Author’s Note: This article was published on iREIT on Alpha in early October of 2022.

ismagilov

Dear readers,

In this article, I’m going to be looking at perhaps one of the more important questions in the current market.

It’s no secret that the market we’re in is rife with undervaluation. We have companies of quality trading at steep discounts, many offering conservative returns in the triple-digit level or thereabout.

I argue that many of these upsides are indeed very realistic, at least in the longer term. But this doesn’t make it easier to invest in them when the market is dropping as it currently is and seems to continue wanting to do so for the foreseeable future.

So aside from the question of “When” to invest, there is another question to answer.

Because “When” isn’t a question I can answer for you. The “when”-portion is entirely dependent on your personal circumstances, including things like your capital inflow, your real-life capital requirements, your investment timeframe, and other very individual considerations.

Only you can answer them.

For myself, I keep no more than 5% cash at any time. I invest usually on a weekly or bi-weekly basis, and I typically invest around 50-70% of my monthly savings into the market as time goes on. My investment horizon is longer than 20 years.

However, the second relevant question is a question I actually can assist with, or at least have ideas about, is the “What” part.

By that, we of course mean “What” companies we should be buying here.

And that question, at least to me, is a little easier to answer.

What to look for

Let’s give this a shot. We know that the market can remain chaotic for as long as it “decides” to, or until the FED or macro changes significantly. This could be in a week (unlikely) or 3 years (also unlikely).

Your choices are to invest your capital in stocks, in other things than stocks, or keep it as cash. Keeping it as cash exposes it to record inflation and will erode your buying power over time – this is why despite everything, I keep a very limited amount in cash.

I would also like to point out, that despite market trends, if you’re investing conservatively and with a valuation approach, chances are you’re still somewhat in the black/green, like myself.

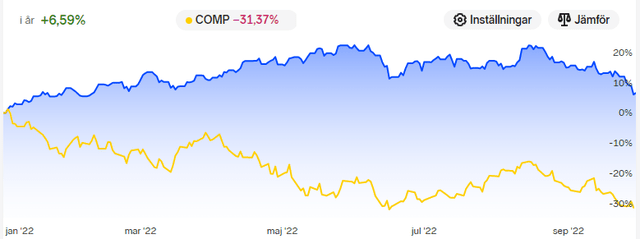

Nordnet Author Portfolio (Nordnet)

Sure – we’re going south. And not all of my partial portfolios are in the green. Scandinavia is down. Europe is mostly down. But as a whole, with the US still included, this is what we’re looking at. The outperformance of close to 40% is what interests me here because to me it in part confirms my own picks and the way they’ve been performed.

So, I don’t keep much cash around. I also don’t invest in treasuries or bonds, or related ETFs. You can read my article on treasuries and TIPS to understand why that is.

No, I invest in stocks.

But I also don’t mind if the investments I make, for market reasons, decline 50% in a short amount of time. Unless the fundamental thesis changes, I won’t be touching the “Sell”-button. If the thesis changes and I can see that the company is unlikely to deliver the alpha I seek, or even may be in danger, then I’ll re-assess. But I won’t re-assess because the market throws a temper tantrum due to macro. That’ll turn around – and I won’t sell because of it.

Note also, however, the following basic circumstances that dictate how I invest, because these influence how I act.

Understand the following.

- I do not invest in a tax-deductible or taxed account. What I mean by this is that I do not pay tax on any gains, and I can’t harvest on tax losses. I pay a flat tax rate determined by the size of my portfolio, nothing else (around 1.4% currently). This influences my choices.

- My current core portfolio generates over 450% of my average annual expenses using only the average annual dividend payouts of my 4.67%-yielding investment portfolio. This also influences how I invest, because I do not need the principal to cover or fund any of my expenses.

I share these facts because if you’re not in the same situation, and you wonder why I invest as I do, these two circumstances may require consideration for you.

I can, and do handle years of sub-par returns from a significant investment, if I believe that I will eventually recoup that in gains. You may not have that luxury, depending on your personal situation. As an example, I waited nearly 4 years for a Swedish investment to yield its reward. When it did (nearly 270%), I sold at above my expected RoR. But until that time, most considered it a “dog”.

Please note that I never go out of my way to find investments that drop such as this, or that take years to recover. If this happens, it’s an unfortunate circumstance of macro, the company, or my own due diligence – no excuses. I make mistakes, like anyone.

I do my best.

What I look for in this environment is:

- Safe companies. This usually comes in the shape of a solid credit rating, stellar fundamentals, low debt, dividend coverages, and moats on the market and its business.

- Dividends. I want well-covered, growing dividends based on solid cash flows. I want those cash flows to be as recession-resistant as possible. Dividend traditions are an advantage here as well.

