The Federal Reserve remits most of its working earnings to the US Treasury. Federal Reserve remittances are authorities revenues that instantly scale back the federal price range deficit. However what’s the budgetary influence of Federal Reserve System losses? The Federal Reserve System has not had an working loss since 1915, so historical past gives no steering as to how these losses will influence the official federal authorities deficit.

In 2023, the Fed will seemingly report tens of billions of {dollars} in working losses because it raises rates of interest to fight raging inflation. Will Fed losses enhance the price range deficit as logic dictates they need to, or will they be handled as an off-budget expenditure? Given the “transparency” of federal budgetary accounting requirements, it isn’t shocking {that a} latest Congressional Funds Workplace (CBO) report suggests Federal Reserve working losses might be excluded when tallying the official federal price range deficit.

The Federal Reserve earns curiosity on its portfolio of Treasury and federal authorities company securities and receives revenues for the funds system companies it gives. Offsetting Fed revenues are the curiosity the Fed pays on financial institution reserve balances and reverse repurchase agreements, dividend funds to Fed member banks, contributions (if any) to the Fed surplus account, and the working bills of the Board of Governors, the 12 Federal Reserve district banks and their branches. Since 2012, bills additionally embody the Shopper Monetary Safety Bureau. Any remaining earnings are transferred to the US Treasury and counted as federal authorities receipts for federal price range functions.

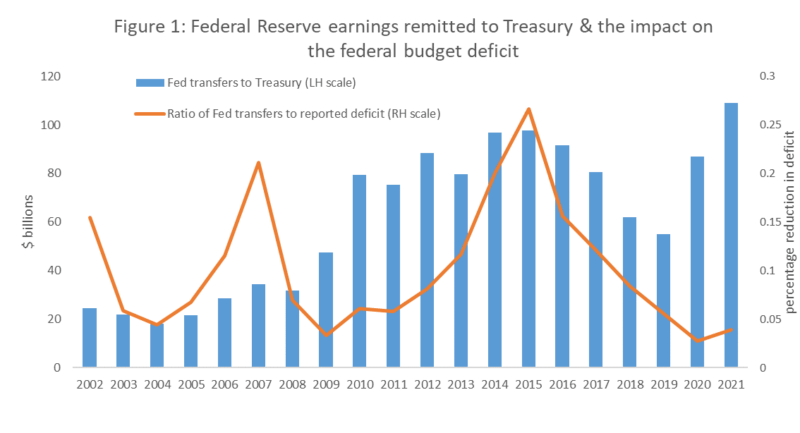

The annual quantity of Federal Reserve working revenue remitted to the Treasury since 2001 is plotted in Determine 1. Additionally proven are estimates of the reductions within the reported federal deficits attributable to the remittances. (The Fed reviews remittances on a calendar-year foundation, whereas the federal deficit is calculated for a fiscal yr ending September 30. The deficit discount estimates in Determine 1 don’t right for this timing distinction.)

In disaster years (2009-2011, 2020-2021) the federal price range deficit is bloated by congressionally appropriated stimulus outlays and decreased tax receipts. In these years, even very giant Fed remittances offset solely a fraction of the mixed federal price range deficit. In years unburdened by huge federal stimulus expenditures, nevertheless, Fed remittances offset a considerable portion of the reported deficit.

By the FOMC’s personal estimates, short-term coverage rates of interest will method 3.5 p.c by year-end 2022. Because the Fed raises quick time period rates of interest to struggle inflation, its curiosity expense will increase. The Fed’s curiosity bills and working expenditures, together with about $630 million per yr in off-budget funding it’s required to supply to the Shopper Monetary Safety Bureau, will quickly exceed its revenues.

Our back-of-the envelope estimates counsel that the Federal Reserve will start reporting internet working losses as soon as short-term rates of interest attain 2.7 p.c, assuming the Fed has no realized losses from promoting its SOMA securities. If short-term charges attain 4 p.c, our estimates counsel that annualized working losses might exceed $62 billion. As mentioned under, these loss estimates are per the Fed Board of Governors’ personal public estimates.

