FTX’s fall from grace this week culminated in the company filing for Chapter 11 bankruptcy on Nov. 11. The filing includes all 130 companies under the umbrella, as well as the trading firm Alameda.

On announcing the news, Sam Bankman-Fried resigned from his position as CEO. John Ray, who oversaw Enron following its accounting scandal in 2007, took charge following SBF’s resignation.

Commenting on the bankruptcy, Ray said the Chapter 11 filing would provide relief and allow for a thorough assessment of the situation to maximize recoveries for all stakeholders.

Chapter 11 filings enable a company to continue trading and are usually implemented in business restructuring cases.

A ‘complete failure’

Ray filed the Chapter 11 Petitions and First Day Pleadings with the Bankruptcy Court of Delaware on Nov. 17.

Having gone through FTX’s books, Ray blasted the previous company administration, saying he has never come across “such a complete failure of corporate controls and such a complete absence of trustworthy financial information.”

In particular, he pointed out compromised systems integrity, faulty regulatory oversight abroad, and concentration of control in the hands of a very small group – all of which were inexperienced and incapable of running an operation the scale of FTX.

Ray said:

“The FTX Group did not maintain centralized control of its cash. Cash management procedural failures included the absence of an accurate list of bank accounts and account signatories, as well as insufficient attention to the creditworthiness of banking partners around the world. Under my direction, the Debtors are establishing a centralized cash management system with proper controls and reporting mechanisms.”

The aftermath

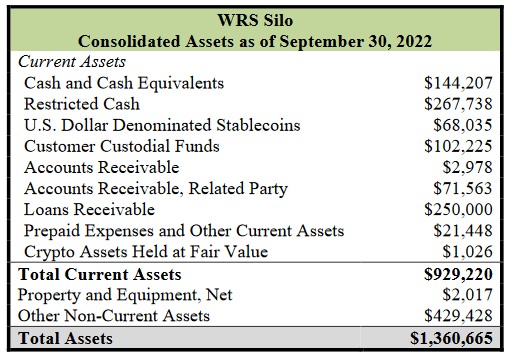

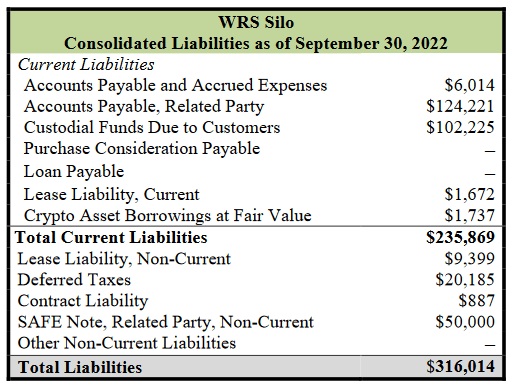

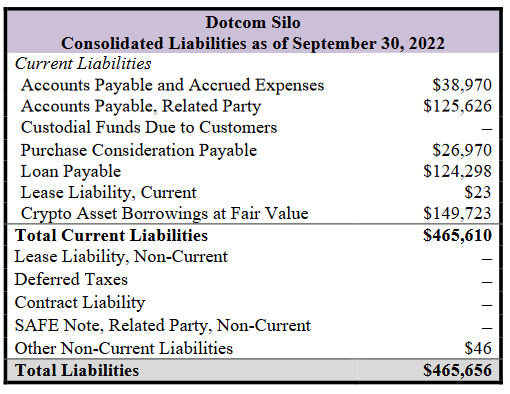

The businesses were divided into four groups or silos to manage the bankruptcy process. For each Silo, Ray included an unaudited balance sheet as of Sep. 30, 2022. A summary is as follows:

West Realm Shires Inc. Silo (WRS) includes FTX U.S., LedgerX, FTX US Derivatives, FTX U.S. Capital Markets and Embed Clearing, among other entities.

- The balance sheet showed $1.36 billion in Total Assets, of which $929.2 million is related to Current Assets. Total Liabilities are $316 million, with $235.9 million in Current Liabilities.

