Updated on December 8th, 2022 by Quinn Mohammed

Grocery stocks are in an uncertain position. Industry trends are changing as more consumers gravitate toward online shopping and grocery delivery, which accelerated during the coronavirus pandemic.

Meanwhile, competition among grocery stocks is heating up. E-commerce giant Amazon.com (AMZN) made a huge entry into grocery with its ~$14 billion acquisition of Whole Foods and is in the process of rolling out its cashier-less technology.

Other grocery stocks such as Costco Wholesale (COST), Walmart Inc. (WMT), Kroger (KR), and Target (TGT) have seen great success with their own e-commerce platforms.

Many of these grocery stocks remain attractive for dividend growth investors. For example, Walmart and Target are both members of the Dividend Aristocrats.

The Dividend Aristocrats are a group of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

The requirements to be a Dividend Aristocrat are:

- Be in the S&P 500

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

You can download an Excel spreadsheet of all 65 Dividend Aristocrats (with important financial metrics such as dividend yields and payout ratios) by clicking the link below:

Costco and Kroger are members of the Dividend Achievers list, a group of stocks with 10+ years of consecutive dividend growth.

You can see the entire list of all ~347 Dividend Achievers by clicking here.

These retailers are all making progress to better compete with Amazon, adapt to the changing consumer demands, and continue generating growth.

This article will discuss the top 7 grocery stocks ranked in order of expected returns.

Table of Contents

We have ranked the top 7 grocery stocks according to expected returns. The grocery stocks are listed from lowest to highest five-year expected total returns. You can use the following links to instantly jump to any specific stock:

Best Grocery Stock #7: SpartanNash Co. (SPTN)

- 5-year expected annual returns: 2.2%

SpartanNash is a value-added wholesale grocery distributor and retailer. The corporation supplies 2,100 independent grocery retail locations in the United States.

The company itself also owns 147 supermarkets in nine states. SpartanNash operates under retail banners such as Dan’s Supermarket, D&W Fresh Market, Econofoods, Family Fare, Forest Hill Foods, No Frills, Supermercardo Nuestra Familia, and more. The company is also a distributor of grocery products to U.S. military commissaries.

SpartanNash reported third-quarter fiscal 2022 results on November 9th, 2022. Net sales of $2.3 billion was a 10.8% increase from $2.1 billion in the same prior year period. Adjusted earnings per diluted share were flat year-over-year at $0.55. And adjusted EBITDA rose 11.3% year-over-year to $57.3 million.

SpartanNash’s estimated annualized total returns over the next five years come in at 2.2%, driven by 3.0% earnings-per-share growth and a 2.5% dividend yield, offset by the potential for a valuation headwind.

Click here to download our most recent Sure Analysis report on SpartanNash (preview of page 1 of 3 shown below):

Best Grocery Stock #6: Walmart Inc. (WMT)

- 5-year expected annual returns: 5.7%

Walmart traces its roots back to 1945 when Sam Walton opened his first discount store. The company has since grown into one of the largest retailers in the world, serving over 230 million customers each week. Revenue will likely be around $600 billion this year, and the stock trades with a market capitalization near $410 billion.

Walmart reported third-quarter earnings on November 15th, 2022, and results were better than expected for both the top and adjusted bottom lines. Total revenue was up 8.8% to $153 billion, powered by comparable sales of +8.2% in the US.

That beat consensus estimates for a gain of 6.9%, as transaction count rose 2.1%, and the average ticket was higher by 6.0%. E-commerce sales were up 16% during the quarter and were 24% higher than in the same quarter of 2020. Sam’s Club sales were up 10.0%, while membership income rose 8.0%.

Walmart’s estimated annualized total returns over the next five years come in at 5.7%, driven by 8.0% earnings-per-share growth and a 1.5% dividend yield, offset by the potential for a valuation headwind.

Click here to download our most recent Sure Analysis report on Walmart (preview of page 1 of 3 shown below):

Best Grocery Stock #5: Dollar General Corp. (DG)

- 5-year expected annual returns: 7.3%

Dollar General Corporation opened its first dollar store in 1955. Today, it is the leading U.S. “dollar store.” About 80% of its items are offered at $5 or less.

Dollar General sells a wide variety of merchandise in four categories: consumables, seasonal, home products, and apparel. About 77% of sales are from consumables. Dollar General operated 18,818 stores in 47 states as of October 28th, 2022. Total sales were $34 billion in FY 2021.

Dollar General reported third quarter 2022 results on December 1st, 2022. The company is performing well due to new store openings, higher transaction amounts, and increased customer traffic, which is somewhat offset by store closures. Still, margins are under pressure due to inflation and supply chain challenges.

Dollar General’s estimated annualized total returns over the next five years come in at 7.3%, driven by 10.0% earnings-per-share growth, a 0.9% dividend yield, and the potential for a valuation headwind.

