Justin Sullivan/Getty Images News

September 29th proved to be a very painful day for shareholders in drugstore retailer Rite Aid (NYSE:RAD). In response to some mixed financial results reported for the second quarter of the company’s 2023 fiscal year, shares of the enterprise plummeted 28% for the day. Driven in part by this decline, the stock is now down by 65.6% for the calendar year, with a mixture of lower expectations by investors and concerns about the economy more broadly proving to be rather painful for shareholders. Digging into the numbers, it is true that the company could definitely be doing better than it is now. Anybody who says that the firm is doing just fine is wrong. Having said that, the picture now is not as bad as it could be either. Given how cheap shares are today, I would normally consider this a very attractive prospect right now. But because of downward revisions for profitability, combined with instability in the economy, I do think a more appropriate rating at this time would be a ‘hold’, reflective of my view that it’s likely to generate returns at more or less match the S&P 500, compared to the ‘buy’ rating I had on the stock previously.

Rite Aid Q2 2023 earnings – A mixed quarter

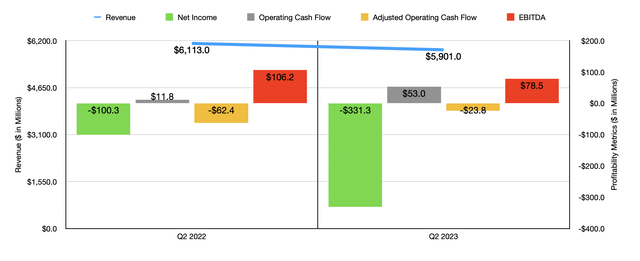

Assessing the performance of a company like Rite Aid can be rather complicated. This is because the firm itself continues to post results that are both positive and negative simultaneously. For starters, we should touch on the revenue data provided by the firm covering the second quarter of its 2023 fiscal year. During that quarter, sales came in at $5.90 billion. The first thing that investors might notice is that this represents a 3.5% decline compared to the $6.11 billion in revenue the firm reported the same time one year earlier. This on its own is bad. But to better truly understand the picture, we need to dig a bit deeper and understand the reasons for the decline.

Author – SEC EDGAR Data

As an example, we can know that a big portion of the company’s revenue decline was associated with a reduction in store count. At the end of the latest quarter, the company had 2,352 stores in operation. This was down from the 2,501 stores operating the same quarter one year earlier and was even down from the 2,361 that the company had just one quarter ago. ultimately, a reduction in store count is almost never a good thing since it represents a permanent decline in the company’s potential to generate sales. However, there were positive aspects to this. As an example, same-store sales growth reported by the company actually came in strong at 5.6%. This stacks up favorably against the 2.6% increase reported in the second quarter of the company’s 2022 fiscal year. Investors also should keep in mind that this sales figure was actually higher than what analysts anticipated by the tune of $40 million.

When looking at sales, we see a definite disparity between the company’s two operating segments. Overall revenue for the Retail Pharmacy Segment, for instance, declined by only 1.1%, with a reduction in COVID vaccine and testing revenue, combined with store closures, negatively affecting the company. The real weakness for the firm came from the Pharmacy Services segment, with revenue plunging by 9% year over year. Management attributed this drop to a few different factors, including a planned decrease in Elixir Insurance membership and a previously announced client loss due to industry consolidation. This was somewhat offset by increased utilization of higher-cost drugs. Naturally, the industry consolidation loss does not bode well for the company. At the end of the day, this just goes to illustrate how competitive this space can be.

On the bottom line, the picture for the company was also mixed. During the quarter, Rite Aid generated a net loss of $331.3 million. That dwarfs the $100.3 million loss reported the same quarter one year earlier. On a per-share basis, the company generated a loss of $6.07. That compares to the $1.86 per share loss experienced in the second quarter of the 2022 fiscal year. On an adjusted basis, the company’s loss of $0.63 per share missed expectations by $0.17 per share. Key drivers of this pain included facility exit and impairment charges, as well as goodwill and intangible asset impairment charges. Collectively, these totaled $298.05 million for the latest quarter. That compares to the $11.35 million that they made up during the same quarter one year earlier.

