Dzmitry Dzemidovich

During these difficult times when the market can be volatile, sometimes the best approach it’s to focus on capital preservation over capital appreciation. When it comes to stocks in particular, this opportunity is rarely guaranteed. But one case where it’s practically guaranteed for investors to lock in a modest return, with very little downside should things go wrong, involves STORE Capital (NYSE:STOR). Due to the pending sale of the company in an all-cash deal, shares seem to have a little bit of upside from here. Unfortunately, a recent development has quashed the idea that upside might be greater. But even achieving a small uptick in value can be considered a win when markets are turbulent.

Some cash is still on the table

On September 15th of this year, the management team at STORE Capital announced that they had agreed to sell the company to GIC and funds managed by Oak Street in an all-cash deal valuing the company at around $14 billion on an enterprise value basis. As I covered in a prior article, STORE Capital operates as an internally managed net-leased REIT the focus is on acquiring single-tenant operational real estate. Its assets are significant and diverse, ranging from restaurants to pet care facilities, to lumber and construction materials wholesalers, to metal fabrication facilities, and more. In that article, I found myself impressed by the company’s historical growth and by how attractively priced shares were. My findings ultimately led me to rate the business a ‘buy’, reflecting my belief back then that the stock would likely outperform the broader market for the foreseeable future. Thanks in part to the aforementioned acquisition, that call has played off nicely. While the S&P 500 is down by 9.6%, shares of the REIT are up by 16.8% if we include distributions collected.

Clearly, I was not the only one who found the company to be an appealing opportunity. That’s why the agreement between management and the aforementioned other parties formed to take the enterprise private in a deal valued at $32.25 per share. Based on my estimates, this implies an equity value of $9.12 billion. Add on the net debt the company has, and we get an enterprise value of $13.77 billion. For a time following the announced acquisition, there was some hope that the company might ultimately find a better deal. This hope was allowed to persist because, as part of the merger agreement, management had one month set aside as a ‘go-shop’ period whereby the company and its advisers were able to solicit acquisition proposals from other third parties to see if a better deal might be had.

On October 17th, the company announced that it had solicited proposals from 15 potentially interested third parties. However, during that time, none of the parties in question contacted STORE Capital with a counteroffer of any kind. If they had and if the terms of the deal had been more attractive, upside for shareholders could have been more significant. In essence, this created a situation where downside for the company was very limited while upside could be quite nice had a better deal come through. But since that time has come and gone, the company has now fallen under a ‘no-shop’ Provision that limits its ability to negotiate acquisition proposals with, or provide nonpublic information to, third parties unless a specific exception applies.

Although this may be disappointing for investors who felt that the purchase price offered for STORE Capital was not adequate, the fact of the matter is that the deal seems to be taking place at fairly attractive terms anyways. For instance, for the 2022 fiscal year as a whole, management recently revised higher their expectations for adjusted FFO (funds from operations) per share from between $2.20 and $2.23 to between $2.25 and $2.27. At the midpoint, this would imply adjusted FFO of $638.9 million. By comparison, this metric back in the 2021 fiscal year came out to $541.1 million.

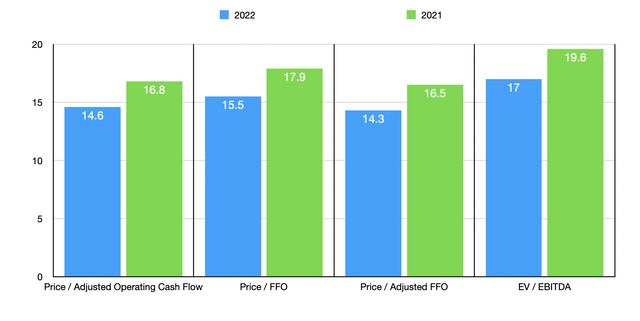

Author – SEC EDGAR Data

If we assume that other profitability metrics would rise at the same rate that adjusted FFO was forecast to do, then we should anticipate FFO of $587 million, adjusted operating cash flow of $624 million, and EBITDA of $809.1 million for the current fiscal year. This implies a forward price to adjusted operating cash flow multiple of 14.6. This is down from the 16.8 reading that we get using data from 2021. The forward price to FFO multiple would be 15.5, while the forward price to adjusted FFO multiple would be 14.3. By comparison, the data from 2021 pegged these numbers at 17.9 and 16.5, respectively. And finally, the EV to EBITDA multiple would come in at 17, down from the 19.6 reading that we get using data from 2021.

As part of my analysis, I decided to compare STORE Capital to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 11.6 to a high of 20.2. These particular multiples include data from the 2021 fiscal year. In this case, compared to the data we’re using from 2021, three of the five companies were cheaper than STORE Capital. Meanwhile, using the EV to EBITDA approach, the range was between 14 and 23.5. In this case, four of the five were cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| STORE Capital | 16.8 | 19.6 |

| W. P. Carey (WPC) | 16.2 | 18.8 |

| Broadstone Net Lease (BNL) | 16.6 | 19.1 |

| Essential Properties Realty Trust (EPRT) | 20.2 | 23.5 |

| American Assets Trust (AAT) | 17.0 | 17.7 |

| Empire State Realty Trust (ESRT) | 11.6 | 14.0 |

Averaging out the pricing of these five similar businesses, I then asked myself what kind of downside might exist for STORE Capital should the acquisition fail for any reason. On a price to operating cash flow basis, I estimated that downside would be around 3%. Using the EV to EBITDA approach, downside would be slightly greater at 7.8%. But as I have experienced before, the probability of a deal failing at this point is quite low. By comparison, there is a bit of upside that is almost guaranteed for investors from this point. From the current share price of the company to the buyout price, that upside is around 2%. Some investors might point to the continued distribution of STORE Capital. But as management made clear recently, the payout made on October 17th covering the third quarter of the year for $0.41 per share was the last that the company will make available to shareholders. for those who captured that distribution, implied upside including what’s left on the table would have been 4.5%.

Takeaway

While these returns may not sound great, it’s important to understand just how rough the market has been this year. Year to date, the S&P 500 is down by 21.3%. As a whole, REITs are faring even worse. Through October 20th, the Nareit All-Equity REITs Index was down by 30.4%. If these were more normal market conditions, I would tell investors that the upside might not be worth the opportunity cost elsewhere. But for those who are still cautious about the market and think that additional downside might be on the table, owning shares in STORE Capital until they are formally purchased in early next year might make for a good idea.