Revealed on July fifteenth, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an fairness funding portfolio price over $360 billion, as of the tip of the 2022 first quarter.

Berkshire Hathaway’s portfolio is full of high quality shares. You’ll be able to observe Warren Buffett shares to search out picks for your portfolio. That’s as a result of Buffett (and different institutional traders) are required to periodically present their holdings in a 13F Submitting.

You’ll be able to see all Warren Buffett shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

Observe: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

As of March thirty first, 2022, Buffett’s Berkshire Hathaway owned simply over 62 million shares of Basic Motors (GM) for a market worth of $2.7 billion. Basic Motors represents about 0.75% of Berkshire Hathaway’s funding portfolio. This marks it because the 17th largest place within the public inventory portfolio.

This text will analyze the auto producer in better element.

Enterprise Overview

Basic Motors produces vehicles, vans, and vehicle elements and gives vehicle financing options to its prospects. GM’s model portfolio consists of Chevrolet, Cadillac, Baojun, Buick, GMC, Holden, Jiefang, Wuling, Maven, and OnStar.

Basic Motors reported first quarter 2022 outcomes on April 26th, 2022. For the quarter, income was $35.98 billion, up 10.8% from $32.47 billion within the first quarter of 2021. Web revenue fell by $83 million year-over-year to $2.94 billion. The corporate’s web revenue margin was down by 110 foundation factors to eight.2%.

Supply: Investor Presentation

The corporate posted diluted earnings-per-share of $1.35 for the quarter, which was down from $2.03 within the prior yr interval. Adjusted diluted EPS, nonetheless, fell from $2.25 within the prior yr interval to $2.09 in the latest quarter.

Management is guiding for full-year diluted EPS between $5.76 and $6.76 and adjusted diluted EPS of $6.50 to $7.50. Moreover, the corporate anticipates producing web revenue between $9.6 billion and $11.2 billion, and adjusted EBIT between $13.0 billion and $15.0 billion.

We estimate that Basic Motors can generate $6.90 in earnings-per-share for the fiscal 2022 yr.