In 2011, the Federal Reserve introduced its official place concerning realized losses on its funding portfolio and system working losses:

[I]n the unlikely [sic] state of affairs during which realized losses had been sufficiently giant sufficient to end in an total internet revenue loss for the Reserve Banks, the Federal Reserve would nonetheless meet its monetary obligations to cowl working bills. In that case, remittances to the Treasury can be suspended and a deferred asset can be recorded on the Federal Reserve’s steadiness sheet.

Amongst monetary establishments, the Fed has the distinctive privilege of setting its personal accounting requirements, and the Fed has determined that, in contrast to for all its regulated banks, working losses won’t scale back the Federal Reserve’s reported capital and surplus. The Fed will preserve a optimistic reserve surplus account within the occasion it books working losses by offsetting its operational losses, one-for-one, with an imaginary “deferred asset” account, irrespective of how giant the loss. Until Congress intervenes, the Fed won’t remit any revenues to the US Treasury—even because it continues paying dividends to its member banks—so long as this deferred asset account has a optimistic steadiness.

As an alternative of issuing a brand new marketable Treasury safety, which might rely in the direction of the deficit, the Fed will cowl its losses with a nonmarketable receivable referred to as deferred belongings recorded on the Fed’s steadiness sheet. The financial actuality, in fact, is that Fed losses enhance the federal government’s deficit.

Federal Reserve Board estimates of the system’s potential cumulative working losses are mirrored in estimates of its deferred asset steadiness pictured in Determine 2. The Federal Reserve Board’s personal estimates counsel that its cumulative working losses (within the estimated “90 p.c interval” case) might method $200 billion by 2026, Furthermore, the Fed initiatives that it could not resume making any Treasury remittances till 2030 or later. Understand that these projections assume the Fed can scale back inflation with pretty modest will increase in short-term rates of interest with the anticipated short-term price path peaking at lower than 4 p.c in 2023, earlier than slowly declining towards 2.5 p.c in 2026.

Determine 2: Federal Board of Governors Projection of Treasury Remittances and System Deferred Asset Account Balances 2023-2030

Whereas the Board of Governors totally anticipates working losses starting in 2023, the CBO didn’t get that memo. In its most up-to-date forecast, the CBO initiatives that the Fed will proceed making optimistic remittances to the Treasury yearly between 2022 and 2032. Whereas the CBO forecast anticipates a pointy decline in remittances in 2023 by way of 2025, it expects a restoration towards 2021 remittance ranges thereafter, with the Fed lowering rates of interest as inflation returns to focused ranges.

Whereas the CBO doesn’t mission any Fed working losses, its rationalization of price range accounting suggests any such losses can be excluded from price range deficit calculations: “Though it remits earnings to the Treasury (that are recorded as revenues within the federal price range), the Federal Reserve’s receipts and expenditures should not included instantly within the federal price range…” Working losses might be a Federal Reserve expenditure, so this CBO assertion would seem to exclude Fed working losses from the federal deficit calculation. It’s unusual to not rely the Fed’s losses within the price range accounting, contemplating that the Fed’s earnings are counted. Maybe as a result of the CBO doesn’t anticipate Federal Reserve losses, it has failed to contemplate them explicitly in its description of deficit accounting.

Easy accounting logic means that if the federal price range deficit is decreased when the Fed earns revenues in extra of bills and remits these earnings to the US Treasury, Fed losses ought to enhance the reported federal price range deficit. That is very true since Federal Reserve System losses now embody the tons of of hundreds of thousands of {dollars} of off-budget funding it’s required to switch to run the Shopper Monetary Safety Bureau. If the present accounting guidelines stay unchallenged, the Congress might cross new laws requiring the Federal Reserve to fund any variety of actions off-budget with none influence on the reported federal price range deficit.