JStuij

My articles on Chemours Firm (NYSE:CC) is a part of SA’s present sole protection on the corporate. Only a few contributors appear to be following this enterprise, which will be thought-about a little bit of a disgrace. My article 2 items in the past particularly guided for a “HOLD” with a $25 PT. Think about my shock when just a few days later, my value alert went off and the corporate dropped under $25/share. I purchased a couple of shares and saved a watch on the corporate.

There is no doubt that Chemours stays a really unstable enterprise. However as with different chemical companies I spend money on, this may ultimately be sufficient to provide us an upside right here.

Allow us to see, due to this fact, what a 16%+ drop does to the attraction of Chemours Firm.

Revisiting Chemours Firm

Chemours will proceed to be a play on unstable commodity pricing that is influenced by macro in addition to the general uncertainty and pricing ranges and impacts that we’re presently seeing.

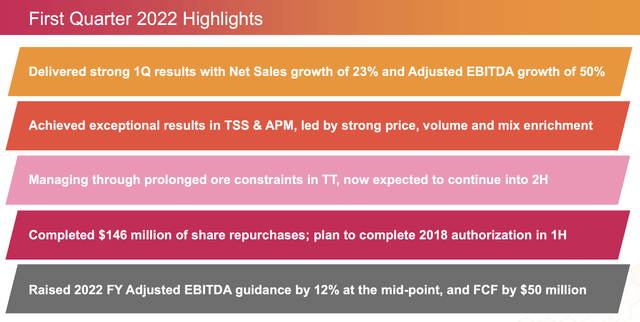

In my final article, I identified a current value drop on Chemours, that may be adopted by yet one more value drop solely a short while later. Whereas 4Q21 outcomes weren’t precisely unhealthy, 1Q22 have been truly pretty optimistic. These outcomes noticed gross sales will increase and elementary energy in the complete portfolio. With GAAP EPS greater than doubling YoY, and EBITDA up 50%+ on an adjusted foundation, buyers might be excused for anticipating Chemours to proceed to outperform right here.

I preserve my stance that for probably the most half, Chemours is optimistic right here. There are dangers to any firm – CC included – however specializing in these comes at a price of ignoring what is clearly a big potential long-term optimistic when it comes to demand.

Chemical firms have seen these type of optimistic demand tendencies for over a 12 months now. Firms, CC included, have been capable of push value will increase to be able to retain their margins and offset the price will increase that we’re presently seeing throughout the complete market.

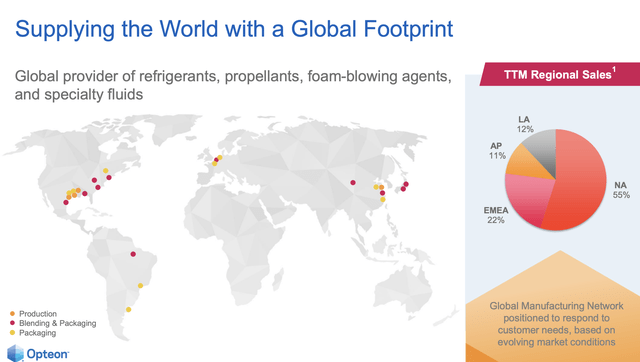

Chemours Opteon Functions (CC IR)

What has occurred in Ukraine – however for CC, I see this as a web optimistic. Transferring right into a extra pressured setting with extra tightness on the supply aspect, firms like Chemours are like as to not see improved ranges and tendencies right here.

I imagine that as we transfer into the next price and pressured setting, it is firms like this that may shine.

The favorable pricing dynamic we’re seeing is one which I anticipate will proceed going ahead, and what we noticed when it comes to EBITDA will solely proceed. We might see this within the final quarter, with the present pricing momentum basically which means that Chemours dictates the pricing and might cost a hefty premium for what it sells. This truth continues to outweigh the upper variable enter prices, hailing from a mixture of feedstock value inflation, working prices, labor prices, and logistical prices.

Chemours Opteon (CC IR)

The corporate additionally managed to tremendously enhance its web debt, which is now solidly under 2x when it comes to TTM web leverage, and gross debt of round $2.6B, with an ending money stability of $1.145B, and complete liquidity inclusive of debt and revolvers at nearly $2B. Chemours has no must faucet debt or fairness within the close to future from a money viewpoint.

Chemours 1Q22 Highlights (CC IR)

The corporate noticed wonderful efficiency throughout the board from its varied segments. We might level to its Titanium applied sciences phase, which noticed an nearly 30% YoY gross sales improve, however the true stars of the quarter have been the thermal and specialised options phase.

Thermal and specialised options noticed 40% web gross sales progress, with once more, robust pricing and market dynamics and over 11% EBITDA margin improve regardless of feedstock pricing, vitality pricing, and logistics. The corporate totally expects the upside to proceed, with regular seasonal gross sales patterns for the enterprise.

For Superior efficiency supplies, the corporate delivered report gross sales with double-digit gross sales will increase and pricing pushes, related tendencies to the opposite segments. Adjusted EBITDA margins rose by 6%, once more regardless of headwinds, and these markets are anticipated to stay robust as nicely.

All of those tendencies have been so good that the corporate bumped its steerage, to the place the one method it is available in on the low finish of the idea vary, is that if the availability chain situations materially proceed to deteriorate throughout the board, or if we see even increased spiking vitality prices for the corporate – or if China shutdowns final considerably longer.

If any of the upside assumptions, comparable to restoration, begins materializing, CC expects an EPS that tendencies barely north of $5.5 and over half a billion in free money stream with adjusted EBITDA of over $1.5B.