Progress Prospects

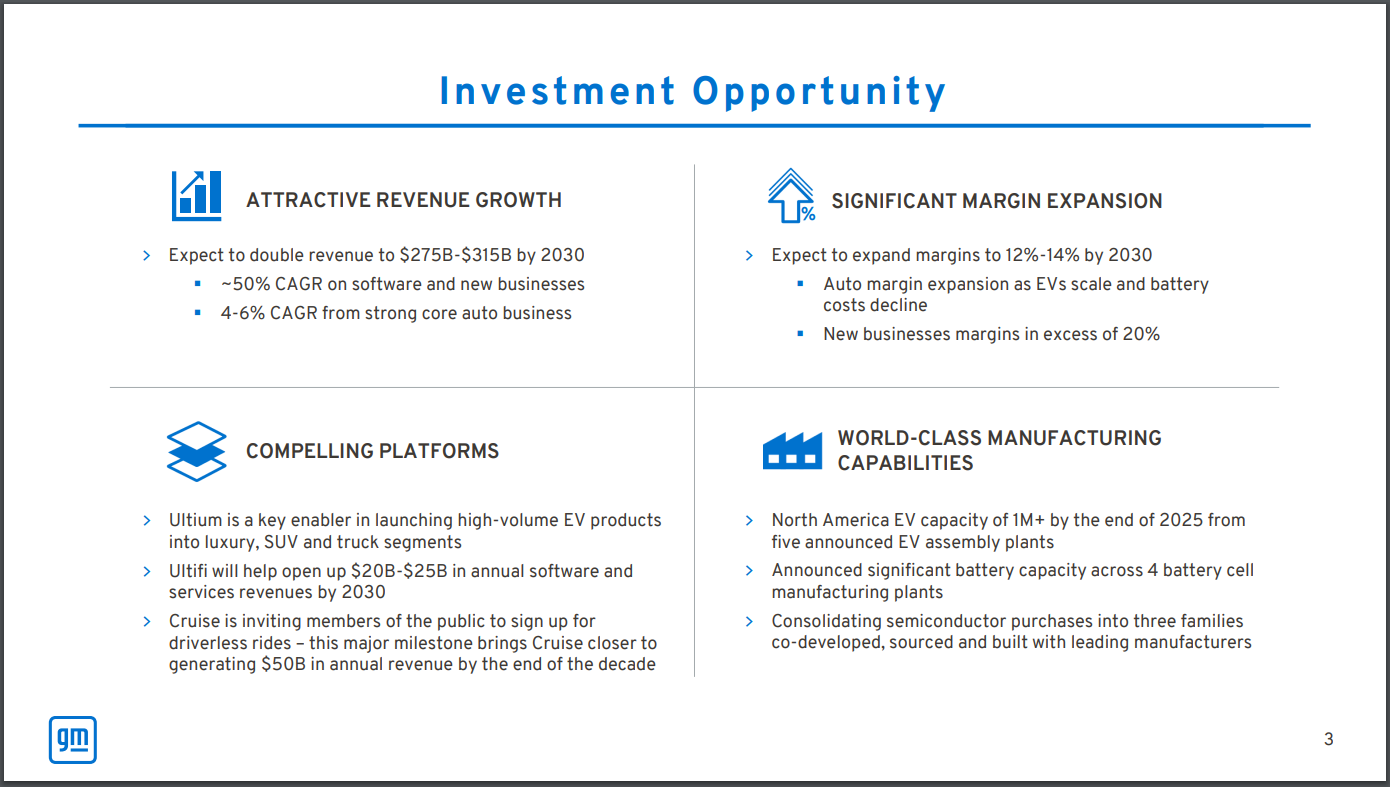

Basic Motors is forecasting huge income development inside the decade, anticipating a doubling of their income by 2030. At that time, GM will probably be producing income of $275 billion to $313 billion.

Supply: Investor Presentation

The majority of this development is anticipated to return from the corporate’s software program and new companies, with solely mid-single digit development from its established, core auto enterprise.

The corporate is making an enormous push on going all electrical. GM is aiming to transform 50% of their North American and China footprint to EV by 2030. The corporate is investing in EV meeting services to succeed in this purpose. Rising their worldwide market share will even seemingly add to earnings development.

The corporate can be shifting ahead on its built-in autonomous automobile (AV) technique with Cruise. GM now owns about 80% of Cruise after buying SoftBank’s fairness possession stake for $2.1 billion and making a further $1.35 billion funding within the firm.

GM can also opportunistically repurchase shares, nonetheless, over the past decade, the corporate has truly elevated its general share depend. Nonetheless, shares excellent have decreased since their excessive in 2014.

Within the brief time period, the microchip scarcity and elevated price inflation weigh on the corporate’s efficiency, however elevated pricing offsets this. The corporate is difficult at work making an attempt to extend margins in a tough atmosphere.

We mission that the corporate can develop earnings per share by about 6.0% yearly by way of 2027.

Aggressive Benefits & Recession Efficiency

Basic Motors has a comparatively secure place within the US market and the Chinese language market, and Basic Motors is among the many best-positioned firms within the truck market. The corporate has a large community of dealerships from which to market and promote their autos. GM additionally invests closely in R&D and in its AV technique with Cruise.

Basic Motors’ dividend was lower in 2020, and the corporate needed to be restructured following chapter throughout the Nice Monetary Disaster. All this to say, GM is just not a dependable dividend payer, and isn’t recession resistant. Revenue traders, or dividend development traders, could also be higher off holding their distance from GM as an funding.

Valuation & Anticipated Returns

Shares of Basic Motors have traded for a median price-to-earnings a number of of round 7.6 and 6.9 within the final ten and 5 years, respectively. Shares are actually buying and selling beneath this common, which signifies that shares might be undervalued on the present 4.7 occasions ahead earnings.

Our truthful worth estimate for Basic Motors inventory is 6.5 occasions earnings. If this proves appropriate, the inventory will profit from a 6.8% annualized achieve in its returns by way of 2027.

Shares of Basic Motors at the moment pay no dividend, which compares unfavorably to the ten-year common yield of three.2%. Earlier than 2020, the corporate paid a $1.52 annual dividend. This was lower close to the start of the COVID-19 pandemic, however earnings truly grew following the preliminary drop because the demand for autos was immense.

Placing all of it collectively, the mixture of valuation adjustments and EPS development produces whole anticipated returns of 13.2% per yr over the following 5 years. This makes Basic Motors a purchase, however the firm has a poor historical past, and hasn’t produced a lot by way of whole returns since its itemizing in 2010.

Ultimate Ideas

Basic Motors has undergone quite a few transformations over the many years. Right now, the corporate is aggressively shifting in the direction of an all-electric fleet. The corporate can be investing closely in autonomous autos. The panorama is fierce and aggressive.

GM is just not a dependable revenue or dividend development inventory, as the corporate has each undergone chapter up to now and lower its dividend.

Right now, GM seems to supply stable worth and an intact development thesis, however its whole return historical past is lacklustre.

Different Dividend Lists

Worth investing is a beneficial course of to mix with dividend investing. The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].