The principle distinction between an S-corp vs. C-corp is how they’re shaped, how they’re taxed and their possession restrictions. A C-corp is topic to company tax charges and has no restrictions on possession. An S-corp is a pass-through entity that experiences its earnings on the house owners’ private taxes, and possession is restricted to as much as 100 shareholders.

For those who construction your online business as an organization, you’ll face an essential resolution: whether or not to arrange an S-corp vs. a C-corp. This selection has large implications for the way a lot you’ll pay in taxes, your skill to lift cash and the way simply you’ll be able to increase your online business.

This information explains the variations between an S-corp vs. a C-Corp, the professionals and cons of every of those entity varieties and how one can determine which is true for your online business.

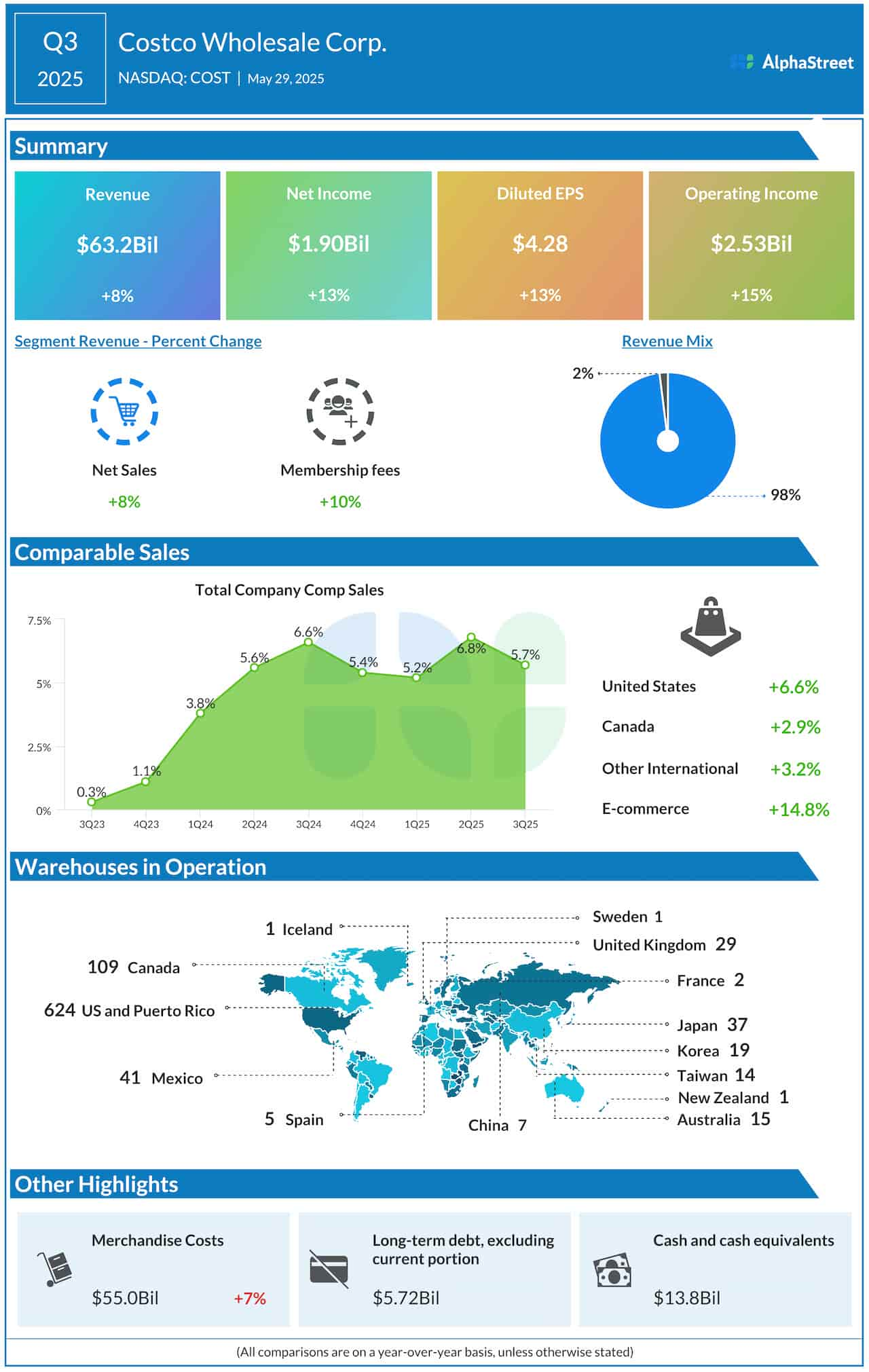

S-corp vs. C-corp, summarized

|

Elect by submitting IRS Kind 2553. |

Default sort of company. |

|

|

Private earnings tax on earnings (pass-through taxation). |

Company tax plus private earnings tax on dividends. |

|

|

Tougher to lift enterprise capital. |

Higher for elevating enterprise capital. |

|

|

Variety of Shareholders and Inventory Lessons |

100 or fewer shareholders, one class of inventory. |

Limitless shareholders, a number of lessons of inventory. |

|

Shareholders should be U.S. residents or residents. |

U.S.-based and overseas shareholders okay. |

What are the variations between an S-corp vs. C-corp?

The variations between S-corporations and C-corporations fall into three main classes: formation, taxation and possession.

Usually, taxes are the largest and most essential distinction between S-corps and C-corps. C-corps are topic to company tax charges; S-corps permit for pass-through taxation, which means house owners report the enterprise earnings and losses on their private earnings tax returns.

1. Formation

Probably the most fundamental distinction between S-corporations and C-corporations is formation.

C-corp formation

The C-corp is the default sort of company. While you file articles of incorporation together with your secretary of state to register your online business as an organization, your organization will change into a regular C-corp.

S-corp formation

To construction your organization as an S-corp for federal tax functions, file IRS Kind 2553 (proven under). You might need to file extra kinds on the state stage to be handled as an S-corp for state taxes.

