Vertigo3d

Even though the stock price has recovered from $55 to $63, Realty Income Corporation (NYSE:O) is a strong passive income choice for investors looking to hedge against a recession.

Realty Income, a real estate investment trust (“REIT”), remains one of the most reliable sources of dividend income in the market, easily covering its third-quarter dividend with funds from operations.

Since the payout ratio was only 76% in the third quarter, dividend growth is practically guaranteed, and the valuation of Realty Income at an FFO (funds from operation) multiple of 16.1x is still quite compelling in my opinion.

Realty Income Is Primarily A High-Quality Recession Hedge

Aside from the promise of consistent dividend growth, Realty Income provides another valuable benefit to passive income investors. Because it has a broadly diversified, well-managed real estate portfolio leaning toward necessity-based retail outlets and a history of growing its cash flow in a variety of economic environments, the trust is a strong hedge against a recession.

In terms of the first point, Realty Income is heavily focused on non-discretionary retail. Non-discretionary retail includes stores such as supermarkets and pharmacies that sell essential goods and services that people require regardless of the state of the economy in the United States, and 92% of the trust’s rent is resistant to economic downturns, according to Realty Income.

Realty Income’s portfolio included 11,733 mostly retail properties in 79 industries across the United States and Europe at the end of the third quarter, with the trust’s total property and land investments valued at $34.2 billion.

Diversified Real Estate Portfolio (Realty Income Corp)

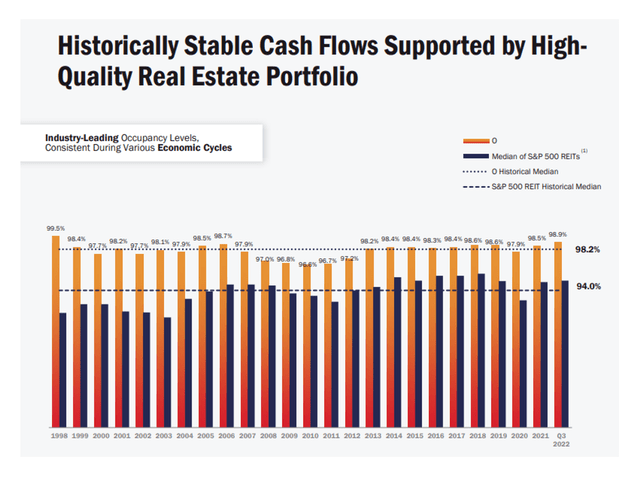

Realty Income’s real estate assets are also well-managed: the trust’s occupancy has averaged 98.2% since 1998 and has only dropped to 96.6% in 2009.

Occupancy Levels (Realty Income Corp)

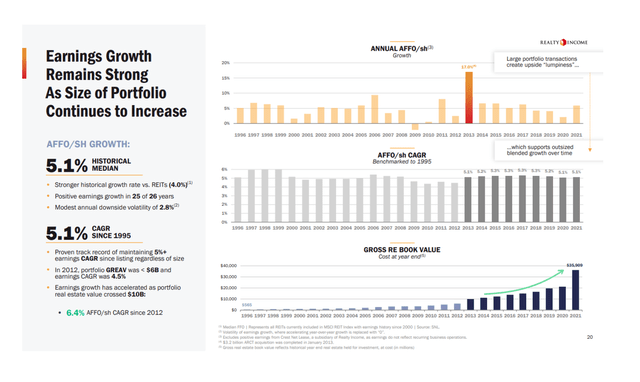

Realty Income has consistently increased its adjusted funds from operations over time. Realty Income increased its adjusted funds from operations in 25 of the 26 years, resulting in a 5.1% average AFFO per share growth rate.

Only in 2009, a bad year for real estate in the United States, did the trust show a negative annual growth rate in adjusted funds from operations.

Average AFFO Per Share (Realty Income Corp)

In my opinion, Realty Income’s broadly diversified portfolio, historically high occupancy rates, and a track record of cash flow growth translate into a high-quality REIT investment in which passive income investors can have a high degree of confidence during recessions.

High Margin Of Safety For Realty Income’s Dividend

The trust’s rock-solid near-5% dividend and history of consistent dividend growth are the most compelling reasons to buy Realty Income stock.

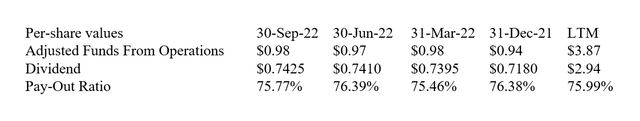

The retail real estate investment trust earned $0.98 per share in adjusted funds from operations in the third quarter while paying out only $0.7425 per share.

The trust’s dividend payout ratio in 3Q-22 was 76%, which was also the payout ratio over the previous twelve months.

The low AFFO payout ratio should allow Realty Income to raise its dividend in the future, while the current payout of $0.2480 per share has a relatively high margin of safety.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

Strong Yield During Recession Times

Realty Income pays an annualized dividend of $2.976 per share, yielding a 4.7% forward dividend yield. The dividend amount paid in the third quarter increased by 5.1% over the previous year.

Outlook For 2022, Bargain Valuation

Realty Income restated its adjusted funds from operations guidance from $3.84 to $3.97 to a new range of $3.87 to $3.94, while maintaining its $6 billion real estate acquisition target for 2022.

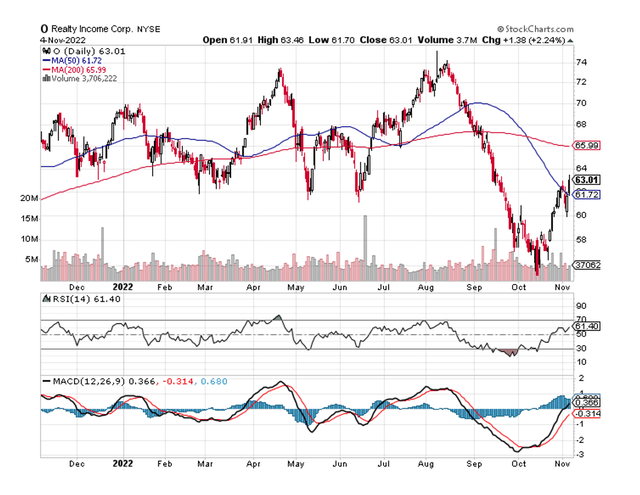

Based on Realty Income’s AFFO forecast and the stock closing Friday at $63.01, the trust is currently valued at 16.1x AFFO. Realty Income has previously traded at higher AFFO multiples (in excess of 20x), so I believe the current valuation is still appealing to passive income investors.

Realty Income Stock Price (StockCharts.com)

Why Realty Income Could See A Lower/Higher Valuation

The stock market has been generally weak in recent months, which was partly due to the rise in interest rates. Having said that, Realty Income’s real estate business has not been fundamentally impacted by previous rate hike cycles, suggesting that investors may be missing a buying opportunity here.

In the short term, Realty Income’s stock is likely to trade in the same direction as the market, but given the trust’s portfolio’s quality, the long-term trend for Realty Income should be upward.

My Conclusion

Realty Income generated enough funds from operations in the third quarter to fund its dividend to shareholders while maintaining a low dividend payout ratio to ensure dividend growth and a very high margin of safety.

The FFO multiple for Realty Income is also quite low, given that the trust pays one of the safest dividends in the entire stock market.

I believe that passive income investors still have an opportunity to purchase Realty Income at a very attractive yield and valuation.

:max_bytes(150000):strip_icc()/Health-GettyImages-1163723632-780d7541a140489594c99fe9001f3f79.jpg)