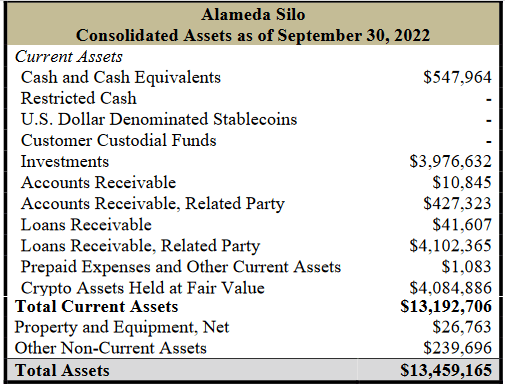

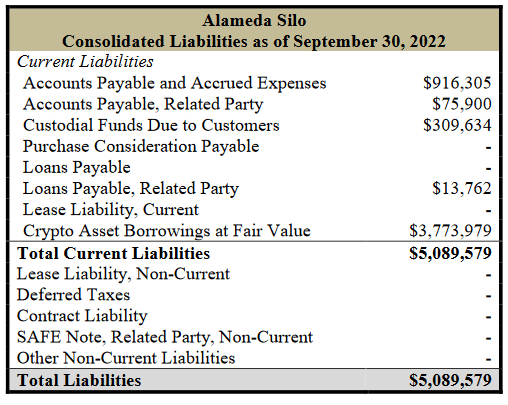

Alameda Silo refers to entities specializing in quantitative trading funds; it includes Alameda Research LLC and debtors based in Delaware, Korea, Japan, the British Virgin Islands, Antigua, Hong Kong, Singapore, Seychelles, the Cayman Islands, the Bahamas, Australia, Panama, Turkey, and Nigeria.

- The balance sheet showed $13.5 billion in Total Assets, of which $13.2 billion are Current Assets. Total Liabilities are $5.09 billion, all of which are current.

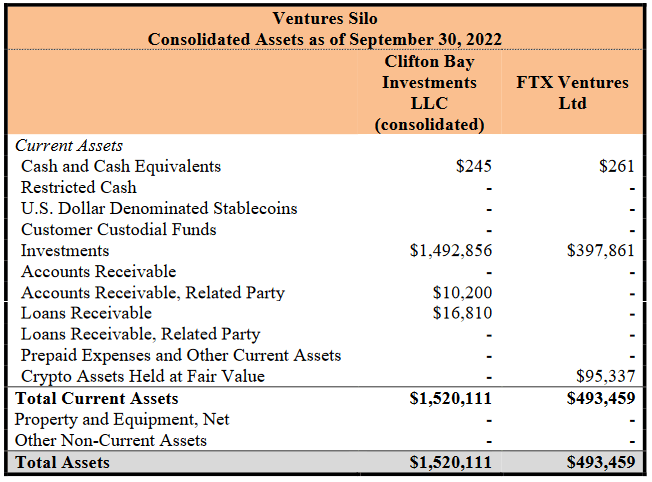

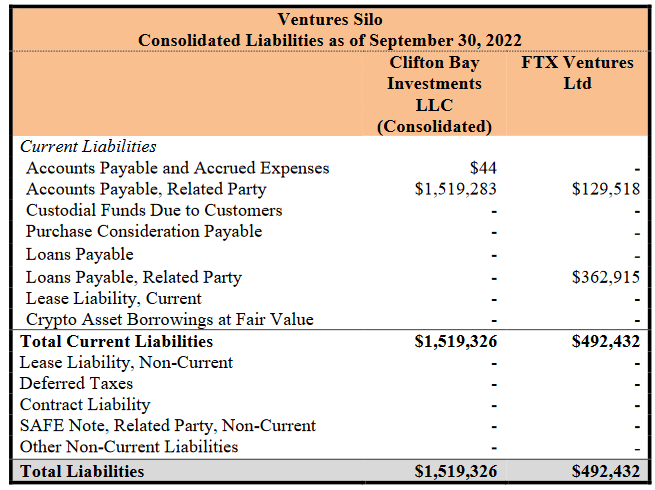

Ventures Silo companies relate to private investment entities, including Clifton Bay Investments, LLC, Clifton Bay Investments Ltd., FTX Ventures Ltd., and Island Bay Ventures Inc, among other entities.

- The combined balance sheet of Clifton Bay Investments LLC and FTX Ventures Ltd showed $2.014 billion in Total Assets, of which all are current. Likewise, total Liabilities come in at $2.012 billion, which is current.

