SDI Productions

This month-to-month article collection exhibits a dashboard with combination trade metrics in shopper staples. It might additionally function a top-down evaluation of sector ETFs just like the Client Staples Choose Sector SPDR ETF (XLP) and the Vanguard Client Staples ETF (NYSEARCA:VDC), whose largest holdings are used to calculate these metrics.

Shortcut

The following two paragraphs in italic describe the dashboard methodology. They’re vital for brand new readers to know the metrics. In case you are used to this collection or in case you are wanting time, you’ll be able to skip them and go to the charts.

Base Metrics

I calculate the median worth of 5 elementary ratios for every trade: Earnings Yield (“EY”), Gross sales Yield (“SY”), Free Money Stream Yield (“FY”), Return on Fairness (“ROE”), Gross Margin (“GM”). The reference universe consists of massive firms within the U.S. inventory market. The 5 base metrics are calculated on trailing 12 months. For all of them, greater is best. EY, SY and FY are medians of the inverse of Value/Earnings, Value/Gross sales and Value/Free Money Stream. They’re higher for statistical research than price-to-something ratios, that are unusable or non accessible when the “one thing” is near zero or destructive (for instance, firms with destructive earnings). I additionally have a look at two momentum metrics for every group: the median month-to-month return (RetM) and the median annual return (RetY).

I desire medians to averages as a result of a median splits a set in a very good half and a foul half. A capital-weighted common is skewed by excessive values and the most important firms. My metrics are designed for stock-picking fairly than index investing.

Worth and High quality Scores

I calculate historic baselines for all metrics. They’re famous respectively EYh, SYh, FYh, ROEh, GMh, and they’re calculated because the averages on a look-back interval of 11 years. For instance, the worth of EYh for meals within the desk under is the 11-year common of the median Earnings Yield in meals firms.

The Worth Rating (“VS”) is outlined as the typical distinction in % between the three valuation ratios (EY, SY, FY) and their baselines (EYh, SYh, FYh). The identical manner, the High quality Rating (“QS”) is the typical distinction between the 2 high quality ratios (ROE, GM) and their baselines (ROEh, GMh).

The scores are in share factors. VS could also be interpreted as the proportion of undervaluation or overvaluation relative to the baseline (constructive is sweet, destructive is dangerous). This interpretation have to be taken with warning: the baseline is an arbitrary reference, not a supposed honest worth. The formulation assumes that the three valuation metrics are of equal significance.

Present information

The following desk exhibits the metrics and scores as of final week’s closing. Columns stand for all the info named and outlined above.

|

VS |

QS |

EY |

SY |

FY |

ROE |

GM |

EYh |

SYh |

FYh |

ROEh |

GMh |

RetM |

RetY |

|

|

Staple/Meals Retail |

-34.54 |

12.71 |

0.0332 |

1.7268 |

0.0098 |

22.13 |

20.53 |

0.0434 |

1.9302 |

0.0322 |

16.53 |

22.43 |

5.95% |

15.31% |

|

Meals |

-6.74 |

10.72 |

0.0541 |

0.5601 |

0.0197 |

20.95 |

28.34 |

0.0461 |

0.6801 |

0.0246 |

15.31 |

33.51 |

6.67% |

8.09% |

|

Beverage |

-22.43 |

-23.58 |

0.0321 |

0.2364 |

0.0104 |

18.72 |

40.75 |

0.0370 |

0.2681 |

0.0180 |

24.57 |

53.17 |

8.38% |

18.40% |

|

Family prod. |

-3.44 |

0.91 |

0.0665 |

1.1002 |

0.0056 |

18.25 |

38.89 |

0.0444 |

0.8759 |

0.0392 |

17.11 |

40.87 |

4.82% |

-15.44% |

|

Private care |

-13.27 |

8.61 |

0.0368 |

0.3791 |

0.0166 |

22.11 |

63.17 |

0.0385 |

0.4577 |

0.0203 |

21.53 |

55.16 |

7.87% |

-1.12% |

|

Tobacco |

31.93 |

100* |

0.0622 |

0.6338 |

0.0222 |

207.17 |

50.86 |

0.0589 |

0.4623 |

0.0145 |

31.65 |

52.69 |

1.53% |

4.84% |

*capped for comfort

Worth And High quality chart

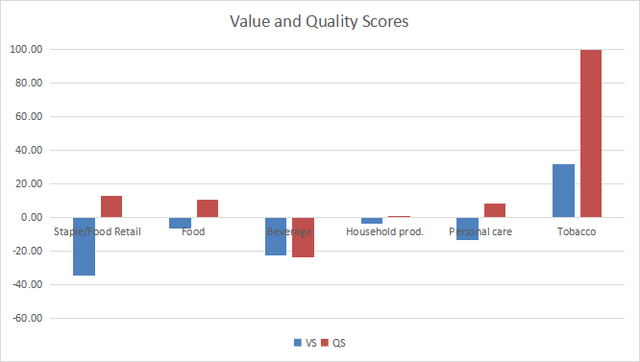

The following chart plots the Worth and High quality Scores by trade (greater is best).

Worth and high quality in shopper staples (Chart: writer; information: Portfolio123)

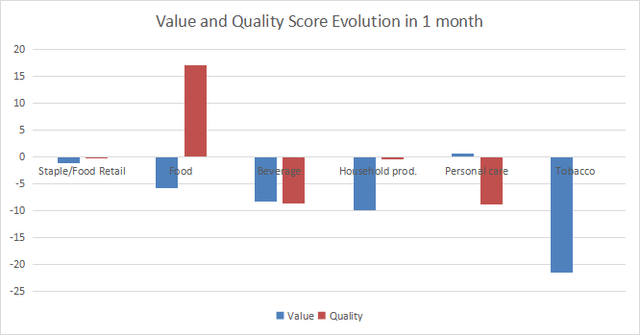

Evolution since final month

Essentially the most notable strikes are an enchancment in high quality rating for the meals trade and a deterioration in worth rating for tobacco.