- Upside – comes from the company trading at a discount. That’s the easiest thing to find here because most great companies are what we can consider “cheap” here, at least compared to a year back or so.

- Forecasts need to be good. I want the company to forecast at least stable results, or preferably growing earnings over the next few years. That way, the dividends are usually safe, and the company is what I would consider a good investment.

When these factors come together in a single investment, that’s when I consider that investment a “BUY”. The greater these upsides or fundamentals are, the bigger the “BUY” is we’re looking at.

And seeing the market today, it’s clear that we’re looking at quite a few potential “BUYs” here. When I look at my watchlist, which includes over 100 companies, many show up in bright green, implying an above-60% upside for the company based on my price targets.

For our subscribers, here are the companies I would give the highest potential investment theses at this time – based on the above 4 factors.

Companies I love investing in right now.

1. Castellum (OTCPK:CWQXF)

Swedish real estate is at its best and still 7.5% of my portfolio, and I may be looking at buying more whenever I can. Real estate assets secured with a sub-40% LTV ratio, and a weighted average interest of below 2% still, now yielding above 6% for the native. It’s among the first with a NollCo2 certification and a green equity designation from Nasdaq.

Also, it recently reported 1H22 with record results, seeing prop management income and per-share value increasing, positive net leasing, and occupancy close to 94% with a portfolio including some of the nation’s largest public institutions, banks, and businesses.

Castellum IR (Castellum IR)

If you’re yet unfamiliar with the company, I urge you to look it up and see if it might be of interest to you – because the current valuation is cheap. Even to a conservative multiple, we’re talking 50% upside, and that RoR goes up to 100% if we look at the company’s previous ATHs. At this price, I’m a “BUY” on Castellum, and I consider it worth at least 185 SEK for the native. I’m filled to the gills both in my private and my corporate portfolio.

2. Telefonica (TEF) & Orange (ORAN)

The question is – do these companies’ recent price declines have anything to do with the company’s relative performance in home & key markets?

Short answer: No.

Long Answer:

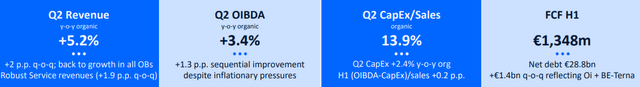

Telefonica and Orange both are seeing significant progression in EBITDAaL and OIBDA while strengthening their hold on their respective core geographies. To that comes that Orange’s CapEx rollout was extremely front-loaded, to where they now can dial things back, giving them an advantage over its peers and making its 7-10% yields quite well-covered and safe, all things considered.

There is nothing in these companies’ business results that would suggest any justification for this sort of price action.

TEF IR (TEF IR)

Orange IR (Orange IR)

Quite the opposite, both companies are moving forward with their respective plans, which you can read more about in my articles on them. These companies come in at upsides of starting at 50% but going up to 80-90%. Given the underlying assets they represent, I’m pushing money to work and expanding my positions.

Most of the telco sector is under pricing pressure due to expected margin compression from cost increases. As of yet, these have not materialized to any significant degree. I remain positive about these companies and consider both “BUYs”.

3. Airbus (OTCPK:EADSY)

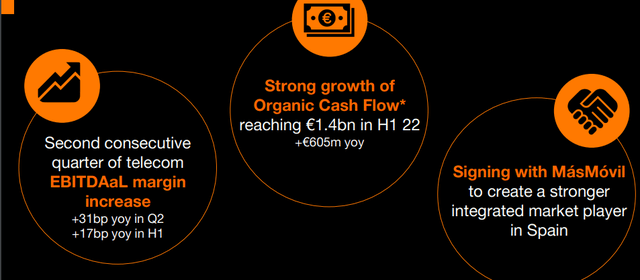

Airbus is currently trading at €88 for the native. Now, don’t get me wrong – I love seeing this given where I believe the company is going. But it’s still interesting to see the market disregarding the ramp-up for production and growth in the company. It’s all a question of how we value the cash flows and earnings potential for one of the largest aerospace and military firms in the world.

I would assign a premium to it – but even if you give it no more than a 15-17x conservative P/E, which is around half of its premium, your potential upside is almost 30% annually. This is based on an average of 16.1% EPS growth annually until 2024E.

Airbus Upside (FAST Graphs)

If we consider a reversal to standard likely, that’s an upside of nearly 190% total until 2024E.

I have a large position in Airbus at a cost average of around €95/share – and I’m expanding it slowly at this time. The company is beyond what I would consider safe at “A”. The yield isn’t the greatest – but the upside makes up for that.

I’m “LONG” Airbus here.

