Published on October 20th, 2022 by Nikolaos Sismanis

The shipping industry is quite complex, and highly cyclical. Whether it comes to transporting containers, dry bulk such as grain, or energy resources like crude oil and liquefied natural gas (LNG), the performance of each shipping company depends on various macro-economic factors.

The smallest change in either the demand for transportation or the underlying supply/availability of vessels can have major effects on shipping rates. Further, companies in the industry have historically been quite leveraged, carrying additional risk.

Thus, it’s no wonder shipping companies lack attractive dividend growth track records. Nevertheless, there are certain companies in the space whose qualities and dividend prospects stand out.

With all this in mind, we created a list of over 40 shipping stocks, along with important financial ratios such as dividend yields and price-to-earnings ratios.

You can download your free shipping stocks list by clicking on the link below:

Our shipping stocks list was derived from two major ETFs that track the global shipping industry:

- ProShares Supply Chain Logistics ETF (SUPL)

- SonicShares Global Shipping ETF (BOAT)

Below, we examine 7 such shipping stocks, whose dividends we see as relatively safer compared to the rest of their peers. They are listed in no particular order.

Table of Contents

Shipping Stock #7: Danaos Corporation (DAC)

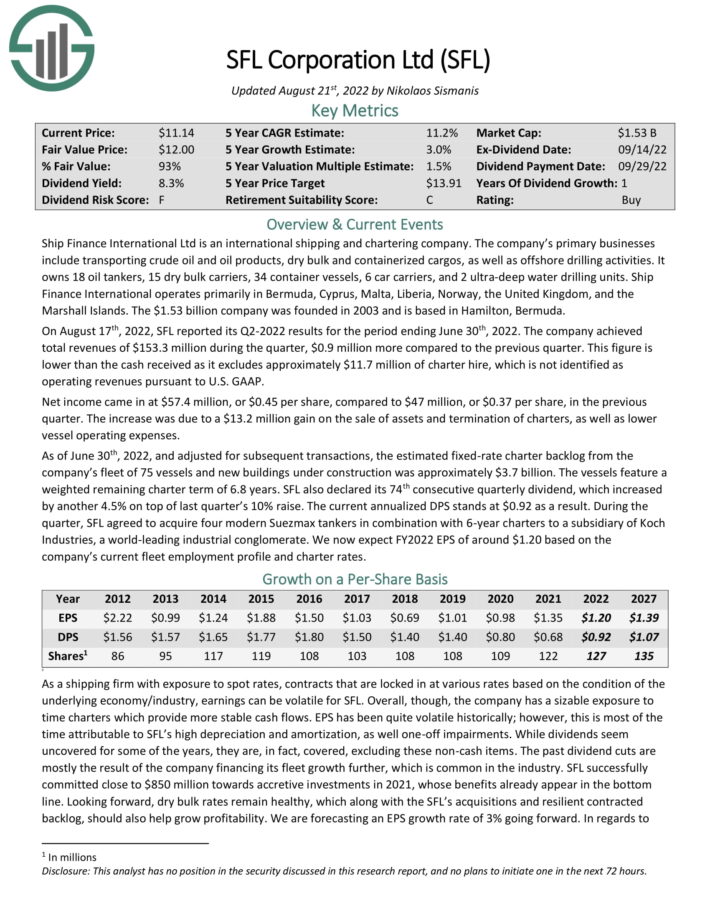

Danaos Corporation is the second-largest publicly traded pure containership company. With a market cap of $1.2 billion, Danaos only comes behind Atlas Corp. (ATCO). The company owns a fleet of 71 containerships aggregating 436,589 TEUs, which it leases to containership liners such as MSC and Maersk. Danaos’ business model is lean, as the company has nothing to do with actually operating these vessels, resulting in high-margin and predictable cash flows.

