Angel Di Bilio

Introduction

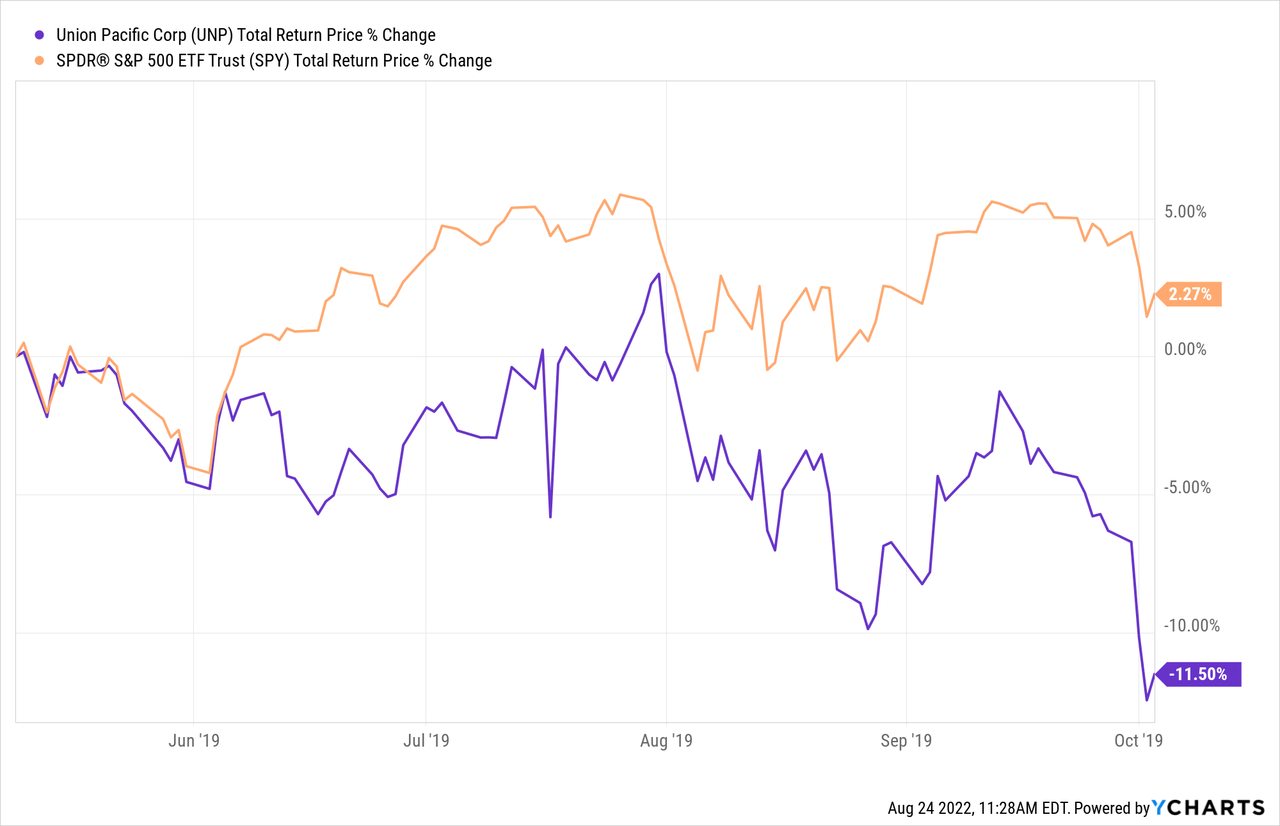

It has been almost three years since I’ve written about Union Pacific (NYSE:UNP) inventory, so I feel it is due for an replace. My final two articles had been on Might ninth, 2019 titled “Union Pacific: A ten-Yr Full-Cycle Evaluation“, the place I used to be bearish, and I adopted that up with a “Maintain”, or, “impartial” article later that 12 months on October third, 2019, titled “Revisiting My Union Pacific Promote Rankings“. In between my “Promote” and my “Maintain” articles, that is how UNP carried out.

