U.S. nonfarm payrolls added 263,000 jobs in September, less than the 315,000 gain in August. The average monthly gain over the last 21 months (since January 2021) was 501,000. Private payrolls posted a 288,000 gain in September versus a 275,000 gain in August (revised down by 33,000 while July was revised down by 29,000 to a gain of 448,000). The average monthly gain over the 21 months since January 2021 was 473,000. However, the monthly gains appear to be slowing. Over the 13 months from January 2021 through February 2022, the average monthly gain was 544,000; for the five months from March 2022 through July 2022, the average was 376,000; and over the last two months, the average has dropped to 282,000 (see first chart).

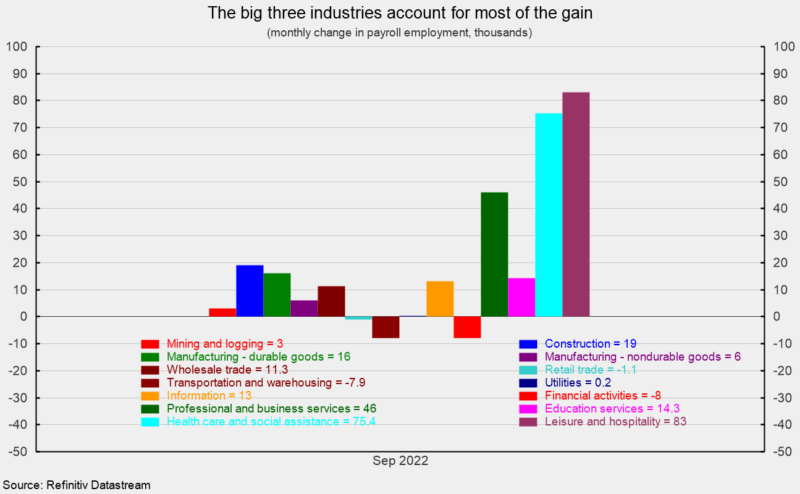

Gains in September were widespread, though still driven by the three large industries. Within the 288,000 gain in private payrolls, private services added 244,000 versus a 3-month average of 289,700 while goods-producing industries added 44,000 versus a 3-month average of 47,300.

Within private service-producing industries, education and health services increased by 90,000 (versus a 95,700 three-month average), leisure and hospitality added 83,000 (versus 67,700), business and professional services added 46,000 (versus 61,300), information services gained 13,000 (versus 11,300), and wholesale trade gained 11,300 (versus 14,400; see second chart).

On the downside, financial activities lost 8,000 (versus an average gain of 13,600). Transportation and warehousing dropped by 7,900 jobs (versus an average 5,000), and retail employment fell by 1,100 (versus 19,300; see second chart).

Within the 44,000 gain in goods-producing industries, construction added 19,000, durable-goods manufacturing increased by 16,000, nondurable-goods manufacturing added 6,000, and mining and logging industries increased by 3,000 (see second chart).

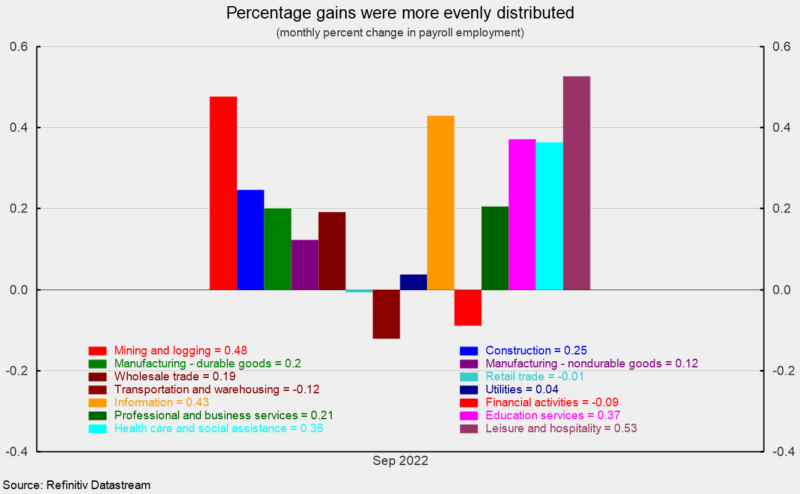

While a few of the services industries dominate actual monthly private payroll gains, monthly percent changes paint a different picture. Gains were more evenly distributed, with strong gains in leisure and hospitality, mining and logging, information industries, and education and health care (see third chart).

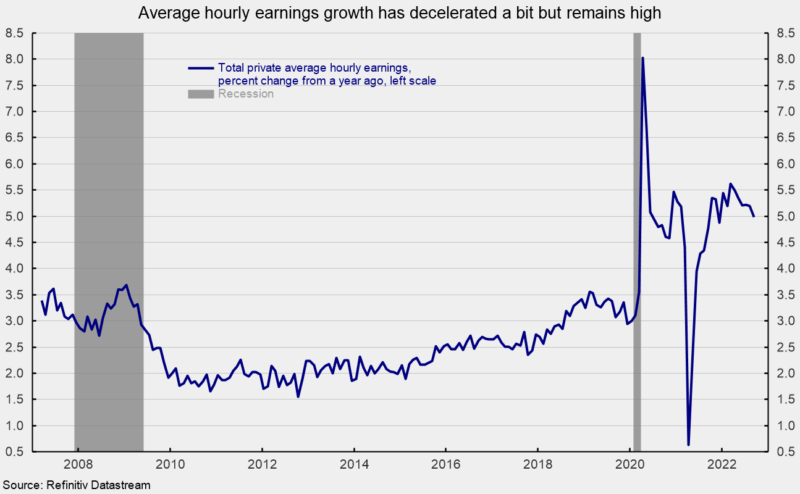

Average hourly earnings for all private workers rose 0.3 percent in September, similar to the August gain. That puts the 12-month gain at 5.0 percent, down from a recent peak of 5.6 percent in March 2022 (see fourth chart). Average hourly earnings for private, production and nonsupervisory workers rose 0.4 percent for the month and are up 5.8 percent from a year ago, down from 6.7 percent in March.