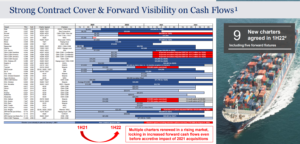

The company had a rough time during the past decade, with an oversupply of containership vessels surprising containership rates and, thus, leasing rates. The COVID-19 pandemic caused a port congestion crisis amongst other supply chain bottlenecks, resulting in surging freight rates that were nine to ten times higher than their pre-pandemic ones. Danaos executed impeccably on this opportunity by securing long-term multi-year charters at record rates.

While freight rates have currently been corrected significantly (they still remain more than double their pre-pandemic levels), Danaos’s future cash flows remain locked in near record levels, with some of them extending as far out as 2028! The company’s charter backlog currently stands at $2.3 billion, almost twice the company’s market cap – and remember, these are ultra-high margin cash flows.

Source: Investor Presentation

The company has already taken advantage of its record profits to repay its debt prematurely, reducing its leverage to a very healthy 0.9X. For context, leverage was 7.3X back in 2017. Additionally, the company’s book value per share based on its equity value on the balance sheet now stands close to $116. However, this doesn’t reflect Danaos’ revenue backlog, which, if discounted back according to my estimates, should boost the BVPS to anywhere between $140 and $170.

Management has been openly well-aware of the mismatch between the stock price and the company’s book value during post-earnings calls. In response, they have launched a $100 million stock repurchase program, 25% of which has already been completed.

Shares are currently yielding a substantial 5.2%, with Danaos only paying out around 10% of its adjusted earnings (excluding the changes in the value of its minority holding in ZIM Integrated Shipping Services (ZIM)). Thus, Danaos should retain adequate cash to fund its forthcoming fleet expansion while rewarding shareholders satisfactorily.

With Danaos enjoying multi-year cash flow visibility, trading at a substantial discount to NAV, buying back stock, and paying a sizable yield that is very well-covered, the company currently presents one of the best risk/reward opportunities in shipping, in our view.

Shipping Stock #6: SFL Corporation Ltd. (SFL)

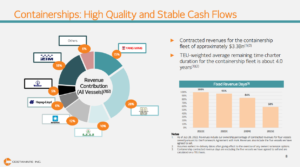

SFL Corporation has one of the most diversified fleets in shipping, having exposure on multiple industry fronts, including transporting crude oil and oil products, dry bulk and containerized cargos, as well as offshore drilling activities. The company owns 18 oil tankers, 15 dry bulk carriers, 34 container vessels, six car carriers, and two ultra-deepwater drilling units.

Similar to Danaos, SFL is not actually involved with operating any of its assets. They are instead secured under long-term contracts. Since SFL has exposure to multiple asset classes, its leasing rates vary based on the underlying market conditions of each market segment. For instance, there could be a trading period in which containerships have low absorption rates, but demand for tankers is increasing.

This, combined with the company negotiating longer-than-average leasing contracts, has been a great strategy to de-risk cash flows. SFL’s contracted revenues now stand at $3.7 billion, featuring a weighted remaining charter term of 6.8 years.

Source: Investor Presentation

In fact, precisely because of its diversified asset base and multi-year leases, SFL has been one of the most generous dividend payers in the industry. Dividends have not been consistent, with occasional “cuts” which occurred for SFL’s fleet growth to be financed. Still, they have always remained substantial with shareholder value maximization in mind – that’s a rare trait in the industry.

The dividend has now been increased for four consecutive quarters, with the current quarterly rate implying a yield of 9.5%. Based on our earnings-per-share estimate for fiscal 2022, SFL’s payout ratio stands close to 77%.

Considering that one of its rigs is marketed for new charter opportunities in 2023 with an excellent trading environment in the energy sector, there is likely more room for the dividend to grow in the coming quarters.

Click here to download our most recent Sure Analysis report on SFL (preview of page 1 of 3 shown below):

Shipping Stock #5: Costamare Inc. (CMRE)

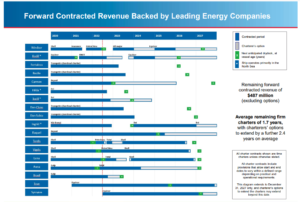

Costamare’s fleet includes containerships and dry bulk vessels. Specifically, its fleet comprises 76 containerships with a total capacity of around 557,400 twenty-foot equivalent units and 45 dry bulk vessels with a total capacity of around 2,435,500 deadweight tons.

