Updated on October 17th, 2022 by Quinn Mohammed

In late October 2021, Tennant Company (TNC) increased its dividend for the 50th consecutive year. As a result, it joined the list of Dividend Kings.

The Dividend Kings are a group of just 45 stocks that have increased their dividends for at least 50 years in a row. We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all 45 Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Tennant Company is a reliable dividend growth stock that can increase its dividend, even during recessions.

At the same time, the stock appears significantly undervalued right now, making Tennant Company stock a buy for income investors.

Business Overview

Tennant Company is a machinery company that produces cleaning products and offers cleaning solutions to its customers. In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe. Tennant was founded in 1870.

Tennant Company reported its second-quarter earnings results on August 9th. The company generated revenues of $280 million during the quarter, which was 0.4% higher year-over-year. Revenue was also up sequentially.

Tennant Company generated adjusted earnings-per-share of $0.92 during the quarter, which was a 22% decrease compared to $1.18 in Q2 2021.

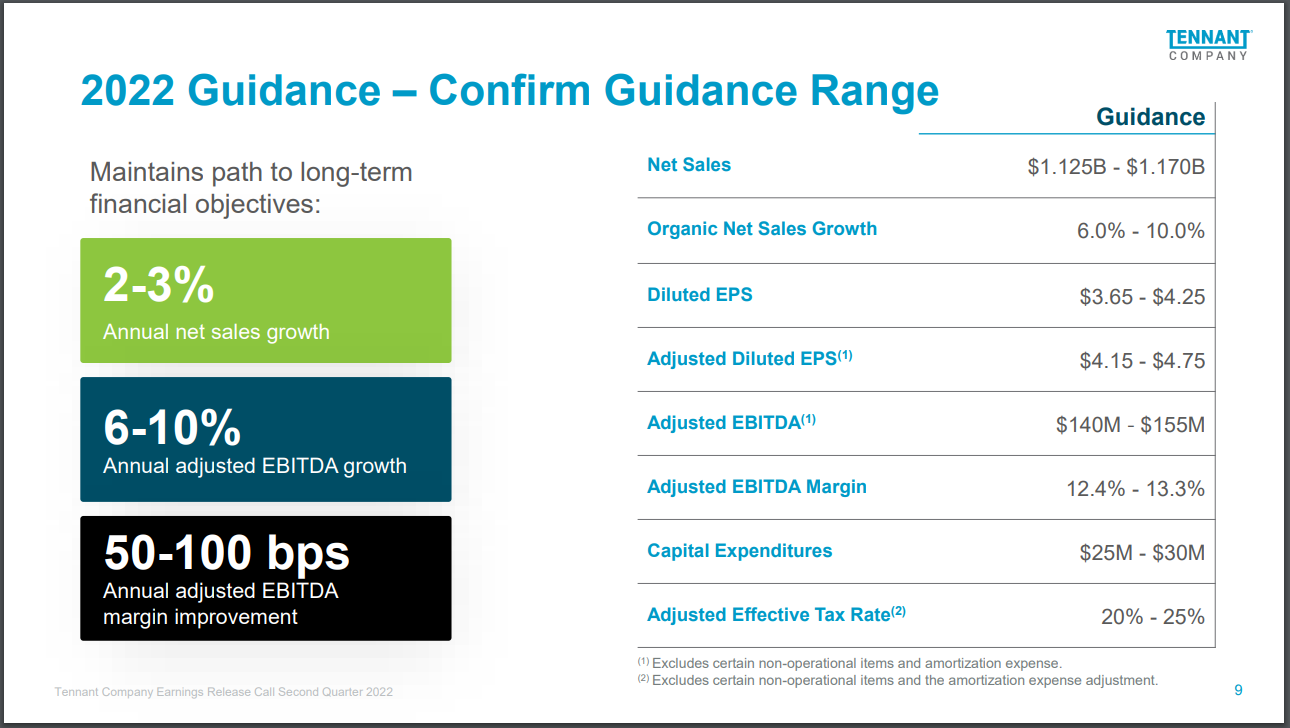

Source: Investor Presentation

Management is forecasting that adjusted earnings-per-share will fall into a range of $4.15 to $4.75 in 2022, which would be an improvement at the midpoint versus 2021, and which means new record profits for the current year.

