4kodiak

Probably the most enduring truths I’ve realized by way of my a long time within the on line casino enterprise is that administration deal with execution relatively than expressing lofty earnings objectives is what defines a foundational portfolio inventory. Nice properties are extra the results of sensible administration imaginative and prescient that drives execution over time. Quarter-to-quarter outcomes are snapshots. Long run resilience is the product of a sensible operational tradition that bends however would not break in good occasions or unhealthy.

There are few higher examples of this than Boyd Gaming Company (NYSE:BYD), which by way of its lengthy historical past starting with visionary founder Sam Boyd in 1975 has displayed a intestine degree understanding of how one can become profitable within the on line casino enterprise. Amongst its demonstrated talent units over time is wise asset allocation, typically in opposition to the grain of prevailing typical knowledge within the trade.

Sam had his share of arduous manner decisions-on the craps desk of growth. He took his worthwhile Vegas locals operation public in 1963. However over 17 years alongside got here the spiders: within the enamel of recessions hitting gaming markets and his plan to get into the strip luxe market with the ill-fated Echelon mission, Sam confronted solely lesser of varied evils. He confronted chapter except he moved quick. BYD inventory dropped to $3. However quickly, Sam put Keith E. Smith within the driver’s seat as CEO. (Beneath: Sam Boyd constructed an amazing locals gaming enterprise however stubbed his toe on misinterpret markets. Corrected when he stepped apart).

BYD archives

What adopted subsequent was a rationalization of the corporate’s enterprise from the bottom up. Cleansing up the steadiness sheet, dropping dream sequences about mega-projects, and focusing arduous on what had made the corporate worthwhile traditionally: the on a regular basis slot participant regardless of the place she or he was.

The most important choice it made was to accomplice with MGM, sharing the danger of an amazing mission in Atlantic Metropolis.

That call was the conceptual construction of its Atlantic Metropolis entry 50% partnered with MGM Resorts Worldwide (MGM) -the Borgata on line casino lodge on the Marina. I recall a presentation to trade leaders I attended run by its administration team-to-be in 2000. At the moment, the market was predominantly pushed by geography because it nonetheless is. All of us lived off quantity bus ridership from New York, Northern New Jersey, and Metro Philadelphia. And all of us noticed it as a vital evil. We competed in digital hand handy fight over “bus packages” which had been closely couponed affords of coin, meals and repeat go to rebates.

Harrah’s was an exception, focusing its advertising and marketing on drive-in to its greatest on the town storage. Drive-in patrons had greater common gaming budgets, had been much less comp-sensitive, and felt extra comfy within the nice, relaxed environment of the Marina space.

All of us on the Boardwalk realized our lesson in time and constructed garages to accommodate the extra useful prospects. However the bus buyer nonetheless prevailed as comprising the core supply of mass slot enterprise. The one attribute shared by each bus and drive-in patrons was the fundamental age demo: Atlantic Metropolis’s bread and butter buyer, regardless of the mode of transportation, was the older, if not oldest demographic base of the U.S. northeast. Whereas occasions and leisure bookings interesting to youthful demos mushroomed, and did start to maneuver some youthful prospects into the market, total, their per-trip numbers and worth had been a small a part of the market.

So, throughout the Borgata trade presentation, administration made two factors. One, no bus program. And two, its advertising and marketing can be strongly aimed toward a youthful demo. When questions had been raised as to how they thought they had been to keep away from bussing and discover a path to a youthful demo, their executives merely mentioned they believed the youthful, less-giveaway delicate demo would reply to a superior property and advertising and marketing focus.

BYD was the working companions of the Borgata property. From the day it opened in 2003, it shortly soared to first place in gaming win, non-gaming income out there. And any day you walked the property, you noticed a paucity of gray hairs on the slots-though they had been there. What you probably did see was lots of Gen Xers, and the youthful fringe of boomers crowding across the blackjack tables, filling the lounges and eating retailers, and rocking to the modern rock performers of the day. The Borgata, in opposition to the grain, was making a ton.

Because it turned out, BYD’s 50% sunk value within the $1b property had an amazing run of 13 years with nice accretion to its backside line from the Borgata. Then, in 2016, when administration’s considering within the gentle of the rising aggressive grid in neighboring states modified, it bought its pursuits to its MGM accomplice for $900m, with internet proceeds on the sale of $589m. The corporate then pivoted and used these proceeds with some lending to vastly increase its regional and Vegas locals market.