Supply: IRS.gov

Whether or not you construction your organization as an S-corp or C-corp, you may have to file articles of incorporation, appoint a registered agent and create company bylaws. For extra info, try our step-by-step information on learn how to incorporate.

2. Taxation

Taxation is the biggie when evaluating an S-corp vs. a C-corp. Many enterprise house owners construction their corporations as S-corps to save cash on taxes.

C-corp taxation

C-corps are topic to “double taxation.” First, the C-corp pays taxes on its earnings when it recordsdata its company earnings tax return (Kind 1120). Then, the C-corp house owners might pay taxes on these earnings once more on their private earnings tax returns if the company distributes these earnings to shareholders within the type of dividends.

The one solution to keep away from double taxation is to not make any earnings (i.e. function at a loss) or reinvest earnings again into the enterprise as an alternative of paying dividends. Wages and salaries, together with proprietor salaries, are usually tax-deductible bills. Nevertheless, the IRS can “re-label” extreme salaries as taxable dividends.

S-corp taxation

Paying taxes as an S-corp is a bit totally different. An S-corp is a pass-through entity for tax functions, which suggests shareholders report their share of the enterprise’ earnings and losses on their private tax returns by submitting Kind 1120S. House owners pay taxes at their private earnings tax charge.

Moreover, house owners of S-corporations and different pass-through entities (like LLCs, sole proprietorships, and partnerships) might be able to deduct as much as 20% of certified enterprise earnings from their private tax returns. Companies in particular service trades or professions, reminiscent of consulting, medication or legislation might face limits on the deduction at excessive earnings ranges.

Remember to seek the advice of a professional lawyer or tax professional to find out how an S-corp may have an effect on your taxes.

S-corp vs. C-corp tax instance

Let us take a look at one other instance to know what enterprise taxes might appear like for S-corps vs. C-corps.

-

Suppose your online business, a C-corp, has a taxable earnings of $100,000. A C-corp would first pay the company earnings tax charge (21%, for instance). If the rest is paid out as a dividend, it could be topic to a dividend tax charge, which can be about 15%.

