kynny/iStock via Getty Images

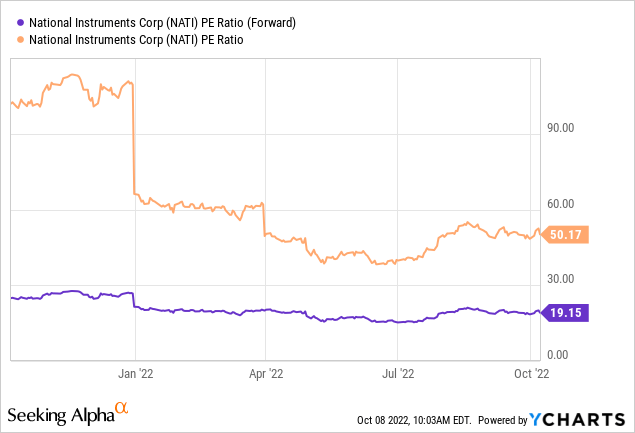

Automated test equipment producer National Instruments (NASDAQ:NATI) has lowered its mid-term financial targets at this year’s investor day, with the new mid-to-high single-digits growth guidance implying slowing momentum in 2024/2025. Still, the company deserves credit for its post-COVID recovery – a meaningful improvement relative to the flattish revenue growth profile pre-transformation. NATI is also positioned to capitalize on secular trends such as electrification and autonomous driving via its higher-growth business units, while the long-term migration to recurring software revenue presents upside to the multi-year earnings growth algorithm. That said, NATI’s resilience will be tested by more macro weakness in the coming quarters as the Fed continues on its rate hike cycle. With the valuation still relatively rich at ~19x fwd P/E (or ~50x trailing), I would hold off for now, pending further visibility into the execution.

Key Drivers of the Mid-Term Growth Outlook

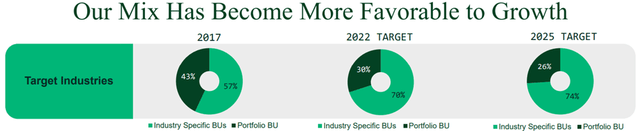

As part of its mid to long-term transformation, NATI remains focused on growth opportunities around new tech inflections, such as in EV and ADAS, as well as product analytics, all of which are creating new testing requirements. As things stand, NATI has targeted a 2025 revenue contribution of ~74% from industry-specific business units and the remainder from its core portfolio business units. The benefits from this shift are twofold – not only does it add to the growth potential, but it also de-risks the cash flow profile by creating a more resilient/less cyclical revenue stream (note the ‘portfolio’ business unit is more exposed to macroeconomic fluctuations).

National Instruments

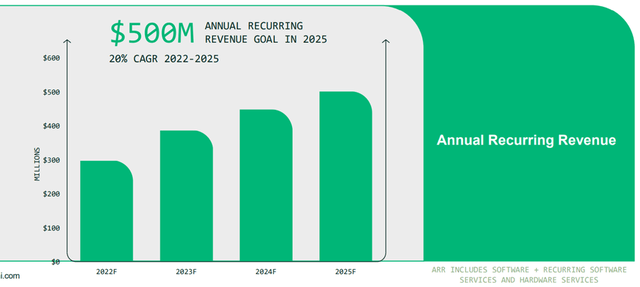

The other key driver is NATI’s planned transition to a subscription-based software model (vs. the current license sales model) within its ‘portfolio’ segment. For context, NATI’s software offerings help to automate test systems for the industry. While the shift presents a revenue headwind near-term (~$30m in 2022), this evens out in 2023/2024 before turning accretive over a mid to long-term horizon. Per management, the company will hit annual recurring revenue of ~$500m by 2025. As subscriptions generate more predictable recurring revenue at higher margins, I view this as a positive step. Plus, NATI’s efforts to build out more modular software solutions that reach its customers quickly, as well as a more complete solution set, present potential upside to the current growth targets.

