Updated on September 29th, 2022, by Nikolaos Sismanis

Investors looking for the best-in-class dividend growth stocks should consider the Dividend Kings. These are stocks that have raised their dividends for at least 50 consecutive years. It is no easy task raising a dividend for over five decades, which explains why there are just 45 Dividend Kings. You can see all 45 Dividend Kings here.

In addition, we created a downloadable list of all 45 Dividend Kings, along with important financial metrics like dividend yields, price-to-earnings ratios, and more. You can download your copy of the Dividend Kings list by clicking on the link below:

Coca-Cola (KO) is a time-tested Dividend King. It has raised its dividend for 60 consecutive years. This is an extremely impressive history of consistent dividend increases, even in difficult operating environments. Coca-Cola benefits from global competitive advantages and a recession-resistant business model.

Investors can expect the company to continue increasing its dividend for many years. This article will discuss Coca-Cola’s recent earnings, future growth potential, and expected returns.

Business Overview

Coca-Cola was founded in 1892. Today, it is the world’s largest non-alcoholic beverage company. It owns or licenses more than 500 non-alcoholic beverages, including both sparkling and still beverages.

Related: Analysis on the top beverage industry stocks.

It now sells products in more than 200 countries around the world and has 20 brands that each generate $1 billion or more in annual sales.

Its brands account for about 2 billion servings of beverages worldwide every day, producing more than $38 billion in annual revenue.

The sparkling beverage portfolio includes the flagship Coca-Cola brand, as well as other soda brands like Diet Coke, Sprite, Fanta, and more. The still beverage portfolio includes water, juices, and ready-to-drink teas, such as Dasani, Minute Maid, Vitamin Water, and Honest Tea.

Source: Investor Presentation

Coca-Cola dominates sparkling soft drinks, but the company is attempting to maintain and even improve this dominant position with product extensions of existing popular brands, including reduced and zero-sugar versions of brands like Sprite and Fanta.

This is a challenging time for Coca-Cola. Sales of soda are slowing down in developed markets like the U.S., where soda consumption has steadily declined for years.

Declining soda consumption is a significant challenge for the company. While Coca-Cola’s total volumes certainly still rely upon sparkling beverages such as soda, the company has gone to great lengths in recent years to diversify away from its core products, understanding that the long-term growth prospect for sparkling beverages isn’t particularly inspiring.

Coca-Cola has acquired multiple still beverage brands in recent years to revitalize its future growth.

Growth Prospects

In an effort to return to growth, Coca-Cola has invested heavily outside of soda in areas like juices, teas, dairy, and water, to appeal to changing consumer preferences. Despite headwinds from declining soft drink consumption, we continue to see Coca-Cola as having a favorable long-term growth outlook.

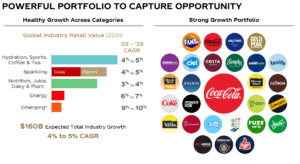

One reason we like the stock is that it competes in an industry that continues to grow globally in excess of the rate of broad economic growth. This leads to strong levels of overall growth in the industry, which Coca-Cola has certainly been capitalizing on in recent years.

In addition, the ready-to-drink category is sold through highly-diversified channels and continues to have mid-single digit projected growth rates, both for Coca-Cola and the industry. This is particularly true for still beverages like milk, tea, and water. Coca-Cola’s years-old strategy to diversify away from sparkling beverages is due to this, and it is undoubtedly bearing fruit.

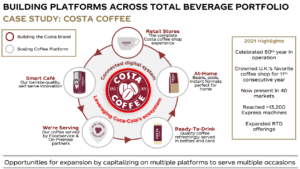

Coca-Cola also continues to acquire brands in order to grow, including its acquisition of Costa, a coffee brand based in the U.K.

Source: Investor Presentation

This was certainly an out-of-the-box buy for a sparkling beverage company, but Coca-Cola is doing what it takes to secure its future growth.