-

In distinction, an S-corp’s taxable earnings of $100,000 could be reported on the proprietor’s private earnings tax return. The tax invoice would depend upon the proprietor’s different tax deductions and tax credit, in addition to their tax bracket.

An S-corp might save house owners cash on taxes, although that is not all the time the case. Sure forms of business-level tax deductions, reminiscent of charitable donations and fringe advantages, are absolutely deductible just for a C-corporation. A professional accountant or enterprise lawyer may help you determine the construction friendliest to your backside line.

3. Possession

The final main distinction between S-corp vs. C-corp constructions is the possession restriction. C-corporations are extra versatile if you happen to’re trying to increase or promote your online business.

C-corp possession

C-corporations haven’t any restrictions on possession. You’ll be able to have an infinite variety of shareholders, in addition to totally different lessons of shareholders.

Enterprise capital corporations and angel buyers choose to carry most popular inventory, which is barely an choice for C-corps. This makes it way more tough to fundraise as an S-corp.

Moreover, if you happen to plan to promote your online business or spin-off a subsidiary, a C-corp could possibly be a better option. A C-corp cannot personal an S-corp; different S-corps, LLCs, normal partnerships, or most trusts can also’t personal S-corps. Then again, different companies, LLCs, or trusts can personal C-corps.

S-corp possession

S-corporations can have solely as much as 100 shareholders. Shareholders of an S-corp should be United States residents or resident aliens; C-corps are open to overseas buyers.

S-corporations are restricted to at least one class of inventory, which means that there’s just one type of shareholder. There’s no hierarchy or distinction between shareholders of the enterprise, which makes fundraising more durable.

What are the similarities between S-corps vs. C-corps?

S-corps and C-corps are related in a lot of methods.

-

Restricted legal responsibility safety: Each S-corps and C-corps are legally separate from their house owners, which means their shareholders have restricted legal responsibility safety. Put merely, this implies shareholders should not personally responsible for the enterprise’s money owed or obligations. It is a main promoting level of an organization.

-

Incorporation: You may want to finish the correct incorporation paperwork, file articles of incorporation, appoint a registered agent and create company bylaws.

-

Construction: Though the shareholders of an S-corporation or C-corporation personal the enterprise, they don’t make a lot of the selections. Administration and coverage points are left to the corporate’s shareholder-elected board of administrators. And the conventional, day-to-day work of operating the enterprise is on the officers of the company—just like the CEO, COO, and CTO.

-

Compliance: Each S-corps and C-corps have to satisfy sure documentation and compliance obligations—reminiscent of issuing inventory, paying charges and holding shareholder and director conferences.

Supply: NYC.gov

Find out how to determine between S-corporation vs. C-corporation

Many small enterprise house owners go for S-corp standing to save cash on taxes. However, if you happen to’re planning to lift investor cash sooner or later or have plans to develop into a really massive firm, a C-corp is likely to be the higher choice.

Here is one other have a look at the benefits and downsides of S-corporations vs. C-corporations.

Benefits of an S-corp

-

Cross-through taxation: S-corp taxation is undoubtedly its largest profit. S-corps don’t should pay taxes on the enterprise’s earnings twice. Avoiding double taxation is a large profit for smaller companies.

-

Deduction of enterprise earnings: Present legislation permits house owners of most S-corps and different pass-through entities to deduct a few of their enterprise earnings on their private tax returns. This enterprise tax deduction can considerably cut back your tax burden.

-

Tax submitting necessities: S-corp house owners can write off losses on their particular person tax returns. It is a profit for newer companies which are doubtless working at a loss for the primary few years.

Benefits of a C-corp

-

Simpler to kind: The C-corp is the default sort of company, so there is no extra paperwork to fill out.

-

Fringe advantages: C-corporations can deduct fringe advantages to staff, reminiscent of incapacity and medical insurance. Shareholders of a C-corporation don’t pay taxes on their fringe advantages, so long as 70% of the company receives those self same fringe advantages.