National Instruments

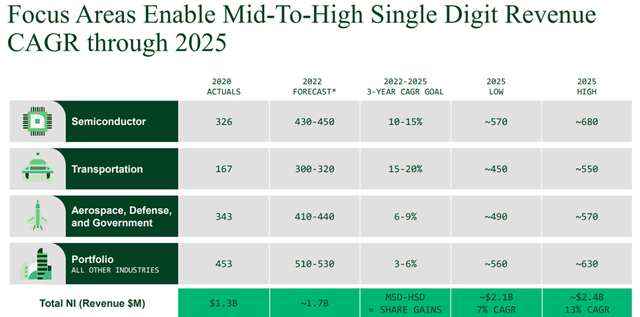

Mid-Term Revenue Guidance Update Signals a Slowdown Ahead

The updated NATI target model now calls for revenue growth of 7-13% CAGR through 2025, with a mid-teens % revenue growth in 2023, followed by a mid-to-high single-digit CAGR over the 2023-2025 period. While the reiterated 2023 target came as no surprise, the 2023-2025 growth outlook represents a worrying slowdown from the prior three years of double-digit % revenue growth. By business unit, the semiconductor and aerospace & defense guidance remain intact at +10-15% CAGR and +6-9% CAGR, respectively, while transportation growth was raised to +15-20% CAGR (up from +10-12% previously). The key drag was its ‘portfolio’ outlook, however, which now stands at +3-6% CAGR (down from +5-6% prior) to account for macro headwinds.

National Instruments

While the revised mid-term growth outlook was disappointing, NATI could see some near-term relief from easing supply chain constraints. While key component shortages remain a bottleneck on NI’s production volumes, recent mitigating steps should help massively, particularly for semiconductor supply. Of note, NATI cited meaningful progress in its product redesigns and in reallocating orders toward alternate suppliers. Any P&L benefits will likely only flow through next year, though, as lead times are guided to stay at >8 weeks through year-end (albeit with minimal cancellations).

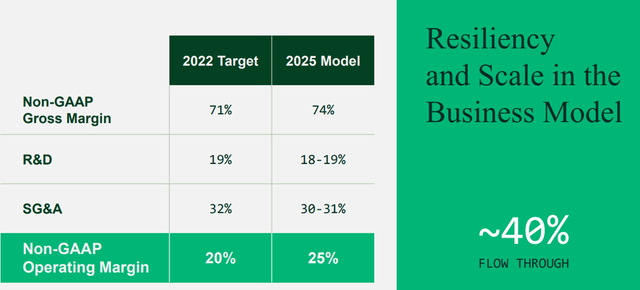

Margin Targets Revised Lower

NATI’s gross margin target was lowered as well, reaching 74% by 2025 vs. its previous target of 75%. In particular, management appears to be embedding a more conservative view on premium component cost stickiness in light of the challenging operating backdrop, as well as product mix headwinds. In addition, lower broker spot buys are another key driver of the financial model. Recall that COVID-driven supply chain disruptions have led to an increase in broker spot buys and freight costs, in turn, weighing on gross margins to the tune of ~500 bps in 2022. This impact has abated at a slower pace than expected (despite NATI’s best efforts), though, as demand challenges have led to higher cost component inventory remaining on the balance sheet.

National Instruments

That said, the 2023 operating margin guidance of 23% was reiterated, along with the operating margin expansion target of ~100 bps/year through 2025. This implies NATI gets to an impressive ~25% operating margin by 2025 – a significant improvement from the mid-teens % margin pre-transformation. Key margin expansion drivers include sales channel optimization initiatives across digital and distribution (particularly for lower-tier customers). In addition, unlocking operating leverage benefits will also be crucial to the algorithm – NATI’s cost structure is already ~20% variable, while its shift toward hiring engineers in less competitive locations should help mitigate wage inflation.

Compelling Growth Play but Priced at a Premium

NATI’s new management team has done a great job on the execution thus far, moving the company ever closer to the revenue and operating margin targets initially laid out in 2020 as part of its ongoing business transformation. Through 2025, NATI retains a compelling balance of growth via its business units tied to secular growth markets (such as ADAS and EVs) and defensiveness via end markets like R&D applications as well as its recurring software contribution. As NI continues to migrate away from a software licensing model to a recurring software subscription model, there is a clear line of sight to a sustained mid-to-high single-digit growth algorithm as well (in line with peer Keysight (KEYS)).

That said, the valuation multiple is already quite rich at ~19x fwd P/E (~50x trailing P/E) and could be vulnerable to some compression should a macro slowdown/recession scenario materialize. Plus, a successful mid to long-term transformation is not a given, and execution remains the key overhang at this juncture.