Printed on July eighth, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an fairness funding portfolio value over $360 billion, as of the tip of the 2022 first quarter.

Berkshire Hathaway’s portfolio is full of high quality shares. You may comply with Warren Buffett shares to seek out picks for your portfolio. That’s as a result of Buffett (and different institutional buyers) are required to periodically present their holdings in a 13F Submitting.

You may see all Warren Buffett shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

Observe: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

As of March thirty first, 2022, Buffett’s Berkshire Hathaway owned about 1.5 million shares of Royalty Pharma plc (RPRX) for a market worth of $58.3 million. Royalty Pharma represents about 0.2% of Berkshire Hathaway’s funding portfolio. This marks it as one of many backside positions within the portfolio.

This text will analyze the healthcare firm in larger element.

Enterprise Overview

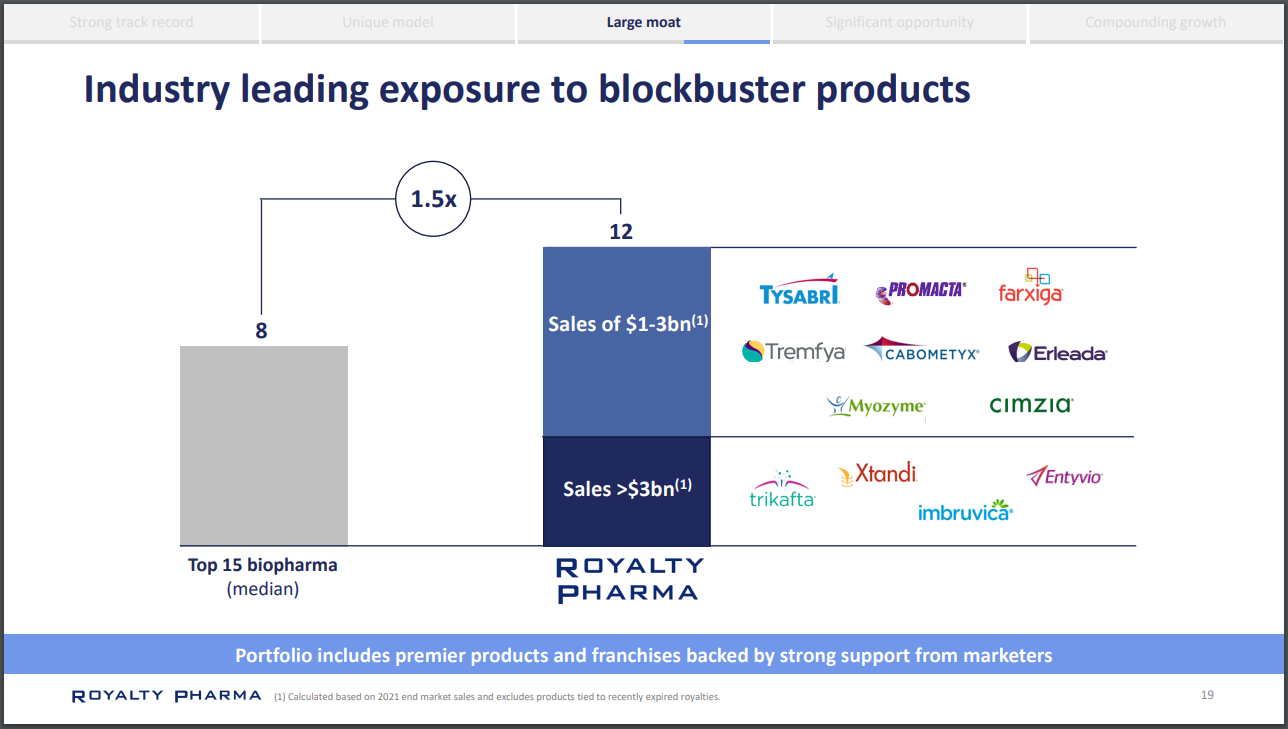

Royalty Pharma plc owns biopharmaceutical royalties and funds innovation within the biopharmaceutical business within the U.S. The corporate’s portfolio holds royalties on roughly 35 marketed therapies and 10 development-stage product candidates, addressing areas reminiscent of uncommon illness, most cancers, neurology, infectious illness, hematology, and diabetes.

