rvlsoft/iStock Editorial via Getty Images

Thesis

Long-term investors in The Procter & Gamble Company (NYSE:PG) have generated highly consistent returns from the leading consumer packaged goods company worldwide. Its highly consistent 5Y (10.8%) and 10Y (10.3%) total return CAGR is a testament to the market’s confidence in its long-term strategy. Therefore, we believe significant dips in PG’s valuations offer substantial opportunities for investors to add more positions if the valuations are reasonable.

PG has fallen markedly in 2022, with a YTD total return of -14.5%. However, we deduce that its valuations are not attractive, even though it’s likely at a near-term bottom. While P&G could recover its growth cadence from FY23, we find it challenging to justify a Buy rating at the current levels. Therefore, a worse-than-expected recessionary theme could hamper the recent easing of supply chain headwinds.

As a result, we believe it’s appropriate for us to remain cautious on PG and reiterate our Hold rating for now.

PG’s Valuations Remain Expensive

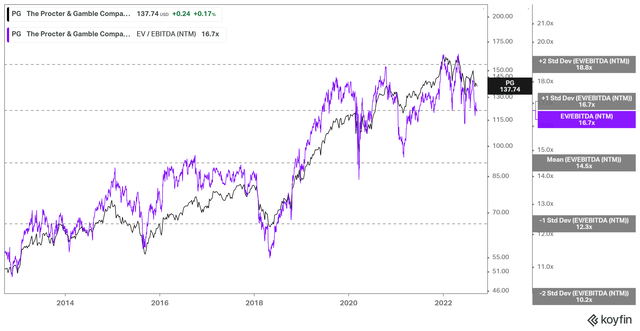

PG NTM EBITDA multiples valuation trend (koyfin)

As seen above, PG last traded at an NTM EBITDA multiple of 16.7x, markedly above its 10Y mean of 14.5x. Notably, it’s still within the one standard deviation zone above its 10Y mean, despite its fall from its 2021 highs.

Investors should consider that PG faced significant selling pressure at the two standard deviation zone above its 10Y mean, which also coincided with its tops in December 2021 and April 2022. Therefore, we postulate the reward-to-risk balance is not attractive at the current levels amid worsening macro headwinds.

PG NTM Dividend yield % valuation trend (koyfin)

Moreover, its NTM dividend yield of 2.57% also seems relatively low compared to its 10Y mean and is unlikely sufficient to help undergird its valuations at the current levels.

Management Remains Confident Of Its Execution

P&G is a well-managed company that has executed remarkably well over the years. Therefore, management has strong credibility with investors, coupled with the revenue visibility offered by its more defensive product categories.

Notwithstanding, the company is not immune to global macroeconomic pressures, exacerbated by its weak performance in China. Therefore, we believe PG’s relative weakness in 2022 reflects consumer spending challenges as the market parsed the impact on P&G’s medium-term outlook.

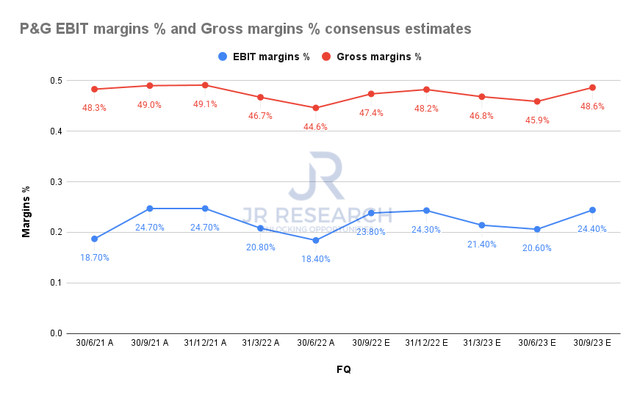

P&G EBIT margins % and Gross margins % consensus estimates (S&P Cap IQ)

P&G’s pricing leadership and strong competitive moat have helped mitigate the pressure against its margins profile. Therefore, its gross margins have been relatively stable, even though it has fallen markedly from FQ4’21. P&G has also been impacted by the global supply chain headwinds and inflationary pressure, exacerbated by geopolitical tensions.

Notwithstanding, the consensus estimates (bullish) indicate that P&G’s margins could have reached a nadir in FQ4’22 (ended June 2022 quarter). It projects a reacceleration in its margins profile through FY23, which could undergird the recovery of its operating leverage.

Management’s commentary at a recent September conference also corroborated its confidence in potentially less intense costs headwinds moving ahead. CFO Andre Schulten accentuated:

We see some good news on commodity input costs sequentially. So that’s a little bit of help versus the numbers that were underlying our guidance. Transportation in the US is easing a little bit. The two forces that work against that [are] pass-through from suppliers in terms of floor pack material costs as they are working through their cost challenges. (Barclays Global Consumer Staples Conference)

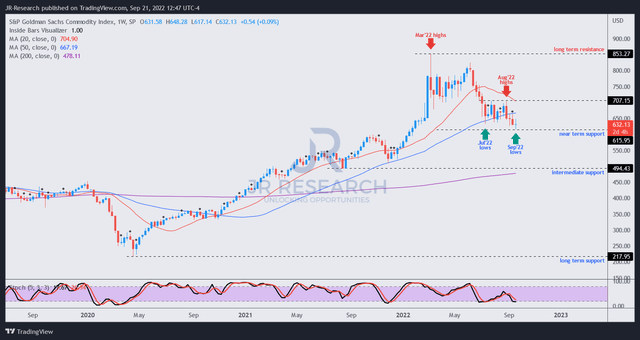

SPGSCI price chart (weekly) (TradingView)

We are confident that P&G could see some cost mitigation tailwinds in H1’23. The GSCI Commodity Index (SPGSCI) has continued to moderate through September, driven by the looming threat of a global recession.

Also, we discerned that the global supply chain pressure fell off the cliff in August, reverting to early 2021 levels. Moreover, global freight costs have collapsed nearly 35% over the past three months as the market adjusted its expectations of potentially significant demand destruction from elevated freight rates. While it’s still well above pre-COVID levels, it could help mitigate some of the demand pressure from a weaker consumer outlook.

Is PG Stock A Buy, Sell, Or Hold?

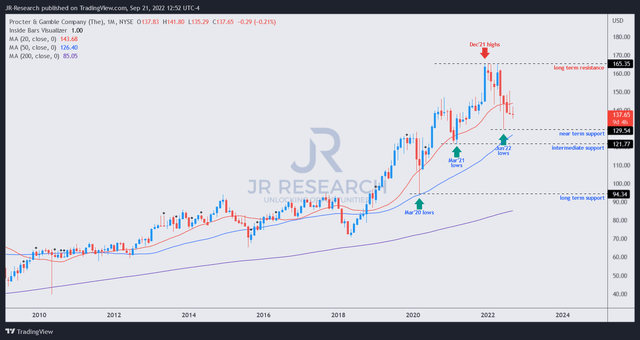

PG price chart (monthly) (TradingView)

Our assessment of PG’s long-term price action suggests that it has a clear long-term uptrend. Therefore, we believe it demonstrates the market’s high confidence level in P&G’s market leadership and strong competitive moat. However, we noted that PG could re-test its June lows, which should provide critical clues to its medium-term directional bias.

While we are not bearish on PG, we don’t find the current levels as attractive, despite its sharp pullback from its April 2022 highs.

Accordingly, we reiterate our Hold rating on PG and urge investors to continue watching from the sidelines.

:max_bytes(150000):strip_icc()/Health-GettyImages-1469940735-84bf83838a394220a471983e23e1e21c.jpg)