whitelook/iStock via Getty Images

iShares MSCI Poland ETF (NYSEARCA:EPOL) is an exchange-traded fund that provides investors with direct exposure to Polish equities. The fund is not cheap, with an expense ratio of 0.57%. Further, performance (to October 28, 2022, YTD) has been poor at -40.92% as reported by iShares themselves. Net assets under management were also relatively low at just $168 million.

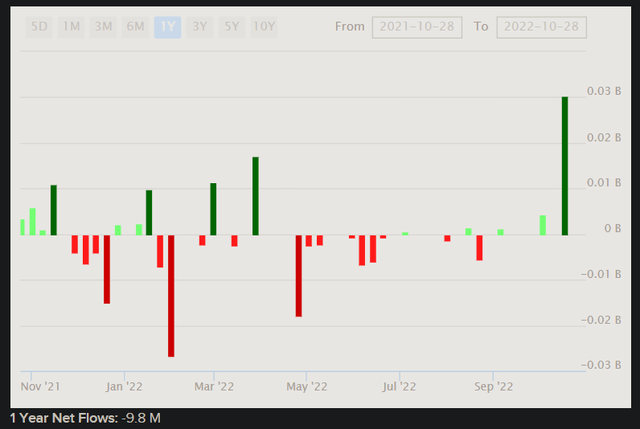

Net fund flows have been negative over the past twelve months, although interestingly they have turned up most recently in late October 2022, as shown below.

ETF Database

The geographical and political proximity of Poland to Ukraine, in the midst of the escalation of the Russo-Ukrainian War this year, has put a lot of pressure on Polish equities. The Polish equity market is not especially developed, and hence EPOL only has 34 holdings as of October 28, 2022. With a relatively small level of international allocation to Poland (even before 2022), periods of risk aversion can sent prices falling fairly sharply.

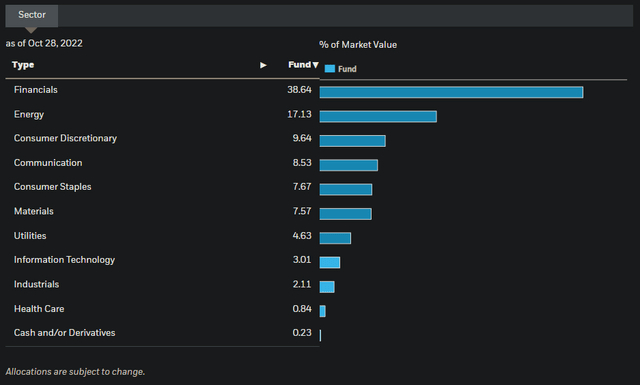

The fund is exposed mostly to Financials companies (39% as of October 28, 2022). Energy is another significant sector exposure of EPOL (at 17%). On balance, the fund is mostly exposed to cyclical sectors.

iShares

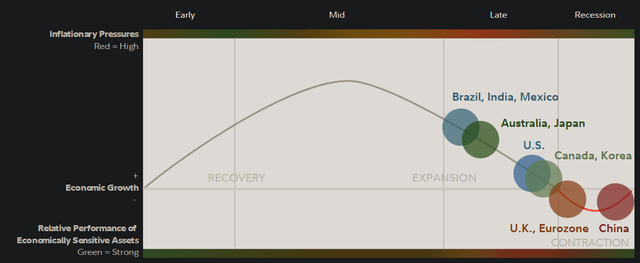

Therefore, EPOL functions as a coherent cyclical bet on the European economy, which is currently heading into recessionary territory (per research from Fidelity for Q4 2022). The eurozone is in fact thought to be already in a recession, based on falling business activity, weaker credit creation (at least leading into the recessionary period), weaker earnings growth, still relatively easy monetary policy, and higher inventory/sales ratios.

Fidelity

However, markets are forward-looking. I last covered EPOL in June 2022. At the time I had a neutral outlook on the fund’s potential given regional conflict (Russia vs. Ukraine), inflationary pressures, weaker earnings growth expectations, and tight local monetary policy. Since then, EPOL has fallen -24.41% on a price-only basis as compared to the S&P 500 index value’s fall of -6.33% over the same time frame (per Seeking Alpha data).

Having said, I did still think that the fund was priced inexpensively. So, valuation has not been a discounting factor so much as the cyclical view. With markets typically looking forward around 6-12 months or so (with respect to the real economy), it would make sense that EPOL could make a comeback, and perhaps the recent net positive fund flows demonstrate this potential.