It fell somewhat bit, which, mixed with rising earnings was sufficient to maneuver UNP close to the mid-point of truthful worth. For buyers who rotated out of the inventory resulting from valuation after my first article, it was okay on the level of publication of the second article to rotate their a refund in. UNP by no means fell far sufficient to have a large enough margin of security for me to purchase personally, even in the course of the March 2020 decline, although.

So, mainly, my final UNP article was about 3 years in the past and I valued UNP inventory across the midpoint of truthful worth with roughly an 8% anticipated long-term 10-year CAGR.

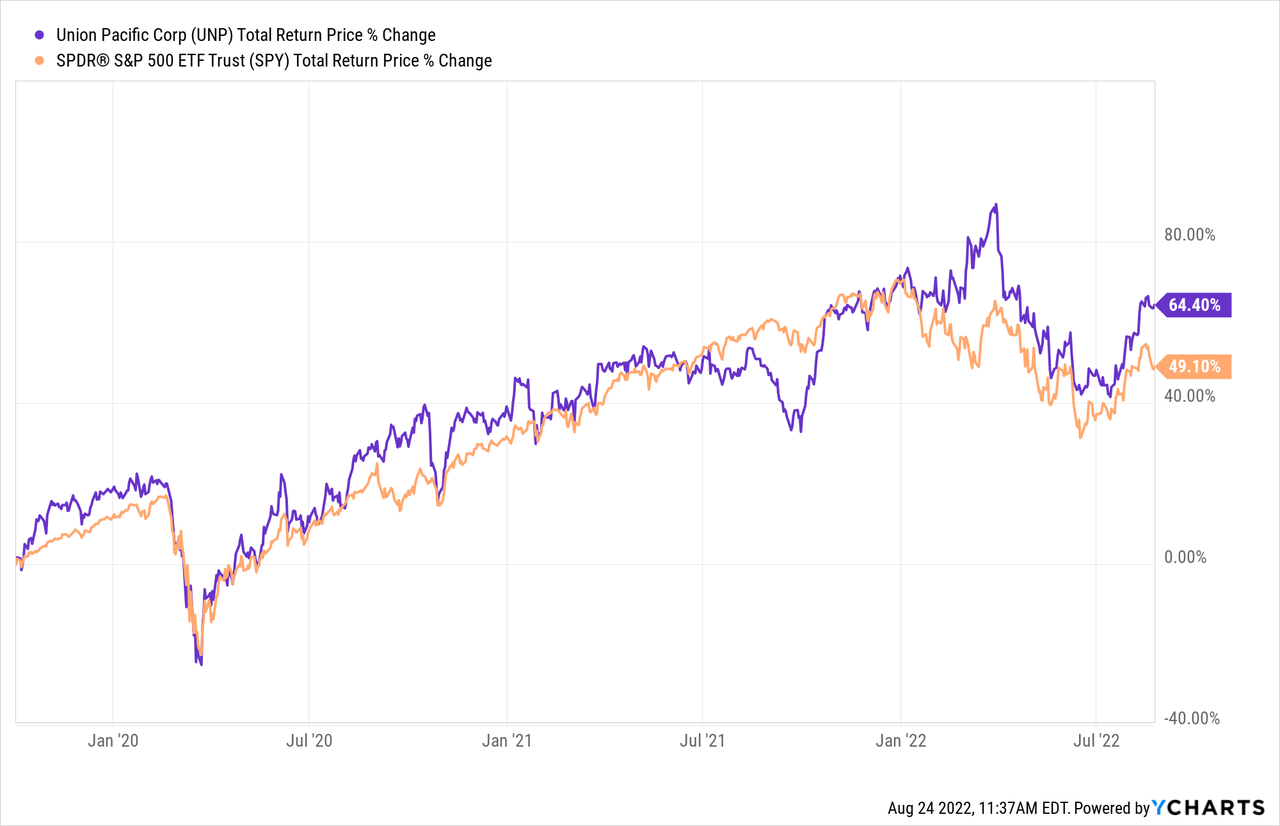

Authorities stimulus has for sure improved UNP’s absolute returns since then, however for many of this era it has been buying and selling equally to the S&P 500, with some underperformance in mid-2021, and a few outperformance this 12 months. Total, although, I feel it is truthful to name the relative efficiency common.