The company has paid 47 consecutive quarterly common dividends since its IPO, which has been possible due to employing a similar multi-year chartering strategy when it comes to its containerships, similar to that of Danaos.

Particularly, Costamare’s contracted revenues for its containership fleet amount to $3.3 billion, with their TEU-weighted average remaining time charter duration standing at about 4.0 years. Excellent cash flow visibility at great rates should provide almost totally predictable containership revenues, at least through 2024.

Source: Investor Presentation

The company’s dry bulk vessels operate in the open market, which is currently under pressure mainly due to China’s conservation industry suffering. Nevertheless, they should not produce money-losing results at current rates.

Shares of Costamare are now attached to a 4.7% yield, and similar to Danaos, the payout ratio should stand just over 10%, meaning current dividend payouts should be very well-covered. Accordingly, the company may pay a substantial special dividend this year, similar to last year’s $0.50, which was more than double the common annual dividend.

Costamare’s management is also well aware of the current undervaluation of its shares. This is a consistent theme amongst containership owners as the market seems to be ignoring their multi-year charters, focusing on the actual declining spot rates. Accordingly, last quarter, the company repurchased around $60 million worth of common shares, representing 3.8% of total common shares.

Approximately $90 million for common and $150 million for preferred shares remains authorized to be repurchased.

Related: 6 Preferred Stocks To Buy Right Now, And 1 To Avoid

It’s worth noting that nearly 60% of the company’s shares are owned by insiders (the sponsor family), who have reinvested $130 million back into the company through Costamare’s DRIP program. Thus, their interests with common shareholders are totally aligned.

Shipping Stock #4: KNOT Offshore Partners LP (KNOP)

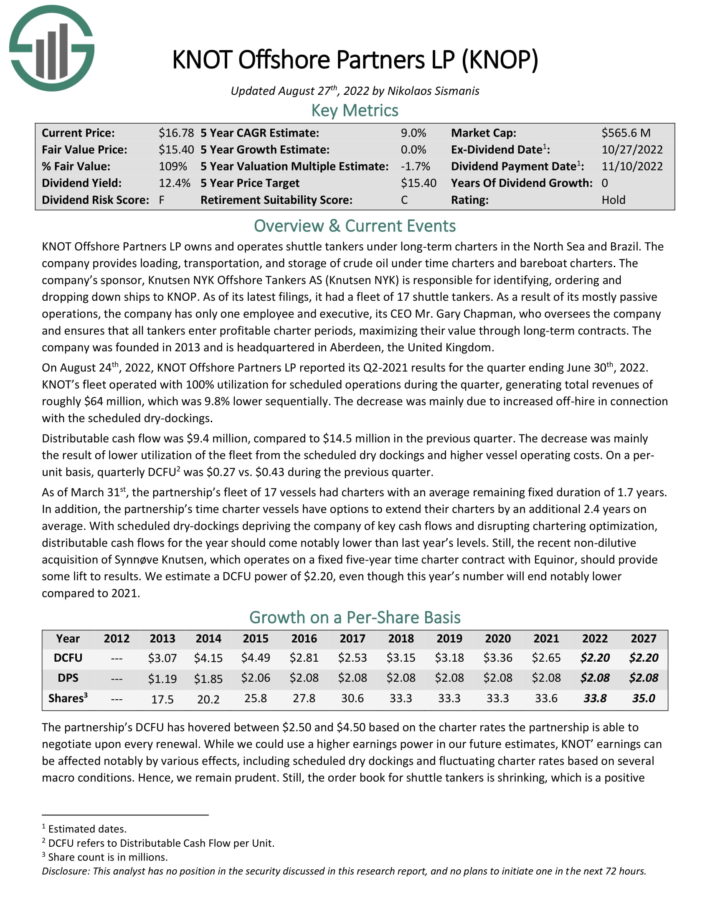

KNOT Offshore Partners LP is one of the most unique publicly traded shipping partnerships. The partnership fleet contains 17 shuttle tankers. Shuttle tankers are a niche in the shipping industry and are quite limited in availability. Only around 100 shuttle tankers exist in the world today.