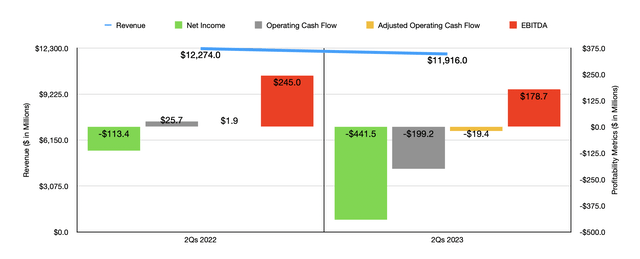

Author – SEC EDGAR Data

Other profitability metrics, however, were mixed. Operating cash flow went from $11.8 million in the second quarter of 2022 to $53 million the same time this year. If we adjust for changes in working capital, it would have gone from negative $62.4 million to negative $23.8 million. And over that same window of time, we would have seen EBITDA actually worse and, going from $106.2 million to $78.5 million. In the chart above, you can also see financial data covering the first half of the 2023 fiscal year as a whole, relative to the same time one year earlier. Just as was the case in the second quarter, data for the first half of the year in its totality was worse than what was experienced last year.

Usually, when you see a company fall this hard, you might expect that management has been making significant changes to guidance. But that is not the case here. For the 2023 fiscal year as a whole, the firm still expects revenue of between $23.6 billion and $24 billion. That’s consistent with the guidance the company reported in its first quarter earnings release. This is not to say that all guidance remained flat. The firm is now anticipating a net loss of between $477.3 million and $520.3 million. This is significantly greater than the prior expected loss of between $203.3 million and $246.3 million. It is comforting to know that much of this revision is being caused by non-cash items. But losses are still losses at the end of the day. More consistent is EBITDA, with management forecasting a number of between $450 million and $490 million. This represents a decline of only $10 million for the range that was given when the company reported financial data for the first quarter of its 2023 fiscal year. No guidance was given when it came to operating cash flow. But if we were to annualize interest expense, and use EBITDA less that interest expense figure as a proxy for it, we should anticipate a reading of roughly $268.7 million. That compares to the $210.2 million the company reported for its 2022 fiscal year.

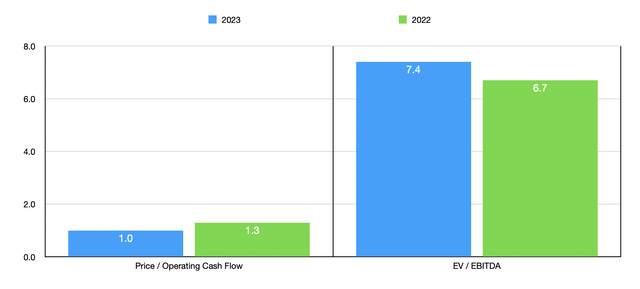

Author – SEC EDGAR Data

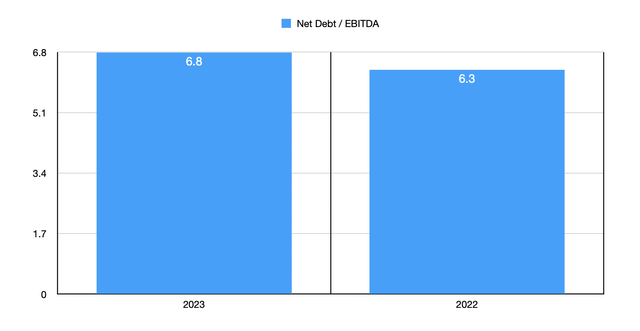

Given these figures, we can calculate that the company is trading at a forward price to operating cash flow multiple of only 1. This compares to the 1.3 reading that we get using data from 2022. However, looking at this metric alone ignores the tremendous amount of debt the company has on its books. Using the 2023 estimates, the firm has a net leverage ratio of 6.8. That compares to the 6.3 reading that we get using data from 2022. A more appropriate measure of value, then, would be the EV to EBITDA multiple. Using data from the 2023 fiscal year, this would come in at 7.4. That compares to the 6.7 reading that we get using data from the 2022 fiscal year. Because of the company’s size and condition, it’s truly difficult to find a good comparable. We could look at some drugstore chains overseas. But those have their own comparability issues. Probably the best approach is to compare the firm to Walgreens Boots Alliance (WBA), even though Walgreens is significantly larger and healthier by comparison. Because of its continued shift into being a diversified healthcare provider, CVS Health (CVS) would not be an appropriate comparable anymore in my opinion. Regardless, Walgreens is trading at a forward price to operating cash flow multiple of 6.1 and an EV to EBITDA multiple of 10.6.

Author – SEC EDGAR Data

Takeaway

Based on the data provided, things at Rite Aid are not going as awfully as the market might have you think they are. But they also aren’t going great either. Cash flows looked to be holding up fairly well, but other profitability metrics are discouraging. The continued decline in store count is problematic and leverage is high. Yes, upside potential from here could be significant. And given how shares are priced today, I would be bullish about the company if we weren’t in such a questionable economic position. But given that, combined with the other issues I mentioned, I do think a ‘hold’ rating is appropriate for the enterprise at this time.