On this article, I will overview Union Pacific’s valuation, to see the place the valuation stands at present.

My Valuation Technique For Union Pacific

The valuation methodology I take advantage of for Union Pacific first checks to see how cyclical earnings have been traditionally. As soon as it’s decided that earnings aren’t too cyclical, then I take advantage of a mix of earnings, earnings progress, and P/E imply reversion to estimate future returns primarily based on earlier earnings progress and sentiment patterns. I take these expectations and apply them 10 years into the long run, after which convert the outcomes into an anticipated CAGR proportion. If the anticipated return is basically good, I’ll purchase the inventory, and if it is actually low, I’ll usually promote the inventory. On this article, I’ll take readers by every step of this course of.

(An fascinating facet observe: Once I wrote my very first UNP article again in 2018, I truly didn’t but use this earnings-based classification of cyclicality. At the moment I primarily based my choice purely on historic value cyclicality. It wasn’t till round early 2019 I found it was higher to make use of historic earnings patterns quite than value cyclicality (or trade, or analyst classification) to find out how cyclical a enterprise actually was.)

Importantly, as soon as it’s established {that a} enterprise has an extended historical past of comparatively secure and predictable earnings progress, it does not actually matter to me what the enterprise does. If it constantly makes more cash over the course of every financial cycle, that is what I care about — numbers over tales.

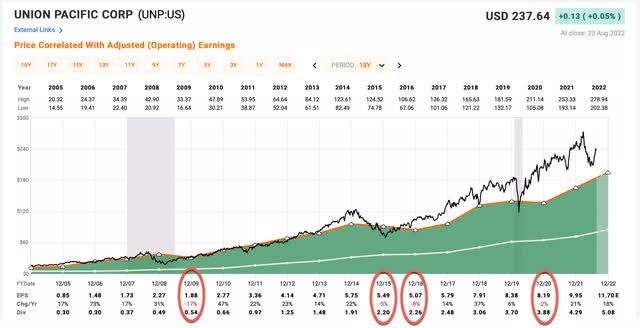

FAST Graphs

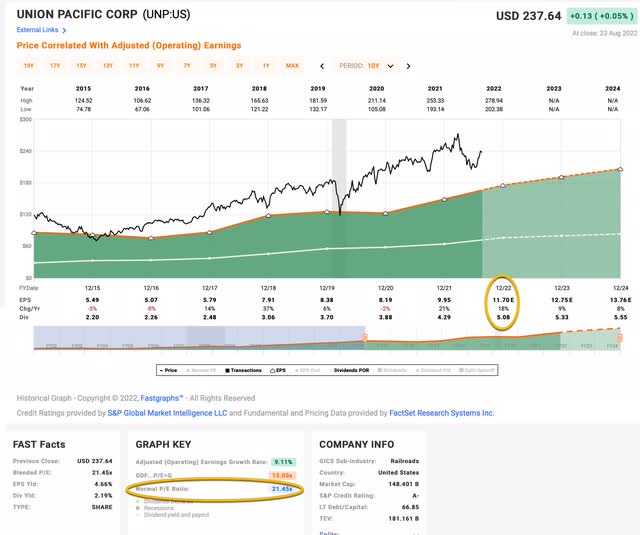

UNP’s historic earnings are represented by the darkish inexperienced shaded space within the FAST Graph above. I’ve circled the destructive EPS years in crimson. There have been 4 of these years since 2003. The deepest was a -17% decline in 2009. This implies that UNP is just not a very cyclical enterprise, however we do have to be somewhat bit cautious right here. As we’ll see later, UNP buys again a number of inventory, and that inflates EPS, lowering declines.