The partnership’s overall operations are pretty passive. KNOT has only one employee and executive, its CEO Mr. Gary Chapman, who oversees its assets and ensures that all tankers enter profitable charter periods, maximizing their value through long-term contracts.

Demand for shuttle tankers is very volatile because the energy industry is very volatile. Accordingly, the company’s charters are somewhat shorter-term than those we saw containership owners land. KNOT’s remaining forward contracted revenue stands at $487 million, with an average remaining charter period of 1.7 years. Charterers’ options to extend charrs could push this by a further 2.4 years, on average.

Source: Investor Presentation

KNOT has made a name for itself being a reliable high-yield stock. Distributions have never been cut since its public listing in 2013, with the current annual distribution rate of $2.08/unit remaining stable since 2016. At the stock’s current price levels, it implies a massive yield of 13.4%, which is in line with its historical average.

KNOT distributable cash flows per share have historically hovered between $2.50 and $4.50 based on the charter rates the partnership is able to negotiate upon every renewal. We expect the company to deliver DCFU of $2.20 as dry dockings and other challenges have pressured its bottom line lately.

With the order book for shuttle tankers shrinking and the current environment in the energy market pointing towards a favorable landscape for the shuttle tankers, DCFU could re-expand from next year, reducing the risk of a distribution cut.

Still, we remain prudent as distributions could be indeed slashed following any unforeseen event in the short term amid razor-thin coverage. KNOT’s massive yield should justify the underlying risks, nonetheless.

Click here to download our most recent Sure Analysis report on KNOP (preview of page 1 of 3 shown below):

Shipping Stock #3: Global Ship Lease, Inc. (GSL)

You can think of Global Ship Lease as Danaos’ younger sibling. It’s also a pure play on containership lessors. The company’s fleet underwent a tremendous transformation last year. The company went on to acquire 23 vessels, expanding its total fleet to 65 vessels.

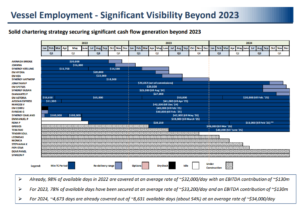

Besides the fact that these new vessels became immediately accretive to earnings, the purchase took place just before containership rates exploded last year. The company took the opportunity to extend the legacy charters on these vessels at remarkably higher rates – they now extend even further out from those of Danaos.

Further, in late August, the company announced a massive extension for six ECO 6,900 TEU modern ships with Hapag-Lloyd. These leases won’t even begin producing cash flows -which are also considerably higher than their previous ones- until late 2023 to late 2024. In fact, these leases have now secured predictable revenues for five years all the way through 2029!

Source: Investor Presentation

GSL currently offers the best cash flow visibility in shipping by far, with earnings set to grow via ironclad leasing contracts (no meaningful track in the industry of re-negotiations that went against lessors). And, while the stock currently yields a substantial 8.6%, dividends only account for around 20% of its earnings.

The company could increase its dividend, but it’s likely that excess earnings will be used to buy back stock on the cheap. In fact, to illustrate how ridiculously cheap GSL is, the lease extensions mentioned earlier, which involve only six of the company’s 65 vessels, added $393 million in adjusted EBITDA backlog, which equates to 61% of the company’s current market cap.

With its charter backlog approaching nearly $3.0 billion following this extension, GSL is set to generate its current market cap as net income 3-4 times over in the coming years. Thus, the company has already started repurchasing shares along with its senior notes rather aggressively.

Shipping Stock #2: Euroseas Ltd. (ESEA)

If GSL is Danaos’ younger sibling, Euroseas is the youngest one in the family. The company is a pure play on containership as well, owning just 18 vessels. They comprise ten feeder containerships and eight intermediate containerships, with a cargo capacity of 58,871 TEU.