It was a seamless expression of BYD’s fastidiously laid out growth program past its Nevada borders to accumulate modestly worthwhile or underperforming regional properties, constructing itself out to the U.S. center west and south. Within the course of, BYD turned a number one nationwide on line casino operator, which at present contains 28 properties in 10 states divided in three divisions: Las Vegas Locals, Downtown Vegas, and Midwest/South.

BYD archives

So, what we noticed was a administration with a clear-eyed imaginative and prescient of the principle likelihood because the final fifteen years confirmed a enterprise which was consolidating. They transfer their capital round to match their recognition as to the place the gaming market was headed. They moved their items across the board like chess masters in my opinion by placing their footholds in markets they understood, at acquisition costs that held cheap premiums and a ahead plan for regular development. BYD noticed itself as a U.S. firm and didn’t enter the worldwide fray in Asia or anyplace else.

No firm within the gaming and leisure sector within the U.S. was, after all, proof against the devastation of the covid-19 outbreak in 2020. BYD was pressured to put off 25% of its workforce. However the firm deftly shaved its value construction to carry working margins that at first assured solvency by way of the worst of the disaster. And equally necessary, positioned itself to get better at a gentle tempo because the covid-19 disaster developed into the sporadic outbreaks we reside with until at the present time and restoration started to indicate in each Las Vegas locals markets and its properties within the Midwest and south.

It additionally launched a partnership with a northern California tribal group south of Sacramento, lending them ~$107m in opposition to the longer term proceeds of a administration contract, giving them 35% of the income pre-tax. The Sky River on line casino property is anticipated to open by the tip of this 12 months. The metro space has 2.3m folks and is a 1.5-hour drive from San Francisco’s metro’s 4.5m inhabitants base.

Why BYD is a foundational holding for sector traders

Having demonstrated an extended monitor file of very savvy asset allocation reflecting a stable understanding of how and the place gaming markets work finest, BYD stands among the many finest buys within the sector at present. The U.S. gaming sector as a complete is enhancing however nonetheless bumpy as a result of sporadic covid-19 outbreaks, scare headlines about new variants, rampant inflation, labor shortages, and provide chain crises.

Then again, outcomes from its main operators in 1Q22 replicate enhancing outcomes, partially attributable to the huge bathe of covid-19 disaster cash printing by the federal authorities that put plenty of probably disposable earnings within the palms of people that actually did not have to fret about the place their subsequent meal was coming from.

The core issue within the early restoration cycle has been the boldness in not less than the decline of disaster hysteria, of masking mandates dropped, excessive gasoline costs, that has introduced again the all-crucial older demos to regional casinos. In different phrases, the core on line casino prospects, scared away by well being considerations by way of 2020 and most of 2021, started streaming again to their favourite properties in nice sufficient numbers to provide actual earnings positive factors.

BYD capsule look publish preliminary covid-19 disaster

2021 income: $3.37b.

2022E income: $3.48b.

2023E income: $3.55b

The estimates above are these of a consensus of analysts who comply with BYD. I imagine them to be usually within the ballpark base on the very tough forecasting algorithms at their disposal as covid-19 outbreaks proceed to spike right here and there. Utilizing my very own metrics, I come up considerably extra bullish on income largely based mostly on conversations with former colleagues and associates lively in the identical markets as BYD.

My questions pose considerably deeper dives for responders than what one could hear in earnings calls from analysts. A lot of what we focus on is on line casino flooring exercise seen in rated vs. non-rated play tendencies, lodge occupancy vs. labor shortages leading to room stock unused as a result of labor shortages.

I additionally take a look at historic vs. present tendencies in numbers of covers in meals retailers, mass vs. connoisseur rooms, staffing and secure or unstable pressures on comping ranges as a result of aggressive pressures of their markets. Projecting what I hear in opposition to my very own historic proprietary measures, I give you an estimated income base of $3.6b for this 12 months and $3.72b for 2023, up from $3.37b in 2021.

For comparability, baseline pre-covid-19 2019 income was $3.32b, which itself was up 26% from baseline 2018. This tells us that BYD has not solely recovered, however surpassed its base 12 months comparisons. That’s an indicator that its long-term development trajectory was constructive pre-covid-19, and remarkably has resumed now at close to the endgame of the pandemic. Nevertheless, given the lingering uncertainties and seasonable components for 2Q22, we see one thing of a dip in income and earnings potential for 2Q22. Buyers shouldn’t be spooked by such outcomes if BYD experiences an earnings miss for 2Q22. Leads to 1Q22, I imagine, are extra indicative of a extra bullish long run pattern:

2021 EPS: $5.12

2022E EPS: Consensus: $5.46. Our estimate $6.00

2023E: EPS: $5.85 Our estimate: $6.31

3-year CAGR income development so far; 6.88%

Gross revenue margin: 73.88%

ROE: 37.72%

Dividend yield: 1.21%

Return of capital to shareholders, dividends and repurchases aimed toward licensed aim of $500m by early 2023.

