Cecilie_Arcurs/E+ through Getty Pictures

Fee shares may see a “good rebound” within the second half of 2022, writes Mizuho Securities USA analyst Dan Dolev in a be aware to purchasers.

“Particularly, present expectations indicate a constructive inflection within the Funds two-year income progress stack as quickly as 2Q22,” he mentioned. Inventory costs are inclined to comply with such inflections, when latest historical past.

Trying throughout, different tech subsectors, together with Web, Software program or Semis, Mizuho’s analysis signifies that Funds may even see the next constructive inflection than another tech verticals.

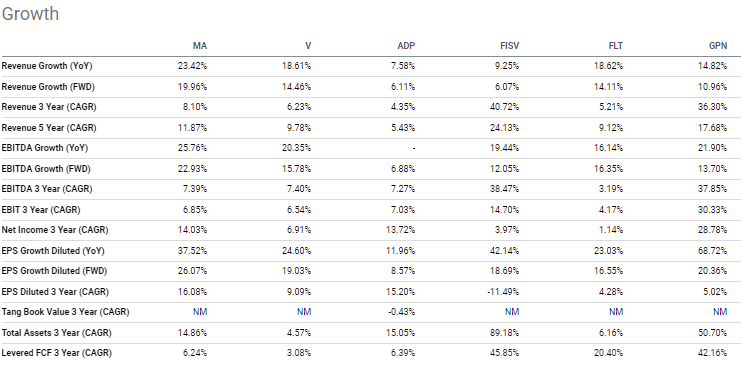

There are a lot of different components that assist decide Mizuho’s scores and value targets. Nonetheless, wanting on the acceleration within the two-year stack, even when adjusting for his or her Russian publicity, Dolev estimates that Fleetcor Applied sciences (NYSE:FLT), Mastercard (NYSE:MA), Visa (NYSE:V), Wex (NYSE:WEX), World Funds (NYSE:GPN), ADP (NASDAQ:ADP), Constancy Nationwide Data (NYSE:FIS), and Fiserv (NASDAQ:FISV) ought to see essentially the most acceleration.

Mizuho has Purchase scores on ADP (ADP), Fiserv (FISV), Constancy Nationwide Data (FIS), Mastercard (MA), and Wex (WEX). It has Impartial scores on Fleetcor (FLT), World Funds (GPN), and Visa (V).

A couple of week in the past, Bernstein analyst Harshita Rawat chosen Visa (V) and Mastercard (MA) because the most probably to see constructive revisions and “enchancment in narrative.”

Examine progress metrics of a few of the firms talked about on this story right here.

Beforehand (March 5), Visa (V), Mastercard (MA) droop operations in Russia as a consequence of invasion of Ukraine