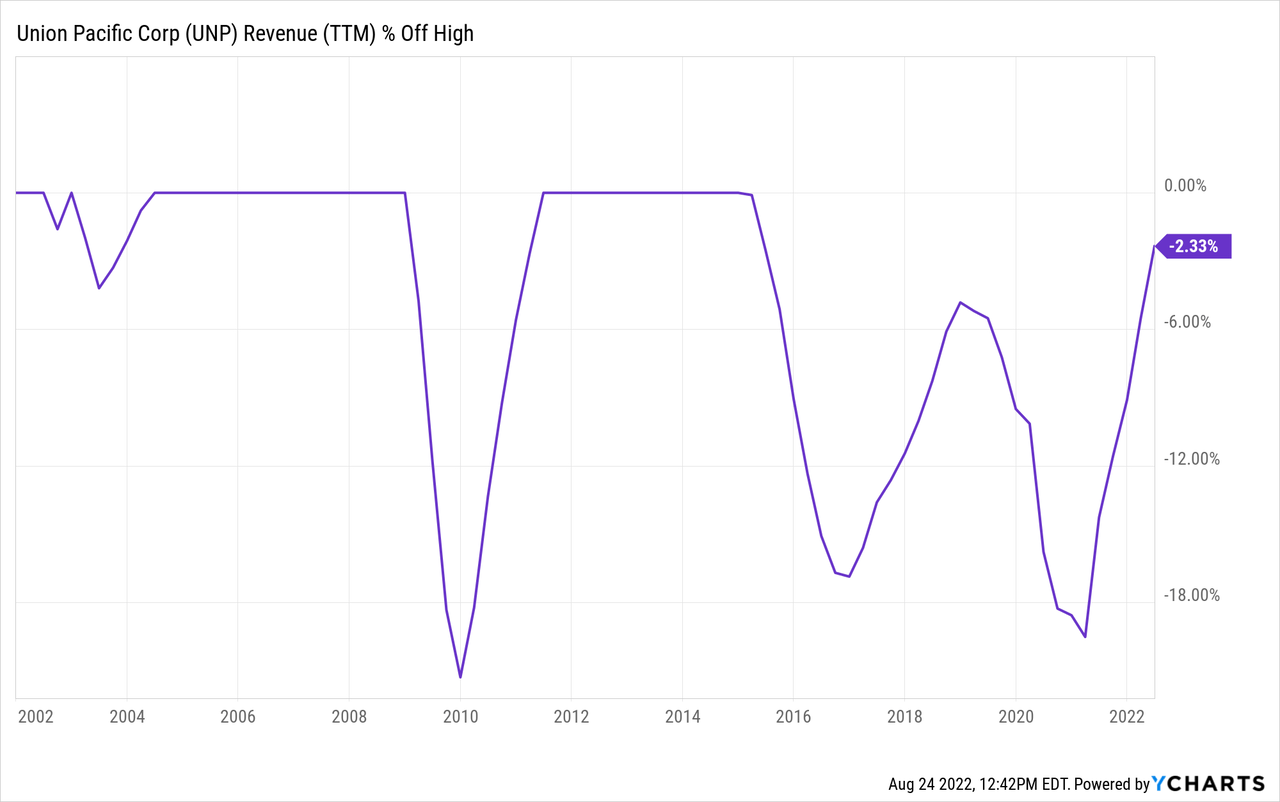

If we take a look at TTM Income % off excessive chart above, we will see that UNP is reasonably cyclical on this regard. At the very least extra so than the EPS pattern suggests. It is simply one thing to bear in mind. I nonetheless suppose general cyclicality is low sufficient to make use of an earnings-based evaluation so long as it controls for buybacks (which I all the time do anyway).

Market Sentiment Return Expectations

With the intention to estimate what kind of returns we’d count on over the following 10 years, let’s start by inspecting what return we might count on 10 years from now if the P/E a number of had been to revert to its imply from the earlier financial cycle. For this, I am utilizing a interval that runs from 2015-2022.

FAST Graphs

Union Pacific’s common P/E from 2015 to the current has been about 21.45 (the blue quantity circled in gold close to the underside of the FAST Graph). Utilizing 2022’s ahead earnings estimates of $11.70 (additionally circled in gold), UNP has a present P/E of 20.38. If that 20.38 P/E had been to revert to the typical P/E of 21.45 over the course of the following 10 years and all the pieces else was held the identical, UNP’s value would rise and it could produce a 10-Yr CAGR of +0.51%. That is the annual return we will count on from sentiment imply reversion if it takes 10 years to revert. If it takes much less time to revert, the return could be increased.