-

Charitable donations: C-corporations are the one sort of enterprise entity that may deduct 100% of charitable contributions. The donations cannot exceed 10% of the enterprise’s whole earnings.

-

Simpler to lift cash: It’s simpler to lift cash for your online business if it’s a C-corp as a result of C-corps can subject a number of lessons of inventory to an infinite variety of shareholders. Plus, buyers face no legal responsibility for the company’s errors. Different companies can personal C-corps outright, which is likely to be a greater match for corporations trying to be acquired.

-

No shareholder restrict: C-corps can have as many shareholders as they need. Additionally, C-corps can have overseas (nonresident alien) shareholders, making it a perfect enterprise entity for any firm that intends to deal abroad.

Disadvantages of an S-corp

-

Tougher to kind: It’s important to file Kind 2553 with the IRS and presumably extra state paperwork to elect S-corp standing. You additionally should ensure you keep inside any restrictions (e.g. such because the 100 shareholders restrict) to take care of S-corp standing and keep away from penalties.

-

Restricted possession: S-corps cap the variety of shareholders they’ll tackle—as much as 100 shareholders. Plus, shareholders should be authorized residents of the US. This poses an issue for high-growth companies or companies trying to conduct enterprise affairs internationally.

-

Restricted inventory flexibility: S-corps stop issuing most popular inventory and totally different lessons of inventory, which may make it more durable to lift cash from buyers and incentivize early house owners.

-

Tax {qualifications}: Usually, S-corps are likely to get extra IRS scrutiny. For those who make a mistake (like going over 100 shares or lacking a submitting deadline), the IRS can terminate your S-corp standing—and also you’ll be taxed as a C-corp.

Disadvantages of a C-Corp

-

Double taxation: C-corps would possibly pay extra in taxes resulting from double taxation. The corporate’s income is taxed on the company stage after which once more on the private stage if it’s distributed as dividends.

-

No private write-offs: House owners can’t write off enterprise losses on their private earnings taxes.

For those who’re not sure of what is finest for your online business—and what the additional implications of any entity sort would possibly entail—it is likely to be helpful to seek the advice of a enterprise lawyer or on-line authorized service that will help you make the fitting resolution.

Find out how to arrange your online business as an S-corp or C-corp

In the end, the steps fluctuate a bit relying on what state your online business operates in. Normally, you may start by selecting a reputation for your online business and submitting articles of incorporation. You may additionally should draft company bylaws, maintain your first board of administrators assembly and subject inventory certificates to your shareholders.

On-line authorized providers reminiscent of LegalZoom and IncFile make it quick and straightforward to file incorporation paperwork if you happen to’re doing issues your self. However ideally, it’s best to rent a lawyer that will help you arrange your company.

Find out how to elect S-corporation standing

As we have talked about, turning into an S-corp takes yet one more step after organising a C-corp. New companies ought to file Kind 2553 with the IRS inside 75 days of the corporate’s formation date. For those who’re an current enterprise that has converted to S-corp standing, then it’s best to file your kind no later than March 21.

Some states additionally require you to file extra paperwork to elect S-corp standing.

As soon as you choose S-corp standing, it is actually doable to return to a C-corp. Nevertheless, doing so can have essential tax penalties, so make sure that to seek the advice of your accountant or a tax lawyer first.

Now that you recognize the variations between an S-corp vs. C-corp, plus their benefits and downsides, you’re nicely geared up to make a sensible selection for your online business. S-corps permit many small companies to save cash on taxes, however C-corps offer you extra choices to increase and lift cash.

This being stated, earlier than lastly selecting a S-corp or C-corp construction, you might also need to contemplate different forms of enterprise entities. Specifically, LLCs are a really small business-friendly sort of possession construction. LLCs provide restricted legal responsibility and fewer burdensome paperwork and regulatory necessities than companies.

The best way you construction your online business is an enormous resolution and has large implications for your online business’s future. For those who don’t really feel positive about selecting your online business entity or accurately structuring your organization, contemplate speaking to a small enterprise lawyer or accountant.

This text initially appeared on Fundera, a subsidiary of NerdWallet.