stocks. So next year, we will have to keep an eye on whether BYD really brings out such electric cars and whether other manufacturers might develop similar plans. I hope that we as a community can activate our swarm knowledge and use the comment function, for example, to keep each other up to date on current developments. With that, I end this somewhat general article without a firm conclusion, but with wise words from John Bogle:

We use the term risk all too casually, and the term uncertainty all too rarely.

Stocks for which this article is relevant: LAC, ALB, SGML, LICY, OTCPK:VULNF, SQM, LTHM, PLL, OTCPK:ARYMF, OTCPK:OROCF, LIT, SLI