Enterprise Earnings Expectations

We beforehand examined what would occur if market sentiment reverted to the imply. That is completely decided by the temper of the market and is very often disconnected, or solely loosely related, to the efficiency of the particular enterprise. On this part, we are going to study the precise earnings of the enterprise. The purpose right here is easy: We wish to know the way a lot cash we’d earn (expressed within the type of a CAGR %) over the course of 10 years if we purchased the enterprise at at present’s costs and saved all the earnings for ourselves.

There are two principal parts of this: the primary is the earnings yield and the second is the speed at which the earnings might be anticipated to develop. Let’s begin with the earnings yield (which is an inverted P/E ratio, so, the Earnings/Value ratio). The present earnings yield is about +4.91%. The best way I like to consider that is, if I purchased the corporate’s complete enterprise proper now for $100, I’d earn $4.91 per 12 months on my funding if earnings remained the identical for the following 10 years.

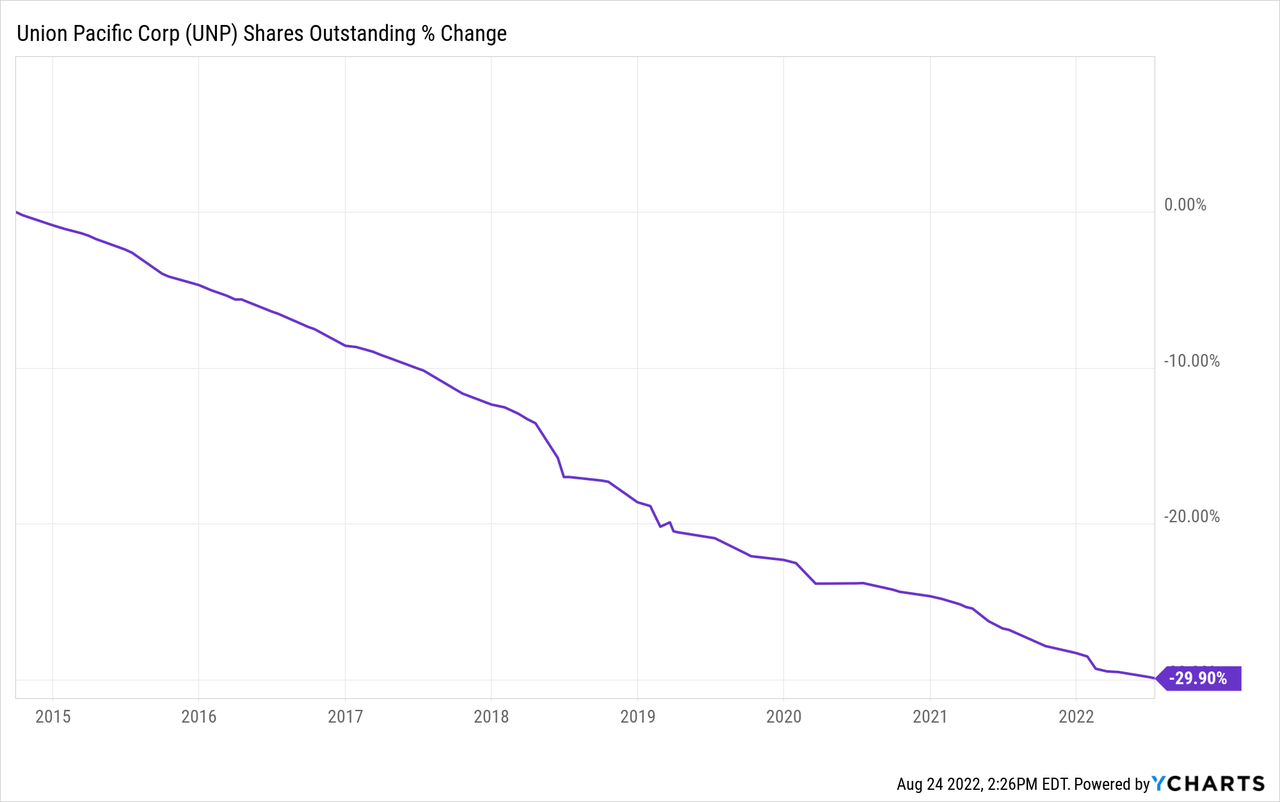

The following step is to estimate the corporate’s earnings progress throughout this time interval. I do this by determining at what fee earnings grew over the last cycle and making use of that fee to the following 10 years. This entails calculating the historic EPS progress fee, making an allowance for every year’s EPS progress or decline, after which backing out any share buybacks that occurred over that point interval (as a result of lowering shares will improve the EPS resulting from fewer shares).

Throughout this time interval, UNP has purchased again a large quantity of shares, almost 30% of the corporate. I’ll make changes to my earnings progress estimates to account for these buybacks, in addition to the destructive EPS years. This may virtually all the time produce a extra conservative earnings progress estimate than most different methods that do not take these elements under consideration. Once I do this, I get an earnings progress fee expectation of +4.48%. All issues thought of, that is not too dangerous, however it’s rather more conservative than the FAST Graph’s +9.11% measurement.

