Zhonghui Bao

Plane lessors have been one in every of my favourite investments as I imagine in worth retention and the long-term demand for air journey that continues to extend. Whereas I do imagine within the long-term energy of plane lessors, I really feel shares of those specialised financing corporations have been underappreciated. Because the final time I wrote about Air Lease Company (NYSE:AL), the corporate’s inventory elevated 0.8% in comparison with 0.2% for the broader market. These will not be extraordinarily sturdy returns however present that Air Lease Company is likely one of the corporations that may outperform the market.

On this investor report, I can be analyzing the second quarter outcomes, which I imagine proceed to painting why an organization comparable to Air Lease Company is good to have in your portfolio.

Air Lease Company Reveals Robust Progress

Q2 2022 outcomes Air Lease Company (Air Lease Company )

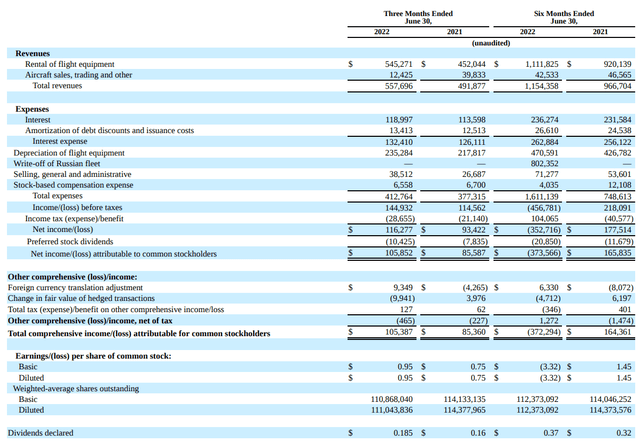

In the course of the quarter, Air Lease Company reported revenues of $558 million in comparison with $492 million within the comparable interval final yr, marking a rise of 13.4% or $65.819 million. The rise in income was pushed by fleet development, decrease revenues accounted for on money foundation in comparison with final yr offset by termination of the leasing actions in Russia valued $18 per quarter and $34 million in different revenues as Air Lease Company bought unsecured claims associated to Aeromexico in Q2 2021.

In the course of the quarter, curiosity bills elevated to $132.4 million because the debt stability elevated and rates of interest are anticipated to rise sooner or later because the debt stability continues rising and rates of interest enhance. Depreciation of flight gear additionally elevated because the fleet grew. SG&A elevated from $26.7 million to $38.5 million, reflecting greater lease exercise, transitions and better insurance coverage premiums, which, because of the scenario in Russia, have elevated by $16 million on annualized foundation. Internet earnings attributable to widespread stockholders elevated barely over $20 million to $105.4 million or 23%.

The consensus for Q2 2022 was $559.5 million with earnings per share of $0.79. Air Lease Company reported $557.7 million in revenues, principally according to the consensus and $0.95 per share beating the estimates by 20%. So, regardless of some headwinds on topline and prices, the energy of the restoration in air journey demand was outstanding within the Q2 2022 earnings. In the course of the quarter, working money stream was $434 million, which is a 70% sequential enchancment and 18% in comparison with final yr. For the six months ended, working money stream improved 14%, and Air Lease Company expects to generate one other $1 billion in money stream within the second half of the yr.

Is Air Lease Company Inventory A Purchase?

Air Lease Company Airbus plane (Airbus)

Beforehand, I had been a critic of administration as they incorrectly assessed the scenario in Russia claiming that there was no impairment danger solely to stroll again on that assertion and introduced a $802 million impairment. Administration actually did not rating factors there, however my evaluation had already proven the impairment danger, so with me, traders have been ready for that.

Proper now, Air Lease Company is way more conservative with regard to statements in regards to the insurance coverage claims in connection to Russia and that may be a good factor as a result of realistically the scenario is so complicated that you would be able to not make any particular statements or forecast.

I imagine that Air Lease Company continues to be a purchase as provide chain challenges persist, that means that Boeing (BA) and Airbus (OTCPK:EADSF) will be unable to assist demand. This gives assist to plane values, lease charges, and urge for food for lease extensions, additional supported by greater rates of interest that make financing of plane costlier for airways. The present delays on the OEMs additionally enable Air Lease Company to evaluation their scheduled funds for flight gear and produce these according to the supply delays.

Moreover, deliveries by 2023 are positioned for 99%, 60% positioned in 2024 and 25% in 2025, with some placements being as far out as 5 years which actually exhibits the energy of the market and demand for the flight gear that’s scheduled to be delivered.

Conclusion: Air Lease Company To Profit From Provide Chain Challenges

I imagine that second quarter outcomes have been good and the prospect for the rest of the yr are good as nicely with $1 billion in money anticipated to come back in. We’re seeing that income is recovering as extra gear is being leased and there’s much less headwind from money accounting on rental revenues and lease restructurings. With the demand-supply imbalance of plane to persist within the years to come back, Air Lease Company will see higher worth for his or her plane and better lease charges which is able to assist their enterprise. I imagine the total impact of that in addition to lease extensions will not be mirrored within the firm’s outcomes. So, I do count on a good stronger future for corporations energetic within the aviation finance sector.