Similar to its peers, the company took advantage of the strong tailwinds the industry found itself enjoying last year, locking in contractually-secured forward-looking revenues at excellent rates. Euroseas has already secured vessel employment for its two new builds that won’t even come online until mid-2023.

Source: Investor Presentation

Again, following the same theme that is consistent with Danaos, Costamare, and Global Ship Lease, Euroseas is currently incredibly undervalued. Shares are presently trading at $21.50. Now consider this: Simply based on Euroseas’ contracted days (which assumes zero revenues for its “Open Days” but includes all costs), the company is set to earn more than $22.5/share over the 2½ years from Q3 2022 to 2024.

In addition to these earnings over the next 2½ years, at the end of 2024, the incremental NAVof Euroseas’ fleet (which assumes scrap prices for the existing fleet at $400/lwt despite the current ones being just below $600/lwt) along with 90% of contract prices for the nine new buildings after repaying the outstanding debt will stand at about $11.5/share. Thus, even under such a brutal downside scenario, Euroseas should be trading at least close to $34/share.

Management forecasts that if its open days are chartered at even half the rate of its contracted days, its earnings over the next 2½ years would be boosted by about $12.5/share (56%) to about $35/share resulting in total value in excess of $46/share. That’s the upcoming value creation and doesn’t even include the actual NAV of its fleet.

Again, with management being well aware of such a severe undervaluation, share repurchases are currently complementing the stock’s 9.6% yield. The company’s share repurchase program of up to $20 million accounts for nearly 13% of its current market cap.

Shipping Stock #1: Scorpio Tankers Inc. (STNG)

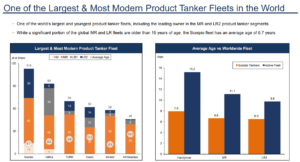

Scorpio is the only pure tanker play in our 7-stock best shipping stocks list. This is because most container ship lessors appear to feature outsized risk/reward investment cases. Nevertheless, tankers have already entered what appears to be a super-cycle.

Since Western allies imposed severe sanctions on Russia, demand for transporting crude oil overseas has surged. Tankers now have to voyage significantly higher distances as well, meaning that elevated rates last considerably longer too.

With a fleet of 113 tankers, Scorpio is the world’s largest product tanker owner, which places the company in the perfect spot to take advantage of the ongoing market situation. Tanker rates have already more than doubled compared to last year. Further Russian sanctions won’t be going anyway any time soon.

These factors, combined with the fact that the tanker order book is currently at just 5% of the global tanker fleet (i.e., limited supply of tankers in the future), Scorpio could be printing cash for years to come.

Consensus estimates for Q3 2022 point toward EPS of $3.91, and that is before the latest surge in rates. while rates could continue surging as we are headed toward winter, even at current rates, Scorpio could be earning north of $15/share/year over the medium term – at least as the ongoing war in Ukraine persists, nonetheless, in my view.

Scorpio has not started payout out meaningful dividends despite these developments, with shares now yielding less than 1%. Management has instead been on a stock repurchase spree lately, as shares have remained undervalued against future earnings projections. I believe that once Scorpio starts receiving monster cash flows in the coming quarters, we will likely see a much more substantial dividend as well.

Final Thoughts

The shipping industry is one of the riskiest, meaning shipping stocks can be volatile. Investing in shipping stocks requires extensive knowledge of each company, and even then, changes in the macro environment can wildly swing sentiment. Risk-averse investors such as retirees relying on dividend income, are generally discouraged from investing in shipping stocks.

Nevertheless, the shipping stocks presented here come with great qualities. Excluding Scorpio, the companies we discussed currently offer sizable dividends, with most being well-covered.

We have specifically selected shipping stocks that offer multi-year charter coverage, and an above-average margin of safety for their dividends. Still, if you do invest in the shipping industry, it is important to monitor your investments.

Additional Resources

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].