Click here to download our most recent Sure Analysis report on Dollar General (preview of page 1 of 3 shown below):

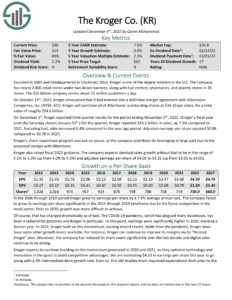

Best Grocery Stock #4: Kroger Co. (KR)

- 5-year expected annual returns: 8.0%

Founded in 1883, Kroger has nearly 2,800 retail stores under two dozen banners and fuel centers, pharmacies, and jewelry stores in 35 states. The $33 billion company serves about 11 million customers a day.

On October 14th, 2022, Kroger announced that it had entered into a definitive merger agreement with Albertsons Companies, Inc. (NYSE: ACI). Kroger will purchase all of Albertsons’ outstanding shares at $34.10 per share, for a total value of roughly $24.6 billion.

On December 1st, Kroger reported third-quarter results for the period ending November 5th, 2022. (Kroger’s fiscal year ends the Saturday closest, January 31st.) Kroger reported $34.2 billion in sales for the quarter, up 7.3% compared to 2021. Excluding fuel, sales increased by 6.4% compared to the year-ago period.

Adjusted earnings-per-share equaled $0.88 compared to $0.78 in 3Q21.

Kroger’s estimated annualized total returns over the next five years come in at 8.0%, driven by 3.0% earnings-per-share growth, a 2.3% dividend yield, and the potential for a valuation tailwind.

Click here to download our most recent Sure Analysis report on Kroger (preview of page 1 of 3 shown below):

Best Grocery Stock #3: Costco Wholesale (COST)

- 5-year expected annual returns: 8.1%

Today, Costco is a diversified warehouse retailer that operates about 830 warehouses, collectively generating about $245 billion in annual sales.

Costco reported fourth-quarter and full-year earnings on September 22nd, 2022, and the results were largely in line with expectations. Costco reported revenue of $72.1 billion, which was 15% higher than the year-ago period and beat estimates by $90 million.

The gain was largely due to a 9.6% comparable sales increase after excluding gasoline sales and foreign exchange, which Costco uses to measure store and e-commerce performance.

Costco’s estimated annualized total returns over the next five years comes in at 8.1%, driven by 9.0% earnings-per-share growth, a 0.7% dividend yield, and the potential for a valuation headwind.

Click here to download our most recent Sure Analysis report on Costco (preview of page 1 of 3 shown below):

Best Grocery Stock #2: Target (TGT)

- 5-year expected annual returns: 11.1%

Target was founded in 1902 and had operations solely in the U.S. market. Its business consists of about 1,850 big box stores, which offer general merchandise and food and serve as distribution points for the company’s e-commerce business. Target should produce about $110 billion in total revenue this year.

Target reported third-quarter earnings on November 16th, 2022, and results were behind expectations on adjusted profits. Total revenue was $26.5 billion, which was 3.4% ahead of the same period a year ago and beat expectations by $120 million. Store comparable sales were up 2.7% year-over-year, while digital comparable sales were up only 0.3%.

Target’s estimated annualized total returns over the next five years come in at 11.1%, driven by 20.0% earnings-per-share growth from this year’s earnings base and a 2.8% dividend yield, offset by meaningful multiple contractions.

Click here to download our most recent Sure Analysis report on Target (preview of page 1 of 3 shown below):

Best Grocery Stock #1: Albertsons Corporation (ACI)

- 5-year expected annual returns: 13.6%

Albertsons (ACI) is one of the largest food and drug retailers in the United States. With $70 billion in sales, a market cap of $11.6 billion and a history dating back to the 1860s. However, Albertsons only went public in 2020 and has paid a quarterly dividend since.

The company reported second-quarter 2022 results on October 18th and announced adjusted earnings of $0.72 per share. This was a 12.5% increase compared to last year’s $0.64 per share.

During the quarter, an announcement was made of a merger agreement between ACI and Kroger, with ACI shareholders expected to receive a total consideration of around $34.10 per share, split between a $6.85 cash dividend and a spin-off of part of the business. This merger is currently under regulatory review.

Albertsons’ estimated annualized total returns over the next five years come in at 13.6%, driven by 3.0% earnings-per-share growth, a 2.3% dividend yield, and the potential for meaningful valuation expansion.

Click here to download our most recent Sure Analysis report on Albertsons Corporation (preview of page 1 of 3 shown below):

Final Thoughts

The grocery industry is changing like never before. Now that Amazon has acquired Whole Foods, the company will likely accelerate its push into the grocery industry even further, especially with new technologies such as cashier-less stores.

That said, the top grocery stocks have decades of experience in the retail industry. They have proven the ability to navigate difficult conditions before and adapt when necessary.

Broadly speaking, the grocery industry is attractive for investors right now. Investors looking to buy grocery stocks should focus on those with durable competitive advantages and the financial strength to continue investing in growth.

Target and Walmart have the longest histories of annual dividend increases, while Kroger, Costco, SpartanNash, and Dollar General also have meaningful dividend growth histories.

Further Reading: 7 Best Food Stocks Now, Ranked In Order

Additional Resources

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].