Finally, while Coca-Cola is the largest beverage company in the world, there continues to be ample room for additional growth. The market is expected to grow by around 4% to 5% through 2025.

Source: Investor Presentation

The market potential for Coca-Cola’s portfolio of beverages is massive, especially in developing and emerging markets. This should provide the company with a long runway for growth in the coming years.

In the meantime, the company continues to execute with strong quarterly results. Coca–Cola reported second-quarter earnings that were better than expected on both the top and bottom lines. The company posted 16% organic sales growth, beating estimates by $730 million. Still, due to FX headwinds, total revenue was up 12% to just over $11.3 billion.

Coca–Cola gained further value share in total nonalcoholic ready–to–drink beverages, driven by share gains in both at–home and away–from–home channels. When it comes to its operating margin, it came in at 30.7% of revenue on an adjusted basis, down 100 bps from the second quarter of last year. Margin compression was due to strong topline growth that was more than offset by the impact of the BODYARMOR purchase, higher operating costs, and an increase in marketing investments.

The company guided organic revenue growth of 12% to 13% for the year and adjusted earnings-per-share growth of 5% to 6%. Accordingly, we forecast the company to achieve fiscal 2022 earnings-per-share of around $2.45.

Competitive Advantages & Recession Performance

Coca-Cola enjoys two distinct competitive advantages, which are its strong brand and global scale. According to Forbes, Coca-Cola is the sixth-most valuable brand in the world. The Coca-Cola brand is reportedly worth $64.4 billion.

In addition, Coca-Cola has an unparalleled distribution network. It has the largest beverage distribution system in the world. Of the roughly 60 billion beverages consumed around the world every day, about 2 billion come from Coca-Cola.

These advantages allow Coca-Cola to remain highly profitable, even during recessions. The company held up very well during the Great Recession:

- 2007 earnings-per-share of $1.29

- 2008 earnings-per-share of $1.51 (17% increase)

- 2009 earnings-per-share of $1.47 (3% decline)

- 2010 earnings-per-share of $1.75 (19% increase)

Not only did Coca-Cola survive the Great Recession, but it also thrived. Coca-Cola grew earnings-per-share by 36% from 2007 to 2010. This shows the durability and strength of Coca-Cola’s business model. The company’s dividend also appears very safe. Based on our projected earnings for the year and the current dividend-per-share run rate, the payout ratio stands at a rather comfortable 72%.

Valuation & Expected Returns

Adjusted earnings-per-share for Coca-Cola is expected to reach $2.45 per share in 2022. Thus, Coca-Cola trades for a price-to-earnings ratio of 23 at its current price levels.

This is in line with our fair multiple of 23 times earnings, which takes into account the stock’s historical valuations as well as future growth estimates. Accordingly, we do not expect any valuation expansion or compression effects in our calculations.

We expect total annualized returns of ~8.7%, consisting of the 3.1% dividend yield, 6% expected earnings growth, 5% dividend growth, and stable valuation assumptions.

These are rather alluring total return projections during the current highly uncertain environment, considering they are coming from such a trustworthy company as Coca-Cola. Investors should be wary of the fact that its future earnings might be negatively affected if the dollar remains quite strong, as a great chunk of its revenues is sourced internationally nonetheless. Shares of Coca-Coca, therefore, earn a hold rating.

Final Thoughts

Coca-Cola has a long and established track record of delivering steady dividends along with annual dividend increases, even during recessions and other challenging periods. We fully expect the company to continue delivering relatively resilient results during the ongoing macroeconomic turmoil and even come out from this phase stronger than ever. The company has multiple growth catalysts and a dominant global position in the beverages industry to support it.

The stock appears to be fairly valued, which might suggest it’s a good opportunity to consider allocating capital to the stock. Coca-Cola should also continue to pay its dividend comfortably, currently offering a solid yield above 3%. And, it should have little trouble raising the dividend each year.

Overall, Coca-Cola can be an attractive holding for income-focused investors.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].