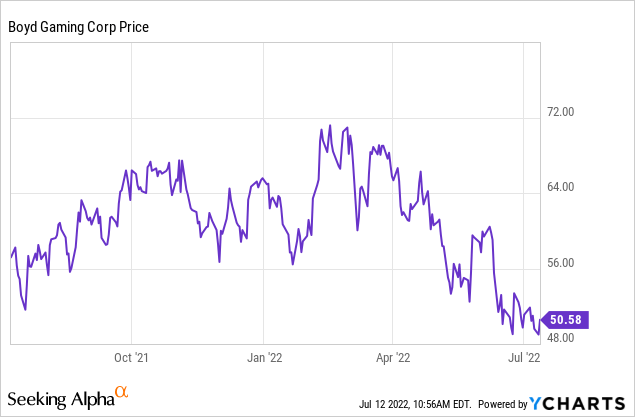

Value at writing: $49.05

Alphaspread Discounted Money Stream worth: $74.50.

52-week vary: $47.66 to $72.77. This places the present value close to 52-week low representing in our view a superb entry level.

Market cap: $5.44b with an EV of $8.95b.

Money available: $493m.

Whole debt: $3.91b.

Present ratio: 0.99. By any measure, indicative of a powerful steadiness sheet in a timeframe forward that may be a disconcerting mix of upside potential, lingering covid-19 challenges, inflation, excessive gasoline costs, and labor shortages. However the monitor file of administration operational tradition lends credence in our view that the inventory is considerably undervalued. If moderating circumstances develop going ahead on covid-19, recession depth, and many others., BYD is positioned to construct bullish sentiment within the sector and transfer right into a PT vary of $66 by the tip of 3Q22.

Planning in progress:

- Estimated capex complete $250m growth and upkeep;

- Search for completion of the transfer of its Treasure Chest river boat on line casino property in Louisiana to a land based mostly, full service on line casino lodge by mid to late 2023.

Challenges forward

Inflation: Firm-wide wage minimal raised to $15 as a part of plan to retain staff, added to which have been retention bonuses for non-executive staff. General inflationary pressures felt in areas like utilities, and meals prices mirrored in menu costs however held to ranges the place elevated volumes can contribute to amelioration. Identical applies to lodge occupancy at present constrained by labor shortages triggering larger prices. However that is anticipated to be compensated by complete extra rooms out there in market the place at present demand is outstripping means to care take rooms.

Main updating and growth of widespread eating retailers at BYD’s Freemont Road properties in downtown Vegas to debut someday late this 12 months. Disruption minimal.

Sports activities betting model chief Fan Duel operative in reside sports activities books at BYD properties. (BYD owns 5% of FD fairness). Over $30m in commissions earned so far, growth of on-line/interactive enterprise by buy for $170 of Pala Interactive LLC a B2B and B2C on-line tech gaming operator to boost BYD’s total entry into on-line with tech know-how, apps, and sports activities betting acumen. Transaction anticipated to shut by finish of 2023.

Conclusion

Primarily based on efficiency metrics alone in tough occasions, BYD ought to be included in any well-balanced gaming portfolio. However behind these numbers lies the unappreciated worth of the inventory in our view, within the sustained stability and savvy of each the company workplace in addition to the working day-to-day administration tradition.

We see BYD as among the many finest buys within the sector now. We do not anticipate them to be as acquisitive as they’ve been prior to now, often making nice capital allocation strikes. We’re in a interval of superior consolidation for BYD, the place consideration and focus is riveted on readiness to embrace macro restoration. Clearly the Fed and the hostage-taking of covid-19 lurk within the foreground right here, joined by a looming stagflation to which there’s little immunity in any inventory.

But BYD’s wholesome steadiness sheet, robust portfolio in three gaming market areas already displaying restoration, and previous efficiency in deft funding strikes, contribute to our confidence in BYD as a foundational firm to personal within the U.S. gaming sector it doesn’t matter what lies forward. Long run, the corporate will prosper off its deeply ingrained buyer tradition.

This isn’t simple. Gamblers in locales just like the Vegas locals market are choosy and persistently demanding. Studies of failures in customer support are all the time a part of the scene. The lyric within the theme “New York New York” that touts if you can also make it right here you can also make it anyplace – applies to BYD. In case you can construct a powerful locals market in powerful Vegas, you can also make cash anyplace casinos are authorized.