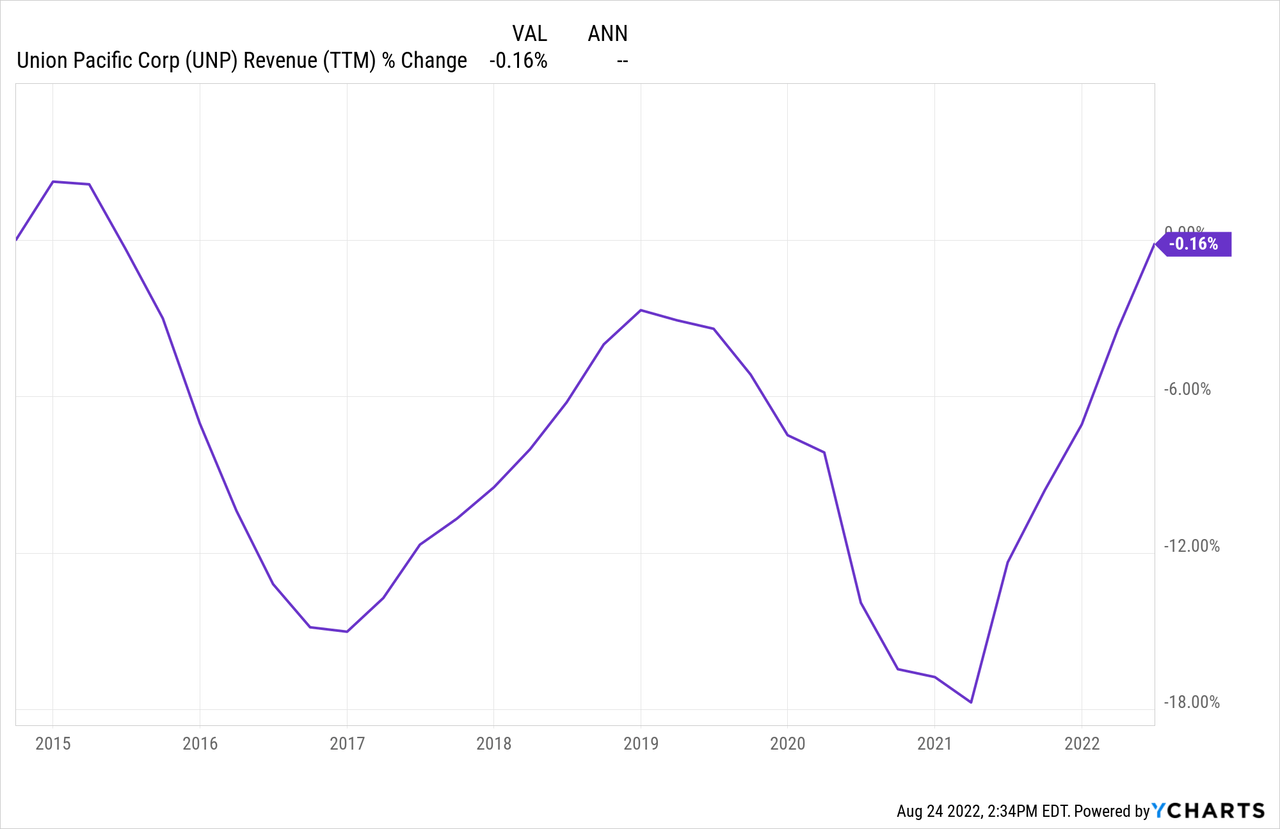

Simply one other little side-note right here for instance my level concerning the earnings progress fee. If we take a look at the income progress fee over this era, which is unaffected by the inventory buybacks we will see what I am getting at.

UNP’s income is flat over this identical 7-year time interval. Do we actually suppose that every 12 months they elevated the effectivity of their enterprise by 9%? Uncertain. Many of the features within the earnings per share have seemingly come from monetary engineering.

Subsequent, I am going to apply that progress fee to present earnings, wanting ahead 10 years with the intention to get a closing 10-year CAGR estimate. The best way I take into consideration that is, if I purchased UNP’s complete enterprise for $100, it could pay me again $4.91 plus +4.48% progress the primary 12 months, and that quantity would develop at +4.48% per 12 months for 10 years after that. I wish to know the way a lot cash I’d have in complete on the finish of 10 years on my $100 funding, which I calculate to be about $163.03 (together with the unique $100). Once I plug that progress right into a CAGR calculator, that interprets to a +5.01% 10-year CAGR estimate for the anticipated enterprise earnings returns.

10-Yr, Full-Cycle CAGR Estimate

Potential future returns can come from two principal locations: market sentiment returns or enterprise earnings returns. If we assume that market sentiment reverts to the imply from the final cycle over the following 10 years for UNP, it is going to produce a +0.51% CAGR. If the earnings yield and progress are much like the final cycle, the corporate ought to produce someplace round a +5.01% 10-year CAGR. If we put the 2 collectively, we get an anticipated 10-year, full-cycle CAGR of +5.52% at at present’s value.