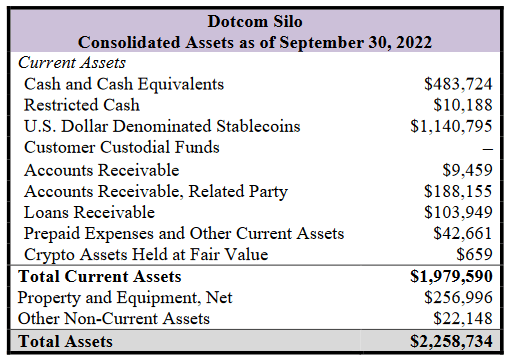

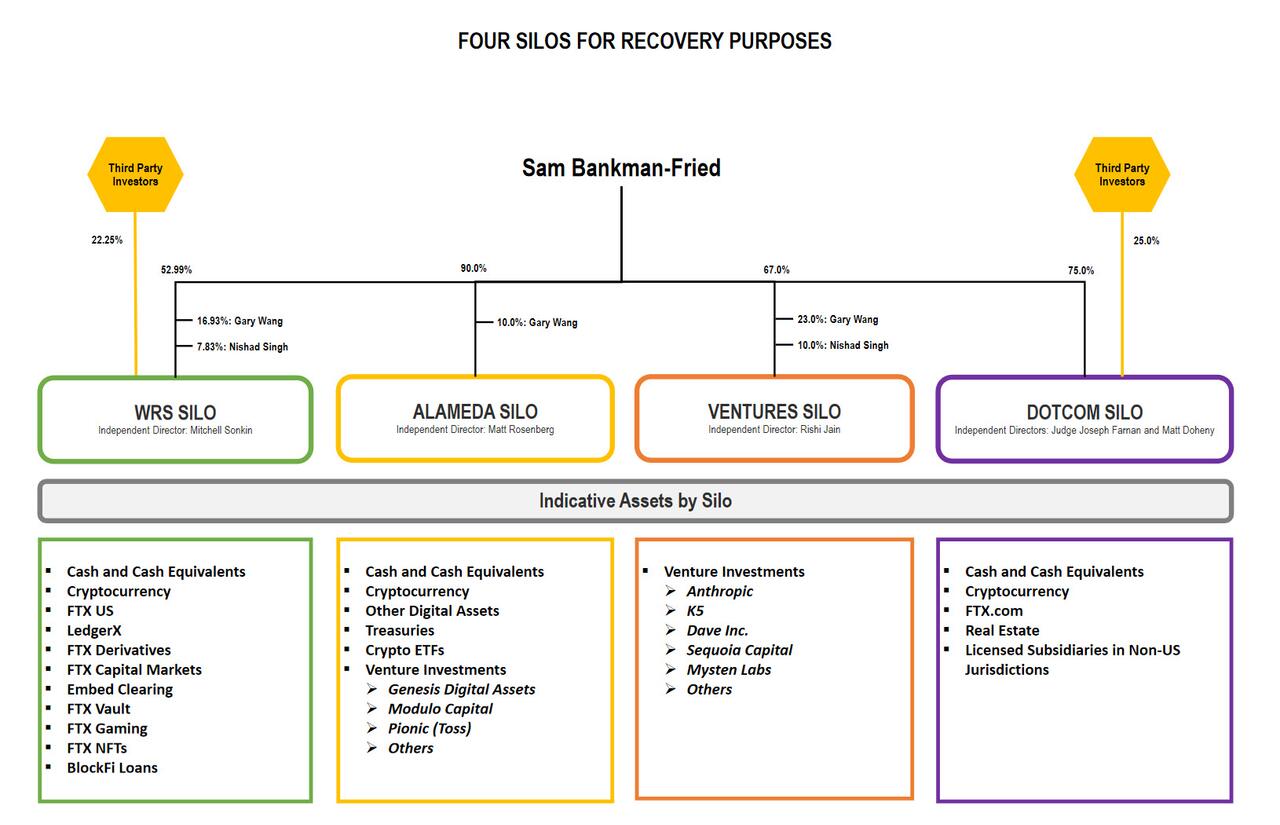

Dotcom Silo holds specific marketplace licenses and registrations and includes the FTX digital trading platform and exchange.

- The balance sheet showed $2.259 billion in Total Assets, of which $1.98 billion is Current Assets. Total Liabilities are $466 million, and all but $46,000 is current.

In each case, current assets exceed total liabilities. However, given the improper corporate controls before his arrival, Ray said he did “not have confidence” in any of the financial statements.