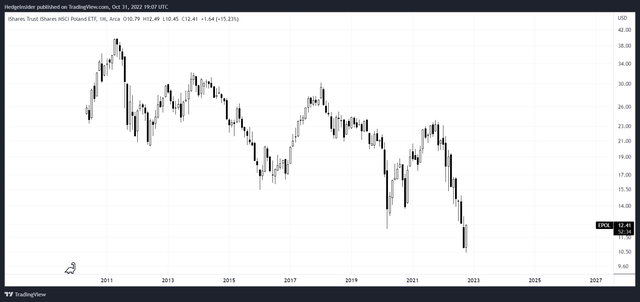

It is however worth pointing out that EPOL has performed terribly since its inception in May 2020. The fund has in fact made all-time lows this October 2022.

TradingView

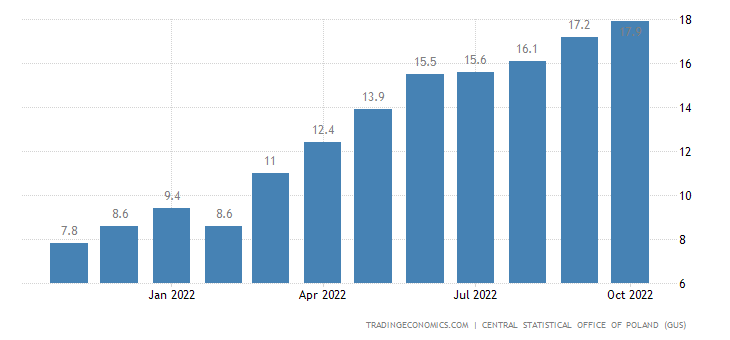

The last time I reviewed EPOL in early June 2022, the 10-year yield was 6.65%. Today, it is even higher at 8.34%. That is a very high risk-free rate. If we want to assume an equity risk premium of circa 4.2-5.5%, and scale that by at least 1.66x in line with the fund’s five-year historical beta, that would give us an ERP of around 6.97-9.13%. Adding in our risk-free rate of 8.34% means that our cost of equity would come in at circa 15.31-17.47%. Then it depends on what kind of growth rate to perpetuity we would want to consider, but the problem is that local inflation has been dire (see below).

Trading Economics

With local inflation still having not peaked, coming in at 17.9% recently (year-over-year), there is a substantial amount of FX risk. In fact, if we look at the USD/PLN rate (which is important as Polish equities, i.e., EPOL’s holdings, are ultimately denominated in Polish złoty) it makes sense that EPOL’s share price has been falling. The U.S. dollar has strengthened considerably against PLN.

TradingView

Local inflation has risen due to the regional war that has sent energy prices up significantly this year, as well as food prices not to mention other core components.

So, local inflationary pressures that have only heated up, coupled with regional conflict, and even local political risk (Poland ranks only a few places above Russia and Ukraine in PRS’ recognized Political Risk Index) have together sent the Polish stock market down, local bond prices down, and the local currency down. This is classic and holistic risk aversion. In this environment, we don’t really want to be thinking about potential earnings growth (nominal or real) if we don’t have to. Dividing 1 over our cost of equity of 15.31-17.47% brings us to a forward price/earnings ratio of circa 5.72-6.53x. That compares to Morningstar’s current forward price/earnings estimate of 4.60x.

In my opinion then, the market has now priced EPOL in such a dire state that it may be even more pessimistic than is fair. I have to say, Poland’s stock market ticks almost no boxes when it comes to investment attractiveness. However, the valuation is still very low, with an implied earnings yield of just 22%. I don’t think the FX risk has disappeared though, with the local current account still negative recently. While you have a significant and positive interest rate spread in favor of PLN vs. USD, this is rarely enough to support a currency alone, at least when ongoing political risk is present.

I think EPOL is a now a bet not only on an economic bounce-back in Europe, but also on a combination of a soft exit to the Russo-Ukrainian War and/or lower energy prices (and probably both). Since I do not see either Russia backing away any time soon, nor energy prices dropping sustainably, it would appear that EPOL is still poorly positioned in spite of its low valuation. EPOL is priced for a hard recession, and this is hardly unfair. Some investors recently appeared to buy the dip in EPOL, but I would still remain neutral for now.

On the other hand, EPOL could be an excellent and interesting bet on a resurgence in the European economy and Poland in 2023. The fund will require another review, but in this article, I have outlined the key factors necessary to make EPOL an attractive investment opportunity; but unfortunately, the stars have not yet aligned.