My Purchase/Promote/Maintain vary for this class of shares is: above a 12% CAGR is a Purchase, under a 4% anticipated CAGR is a Promote, and in between 4% and 12% is a Maintain. A +5.52% CAGR expectation makes Union Pacific inventory a “Maintain” at at present’s value. I’d think about this overvalued, however not essentially overvalued sufficient that it’s a clear “Promote”. And we sort of see this in its relative efficiency in comparison with the S&P 500 this 12 months, through which it has outperformed somewhat bit regardless that the historic efficiency has been about the identical. I’d count on the inventory to underperform the index by somewhat bit going ahead, however I’d not essentially count on it to massively underperform.

Assuming at present’s earnings tendencies keep intact, I’d be a possible purchaser of Union Pacific inventory if the value had been to fall under $154 per share. And if I used to be a present proprietor of Union Pacific inventory (which I’m not) I’d be a vendor if the value rose above $266 per share and not using a corresponding rise in earnings.

Conclusion

When it comes to S&P 500 index shares, general, UNP is a median inventory prone to produce common efficiency over the long run. One factor we will be taught from inspecting Union Pacific inventory is the ability of buybacks and monetary engineering with the intention to make the enterprise seem as whether it is rising sooner than it truly is. So long as UNP can sustain a mid-single-digit actual earnings progress fee, these buybacks will likely be okay, however I feel if progress ever does decelerate sooner or later that buyers will want they’d been paid a bigger dividend as an alternative. Regardless of being solely reasonably cyclical, it ought to be famous that if we do have a recession within the close to future that UNP has traditionally had its inventory punished fairly badly. If the inventory had been to revert to its earlier recession P/E, the value would drop greater than -50% from the place it trades at present. So, whereas the inventory is just not particularly overvalued, it does nonetheless have outsized threat over the close to time period if we get a recession in 2023. On the flip-side, if you’re ready on the sidelines as I’m, the inventory has first rate potential to supply up a compelling worth throughout a recession. If buyers begin panicking at the moment, it could be a very good time to purchase.