Ray said the FTX Group of companies failed to keep centralized control of its cash, meaning there is no list of bank accounts to verify cash balances. Similarly, company controls were poor, with no cash management systems or the use of proper reporting mechanisms.

Ray said the audit firm for the WRS Silo was Armanino LLP, noting that he is “professionally familiar with the firm. He noted, however, that he was not familiar with the audit firm for the Dotcom Silo, Prager Metis, which touts itself as “the first-ever CPA firm to officially open its Metaverse headquarters in the metaverse platform Decentraland.”

The CEO said:

“I have substantial concerns as to the information presented in these audited financial statements, especially with respect to the Dotcom Silo. As a practical matter, I do not believe it appropriate for stakeholders or the Court to rely on the audited financial statements as a reliable indication of the financial circumstances of these Silos.”

Unchecked loans; company funds used to buy houses

The bankruptcy filing also revealed that Sam Bankman-Fried got $1 billion in personal loans from Alameda Research.

Also, Alameda gave a $543 million loan to FTX director of engineering Nishad Singh. The firm also gave Ryan Salame, the co-CEO of FTX, a $55 million loan.

In an apparent disregard for corporate process, Ray claimed,

“Corporate funds of the FTX Group were used to purchase homes and other personal items for employees and advisors.”

The properties were based in the Bahamas, and the new CEO stated that “no documentation” is present to identify the purchases as loans. At the same time, the real estate was registered in the personal names of the employees and advisors.

Where are the digital assets and other investments

Bewilderingly, Ray further depicted a chaotic approach to bookkeeping and security. SBF and Co-Founder Gary Wang “controlled access to digital assets of the main businesses in the FTX Group.” The internal practices were described as “unacceptable” by Ray. A group email account was used as the “root user to access confidential private keys” in a remarkable example of improper security hygiene.

There was no regular cadence to the “reconciliation of positions on the blockchain,” while software was used to “conceal the misuse of customer funds.” Ray specifically highlighted the “secret exemption of Alameda” from specific documentation to prevent funds from being liquidated without manual intervention.

New wallets are allegedly still being discovered. One such cold wallet contains roughly $740 million, but the FTX group of companies is not yet sure of the origin of the funds. Further, it is unclear whether the funds should be split among multiple entities within the FTX Group.

At present, Ray confirmed that $372 million was transferred without authorization after filing the bankruptcy petition, while $300 million in FTT tokens was also minted after the deadline. In addition, the FTX companies believe there are other crypto wallets that SBF and the former leadership team have not yet disclosed.

Forensic analysts have been employed to search for missing funds and attempt to trace transactions to link crypto assets. Ray commented that the analysts might discover “what may be very substantial transfers of company property. Court assistance was mentioned as a potential direction to resolve the issue.

Ray stated the overview of the investigation in its current state.

“It is my view based on the information obtained to date, that many of the employees of the FTX Group, including some of its senior executives, were not aware of the shortfalls or potential

commingling digital assets.”

The new CEO believes that “current and former employees” may be the “most hurt” by the failure of FTX and SBF’s alleged actions.

Astonishingly, Ray claimed that the leading companies related to Alameda and FTX Ventures “did not keep complete books and records of their investments and activities.” A balance sheet is being finalized for the affected companies from “the bottom-up” through cash records.

No paper trail

A lack of records for SBF’s critical decisions was described as one of “the most pervasive failures” by the acting CEO. Communication applications used by SBF were set to “auto-delete” messages, and employees were encouraged to do the same.

In a seemingly basic task, Ray detailed that the companies, now, “are writing things down.”

The team involved in the bankruptcy procedures includes former directors of the SEC and CFTC, along with members of the Cybercrime Unit of the U.S. Attorney’s Office. “Dozens of regulators” have been contacted by Ray and his staff as he posited a need for transparency.

SBF’s current role

Ray took the opportunity to state that SBF “does not speak for them” about the FTX companies involved in the bankruptcy process. He further confirmed that SBF is currently in the Bahamas and described his communication as “erratic and misleading.”

Recovery

Ray noted that due to these cash management failures, exact cash positions are not known at this time. However, the companies are working with turnaround consultants Alvarez & Marsal to resolve this situation.

Any funds located by the FTX group of companies will be “deposited into financial institutions in the United States.” Each “silo” of funds will be segmented so that Ray’s team can allocate “costs across the various Silos and Debtors.”

A Cash Management Motion will be filed “promptly” to detail how cash will be managed going forward.