Feverpitched

Whenever you decide to put money into the stock market, you should be prepared for volatility. But the times that we are currently going through are irregular in terms of the degree of volatility we are experiencing. With the economy showing some signs of strength and other signs of weakness, there’s no telling with the next month or quarter or year might bring. Certainly, this has turned a lot of investors off of certain types of companies, including those that are dedicated to the recreational vehicle space. One company that has been struggling a little bit in this space recently, despite posting robust fundamentals, is LCI Industries (NYSE:LCII). Recent data shows revenue skyrocketing and profitability following suit. Shares look incredibly cheap at this moment. But there is concern that the next few quarters for the company might be rather painful as demand is slated to drop. This creates excess risk associated with a potential value trap scenario. But even if financial performance does revert back to levels seen as far into the past as the 2020 fiscal year, shares do still look to be attractively priced. Because of this, and in spite of some recent share price pressure relative to the broader market, I’ve decided to keep my ‘buy’ rating on the company for now.

When fundamentals go unrewarded

Back in early July, I wrote a rather bullish article regarding LCI Industries. In that article, I discussed how the company had followed the broader market lower over the prior few months. I said that this was taking place even while fundamental performance at the company continued to improve nicely. Given how cheap shares were priced, I could not help but to rate the company a ‘buy’, reflecting my opinion that it should have outperformed the broader market for the foreseeable future. Since then, things are not gone exactly as I would have hoped. While the S&P 500 is up by 0.4%, shares of LCI Industries have generated a modest loss for investors of 3.4%.

Author – SEC EDGAR Data

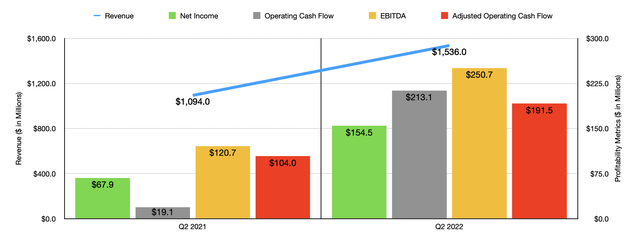

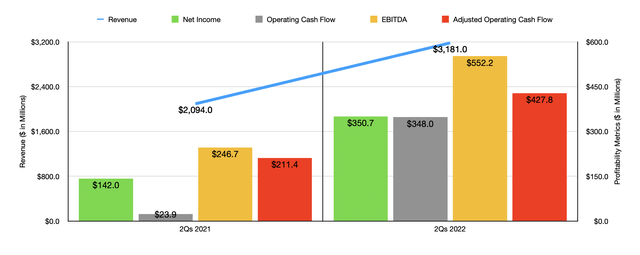

Although this return disparity is not significant in and of itself, it is still undesirable and, in a normal environment, would be considered unthinkable. I say this because the fundamental condition of the company has been really strong lately. You see, when I last wrote about the company, we only had data covering through the first quarter of the firm’s 2022 fiscal year. Today, we now have data covering the second quarter. What the data shows is nothing but strength. Take revenue. During the quarter, sales came in at $1.54 billion. That’s 40.4% higher than the $1.09 billion generated the same time one year earlier. This surge in revenue came even as total 2022 industrywide wholesale shipments from the US of a variety of recreational vehicles is forecasted to come in at between 500,000 units and 530,000 units. This compares to the 552,300 units shipped over the past 12 months and it implies a year-over-year decline of between 35% and 45% in the second half of the current fiscal year. Despite this planned weakness around the corner, the company did still benefit from an increase in selling prices, market share gains, acquisitions, and overall strong demand for the wholesale category in the first half of the year.

Author – SEC EDGAR Data

On the bottom line, performance achieved by the company was remarkably robust. Net income in the second quarter came in at $154.5 million. That marks a significant improvement over the $67.9 million reported one year earlier. Operating cash flow surged from $19.1 million to $213.1 million. Even if we adjust for changes in working capital, the metric would have increased from $104 million to $191.5 million. Meanwhile, EBITDA more than doubled, shooting up from $120.7 million to $250.7 million. Naturally, this strong bottom line performance has also been instrumental, as has been the increase in revenue, in pushing total results for the first half of the year up significantly compared to the same time last year. This much can be seen in the chart above.