Chemours shareholder rewarding coverage comes into focus right here. Sadly, the corporate isn’t huge on bumping its dividend. As a substitute, nearly all of FCF goes to Shareholders within the type of buybacks as much as $750M till 2025. The yield for the corporate, regardless of drops, isn’t any increased than 2.95% right here. That is low irrespective of the way you slice it, on condition that there are EU chemical firms with higher fundamentals that come increased than 5% right here. That makes investing in an organization with a decrease yield just a little tough, regardless of Chemours being a “good” enterprise.

Let us take a look at some valuations and tendencies for this firm and see what we need to get an honest upside going.

The Chemours Firm – Valuation and goal

There isn’t a doubt to my thoughts that there’s loads of upside available for Chemours. I have never had a heavy place within the firm for a few years, however at this valuation, which is now again right down to lower than 7.5X, it is time to significantly get thinking about Chemours.

Some knowledge.

If you happen to invested in the course of the COVID-19 crash, your present RoR for Chemours could be practically 250%. That is from the corporate buying and selling at a P/E under 5X. Beneath 7.5X is due to this fact low, however not record-low as such. Nonetheless, the corporate is not anticipating the type of 2019-2020 earnings deterioration that precipitated the decline in share value.

As a substitute, forecasts and firm steerage predict the corporate’s earnings to develop by nearly 35% on this fiscal, adopted by one other 8% and 14% for 2023 and 2024E, respectively.

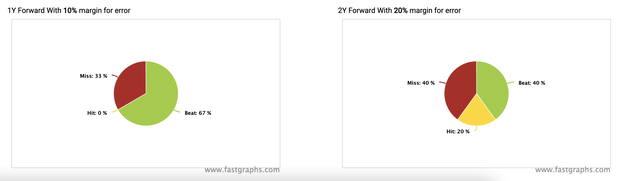

Add to this that Chemours, in contrast to what you may anticipate, truly has an honest pattern of beating estimates.

Chemours Firm Forecast Accuracy (FAST Graphs)

Because of this, I view it as believable that the corporate may truly ship significantly better outcomes than we anticipate them to do. Even when they don’t, and outcomes are extra moderated or in direction of the unfavorable, you may nonetheless have purchased one of many world’s extra vital refrigeration gasoline/product firms at what can solely be described as a big low cost.

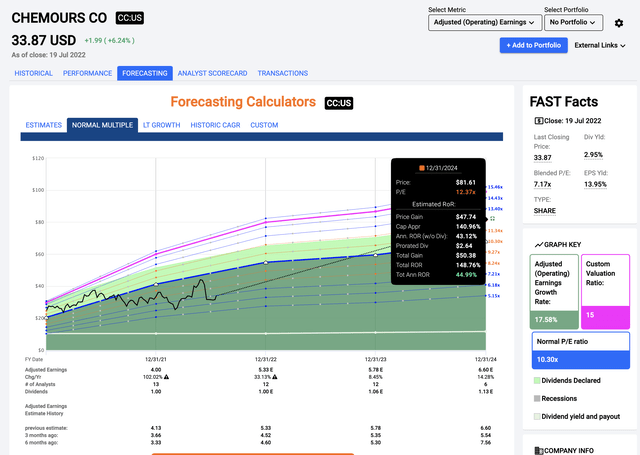

The A-Z of it’s that if the corporate delivers any type of progress and sticks to its typical valuations of round 10-12X P/E, the upside at this explicit time is at least 35% yearly, or 108% in 3 years, or all the best way as much as simply south of 150% complete RoR at a 12X P/E.

Chemours Upside (FAST Graphs)

Is such a improvement possible or in any method believable? I might argue that sure, it most definitely is. The very fact is, there are A-rated firms with increased upsides and nearly 3x the yield out there in the marketplace right now in precisely the identical, or different sectors. However at this value, which is 15%+ under my final stance, with an expectation that now contains large earnings progress, and a set of expectations that I truly take into account fairly believable, I am now lastly prepared to vary my stance on the Chemours Firm.

That is motive sufficient for this text, and this is the reason I am penning this. As a result of as of now, I am beginning to develop my place in what I view as an amazing firm, regardless of a few of the potential downsides right here.

S&P International considers Chemours a “BUY” with a value goal vary of $32-$59, with a median of $42, presently seeing 5 “BUY” suggestions and seven “HOLD”. I am bumping my PT to $35/share, seeing enhancements in valuation, forecasts, and higher visibility for a possible alpha within the firm.

I will not promote my small stake right here. As a substitute, I am going to begin including extra.

Chemours, to me, is now a “BUY” with a $35/share PT, which is extra conservative than most, however with an amazing potential upside in its books.

Present Thesis

My present thesis for Chemours Firm is the next:

- The corporate is basically interesting because of its chemical portfolio however is hounded by potential authorized points and dangers – each future and historic, in addition to an unappealing legal responsibility profile. This must be discounted for, nevertheless it’s totally doable.

- Improved outlooks have confirmed my preliminary bearishness to be exaggerated. I modify accordingly and provides the corporate allowance for future outperformance. I bump my value goal right here.

- I give CC a “BUY” and “Bullish” score, with an total value goal of $35, under the present analyst common, however thought-about truthful on a peer and threat/reward comparability.

Bear in mind, I am all about:

- Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly large – firms at a reduction, permitting them to normalize over time and harvesting capital positive factors and dividends within the meantime.

- If the corporate goes nicely past normalization and goes into overvaluation, I harvest positive factors and rotate my place into different undervalued shares, repeating #1.

- If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

- I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Chemours Firm is presently a “BUY”.