The average workweek for all workers was unchanged at 34.5 hours in September while the average workweek for production and nonsupervisory rose to 34.0 hours from 33.9 hours in August.

Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls for all workers gained 0.5 percent in September and is up 8.7 percent from a year ago; the index for production and nonsupervisory workers rose 0.9 percent and is 9.3 percent above the year ago level.

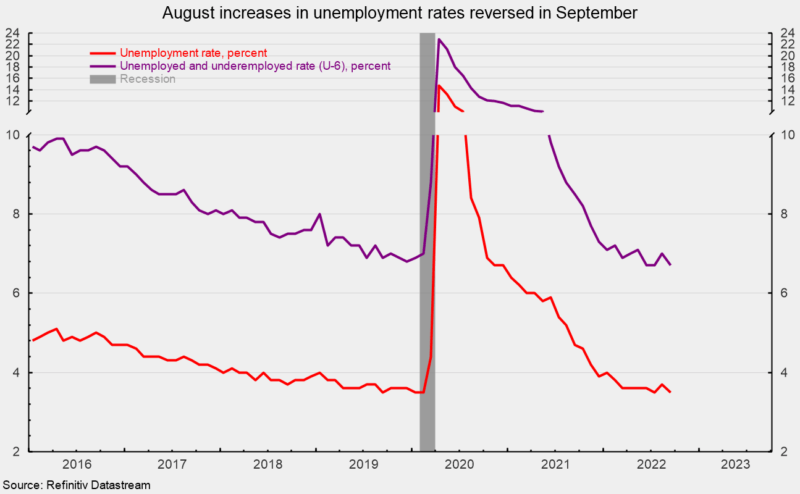

The total number of officially unemployed was 5.753 million in September, a drop of 261,000. The unemployment rate fell 0.2 percentage points to 3.5 percent, reversing the 0.2 percentage point gain in August to 3.7 percent, while the underemployed rate, referred to as the U-6 rate, decreased by 0.3 percentage points to 6.7 percent in September, reversing its 0.3 percentage point rise in August (see fifth chart).

The employment-to-population ratio, one of AIER’s Roughly Coincident indicators, came in at 60.1 percent for September, unchanged from August but still significantly below the 61.2 percent in February 2020.

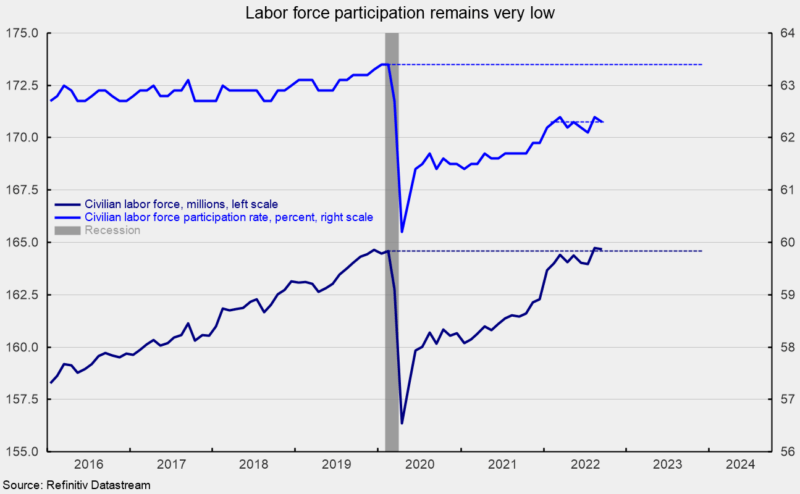

The labor force participation rate fell by 0.1 percentage point in September, to 62.3 percent. This important measure has been trending flat recently, matching the 62.3 percent reading in February 2022. Labor force participation is still well below the 63.4 percent of February 2020 (see sixth chart).

The total labor force came in at 164.689 million, down 57,000 from the prior month and nearly matching the February 2020 level (see sixth chart). If the 63.4 percent participation rate were applied to the current working-age population of 264.356 million, an additional 2.91 million workers would be available.

The September jobs report shows total nonfarm and private payrolls posted solid albeit slower gains than recent prior periods. Continued gains in employment are a positive sign, providing support to consumer attitudes and consumer spending.

However, open jobs have fallen sharply in recent months, raising concerns about future payroll gains. Still, the level of open jobs remains high, suggesting the labor market remains tight. Additionally, labor force participation remains below the lockdown recession, compounding the labor shortage. Persistently elevated rates of rising prices are driving an aggressive Fed tightening cycle. At the same time, the fallout from the Russian invasion of Ukraine and periodic lockdowns in China continue to disrupt global supply chains. Finally, the AIER Leading Indicators Index remains well below the neutral 50 threshold, suggesting an elevated risk of recession. The outlook remains highly uncertain, and caution is warranted.