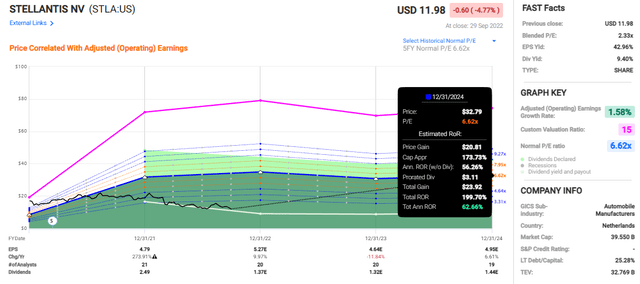

4. Stellantis (STLA)

What would you say if I told you that the company owning Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS, Fiat, Fiat Professional, Jeep, Lancia, Maserati, Mopar, Opel, Peugeot, Ram, and Vauxhall was trading at a P/E of 2.5x and an EPS yield of 40%+?

Would that interest you perhaps even a little?

It should.

Stellantis is down 25.7% for the year. Not the strangest development, all things considered, but it means that the market is valuing this company’s cash flows like absolute garbage. Put simply, I would say that Stellantis is worth at least 100% more. Investing in automotive businesses in this macro isn’t the easiest, but if you consider it a long-term deal, then this becomes easier to swallow.

So does it, if we look at the expected dividends for Stellantis, closing in on 10% here – the expected 2022E dividend is €1.3 for the native, and this one is expected to grow in both 2024 and 2025.

Even only expecting a 6x P/E multiple gives us a close to 200% upside here.

STLA Upside (FAST Graphs)

This reminds me of opportunities like Unum (UNM), Principal Financial (PFG), or Prudential (PRU), where I’ve been able to eke out gains of 50-150% over time. I’m slowly putting money to work in Stellantis – look at my article on the company for more info.

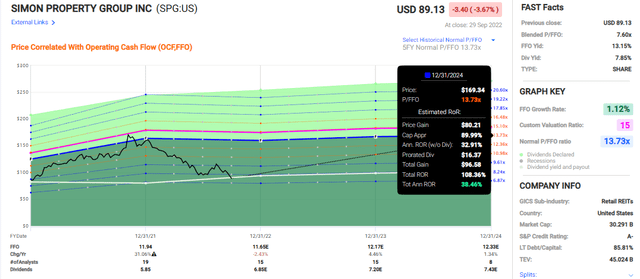

5. Simon Property Group (SPG) & Realty Income (O)

USD-based investments are unfortunately not the greatest for me at this time – but I’m still trying to keep on top of these stakes and add where possible. FX is making it difficult for me though.

However, I won’t be ignoring O at a sub-16x P/FFO multiple or SPG at even lower than that. O is one of the safest REITs on the planet with a yield now of 5.14%, and a credit rating of A-. The company has a 24% annual RoR here, or 64% until 2024E. That’s to a 20x P/FFO, which to me is justified based on the company’s portfolio and assets. For SPG, the upside to a 13.5x P/FFO is now over 105%, and it’s also A-rated.

SPG Upside (FAST Graphs)

Investors and the market may be worried about margin compression and stability due to macro. I won’t call these worries unfounded – but I will call them unlikely.

Recent trends in both companies do not support any significant compression or downward trend. Instead, they support stability, and even slight growth.

6. Microsoft (MSFT)

Okay, first things here. I do not yet own Microsoft. But I intend to invest in it.

Microsoft may not be the cheapest company around. I honestly did not think I would ever be writing of this company as “Buyable”. But the simple fact is, Microsoft currently trades at close to 25x P/E.

The company’s premium is 100% justified given its AAA credit rating. Its yield is low, and you’re paying a high multiple for earnings, but those earnings are also set to grow at the sort of pace that could see your money increase in value by 77% in less than 3 years.

It’s hard to compare Microsoft to anything, or to call the world’s leading OS/software company “risky”. There’s too much of a moat here, and a market share to really say anything negative. The usual negative on MSFT is the valuation – and closing in on 25x P/E, that argument is starting to look thin.

I wouldn’t call Microsoft one of the most undervalued or cheapest businesses to buy, but I would call it an attractive one, for the simple reason that we’re looking at Microsoft as cheap as it hasn’t been since early -21. We haven’t seen sub-25x since COVID-19, and in 2019 before then.

This is a “BUY” for me here.

Wrapping Up

So, these are some companies I currently consider very attractive. It’s hard at this time to really point out the “best of the best” – and even doing it with these, there are plenty of companies that come at similar or comparable upsides. Some may be better for you. I can’t spend an article pointing out every buyable company, because few people know what to do with a list holding 186 names, or how to put them in context of one another.

Even for a professional analyst such as myself, that’s no mean feat – and I don’t always get it “right” either.

I try for the safest, highest, and most conservative upside with the best yield out there. That’s pretty much all I do here.

And I believe these companies are some of the ones you should consider here.

Questions? Let me know.