Understanding what the 2022 fiscal year as a whole might look like is definitely more art than science. This is especially true given the aforementioned expectation of a decline in demand for recreational vehicles in the second half of the year. In fact, we are already seeing some evidence of this weakness. According to one report, the month of July saw a 29% decline in recreational vehicle retail sales, coming in worse than the mid-20% range previously anticipated. And preliminary data for the month of August shows a decline in the low to mid-teen percentage rate.

Author – SEC EDGAR Data

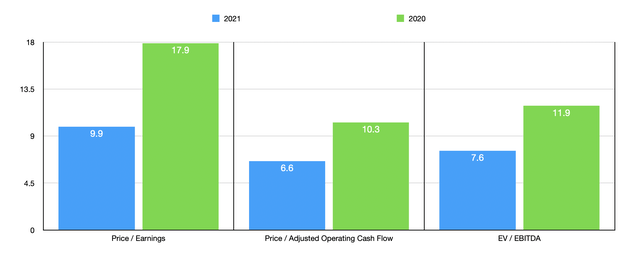

Instead of trying to forecast out what financial performance might look like in the second half of the year, a better approach might be to look at prior years when financial performance was not as strong. Using data from the 2021 fiscal year, for instance, the company is trading at a price-to-earnings multiple of 9.9. The price to adjusted operating cash flow multiple of the company is even lower at 6.6, while the EV to EBITDA multiple should come in at 7.6. Even if financial performance were to come in weaker than that still, the picture might not look all that bad. If we use data from 2020 instead, we would end up with a price-to-earnings multiple of 17.9, a price to adjusted operating cash flow multiple of 10.3, and an EV to EBITDA multiple of 11.9. Even these numbers might suggest some upside potential for investors. As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 3.7 to a high of 44. And when it comes to the EV to EBITDA approach, the range was between 3.2 and 15.8. In both cases, two of the companies were cheaper than our prospect. Using the price to operating cash flow approach, the range was between 1.5 and 116.1. In this case, only one of the five companies was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| LCI Industries | 9.9 | 6.6 | 7.6 |

| Visteon (VC) | 44.0 | 116.1 | 15.8 |

| Adient (ADNT) | 3.9 | 22.2 | 3.2 |

| Fox Factory Holding Corp. (FOXF) | 19.5 | 65.9 | 14.7 |

| Dorman Products (DORM) | 3.7 | 27.5 | 12.8 |

| Superior Industries (SUP) | N/A | 1.5 | 3.5 |

When I say that these companies are similar in nature, I mean that they focus on producing parts that are similar to what LCI Industries produces. If we want something even closer in similarity, such as companies that only focus on the recreational vehicle space, we should look at the next table below. In it, you can see four companies that operate in this space. On a price-to-earnings basis, these companies ranged from a low of 6.7 to a high of 8.4 if we use data from the 2021 fiscal year. In this case, LCI Industries is the most expensive of the group. Using the price to operating cash flow approach, the range is between 7.5 and 15.1, with LCI Industries being the cheapest. And when it comes to the EV to EBITDA scenario, the range is between 4.7 and 6.7, with our target being slightly more expensive than the peer group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| LCI Industries | 9.9 | 6.6 | 7.6 |

| Camping World (CWH) | 6.7 | 15.1 | 4.7 |

| Thor Industries (THO) | 7.3 | 8.9 | 5.7 |

| Winnebago (WGO) | 7.9 | 8.7 | 5.6 |

| Patrick Industries (PATK) | 8.4 | 7.5 | 6.7 |

Takeaway

At this moment, there’s a tremendous amount of uncertainty regarding the recreational vehicle space. When compared to companies strictly in that space, LCI Industries is near the high end of the scale. But when compared to other companies that are similar in nature, the stock looks much more attractive. All things considered, it is highly probable that the next few quarters would be rather difficult for the business and for its peer groups. However, even a return to the kind of performance seen in 2020 would likely mean that the stock is no worse than fairly valued and possibly even has some modest upside. Because of this favorable risk-to-reward payoff, I do still think a soft ‘buy’ rating is appropriate for now.