Rating variations (Chart: writer; information: Portfolio123)

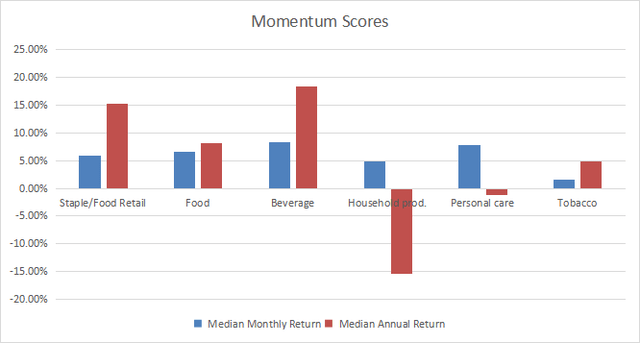

Momentum

The following chart plots momentum information.

Momentum in shopper staples (Chart: writer; information: Portfolio123)

Interpretation

The tobacco trade is the best-ranked in each worth and high quality scores (a notice of warning: there are solely 5 tobacco firms on this universe, so statistics are much less dependable than in different subsectors). Meals, family merchandise and private care merchandise are near their valuation and high quality baselines based mostly on 11-year averages. Beverage and meals/staple retail look overvalued by about 22% and 35%, respectively. Beverage in the one subsector under its high quality baseline.

VDC quick info

The Vanguard Client Staples ETF (VDC) has been following the MSCI USA IMI Client Staples 25/50 Index since 01/26/2004. It has a distribution yield of two.21% and a complete expense ratio of 0.10%, the identical as XLP.

As of writing, the fund has 100 holdings. The following desk exhibits the highest 10 with their development, worth/earnings ratios and dividend yields. Their combination weight is 62.6%. The fund is sort of delicate to dangers associated the highest 5 names: every of them weighs between 7% and 12.5% of fairness worth.

|

Ticker |

Identify |

Weight% |

EPS ttm development% |

P/E ttm |

P/E fwd |

Yield% |

|

PG |

Procter & Gamble Co. |

12.44% |

5.61 |

25.81 |

25.24 |

2.44 |

|

KO |

Coca-Cola Co. |

9.62% |

17.92 |

29.65 |

26.46 |

2.70 |

|

PEP |

PepsiCo Inc. |

8.72% |

12.39 |

27.15 |

27.03 |

2.55 |

|

COST |

Costco Wholesale Corp. |

8.47% |

19.36 |

44.18 |

42.79 |

0.64 |

|

WMT |

Walmart Inc. |

7.08% |

41.30 |

27.74 |

23.86 |

1.61 |

|

PM |

Philip Morris Worldwide Inc. |

4.13% |

2.58 |

17.26 |

17.86 |

4.98 |

|

MDLZ |

Mondelez Worldwide Inc. |

3.64% |

-8.61 |

23.78 |

22.53 |

2.35 |

|

MO |

Altria Group Inc. |

3.26% |

-60.24 |

46.89 |

9.43 |

7.89 |

|

CL |

Colgate-Palmolive Co. |

2.60% |

-27.76 |

35.94 |

27.33 |

2.27 |

|

EL |

Estee Lauder Cos Inc. |

2.59% |

143.95 |

30.78 |

36.65 |

0.85 |

Ratios: Portfolio123

VDC has barely outperformed XLP since inception, however the distinction in annualized whole return is insignificant (27 bps). These two ETFs even have comparable dangers measured in drawdown and volatility.

|

Whole Return |

Annual Return |

Max Drawdown |

Sharpe |

StdDev |

|

|

VDC |

493.98% |

10.07% |

-35.92% |

0.79 |

11.29% |

|

XLP |

467.03% |

9.80% |

-33.45% |

0.78 |

11.07% |

In abstract, VDC is an efficient instrument with low-cost charges for traders in search of a capital-weighted publicity in shopper staples. It holds rather more shares than XLP (presently 100 vs. 35), however this has not made a big distinction in previous efficiency: smaller holdings have a low combination weight relative to S&P 500 firms. For long-term traders, XLP and VDC are equivalents, however liquidity makes XLP a better option for tactical allocation and buying and selling. The fund is considerably uncovered to dangers associated to the highest 5 holdings, which weigh 7.08% to 12.44% individually and 46.3% in combination. Traders who’re involved by this focus could desire the Invesco S&P 500 Equal Weight Client Staples ETF (RHS).

Dashboard Checklist

I take advantage of the primary desk to calculate worth and high quality scores. It might even be utilized in a stock-picking course of to examine how firms stand amongst their friends. For instance, the EY column tells us {that a} meals firm with an earnings yield above 0.0541 (or worth/earnings under 18.48 is within the higher half of the trade relating to this metric. A Dashboard Checklist is distributed each month to Quantitative Threat & Worth subscribers with essentially the most worthwhile firms standing within the higher half amongst their friends relating to the three valuation metrics on the identical time. The listing under was despatched to subscribers a number of weeks in the past based mostly on information accessible at the moment.

|

HAIN |

Hain Celestial Group Inc. |

|

POST |

Publish Holdings Inc. |

|

TSN |

Tyson Meals Inc. |

|

TAP |

Molson Coors Beverage Firm |

|

USNA |

USANA Well being Sciences Inc. |

|

EPC |

Edgewell Private Care Co. |

|

VGR |

Vector Group Ltd. |

It’s a rotating listing with a statistical bias towards extra returns on the long-term, not the results of an evaluation of every inventory.