bluebay2014

By Brian Manby, CFA

Not that you need a reminder, but 2022 has been one of the most volatile years on record. With most major equity indexes in bear market territory, investors have struggled to find relief from the pressure of rising interest rates and record inflation stubbornly weighing on markets.

Cratering markets require creative solutions to keep portfolios afloat, which is why now is an opportune time to revisit the WisdomTree Target Range Fund (GTR), one year after its launch.

Option Mechanics: A Quick Refresher

In October 2021, in collaboration with Valmark, we introduced GTR as a potential solution for market volatility. More importantly, we attempted to address one of investing’s most fundamental concerns: how to attempt to limit downside exposure during steep sell-offs while retaining as much upside potential as possible during market rallies.

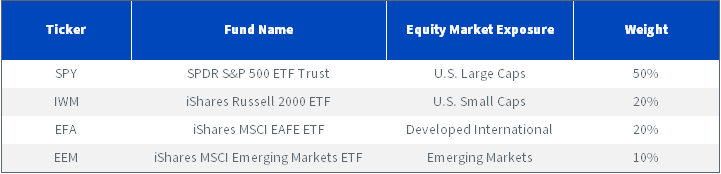

GTR is an options-based strategy that seeks to provide capital appreciation while attempting to hedge risk in equity markets through bull call option spreads. The options purchased and sold are both 15% in-the-money (ITM) and out-of-the money (OTM), completing a spread strategy that attempts to deliver performance for the year ahead in a prespecified “target range.” The ETFs underlying the options provide exposure to U.S. large- and small-cap, international, and emerging markets equities in the following proportions:

ETFs underlying GTR’s Options

Since markets have declined substantially this year (i.e., by more than the 15% range indicated by the options), both options will expire worthless if nothing changes between now and the January 2023 option rollover. The investor’s loss is limited to the net premium paid for the long option position.

On the other hand, if markets rally into -15% to +15% territory since the January 2022 rollover, then the long option position will theoretically be exercised to purchase the asset at a price below the prevailing market value. If they rally beyond +15%, however, the option positions sold may be ITM and would require delivery of the underlying to the buyer (again, at a price below prevailing market value). This effectively caps an investor’s upside from the strategy when markets rise, while also limiting downside to the net premium paid when markets fall.

The Year in Review

The first year of the Fund’s infancy provided several intriguing insights.

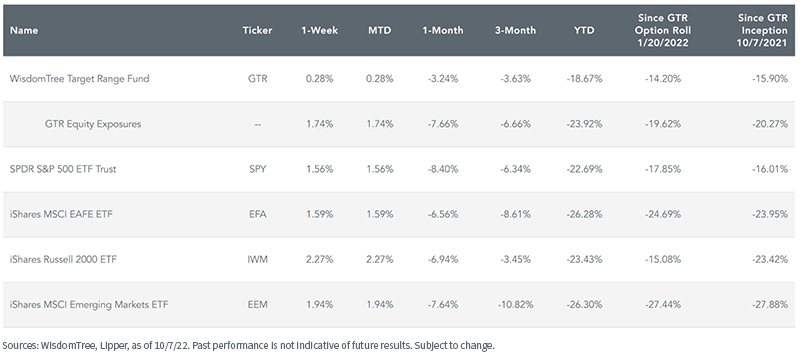

Foremost, GTR delivered partial downside protection, despite roughly 25% declines in the broader markets, accessed via its option exposures. Evident in the Performance & Strategy Statistics section of GTR’s web page, the Fund has outperformed by about 5% year-to-date and since inception.

NAV Price Return for GTR & Exposures Underlying its Option Strategy as of 10/7/22

See GTR’s web page for full standardized performance data and other important information.

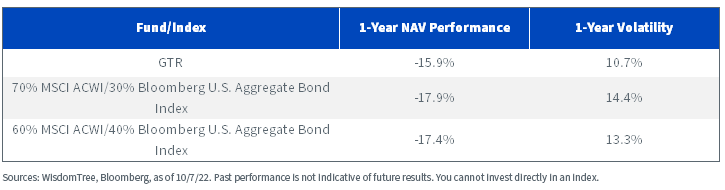

Secondly, GTR provided a risk-return profile that outperformed both a 70% equity/30% fixed income portfolio and a 60/40 one-ticker solution. Consider the MSCI AC World and Bloomberg U.S. Aggregate Bond indexes as an asset class pairing:

Risk & Return Measures as of 10/7/22

GTR not only outperformed this traditional equity/fixed income portfolio by about 1%–2%, but did so with less risk, delivering better risk-adjusted returns and a more efficient portfolio in the context of modern portfolio theory.

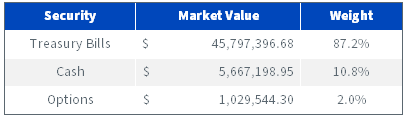

As of October 7, equities remain deep in bear market territory. GTR’s outperformance is a testament to the efficacy of an options strategy to mitigate volatility while retaining upside potential. Options also allow the Fund itself to invest most assets in secure investments like cash and Treasuries, while retaining equity market exposure.

Fund Composition as of 10/7/22

The first year of performance demonstrates that GTR can be a potential solution for volatility, without completely restricting the ability to participate in market rallies. Most importantly, this may help investors keep their portfolios positioned as an auxiliary allocation for whatever market events are on the horizon.

Please take a look at GTR’s web page for more information.

Important Risks Related to this Article

The Fund is actively managed and implements a strategy similar to the methodology of the TOPS® Global Equity Target Range™ Index (the “Index”), which seeks to track the performance of a cash-secured call spread option strategy. There can be no assurance that the Index or the Fund will achieve its respective investment objectives, or that the Fund will successfully implement its investment strategy. Moreover, while the Fund seeks to target returns within a prescribed range, thereby minimizing downside investment loss, there can be no guarantee that an investor in the Fund will experience limited downside protection, particularly short-term investors, investors that seek to time the market and/or investors that invest over a period other than the annual period. The Fund’s options strategy will subject Fund returns to an upside limitation on returns attributable to the assets underlying the options. The Fund’s investments in options may be subject to volatile swings in price influenced by changes in the value of the underlying ETFs or other reference asset. The return on an options contract may not correlate with the return of its underlying reference asset. The Fund may utilize FLEX Options to carry out its investment strategy. FLEX Options may be less liquid than standard options, which may make it more difficult for the Fund to close out its FLEX Options positions at desired times and prices. The Fund’s use of derivatives will give rise to leverage and derivatives can be volatile and may be less liquid than other securities. As a result, the value of an investment in the Fund may change quickly and without warning and you may lose money. Investment exposure to securities and instruments traded in non-U.S., developing or emerging markets can involve additional risks relating to political, economic, or regulatory conditions not associated with investments in U.S. securities and more developed international markets. These and other factors can make investments in the Fund more volatile and potentially less liquid than other types of investments. Please read the Fund’s prospectus for specific details regarding the Fund’s risk profile.

Brian Manby, CFA, Senior Analyst, Research

Brian Manby joined WisdomTree in October 2018 as an Investment Strategy Analyst. He is responsible for assisting in the creation and analysis of WisdomTree’s model portfolios, as well as helping support the firm’s research efforts. Prior to joining WisdomTree, he worked for FactSet Research Systems, Inc. as a Senior Consultant, where he assisted clients in the creation, maintenance and support of FactSet products in the investment management workflow. Brian received a B.A. as a dual major in Economics and Political Science from the University of Connecticut in 2016. He is holder of the Chartered Financial Analyst designation.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.