Growth Prospects

Tennant Company’s earnings-per-share were quite lumpy over the last decade. Overall, the trend pointed upward, but there were a lot of ups and downs; the company has not been able to grow its earnings consistently.

Between 2010 and 2021, Tennant Company recorded an average annual earnings-per-share growth rate of 7%.

However, Tennant Company’s earnings-per-share saw some ups and downs in that time frame, such as in 2017, when profits were down considerably compared to the previous year.

The company expects 2022 to be a strong year overall.

Source: Investor Presentation

Tennant has plans to grow its sales inorganically, especially in the Asia/Pacific region, where it benefits from above-average market growth rates.

The takeover of Chinese cleaning equipment company Gaomei improves Tennant’s sales outlook in the Chinese market, as well as in other Asian markets, over the next couple of years.

As the coronavirus impact wanes, synergies from this acquisition and other moves to bolster the overall profitability and the business in Asia will increasingly pay off and should deliver attractive earnings growth for Tennant.

We expect 6% annual earnings-per-share growth over the next five years for Tennant.

Competitive Advantages & Recession Performance

Tennant Company is the leader in the US cleaning machines market. This serves as a competitive advantage, as Tennant Company’s market leadership allows for better economies of scale and a superior sales network compared to its peers.

During the last financial crisis, Tennant remained profitable, but its earnings still suffered considerably. Tennant’s earnings-per-share throughout the Great Recession of 2007-2009 are listed below:

- 2007 earnings-per-share of $1.79

- 2008 earnings-per-share of $1.35 (24.6% decline)

- 2009 earnings-per-share of $0.65 (51.8% decline)

- 2010 earnings-per-share of $1.31 (101.5% increase)

As you can see, Tennant’s earnings-per-share declined significantly in 2008 and 2009, showing that the company is vulnerable to economic downturns. The company proceeded to more than double its earnings-per-share in 2010, showing it can rebound quickly from recessions.

The company reported earnings-per-share growth in 2020 and 2021 when the coronavirus pandemic sent the U.S. economy into a recession.

Valuation & Expected Returns

Tennant is expected to generate earnings-per-share of $4.45 for 2022. Based on this, the stock trades for a price-to-earnings ratio of 12.9. Our fair value estimate is a price-to-earnings ratio of 18. Thus, the stock appears significantly undervalued. An expanding price-to-earnings ratio could increase annual returns by 6.9% each year over the next five years.

Future returns will also be comprised of earnings-per-share growth and dividends. We expect Tennant to grow earnings-per-share each year by 6.0%, consisting of organic revenue growth and acquisitions.

In addition, shares have a 1.7% current dividend yield. The combination of valuation changes, earnings growth, and dividends results in total expected returns of 14.5% per year over the next five years. We rate the stock a buy.

Tennant Company has been valued at high multiples throughout the last decade. This is somewhat surprising, as its growth has been solid but not outstanding. Still, based on our earnings-per-share estimate, shares are trading below what we deem a fair valuation for the company.

Tennant has a secure dividend, with a projected dividend payout ratio of about 23% for 2022. This gives the company enough room to continue increasing the dividend at a rate in line with its adjusted EPS growth rate.

Final Thoughts

Tennant Company is the leader in the niche market that the company serves. Organic growth and acquisitions should fuel a solid growth rate over the next several years. Shareholders should also see continued dividend increases each year.

Following a strong 2021, Tennant will likely see its profits rise further in 2022. Tennant shares have high expected total returns, which is why we rate the stock a buy.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].