A few of Royalty Pharma’s royalties entitle them to funds linked to the top-line gross sales of some main therapies, reminiscent of AbbVie and Johnson & Johnson’s Imbruvica, Astellas and Pfizer’s Xtandi, Gildea’s Trodelvy, Merck’s Januvia and Novartis’ Promacta, plus many extra.

Supply: Investor Presentation

On Could 5th, 2022, Royalty Pharma reported first quarter 2022 outcomes. The corporate generated web money from working actions of $460 million, a 13% year-over-year lower. Adjusted money receipts rose 15% to $605 million. This enhance was largely attributable to double-digit will increase in royalties from the cystic fibrosis franchise, Tysabri, and up to date royalty acquisitions, partially offset by royalty expirations.

Royalty Pharma held money, money equivalents and marketable securities amounting to $2.3 billion as of March 31st, 2022. The corporate additionally held $7.3 billion in long-term debt.

Administration offered a 2022 monetary outlook, which estimates adjusted money receipts to be between $2.23 billion and $2.3 billion.

We estimate that Royalty Pharma can generate $2.94 in earnings-per-share for the fiscal 2022 yr.

Progress Prospects

Royalty Pharma has deployed billions of {dollars} in capital to accumulate pharmaceutical royalties. The tempo of this capital deployment has sped up lately. Whereas Royalty Pharma deployed $1.49 billion throughout 2012 to 2016, they deployed $2.10 billion between 2017 to 2021. This has led to a doubling of adjusted money receipts from 2012 to 2021.

The corporate will proceed to give attention to buying present royalties for main or late-stage improvement therapies with important enterprise potential. Moreover, Royalty Pharma will selectively purchase newly-created royalties on accepted or late-stage improvement therapies. The corporate can also make fairness investments or present funding in trade for long-term cost streams.

The corporate sees a major alternative the place over $1 trillion of capital is required to fund innovation in biopharmaceuticals over the subsequent decade, and Royalty Pharma plans to capitalize on this.

The corporate’s development-stage therapies are prone to all launch by the tip of 2025, which also needs to enhance the corporate’s prime line.

We challenge that the corporate can proceed to develop earnings per share by about 7.5% yearly by way of 2027.

Aggressive Benefits & Recession Efficiency

Royalty Pharma’s portfolio of pharmaceutical royalties is unmatched within the enterprise. The corporate has acquired royalty pursuits in main pharmaceutical medication since 1996. Between 2012 and 2022 YTD, Royalty Pharma has maintained a few 60% general share within the biopharma royalty market and is the main accomplice for big transactions.

Supply: Investor Presentation

The corporate depends on their skilled workforce in Analysis & Investments. Over 60% of the workforce of 21 professionals have superior levels, and about 50% of them had scientific and/or medical levels. The workforce has a median 14 years of expertise in biopharma and/or funding.

The prescribed drugs that are linked to Royalty Pharma’s royalties are crucial for the sufferers who make the most of them. This provides to the corporate’s recession resilience, as individuals will want their prescribed drugs by way of any time within the financial cycle.

Royalty Pharma has raised its dividend for 2 consecutive years up to now. For a royalty firm, Royalty Pharma sports activities a really low payout ratio of roughly 26% forecasted for 2022. We anticipate continued dividend progress of about 10% every year.

Valuation & Anticipated Returns

Shares of Royalty Pharma have traded for a median price-to-earnings a number of of 14.3 since 2021. Shares at the moment are buying and selling in-line with this common, which signifies that shares might be close to truthful worth on the present 14.7 instances earnings.

Our truthful worth estimate for Royalty Pharma inventory is 15.0 instances earnings. If this proves appropriate, the inventory will profit from a 0.4% annualized acquire in its returns by way of 2027.

Shares of Royalty Pharma at the moment yield 1.8%, which is in-line with its common yields of 1.7% as properly. On a dividend yield foundation, Royalty Pharma shares appear to be buying and selling at roughly truthful worth.

Placing all of it collectively, the mixture of valuation modifications, EPS progress, and dividends produces whole anticipated returns of 9.5% per yr over the subsequent 5 years. This makes Royalty Pharma a maintain.

Closing Ideas

Royalty Pharma has constructed up its portfolio of pharmaceutical royalties since 1996 and holds royalties in blockbuster medication.

The corporate has a steady supply of revenue, and year-to-date, shares have risen practically 10%, in distinction to a falling broader market. Shares appear pretty valued on the present worth, and we anticipate continued earnings and dividend progress.

Different Dividend Lists

Worth investing is a worthwhile course of to mix with dividend investing. The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].